The Problems With Free File

It seems pretty simple. Taxpayers work with the tax service matched to them, fill out their tax return forms and file. There should be zero costs. So, why are not many people taking advantage of the program?

Reporting by nonprofit investigative news group ProPublica in 2019 found several issues with Intuit-owned TurboTax and its marketing.

First, the site was advertising free filing on their homepage and throughout the site. No matter what happened when ProPublica tried to file taxes, there would be a charge. Sometimes more than $200.

It turns out, you actually cannot go directly to TurboTax.com. Hidden in the support section of the site was a note that its impossible to find the actual free version on TurboTaxs site. Instead, people were supposed to go to TaxFreedom.com.

ProPublica later discovered code in the site that .

They also found the company made people with disabilities, the unemployed and students pay more for their services after the new tax law was passed and even steered members of the military away from the free version thats promised by the federal government.

A Senate investigative panel in June 2020 found, among other things, that until recently, the IRS conducted little oversight of the Free File program.

Turbotax Leaving Irs Free File Program

Intuit, the financial software company behind TurboTax, announced Thursday that it will no longer be participating in the IRS Free File Program that allows Americans to use brand-name products to file their tax returns for free.

The company said in a blog post that while it has partnered with the IRS for the program for nearly 20 years, it was not able to continue in the program and deliver all of the benefits that can help consumers make more money, save more, and invest for the future.

The software company explained that the Free File program was surpassing its founding goals of e-file and free tax preparation, and that it had decided to leave due to the limitations of the Free File program and conflicting demands from those outside the program.

Intuit said that its departure from the program will be effective at the end of the current tax season in October.

This decision will allow us to focus on further innovating in ways not allowable under the current Free File guidelines and to better serve the complete financial health of all Americans through all of our products and services, in tax preparation and beyond, Induit said in its Thursday post.

The company went on to say that it can help more customers get access to their refund faster at no cost, to tap into expert resources at will, to choose to use their own data to better budget, save and invest all of which we cannot effectively do as part of the Free File program.

How Do You Get A Lost Tax Return

Visit the IRS Online If you visit IRS.gov/transcripts, youll find an automated Get Transcript option with two choices for recovering your lost tax return online or by mail. Each choice requires you to register and create a free account for which you provide certain information to verify your identity.

Recommended Reading: Tax Deductions Doordash

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the softwares instructions to e-file the

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

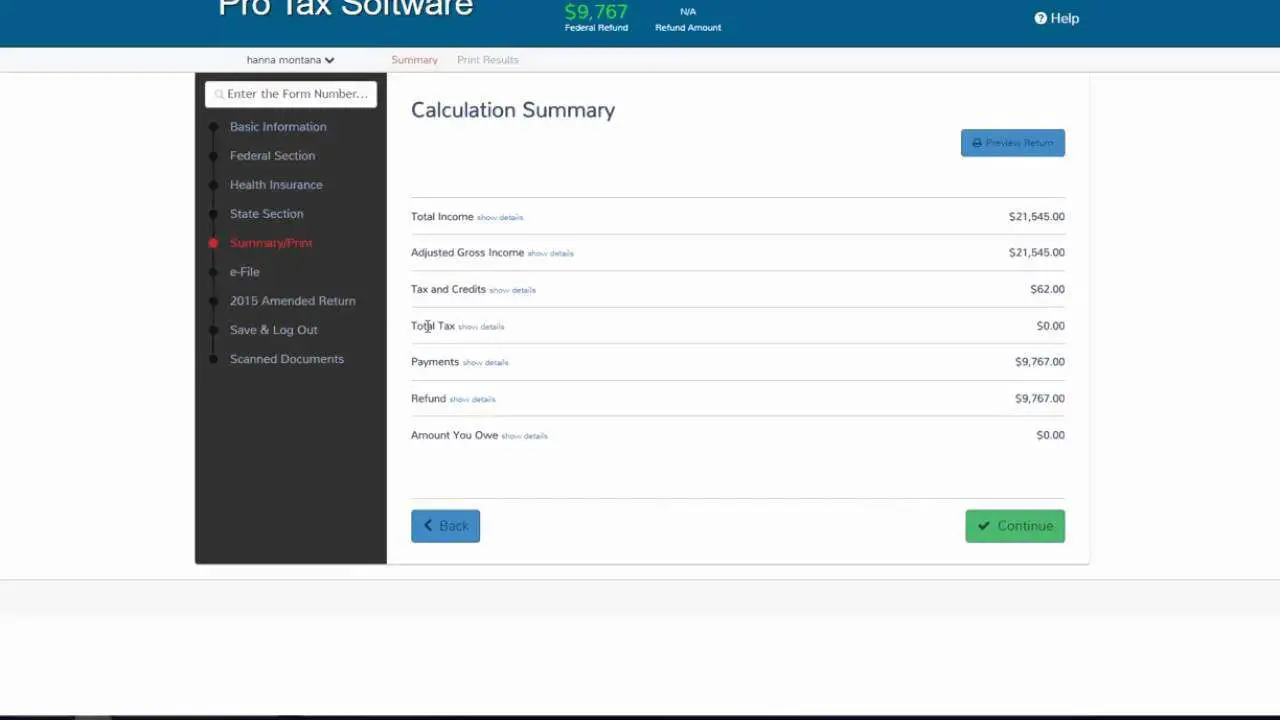

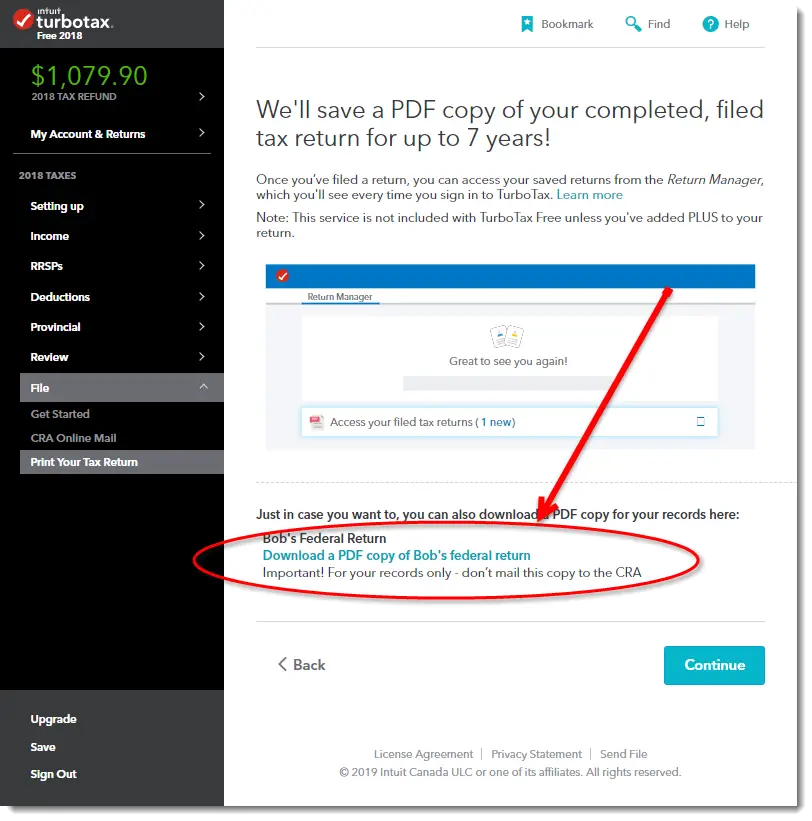

The Internal Revenue Service can provide you with copies of your tax returns from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Recommended Reading: Csl Plasma Taxable

Mail Form 4506 And Payment

Mail Form 4506 and your payment to the appropriate IRS office. The IRS charges a fee for each tax year you request a return for. As of 2021, the fee for each one is $50 and you can make payment by check or money order, payable to the U.S. Treasury.

Also include your Social Security number and the notation Form 4506 request on your check or money order. After signing the bottom of the form, check the instructions to determine the appropriate IRS address. Note that the IRS office you mail it to depends on your address at the time of filing the tax return, not your current address.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Irs Transcripts Are Free

Your other option is to order a tax transcript from the IRS rather than an actual copy of your return. The IRS makes two types of transcripts available: a tax return transcript and a tax account transcript, and both are free. A transcript is more or less a summary of the information included in your return and your payment and refund histories.

Mail in Form 4506T-EZ if you want a tax return transcript, or Form 4506T if you want a tax account transcript. You can also request a transcript online from the “Get Transcript Online” page of the IRS website, or even call the agency, although the IRS isn’t taking phone calls in spring 2020 due to the coronavirus pandemic.

It will take from five to 30 days to get the transcript, depending on whether you make the request online or via USPS mail, and they’re only available for four years the current year and the previous three.

Read Also: Roth Ira Reduce Taxable Income

Can I Get A Copy Of My Tax Return From The Irs

Normally, taxpayers can either request a tax return transcript or order a full copy of a previously-filed return from the IRS.

However, the IRS has suspended virtually all manual operations due to the coronavirus situation. This includes requests for copies of tax returns and mailed transcripts.

Only an online tax return transcript, which you can view, download, and print, are currently available through the IRS.

Transcripts include most line items from your return, like your AGI, and look like this. They’re available for tax years 2017 through 2020 and are free.

Related Information:

If All Else Fails Contact The Irs

Of course, the IRS has copies of your tax returns as well, so you can reach out to the agency if your computer or tablet has since crashed or you cant retrieve your return from TurboTax online for some reason. Unfortunately, youll have to pay for it, and youll have to wait a while to get your hands on it.

You can make your request by snail-mailing Form 4506 to the IRS along with your payment. You can download the form from the IRS website. You must include your spouses name and Social Security number on the form if you filed a joint married return, but your spouse doesnt also have to sign the form.

The fee is $50 for each return as of 2020. The IRS indicates that youll have to wait about 75 days for processing. It keeps returns for seven years.

Dont Miss: Where To File Quarterly Taxes

You May Like: Employer Tax Identification Number Lookup

When Your Tax Return Goes Missing Or Is Lost

Tax returns can go missing for a variety of reasons, such as moving, a flooded basement, or lost or stolen mail. The CRA may be willing to waive those penalties if you can provide proof that you mailed in your tax return. If you mailed in your tax return by regular mail, you cannot provide proof, but if you sent in your package via courier or registered mail, you can provide a tracking number as proof and check the status of your package.

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS launch date.

Please refer to the E-File Service page for details on the e-filing process.

Also Check: Do Nonprofits Pay Payroll Taxes

Don’t Miss: Is Plasma Money Taxable

How Does Turbotax Work

TurboTax packages up the things most people need to file their taxes in easily navigable do-it-yourself plans. For an extra fee, you can hire the direct assistance of a tax professional.

TurboTax offers online and desktop versions of its software, with different prices depending on how many forms you need to complete your return. You can also log in and work on your taxes with the TurboTax mobile app for Android and iOS devices.

Like other tax programs, TurboTax is driven by a series of questions and answers about your household, income, and opportunities for deductions and . In addition to answering these questions, you’ll need to add information from your employer, other income sources, and 1099, 1098, W-2, and other tax forms that may show up in your mailbox or email inbox.

Last Years Tax Info Transferred

Now that youve transferred last years info, you can continue through TurboTax to review and complete your return.

*If you havent yet completed this years tax return with TurboTax, check out our TurboTax coupon page with an exclusive 10-20% discount for all editions of TurboTax including: Basic, Deluxe, Premier, and Self-Employed.

You May Like: Taxes For Doordash

If You Preparedyour Taxes Online

You’ll have to use your TurboTax login if you used the online version of the product. Make sure you sign in to the same account you used to prepare your return. From there, it’s a simple matter of clicking on the “Documents” tab, then on the tax year you want, then finally on “Download PDF.”

TurboTax suggests using the “Account Recovery” tool if you can’t find the return you’re looking for. It’s possible that you’re not signed in under the same account you used to prepare it.

Who Is Eligible And How Does It Work

There are two types of Free File. For those making an adjusted gross income of $72,000 or less, the IRS has partnered with nine companies as part of the Free File Alliance.

What is Adjusted Gross Income ?

Gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to Income include such items as Educator expenses, Student loan interest, Alimony payments or contributions to a retirement account.

TurboTax, 1040Now and TaxACT are among the members.

To use IRS Free File, taxpayers need to go to IRS.gov and use a tool to find the company best matched with their tax situation. In addition to the normal documents needed for taxes, people also need an email address and a copy of last years tax return.

Once the taxpayers are matched to the service, they can fill out their taxes for free. Some providers also offer free state preparation.

Free File is open for the season. The IRS wont begin processing tax returns until Feb. 12, which is later than normal due to the pandemic. The Free File platforms are starting to accept tax returns, but wont transmit until Feb. 12.

This year, the IRS is also recommending that taxpayers file online and use direct deposit for refunds.

For those with an income above $72,000, there are basic Free File fillable forms. Those arent available until Feb. 12.

Read Also: Buying Tax Liens In California

What Is Free File

Yet a simple way to cut down on costs which many people oddly don’t tap into remains using the IRS Free File system, if you qualify. Why pay $40 or $50 or more for online software if you don’t have to do so?

The Free File program at IRS.gov gives eligible taxpayers free access to brand name software programs offered by rival tax-prep companies. Those who qualify can use online software that prompts filers with key tax questions, does the math and allows you to file returns electronically for free. E-filing helps the IRS process returns and issue refunds more quickly than a return filed by paper.

TurboTax was but one partner in Free File. Those who selected TurboTax last year are able to opt for another online tax preparation service in the Free File program. Last year, there were nine tax software products available via Free File in English and two in Spanish.

How To Get Copies Of Past Years Tax Returns

Here’s how to obtain copies of a prior year return you filed in TurboTax Online:

If you don’t see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: Doordash Accounting Method

Import A Pdf For A Prior Year:

If last year you used other tax software, an accountant, or tax service, youll get the option to import a PDF when youre starting in TurboTax. A PDF imports your personal info and your AGI so you can e-file.

Select the method you used to file last year and follow the screens. The PDF needs to be your 1040, 1040A, or 1040EZ, and the program accepts PDFs from a range of providers.

But, if the PDF is password protected or a scan of a hard copy, you wont be able to import. If this happens, dont worry, well guide you through typing in your info.

*Tip: While you can import a 1040EZ return to a paid version of TurboTax, you cant import prior years to their Free Edition , so you may have to pony up for another edition

Why The Government Should Just Do Your Taxes For You

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But here’s the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If I’m not itemizing deductions , the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

This isn’t a purely hypothetical proposal. Countries like Denmark, Sweden, Estonia, Chile, and Spain already offer “pre-populated returns” to their citizens. The United Kingdom, Germany, and Japan have exact enough tax withholding procedures that most people don’t have to file income tax returns at all, whether pre-populated or not. California has a voluntary return-free filing program called ReadyReturn for its income taxes.

The Obama administration supported return-free filing, and Ronald Reagan touted the idea in a 1985 speech:

You May Like: How To Get A License To Do Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How Can I Amend My Tax Return

THAIPOLICEPLUS.COM” alt=”How do i get my agi from last year online > THAIPOLICEPLUS.COM”>

THAIPOLICEPLUS.COM” alt=”How do i get my agi from last year online > THAIPOLICEPLUS.COM”> Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return, do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

Don’t Miss: Efstatus/taxact