Taking A Deduction For Vehicle Costs

If you drive your vehicle for business reasons, you can deduct most expenses you incur from doing so, including gas, insurance, registration fees, and any necessary maintenance. The CRA gives you two options in how you deduct your vehicle costs. You can itemize all those costs and list them as deductions, or you can take the automobile allowance rate in your area for the number of kilometres you drive.

Remember that only business use of your vehicle works as a tax deduction, so keep detailed mileage logs if you have a vehicle that you drive for both personal and business reasons. If you decide to itemize your deductions, you must determine what percentage of your driving you do for business purposes. Then, deduct only that percentage of your vehicle costs. Its often easier to go with the automobile allowance rate so you dont have to keep track of every expense.

Important Disclosures And Information

Bank of America, N.A. and its affiliates provide informational materials for your discussion or review purposes only and is not intended for financial, tax or investment advice. The content on Small Business Resources is provided as is and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. Consult with your own financial professional or tax advisor when making decisions regarding your financial situation.

Not all materials on Small Business Resources will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Merrill Lynch, Pierce, Fenner & Smith Incorporated makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation . MLPF& S is a registered broker-dealer, registered investment adviser, Member SIPC layer, and a wholly owned subsidiary of BofA Corp.

Get Tax Help After Hours

As a small business owner, you’re often dealing with administrative work like taxation outside of business hours. Get help with a range of tax issues from the ATO at a time that suits you.

Small Business Assist provides online guidance and tax information. For a more personalised and secure experience, use the call-back service.

You May Like: Taxes Grieved

Mail Or Courier Imports Of Prescribed Publications

Special rules allow GST/HST registration for non-resident publishers and other suppliers of prescribed publications sent to Canada by mail or courier.

Generally, if you solicit sales of prescribed publications in Canada, you are considered to be carrying on business in Canada. You have to register and collect the GST/HST from your customers, even though the order is supplied from a place outside Canada. This means that foreign publications sold to Canadian residents are taxed the same way as Canadian publications.

As a registered supplier, you collect the GST/HST from your customers in Canada. If you have collected the GST/HST on prescribed publications, we will not assess the tax on mail or courier imports, and Canada Post will not charge the $9.95 handling fee.

Paying Taxes Is Never Fun But There Are Steps You Can Take To Reduce Your Business’s Tax Liability

- A tax liability is the tax debt you owe the federal, state or local government.

- Understanding what deductions you can make, what equipment to purchase and how to invest in operations can help reduce your tax liability.

- Tax credits can reduce your tax

- This article is for small business owners looking to better manage their taxes.

For most people, taxes are due April 15, but businesses must prepare taxes year-round. The decisions you make throughout the year impact your businesss tax liability. If this is your first year filing a business tax return, you might be nervous about how much you owe the government.

Recommended Reading: Do Doordash Drivers Pay Taxes

Recent Changes To The Corporate Income Tax

The Tax Cuts and Jobs Act reduced the top corporate income tax rate from 35 percent to 21 percent and eliminated the graduated corporate rate schedule and the corporate alternative minimum tax. Through 2022, the TCJA allows full expensing of most new investment, after which that benefit is phased out through 2026. The TCJA also limited net interest expense deductions to 30 percent of adjusted taxable income.

The TCJA made fundamental changes to the treatment of multinational corporations and their foreign-source income. Prior to the TCJA, dividends distributed by foreign subsidiaries to their US parent corporations were subject to US tax with a credit for foreign income taxes paida so-called worldwide system. Now, a ten percent return on certain qualified business asset investment is exempt from further U.S. taxa so-called territorial system. However, the reduced-rate Global Intangible Low-Taxed Income minimum tax applies to returns above that amount regardless of whether they are repatriated as dividends. The TCJA also created a new domestic minimum tax, the Base Erosion and Anti-abuse tax , designed to prevent cross-border profit shifting. A deduction for certain foreign-derived intangible income serves as an incentive for corporations to locate intellectual property in the U.S.

What Documents Do I Need To Keep As Part Of My Business Records

While the CRA doesnt specify the documents businesses or entrepreneurs are required to keep, some essential accounting documents you should have in your records include sales invoices, purchase invoices, cash register receipts, formal contracts, credit card receipts, delivery slips, deposit slips, cheques, bank statements, tax returns, and general financial correspondence.

In addition, accountants working papers that were used to determine the obligations and entitlements with respect to taxes are considered part of the books and records of the taxpayer and must be made available to the CRA upon request.

You May Like: Is Plasma Money Taxable

Common Business Structures: Sole Proprietorships And Partnerships

The most common types of businesses are sole proprietorships, partnerships, LLCs, corporations and S corporations . These are legal designations that, for tax purposes, vary primarily in three ways: how income is taxed, how Medicare and Social Security taxes are levied and who is liable for any debts the business incurs.

The simplest structures are sole proprietorships and partnerships, and many small businesses start out in these categories because they’re so easy to set up and run. They don’t need to formally organize with any state agency. If you work for yourself/selves and haven’t selected a business structure, you’re basically considered a sole proprietorship or partnership as far as taxation goes .

Gst/hst For Digital Economy Businesses

As of July 1, 2021, digital economy businesses, including digital platform operators, may have potential goods and services tax/harmonized sales tax obligations under three new measures. This means you may have new obligations, including registering and charging and collecting the GST/HST.

Where the affected businesses and platform operators show that they have taken reasonable measures but are unable to meet their new obligations for operational reasons, the CRA takes a practical approach to compliance and exercises discretion in administering these measures during a 12-month transition period, starting July 1, 2021.

Before the CRA exercises its discretion in the administration of the new measures, an affected business or platform operator must first obtain the CRAs written approval that such discretion will be exercised. Submissions may be made to the CRA after July 1, 2021, until further notice.

A number of publications may be revised at a later date to reflect the new GST/HST digital economy measures. For more information on these new measures and the definitions for the digital economy, go to GST/HST for digital economy businesses: Overview.

Don’t Miss: Pastyeartax Com Review

How To Pay Taxes As A Small Business Owner

How you pay taxes as a small business owner depends on your business structure:

- C-corps and LLCs taxed like C-corps report business income and expenses on Form 1120.

- S-corps and LLCs that elect to be taxed like S-corps report business income and expenses on Form 1120-S, then issue a Schedule K-1 to each shareholder reporting their share of profits or losses.

- Partnerships and LLCs with more than one member report business income and expenses on Form 1065. The completed Form 1065 includes a Schedule K-1 for each shareholder, which theyll need to report their share of profits or losses on their individual tax return.

- Sole proprietorships and LLCs with only one member report business income and expenses on Schedule C, a schedule that gets filed along with the owners individual tax return, Form 1040.

Handling Business Taxes Online

Use the CRAs digital services for businesses throughout the year to:

- make payments to the CRA online with My Payment or a pre-authorized debit agreement, or create a QR code to pay in person at Canada Post

- file a return, view the status of filed returns, and adjust returns online

- submit documents to the CRA

- register to receive email notifications and to view mail from the CRA in My Business Account

- manage addresses

For more information, go to E-services for businesses.

Also Check: Florida Transfer Tax Refinance

What Other Taxes Does A Business Pay

In addition to income taxes, the largest tax bill that small businesses pay is for payroll taxes. These taxes are for FICA taxes .

Your portion as an employer is 7.65% on employee gross payroll. Other payroll taxes, like unemployment taxes and workers’ compensation taxes, increase the amount of tax you must pay as an employer.

Other taxes your business will be responsible to pay include:

- Capital gains taxes on business investments and on the sale of business assets. The capital gains tax rate is based on how long you owned the asset.

- Property taxon real property owned by the business

- Tax on dividends from business investments

Other Canadian Income Tax Deductions

You may also be able to make additional deductions:

- Capital Cost Allowance. No discussion of Canadian income tax and small business would be complete without mentioning capital cost allowance . Understand how to calculate CCA and how to make the most of your capital costallowance claim.

- Registered Retirement Savings Plans. Registered Retirement Savings Plans are the best way to reduce Canadian income tax deductions for small businesses that are structured as sole proprietorships or partnerships. Determine the RRSP contribution limits and how to time your RRSP contributions for maximum income tax impact.

- Scientific Research and Experimental Development. Many small businesses are under the impression that scientific research and experimental development tax incentives are something that only larger or incorporated businesses can use. However, the SR& ED Tax Credit Program may also apply to your small business.

- Gifts to Employees as Canadian Income Tax Deductions. If you’re the generous kind of employer who gifts your employees, you should understand the income tax deduction rules for gifting.

Also Check: How To Pay Taxes Doordash

How Are Small Businesses Taxed

You might be surprised to learn that most small businesses dont pay the corporate rate for income tax.

In fact, 75 percent of small businesses arent considered corporations but something called unincorporated pass-through entities. This means that they pay the owners personal tax rate, according to the National Federation of Independent Businesses.

Owners include income from their small business in their personal taxes, so their income tax rates are calculated based on the business owners total earnings.

Use the 2018 Federal Income Brackets to see what percent tax youll owe based on your income:

- For example, if you make $38,701 to $82,500 per year, youll be taxed $4,453.50 plus 22% of your income over $38,700. The average small business owner makes $59,776 per year. A $4,453.50 base fee plus $4,636.72 means an owner making $59,776 will be taxed $9,090.22.

The $59,776 average small business owner salary is reported by Payscale.

Then use this state tax calculator to estimate what youll be taxed at a state level.

- For example, in New York the state income tax would be $3,033.35.

So in New York, youd be taxed $12,123.57 on $59,776 per year. Dont worry if this number seems high! There are plenty of deductions you can claim.

Partnerships are businesses with more than one owner and the owners each individually report their income on their personal taxes.

List of taxes for small businesses owners:

Small Businesses Pay Income Payroll And Other Taxes

According to NerdWallet, because small business owners pay both income tax and self-employment tax, small businesses should set aside about 30% of their income after deductions to cover federal and state taxes.

Other taxes small businesses pay include:

1. Payroll tax: According to The Balance, after an employer has calculated and withheld the appropriate amounts from employee paychecks for federal income tax withholding and FICA taxes, they must:

a. Calculate and set aside the amount they, as a business, must pay for FICA taxes

b. Make payments to the IRS either monthly or semi-weekly, based on their total employee payroll

c. Report on payroll taxes quarterly using Form 941 or through e-file

2. Income tax: Small business tax rates are tied to the reported income of the businesss owner, so business owners should expect to pay both their income tax and a self-employment tax.

3. Self-employment tax: This is your FICA tax and includes both Social Security and Medicare taxes. Salaried employees split these costs with their employer, but small business owners are both the employee and the employer. That means they have pay it all. Need help calculating your tax? Try our self-employment tax calculator.

4. Capital gains tax: If your business investments appreciate or you make a profit on the sale of business assets, youll likely pay tax on the difference, known as capital gains. The capital gains tax rate is based on whether your gain is long-term or short-term.

Also Check: Buying Tax Liens California

Preparing And Filing Canadian Income Tax

If you operate a Canadian small business, you’ll need to file a business income tax return each year. Part of running a successful business is knowing how Canadian income taxes are filed and prepared, which can help you get the best return. This includes understanding which business expenses qualify as legitimate Canadian income tax deductions, as well as knowing how to maximize those deductions.

Income Taxes For Multi

Multi-member LLCs are treated as pass-through entities for federal income tax purposes. Similar to the single-member LLC, this means that the LLC doesnt pay taxes of its own. Instead, each member pays taxes on the businesss income in proportion to their ownership stake in the LLC. Thus, the LLC tax rate is in accordance with each members individual income tax bracket.

If, for instance, two members in an LLC have a 50-50 ownership split, each owner will be responsible for paying taxes on half of the businesss profits. Each owner can also claim half of the tax deductions and tax credits that the LLC is eligible for, and write off half of the losses. This type of taxation works almost exactly like a partnership.

A multi-member LLC has to file certain tax forms with the IRS, including Form 1065, U.S. Return of Partnership Incomean informational return that must be filed annually with the IRS. The LLC must also give each owner a completed Schedule K-1 by March 15 of each year. The Schedule K-1 summarizes each owners share of LLC income, losses, credits, and deductions. Each owner will attach their Schedule K-1 to their personal income tax return thats filed with the IRS.

Pass-through taxation continues at the state and local levels. Most states have their own equivalent of Form 1065 and Schedule K-1. As mentioned above, a few states like California charge additional LLC taxes.

Recommended Reading: 1040paytax Customer Service

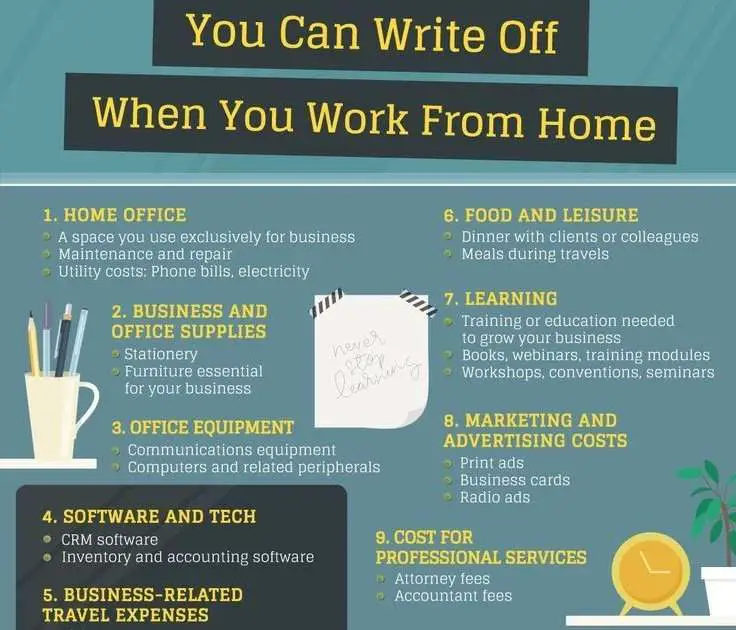

How Does A Write

A write-off is also called a tax deduction. This lowers the amount of taxable income you have during tax time. Basically, let’s say you made $75,000 last year and have $15,000 in write-offs. That means your taxable income for the year would be $60,000. The tax code allows self-employed workers to write off various expenses related to their business. This can include things like business miles with the mileage deduction, usual business expenses, the cost of using your home as an office and much, much more. W-2 workers can often qualify for various write-offs, especially if they itemize their return. Many people can lower their taxable income by writing off things like charitable donations, mortgage interest deduction and more. If you don’t want to itemize, many W-2 employees can also use the standard deduction to lower their taxable income. The standard deduction varies based on your filing status and you can see what yours would be using this calculator.

Goods Imported Into Canada

Goods imported into Canada are subject to the GST or the federal part of the HST, except for non-taxable imports. For more information, see Non-taxable imports.

You have to declare and report imported goods to Canada Border Services Agency for immediate inspection. When the goods are sent by common carrier, the carrier has to report their arrival to CBSA. In all other cases, the person importing the goods has to declare and report the goods to CBSA.

Generally, if you are a GST/HST registrant and the importer of record of goods that you supply and that are delivered or made available to purchasers in Canada:

- you pay the GST or the federal part of the HST at the time of importation

- you can claim an ITC for the GST or the federal part of the HST paid or payable if the imported goods are for consumption, use or supply in your commercial activity

- you charge the GST/HST to your customers on the sale price other than for exempt supplies

If you are not a GST/HST registrant and the importer of record of goods imported into Canada that you supply:

- you pay the GST or the federal part of the HST at the time of importation

- you do not charge the GST/HST to customers, even when the goods are delivered or made available to the customers in Canada.

Don’t Miss: Door Dash Tax Form