Understanding Your Refund Status

As you track the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications about your income tax refund see Request electronic communications from the department.

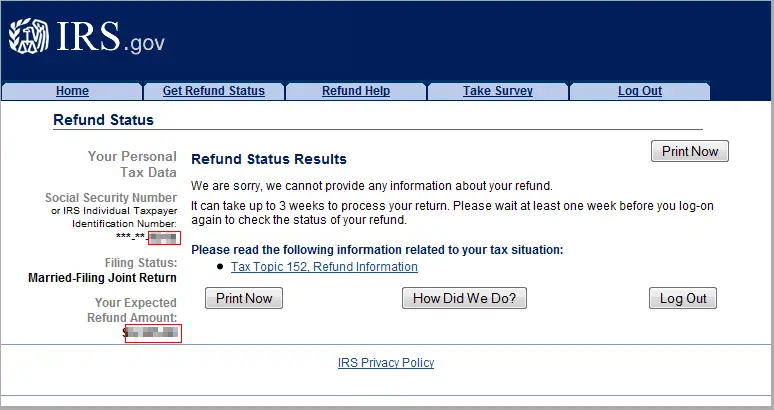

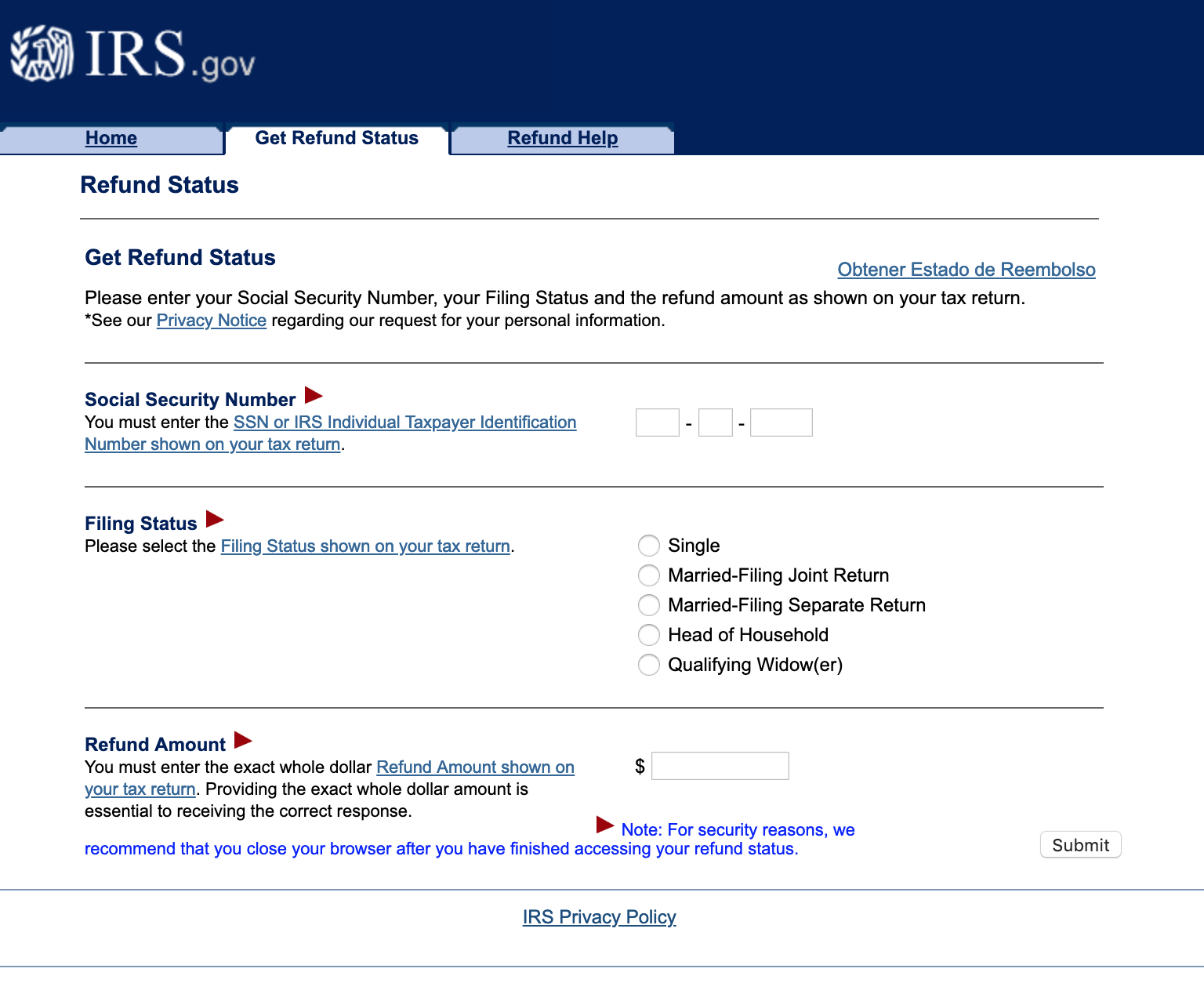

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?

Where Is My Refund

Check your State or Federal refund status with our tax refund trackers.

With the IRS tax refund tracker, you can learn about your federal income tax return and check the status of your federal refund instantly. The IRS’ Wheres My Tax Refund tool provides a safe, fast and easy-to-use portal to track your 2020 refund just 24 hours after it has been received. If youre seeking the status of an amended return, call the IRS directly at 1-800-829-1040. Found your federal return, but looking to get your refund even faster? When you file with Liberty Tax®, you may pre-qualify for an advance loan on your IRS tax refund. Learn more today.

Also Check: Paying Taxes On Doordash

What Information Is Available

You can start checking on the status of your refund within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Wheres My Refund? will give you a personalized refund date after we process your return and approve your refund.

The tracker displays progress through three stages:

To use Wheres My Refund, you need to provide your Social Security number, filing status and the exact whole dollar amount of your refund.

How Do I Find Out If My Tax Return Has Been Processed

You May Like: Deductions For Doordash

How Long Will It Take To Get Your Tax Refund

Its tax season again. Youve gathered your W-2s, 1099s and other pertinent information, completed your tax return and filed it. If youre owed a refund, now all you have to do is wait.

Find: 5 Presidents Who Raised Taxes the Most, and 5 Who Lowered Them

It can be difficult waiting and wondering just how long it will take to get your tax refund, though. According to the IRS, nine out of 10 tax refunds are issued in less than three weeks. But what about the other 10%? And what can you do to make sure your tax return gets processed as efficiently as possible?

Here are the answers youre after straight from trusted tax professionals.

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Recommended Reading: Do You Have To File Taxes With Doordash

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2020 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Don’t Miss: Www.efstatus.taxact.com

Tax Time Guide: Use The Wheres My Refund Tool Or Irs2go App To Conveniently Check Tax Refund Status

IR-2022-43, February 24, 2022

WASHINGTON The Internal Revenue Service reminds taxpayers today that the fastest and easiest way to check on tax refunds is by using the Where’s My Refund? tool on IRS.gov or through the IRS2Go mobile app.

This year, more than ever before, those who don’t normally have to file a tax return may wish to do so to get child-related tax credits that were expanded by the American Rescue Plan. These include the Child Tax Credit and the Child and Dependent Care Credit PDF.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Read Also: 1040paytax.com Safe

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

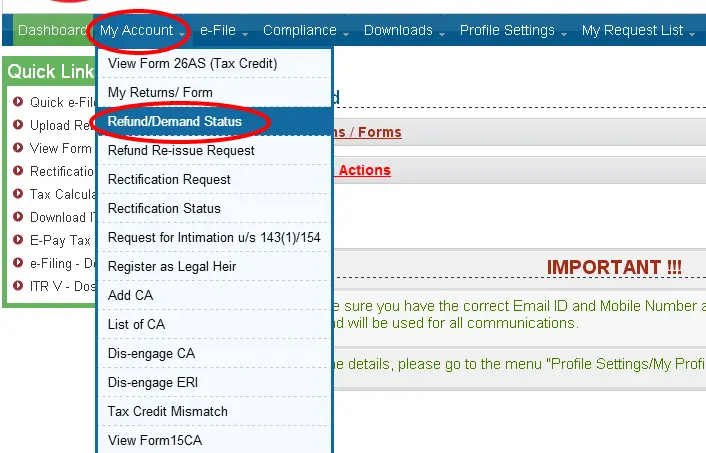

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

Recommended Reading: How Do You Report Plasma Donations On Taxes

How To Check Tax Refund Status In Canada 2021

According to CRA, most income tax refunds in Canada are issued anytime between 2 weeks and 16 weeks, depending on the specific type of tax returns and when you file. Suppose you file returns on or before the due date. In that case, you will receive a Notice of Assessment and applicable tax refund within 2 weeks after CRA receives your electronically filed tax returns, 8 weeks of paper-filed returns, or 16 weeks of getting your non-resident paper-filed tax return. Its also possible to check your tax refund status in Canada and know what to expect.

How you file tax returns matters too. The CRAs goal is to send your refund within 2 weeks if you file online or 8 weeks for Canadians who prefer filing paper returns. Before you start checking your tax refund status, its essential to understand these processing times for paper returns and processing times for electronic returns.

Keep in mind that these timelines are valid for income tax returns received on or before the due date. The Canada Revenue Agency says that tax refunds are often faster if you opt to use direct deposit.

Here’s How Long It Will Take To Get Your Tax Refund In 2022

Three in four Americans receive an annual tax refund from the IRS, which often is a family’s biggest check of the year. But with this tax season now in progress, taxpayers could see a repeat of last year’s snarls in processing, when more than 30 million taxpayers had their returns and refunds held up by the IRS.

Treasury Department officials warned in January that this year’s tax season will be a challenge with the IRS starting to process returns on January 24. That’s largely due to the IRS’ sizable backlog of returns from 2021. As of December 31, the agency had 6 million unprocessed individual returns a significant reduction from a backlog of 30 million in May, but far higher than the 1 million unprocessed returns that is more typical around the start of tax season.

That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. And some taxpayers are already reporting receiving their refunds, according to posts on social media.

However, so far, the typical refund is about $2,300 less than the average refund check of about $2,800 received last year. That could change as the tax season progresses, given that tens of millions of Americans have yet to file. But it could signal that taxpayers could get smaller checks this year, an issue for households already struggling with high inflation.

Don’t Miss: Is Doordash Taxable Income

Can I Track My Tax Refund Canada

In this guide, youll learn how you can see your refund status online. Tax information should be updated 8 weeks prior to applying for a tax refund if you live outside of the US. Using My Account, you can access your tax return information online. If you missed your tax refund and would like to see what your refund was, please sign in to My Account.

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

See how our return process works:

Also Check: Freetaxusa Legit

Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

Check The Status Of A Refund In Just A Few Clicks Using The Wheres My Refund Tool

IRS Tax Tip 2022-26,February 16, 2022

Tracking the status of a tax refund is easy with the Where’s My Refund? tool. It’s available anytime on IRS.gov or through the IRS2Go App.

Taxpayers can start checking their refund status within 24 hours after an e-filed return is received.

Also Check: How Does Doordash Work For Taxes

Earned Income Tax Credit And The Additional Child Tax Credit

Due to changes to the tax law made by the Protecting Americans from Tax Hikes Act , the IRS can’t issue Earned Income Tax Credit or Additional Child Tax Credit refunds before mid-February. This includes the entire refund, not just the part that’s related to the credit claimed on a tax return.

Where’s My Refund? and IRS2Go are updated for most early EITC/ACTC filers with an estimated deposit date by February 19, if they file their taxes early.

If a filer claimed the EITC or the ACTC, they can expect to get their refund March 1 if:

- They choose to get their refund by direct deposit and

- No issues were found with their return.

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Recommended Reading: Is Doordash 1099

Why Is My Tax Refund Coming In The Mail Instead Of Deposited Into My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Just in case, sign in to your IRS account to check that the agency has your correct banking information. If you are receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

Can I Contact The Irs For Additional Help With My Taxes

While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call 800-829-1040 or 800-829-8374 during regular business hours.

Don’t Miss: Doordash Tax Deductions