What Happens If I Miss The Deadline

It entirely depends on whether you were late filing or late to pay your taxes because the IRS has separate penalties for each.

The amount of these penalties will depend on two factors:

- How long past the tax filing deadline you submit your taxes or pay them

- How much you owe in taxes in total

If you donât file your tax return by the deadline , the penalty is 5% of the tax due for each month that return is late.

If you donât pay your owed tax on time, the standard penalty is 0.5% of the unpaid tax amount for each month it remains unpaid.

Both these penalties max out at 25% of the total tax amount owed.

If both penalties apply in the same month, the maximum penalty applied is 5%. You pay the 0.5% failure-to-pay penalty and a 4.5% failure-to-file penalty.

When those five months have passed and the failure-to-file penalty has maxed out, the failure-to-pay penalty continues at 0.5% per month, either until you pay or it maxes out at 25%â45 months later.

Business Tax Return Due Dates

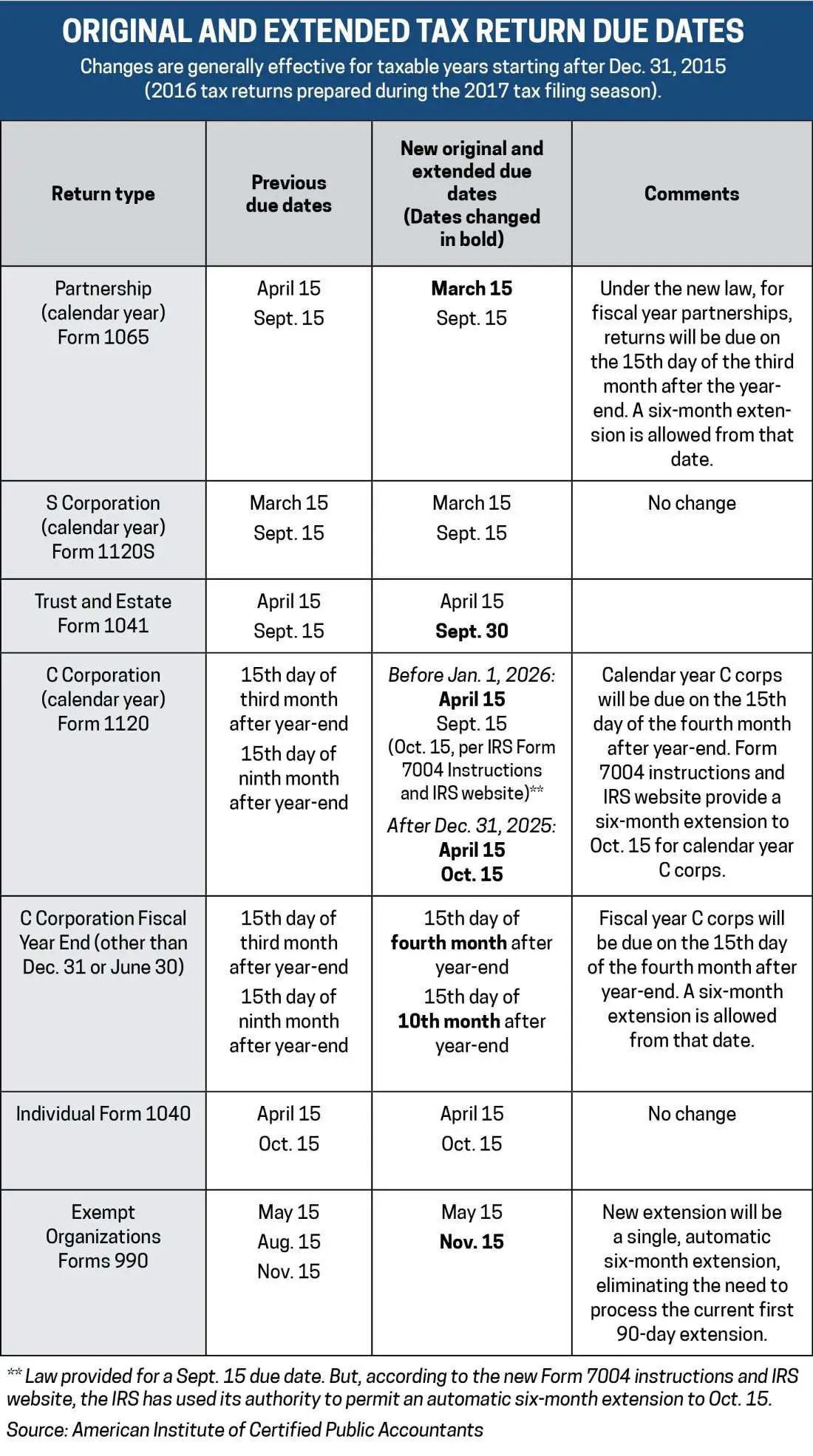

Here are the tax return due dates for small business taxes:

- Sole proprietorship and single-member LLC tax returns on Schedule C with the owner’s personal tax return: May 17, 2021

- Partnership tax returns on Form 1065: March 15, 2021

- Multiple-member LLC returns filing partnership returns on Form 1065:March 15, 2021

- S corporation returns on Form 1120 S: March 15, 2021

- Schedule K-1s for partners in partnerships, LLC members, and S corporation shareholders on their personal tax returns: April 15, 2021

- All other corporations with fiscal years ending other than December 31: the 15th day of the fourth month after the end of the fiscal year

Limited Liability Companies Treated As S Corporations

A limited liability company classified as an association and taxable as a corporation for federal purposes may elect S corporation status. The LLC will also be treated as an S corporation for the state and must file Form 100S . California and federal laws treat these companies as corporations subject to California corporation tax law.

Read Also: Irs Federal Returns

Starting Or Stopping Business Mid

Did you start or stop your business at some point in the last year? While you can’t deduct most costs incurred before you started the business, you may have the option to deduct them by capitalizing them. Whether you stopped or started a business partway through the year, you’ll only file taxes for the time the business was active.

Doing Business In California And Other States

S corporations that do business in California and other states must apportion their unitary business income using Schedule R, Apportionment and Allocation of Income.

Example: In 2000, David’s Toy, Inc., a Nevada S corporation, opens an office in California. Since the S corporation is doing business in both Nevada and California, it must file Form 100S and use Schedule R to apportion income between the two states.

Read Also: Reverse Ein Lookup Irs

Reasonable Salary And Compensation

You must pay a reasonable salary as a salary The IRS does not have a clear definition of what a reasonable salary is, other than proper compensation for the services provided to the corporation. A good rule of thumb is to look at the average salary for the position and pay that as salary, with any excess being paid as a distribution. Failure to do this could result in an audit from the IRS.

How Different States Treat S Corps Differently

State tax rules for S corps vary quite a bit. Many states choose to follow the federal income tax requirements for S corps, but some require you to file additional state forms to be recognized as an S corp. In New Jersey, you have to file Form CBT-2553, for example, while in New York, you have to file Form CT-6.

The District of Columbia, New Hampshire, Tennessee, and Texas donât even recognize S corp status: youâll be taxed like a regular corporation in those states even if youâve filed for S corp status with the IRS.

Meanwhile, states like Louisiana and Mississippi are somewhere in the middle. They donât necessarily prevent you from passing all of your S corp income through to your investors, but it also depends on your specific tax situation.

Our recommendation is to chat with a CPA or tax professional in your state to make sure youâre following your stateâs S corporation rules. If youâre a Bench Premium customer, youâll also have access to on-demand and unlimited tax consultations with in-house tax professionals who can help you ensure youâre compliant.

Don’t Miss: How To Protest Property Taxes Harris County

Did You Convert Your Llc Into A C Corp In 2020

When converting a business from an LLC to a C Corporation, its critical that you involve tax and legal professionals. As weve mentioned before, transitioning your business from LLC to C-Corp can come with costly tax penalties.

The IRS gives all partners just three months to file a short tax year return and pay their income tax liability. After three months, each partner will owe $195 per month the return is late on top of their income tax liability. Let your tax pro know because being late can add up to a lot of money.

What Is Not Covered By The Extension:

- The extension does not apply to federal tax returns and payments that are not due on April 15, 2020, which means estimated tax payments for the second quarter of 2020 are still due on June 15, 2020, and tax returns and payments for taxpayers who use a fiscal year rather than the calendar year generally will not be eligible for the extension.

- The extension is generally not available to S corporations, partnerships, and LLCs treated as partnerships because their tax returns were generally due on March 16, 2020.

- The extension does not apply to information returns, payroll tax deposits, excise taxes, or any other taxes other than federal income taxes, but the IRS has similarly extended the due date for filing 2019 gift and generation-skipping transfer tax returns and making payments that were otherwise due April 15, 2020.

- The extension does not apply to claims for refund that are required to be filed by April 15, 2020.

- The extension does not apply to state tax filing and payment deadlines, but many states have issued their own form of relief in response to the federal extension.

The facts, laws, and regulations regarding COVID-19 are developing rapidly. Since the date of publication, there may be new or additional information not referenced in this advisory. Please consult with your legal counsel for guidance.

You May Like: Csl Plasma Taxable

Reminder For Individual 2021 Tax Return Due Dates

Its recommended that you always double check with the IRS in regards to the tax return due dates and deadlines. If you are filing, its recommended that you connect with a professional CPA or enrolled agent to have your information reviewed.

Our Jetpack Workflow community is full of incredibly talented accounting professionals, and we feature them with weekly interviews on our Growing Your Firm Podcast! to be the first to know about a new episode with a firm owner youll love.

Is This A Tax Schedule

Weve noticed that some startup founders are finding this page by searching for Kruze Consulting Tax Schedules. This is a calendar of tax deadlines for C-Corporations, and isnt technically a tax schedule, as a tax schedule has a particular meaning to CPAs. However, we do think that those founders are actually looking for this list of tax deadlines, so we arent offended.

If your Delaware C-Corp funded startup needs tax help contact us today!

Also Check: Ein Reverse Lookup Free

Requesting An Extension Of Time For Filing A Return

Revised Statute 47:287.614allows an extension of time for filing the combined corporation income and franchise tax return not to exceed seven months from the date the return is due. All extension requests must be made electronically on or before the returns due date. The returns due date is May 15th for calendar year filers, and the 15th day of the fifth month following the close of the taxable year for fiscal year filers. Extension requests received after the returns due date or on paper will not be honored. An extension may be requested in the following manner:

Requesting the extensions electronically through the Bulk Extension Filing application or the Online Extension Filing application on LDR’s web site

Filing an extension request electronically by calling 225-922-3270 or 888-829-3071. For an extension request, select option #3, then select option #2. Taxpayers will need the Corporations LA account number to request the extension or

Requesting the extensions electronically through tax preparation software that supports the electronic filing of the Louisiana Application for Extension to File Corporation Income and Franchise Tax.

Which Is Better An Llc Or S Corp

Whether an LLC or an S corp is better depends on the size and nature of the business and its aspirations for growth.

An LLC tends to be preferable for sole proprietors or enterprises with just a few partners, due to its flexibility and ease of establishment If a business is largeror aspires to bethe S corp might work better. S corps have more financing options: Unlike LLCs, they are allowed to offer equity stakes to investors in return for capital, for example. And if their operations are complex, they would benefit from establishing the formal structures, compliance procedures, and other protocols required of corporations.

Don’t Miss: How Much Tax For Doordash

S Corporation Tax Profile

Although S corporations don’t pay taxes, they still are required to file Form 1120S. Schedule K-1 is also an important document as it goes out to each shareholder and reports on the income, deductions, credits, and losses that each person is responsible for including on their own tax returns.

Form 1120S must be filed no later than mid-month of the third month following the end of the S corporation’s tax year. For example, an S corporation that uses December 31st as the end of its tax year would need to complete Form 1120S by March 15th. If the due date falls on a weekend or recognized holiday, the due date shifts to the next weekday.

Despite not paying federal taxes, some states might require S corporations to pay state taxes.

Start Planning To File For 2021 Today And Save Time And Money

Business owners know there are many ways to save on taxes, but it takes a certain degree of planning to capture all that opportunity cost. A calendar of your critical tax deadlines is a huge step toward being compliant and avoiding late fees and penalties. inDinero can help you build a comprehensive strategy.

Quick Note: This article is provided for informational purposes only, and is not legal, financial, accounting, or tax advice. You should consult appropriate professionals for advice on your specific situation. inDinero assumes no liability for actions taken in reliance upon the information contained herein.

Recommended Reading: Appeal Cook County Taxes

Are Inheritance Taxes Due On The Date Of Death Or When The Inheritance Is Received

While some states do impose an inheritance tax, the federal government only imposes an estate tax. Estate taxes are imposed on the estate itself rather than on the individuals inheriting assets from the estate. Estate taxes aren’t necessarily imposed on the date of death, but they will have been assessed by the time an heir officially receives assets.

Filing An Amended Return

In order to amend the amounts reported for the computation of income or franchise taxes, you must file an amended Form CIFT-620. Louisiana Revised Statute 47:287.614 requires every taxpayer whose federal return is adjusted to furnish a statement disclosing the nature and amounts of such adjustments within 180 days after the adjustments have been made and accepted. This statement should accompany the amended return.

Recommended Reading: Internal Revenue Service Tax Returns

How To Make Estimated Payments

Estimated tax payments must be submitted in the same manner, whether separate, consolidated or combined, and using the same account number that the corporation expects to use when filing the Colorado corporation income tax return. For more information, see publication FYI Income 51.

Partnerships & S Corporations

Estimated tax is the method used to pay tax on income that is not subject to withholding. Individuals who are not residents of Colorado must pay tax on any Colorado-source income. This is intended for nonresident individuals who are included in a partnership or S corporation composite filing. In most cases, you will pay estimated tax if an individual partner expects to owe more than $1,000 in net tax for the year, after subtracting any withholding or refundable credits they might have. This rule must be calculated for each individual included in the composite return, and not as the composite as a whole. Use the Partnerships and S Corporation Estimated Payment Form to submit your business’ estimated payments.

You may also use Revenue Online to submit your partnership or S corporation estimated payments.

C Corporations

In most cases, a C corporation is required to pay estimated tax if it can reasonably expect the net tax liability will exceed $5,000 for the year. For taxpayers with a short taxable year, please see FYI Income 51 for more information. C corporations use the C Corporation Estimated Payment Form .

Who Must Pay The General Corporation Tax

All domestic and foreign S corporations and qualified S subsidiaries in New York City that are:

- Doing business

- Owning or leasing property, in a corporate or organized capacity or

- Maintaining an office.

Please note that New York City does not have an S corporation election and does not recognize a New York State S corporation election. In general, federal subchapter S corporations and qualified subchapter S subsidiaries are subject to the GCT.

If a corporation is not subject to the tax, but it has an officer, employee, agent or other representative within the five boroughs, it must nevertheless file Form NYC-245, Activities Report of Business and General Corporations.

Also Check: 1040paytax.com

How Does An S Corp Work

In many ways, an S corp works as any corporation does. Operating under its home state’s corporation statutes, it establishes a board of directors and corporate officers, by-laws, and a management structure. It issues shares of company stock. Its owners cannot be held personally or financially liable for claims by creditors or against the company.

S corps are distinguished by the fact that they are not federally taxed on most of the earnings they generate and distribute, leaving more money to pass to shareholders . The funds must be allocated strictly based on the shareholders’ equity stake or their number of shares.

S corps must restrict their number of shareholders to 100 or less, and these must all be individuals, non-profits, or trusts. These stockholders, along with the corporation itself, must be U.S.-based.

Come tax time, S corps must distribute the form Schedule K-1 to shareholders, indicating their annual profits or losses from the company, and file Form 1120-S with the IRS.

When To Consider The Tax Extension For Your 2020 Business Taxes

An extension only applies to the deadline for filing your return, NOT paying any taxes youll owe. So, what are some reasons for asking for an extension on filing your return?

Extending your return deadline doesnt need to be a stressful decision. It should help eliminate stress!

For C Corporations, Partnerships, and S Corporations, youll use Form 7004 to request a six-month extension individuals use Form 4868. For nonprofits, you can request a six-month extension using Form 8868.

Before you make any decisions, be sure to talk about it with your tax preparer. They may have a reason not to extend.

Recommended Reading: Efstatus.taxact.com.

Whats The Deadline To Pay Your Taxes

If youâre sending your return in via snail mail, the IRS considers your return âon timeâ if itâs addressed correctly, has enough postage, and is in the mail before the end of business on your filing deadline.

Otherwise, you can e-file your return before midnight on your tax filing deadline day.

If youâre self-employed, your business probably pays taxes in four sums throughout the year, rather than on one day. These are called estimated tax payments. The due date for these 2022 payments are April 15, June 15, September 15, and January 16 .

If youâd rather have someone else handle your bookkeeping and federal income tax filing, check out Bench.

Weâll set you up with a dedicated team of bookkeepers and a tax team to provide year round tax advice and file your taxes for you. With these teams, youâll have a tax planning session to ensure you are more prepared for next year. Weâll take both headachesâbookkeeping and taxesâoff your hands, for good.

Deadlines In Calendar Year 2022

Deadlines for filing taxes typically fall within the same, general range. When it comes to filing your 2021 tax return, these are the dates you need to know about.

- Receiving your W-2 Form: Your employer has until Jan. 31, 2022, to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- Individual income tax returns: April 15 falls on a weekday in 2022, but it is Emancipation Day which is celebrated in Washington, D.C., causing all businesses and government offices to close. Therefore, the filing deadline for your 2021 personal tax return, or Form 1040 or Form 1040-SR is Monday, April 18, 2022.

- Partnership and S-corporation returns:Returns for partnerships and S-corporations are generally dueMarch 15. If you request an automatic six-month extension, though, this date is Sept. 15, 2022.

- Corporation income tax returns: For corporations, the due date is April 18, 2022. The extended deadline is October 17, 2022. The deadline for C-corp returns is typically the 15th day of the fourth month following the end of the corporation’s fiscal year if the corporation operates on a fiscal year, rather than a calendar year.

As of Dec. 16, 2021, the 2022 IRS calendar does not include the filing dates and deadlines for: estate taxes, gift taxes, trusts, exempt organizations, certain types of corporations, foreign partnerships, or nonresident aliens. You can check the dates for each specific category in January 2022.

Read Also: Ccao Certified Final 2020 Assessed Value