Federal Tax Id For The Self Employed

EIN is an Employer Identification Number that is mandatory for businesses but do self employed professionals or sole proprietorship firms need it? According to Internal Revenue Service , a sole proprietor or self employed professionals with DBA will not be required to file for EIN if they dont have any employees and are not filing any pension plan tax returns or excise tax returns. Yet, as a self employed with DBA or sole proprietor, you may require an EIN to fulfill specific purposes. If you are an independent contractor providing personal services then you will be required to provide EIN to your customers.

One of the most important reasons for obtaining an EIN is for opening a business banking account. An EIN is also known as a Federal Employer Identification Number and is used by credit and lending agencies to track business credit of sole proprietors. The advantage of having it means that you will be able to apply for business loans with ease as lenders prefer those with an established or good business credit. As a sole proprietor, having an EIN will enable hiring of employees to have a Solo 401 retirement plan or a tax-deferred pension plan like the Keogh Plan.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Ein Lookup: Finding Your Ein Is Simple And Easy

How do I find my EIN number?! Its so hard!

It can be frustrating to attempt to open a new business account or apply for financing, be asked for your EIN, and proceed to find out that youve lost it and all relevant paperwork with your EIN or Tax ID number on it .

However, there are several simple and easy ways to obtain your EIN even if you dont have a single tax return or your confirmation letter.

If you cant find your EIN or Tax ID number, look around for your confirmation letter, and if you cant find it, look through your relevant tax and business documents. If that doesnt work, simply give the IRS a call and provide the necessary information.

No matter what, obtaining your EIN should be easy. So, if youve lost it, and not having it is holding you back from moving forward with something important, dont sweat it.

Don’t Miss: When Can Start Filing Taxes 2021

The Many Purposes Of An Ein

A business needs an EIN to open a bank account, hire employees and file employment, excise, or alcohol, tobacco, and firearms tax returns. A business also needs an EIN to allow the IRS to track its payroll tax remittances, the taxes it has withheld from employees salaries to be remitted to the government. A self-employed person who wants to establish a Keogh or Solo 401 plan needs an EIN for the retirement plan. An individual who purchases or inherits an existing business needs an EIN for the business.

How To Cancel An Ein

If you apply for an EIN and realize you dont need it or close your business, you can close your business account with the IRS.

How you close your account depends on whether youve ever used the EIN to file tax returns or not.

If you never used the EIN, send a letter to the IRS that includes the complete legal name of your business, your EIN, business address, and the reason you need to close your account. Send your letter to Internal Revenue Service, Cincinnati, OH 45999. You may want to send the letter certified return receipt so you have confirmation that the IRS received it.

If youve filed an income tax return using the EIN, you need to file a final return before the IRS can close your account. Business tax returns, including Form 1065, Form 1120-S, and Form 1120, include a checkbox to mark the return as final. You need to file a final return even if you didnt have any revenues or expenses during your last year in business.

Once the IRS assigns an EIN, it will never assign it to another business entity, even after closing your business account. It remains the permanent federal identification number for that business, and you can reopen your account and reuse the EIN for that same business later if needed.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: How Do I Get Last Year’s Tax Return From Turbotax

Lost Or Misplaced Your Ein

If you previously applied for and received an Employer Identification Number for your business, but have since misplaced it, try any or all of the following actions to locate the number:

- Find the computer-generated notice that was issued by the IRS when you applied for your EIN. This notice is issued as a confirmation of your application for, and receipt of an EIN.

- If you used your EIN to open a bank account, or apply for any type of state or local license, you should contact the bank or agency to secure your EIN.

- Find a previously filed tax return for your existing entity for which you have your lost or misplaced EIN. Your previously filed return should be notated with your EIN.

- Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at . The hours of operation are 7:00 a.m. – 7:00 p.m. local time, Monday through Friday. An assistor will ask you for identifying information and provide the number to you over the telephone, as long as you are a person who is authorized to receive it. Examples of an authorized person include, but are not limited to, a sole proprietor, a partner in a partnership, a corporate officer, a trustee of a trust, or an executor of an estate.

Ein Look Up: Finding Your Companys Ein

An EIN look up is a process by which you can find this unique nine-digit business tax ID number of your company as well as any other business in the US. There is always a probability that you may need to find the EIN of another company you are planning to do business with. There are other times when you may need to find your own EIN for an important business related application. There can be any number of reasons why you may need to find your business tax ID number but the question is how you go about looking up your EIN.

You May Like: What Is California State Tax Rate

Finding Another Companys Ein

Why would you need to find the EIN number of another company? The most commonly stated reason includes validation of information provided by another company. Sometimes when one business chooses its vendors, retailers, or partnership businesses, such a business has to provide relevant information regarding its credibility. In order to check their credibility and to find out if the business exists, you may be required to search its Employer Identification Number. There are several ways to find out the EIN, so lets look at your options.

No Authorization Needed For Nonprofit

While you must be an authorized agent to verify a for-profit business’s EIN, nonprofit entities must maintain public records. Anyone can access this information directly from the IRS. As such, a nonprofit must provide you the EIN upon request, and you can verify this directly with the IRS on the Exempt Organization page of the IRS website.

The site not only verifies EINs but advises you if organizations are in good standing with the IRS. Good standing means they are current on tax returns and filings. You can also see if the organization has had its nonprofit status revoked.

You May Like: How To Determine Fair Market Value Of House For Taxes

Do I Need A Separate Ein For Each Business

There are times when a Limited Liability Company or a sole proprietor may want to start multiple businesses in the same or different industries or specialization. In such a scenario, you can have a single EIN for each of the businesses. It is often recommended though to apply for a separate EIN for each business or each DBA that you may have as it provides higher asset protection if a lawsuit is filed. Secondly, if you have different business types or structures like an LLC as well as a corporation then the tax structure would be different and hence having separate EINs would be beneficial.

How To Find Your Employers Ein

Due to the coronavirus, a massive surge in unemployment has swept the nation. And in many states, you may need your employers EIN in order to file for unemployment. If you need to locate a current or former employers EIN for that or another reason, you can do so in two ways:

- Locate Your W-2: Your employers EIN will appear on your W-2 form in Box b. If you have past tax records, this is the easiest way to find your employers identification number. If you cannot find your physical copy of your W-2, check your tax filing software such as TurboTax or any online payroll records you may have through companies such as ADP.

- Contact Your Employer: If you cannot locate your personal tax forms or dont have sufficient forms due to being an independent contractor, the next step is to contact your employer. Reach out to the accounting, payroll and/or HR departments. They should be able to help you out right away. If your employer is a publicly traded company, you should be able to find it online on the companys 10-K, which is public record. If your employer went bankrupt, look online for public court records which may include its EIN.

Don’t Miss: Can You File Your Taxes For Free With Turbotax

Use Melissa Database For Nonprofits

The Melissa Database provides free federal tax ID lookup for nonprofit organizations.

If you have a legitimate need to find the EIN for another business, then you can use one of these options to look up the number. Just be sure to keep your own EIN secure. Only share the number with a limited subset of peoplelenders, prospective suppliers, bankers, etc. You should guard your business’s EIN just like you would guard your social security number.

Other Ways To Find An Ein

If the person is authorized to receive an EIN from the IRS, she can call the IRSs Business & Specialty Tax Line to get the EIN. Authorized persons include sole proprietors, partners in a partnership, a corporate officer, a trustee of a trust and an executor of an estate.

A party can also hire a business to look up a companys EIN. He can search for local or federal registration forms that a business has filed that may contain an EIN. In addition, he can purchase the companys business credit report, which may contain its EIN. Read More:How to Find EIN Numbers for Free

Read Also: When Will We Get The 3000 Child Tax Credit

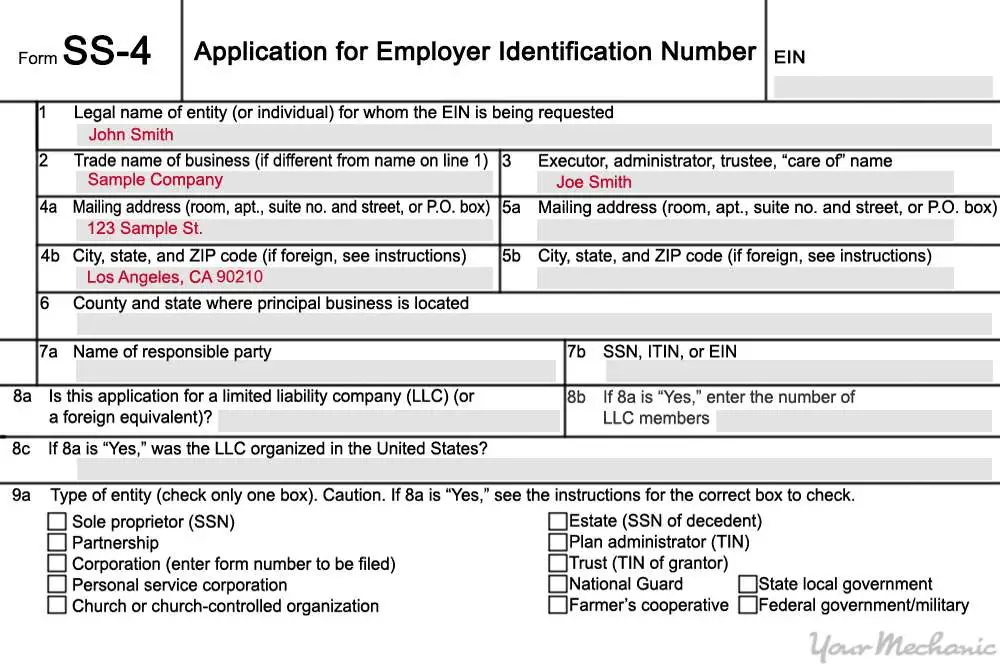

Find Ein Number From Ein Confirmation Letter

One of the ways to find an EIN number is with the help of the employer identification number confirmation letter. In order to understand what the confirmation letter is and how do you find EIN, lets look at an example:

You have formed a company and applied with the IRS for an employer identification number. You want to open a bank account for business transactions and your bank asks for a confirmation regarding the issue of the EIN. In such a scenario, what do you do? This is where the form CP575 comes to the rescue. Yes, this is a form that will help you find an EIN number so that you can provide it to the bank.

When a business applies for an EIN by submitting Form SS-4, the Internal Revenue Service issues a Form CP 575 after two weeks post approval to confirm that an Employer Identification Number that has been issued for the business in question. The Form CP 575 contains the EIN number allotted to a business and this letter is sometimes used by businesses for EIN look up.

Bulk Ein Search And Other Bulk Search Options

If you work in an industry that requires the EINs of multiple companies as part of your regular operations, you would benefit from a bulk EIN search rather than a series of individual searches.

You can request a quote for ten or more of the same search. This applies to EIN search as well as any other investigator searches. When placing a bulk order, you can order the same kind of investigator service for multiple subjects or place a custom order.

Just select an investigative or batch processing service from the dropdown box, enter any additional details , and click the Order button!

Once you click Order, you will be taken to an order confirmation page where you can upload the file with the information for your investigator. You wont be charged yet Searchbug will contact you with a quote first and then will obtain payment authorization.

Bulk processing is available for any of the searches Searchbug offers. This includes assisted SSN and name matching, employment history report, verified place of employment search, and much more.

Also Check: What Is The Tax Rate In Ny

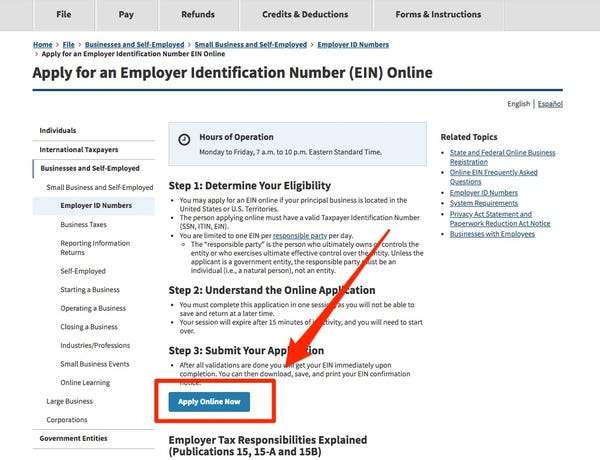

How To Get An Ein For Your Business

If you are the sole employee of your business, you could use your personal Social Security number to file your business’ taxes.

But with an EIN, you can file your personal and business taxes separately. And if you have any other employees, you MUST obtain an EIN.

To be eligible to receive an EIN for your business, you must have the following:

- A valid taxpayer identification number in the form of a Social Security number, individual taxpayer identification number, or a different employer identification number

If you meet these requirements, you can complete an online EIN application on the IRS’ website. The application is available MondayFriday, 7 a.m. to 10 p.m. EST.

You may also fax or mail an application to the IRS.

International Applicants

If you are not a resident of the United States, complete Form SS-4 and fax or mail it to the IRS. You may also call the IRS at 267-941-1099 and provide the information on the Form SS-4 over the phone.

Individual Taxpayer Identification Number

To file for your ITIN, mail a completed Form W-7, proof of your identity and any foreign state documentation to the IRS at this address:

Internal Revenue Service Austin Service Center ITIN Operation P.O. Box 149342 Austin, TX 78714-9342

You can also submit your ITIN application in person through an IRS-authorized Certifying Acceptance Agent program, or contact your local IRS Taxpayer Assistance Center to have the IRS send you your ITIN by mail.

Also Check: What Property Tax Exemptions Are Available In Texas

Employer Tax Responsibilities Explained

Publication 15PDF provides information on employer tax responsibilities related to taxable wages, employment tax withholding and which tax returns must be filed. More complex issues are discussed in Publication 15-APDF and tax treatment of many employee benefits can be found in Publication 15. We recommend employers download these publications from IRS.gov. Copies can be requested online or by calling 1-800-TAX-FORM.

Can I Transfer My Ein

There are times when a business may go through structural changes and then there are times when it witnesses ownership changes. According to the Internal Revenue Service, a business entity will have to apply for a new EIN if it undergoes any ownership change and this means transfer of an existing EIN is not possible.

Read Also: How To Get Tax Exempt Status

Does An Ein Expire

An EIN is your businesss equivalent to your Social Security number. And just like an SSN, your EIN does not expire. That means if you started a business long ago that you want to revitalize now, youll need to locate your original EIN rather than applying for a new one. Additionally, the IRS cannot cancel an EIN. Even if you never got far enough in your business to file taxes, if you applied and received an EIN, it remains to this day.

If you cannot locate an old EIN, contact the Business & Specialty Tax Line at 800-829-4933 between the hours 7 a.m. and 7 p.m. local time to obtain a copy of your EIN.

Contact The Irs To Find Your Ein

If you can’t find your EIN on any of your documents, you can contact the IRS at 800-829-4933, but you’ll need to call them Monday through Friday between 7 a.m. and 7 p.m. local time.

If your EIN changed recently and isnt on older documents, this should be your first option. Be sure that the person contacting the IRS is authorized to do so. Authorized people generally include the sole proprietor, a partner in a partnership or a corporate officer.

Recommended Reading: Can You File State Taxes Before Federal