Tax Day 2021 Deadline: The Last Day You Can File And How To Get An Extension

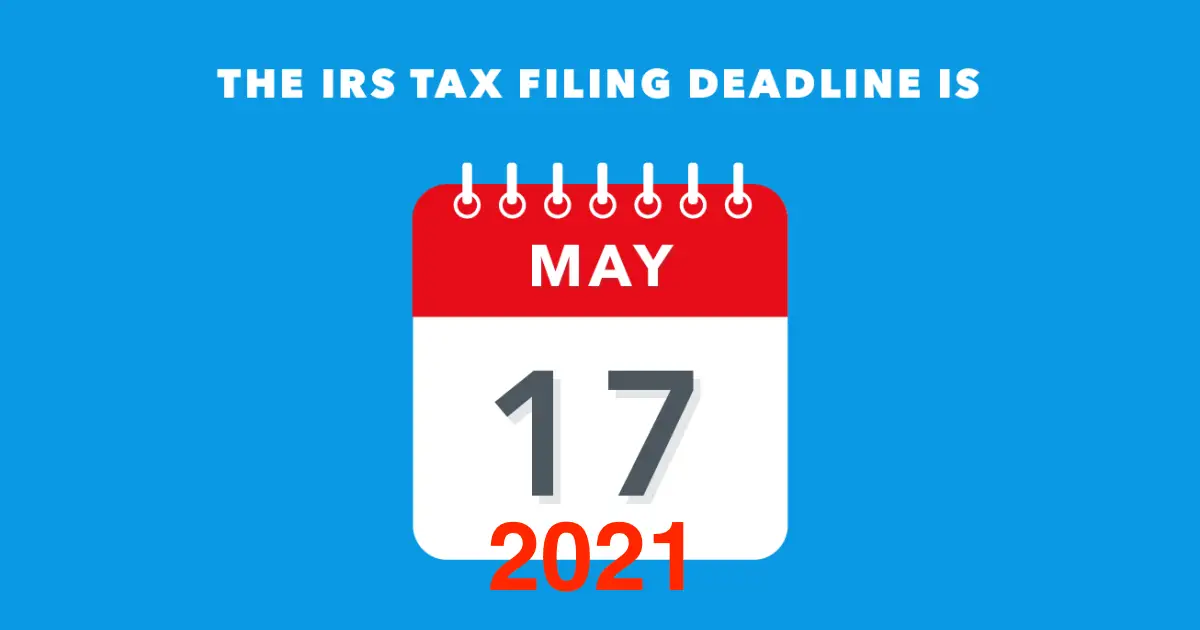

The IRS has officially postponed the deadline for 2021.

With millions of Americans still struggling to navigate COVID-19 and its impact on the economy, the IRS has elected to once again postpone the date that your federal income tax return is due. The new deadline of May 17, which will give you an extra month or so to get your paperwork in order this year, isn’t quite as generous as last year’s extension, which ran to July 15 — but, if you’re playing catch-up, it’s better than nothing.

Still, the clock is ticking for all of us — including the millions of taxpayers that will be facing an array of new, and potentially complicated, tax issues. They include unemployment insurance claims, stimulus check income and questions about eligibility for the home office deduction, just to name a few.

As such, the best thing you can do is to start now. Filing early means a quicker turnaround on your refund and getting any missing stimulus money faster.

See also

Read more: Best tax software for 2021

What Doesnt The Tax Deadline Extension Apply To

Remember that the federal governments May 17 income tax deadline extension only applies to your federal taxes. Most states have left their normal tax deadlines in place, but five states have later tax filing deadlines.

Find your state governments tax agency website on the Federation of Tax Administrators list to learn more.

| 2021 State Income Tax Deadlines | |

| State | |

| Wyoming | No state return necessary |

If you need even more time to complete your 2020 federal returns you can request an extension to Oct. 15 by filing Form 4868 through your tax professional, tax software or using the Free File link on IRS.gov. Filing Form 4868 gives taxpayers until Oct. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due. Taxpayers should pay their federal income tax due by May 17, 2021, to avoid interest and penalties.

If you mail in your return, it must be postmarked May 17 or sooner. Heres a tax refund schedule to give you an idea when to expect your refund after youve filed. If you cannot file your tax return by the deadline, you need to file for a tax extension by May 17, 2021.

Its also important to note that the income tax refund schedule remains unchanged. This serves as an incentive for people to still file sooner rather than later.

The Island Of Misfit Tax Extenders

Outside of the TCJA and COVID-19-relief extenders, many of the remaining ones are remnants of past temporary tax policies, such as the stimulus package passed in response to the Great Recession. Some fall into clear categories: green energy, traditional energy, and cost recovery. Then theres a grab bag of others, often related to state- or territory-level policy issues.

The largest group of extenders is aimed at energy production. The Joint Committee on Taxation explains the two primary motivations for energy-related tax provisions are promoting energy independence and addressing externalities related to pollution. The current mix of energy-related tax provisions is suboptimal for addressing either concern, as the provisions were not developed in a coordinated way and are not permanent parts of the tax code. Energy production goals could be better accomplished if Congress avoided a piecemeal approach and instead worked toward a cogent solution for energy-related tax policy.

Recommended Reading: Internal Revenue Service Tax Returns

What Happens If You Miss The Tax Deadline

If you file your taxes after the April 18 deadline, you may get hit with a Failure to File Penalty.

According to the IRS, “if you don’t file your tax return by the due date” you will incur a penalty that is based on a percentage of the taxes you owe.

The amount you may have to pay is calculated by how late you file your tax return, and the amount of unpaid tax as of the original payment due date. Interest can also be changed on a penalty. Here’s a breakdown of the math.

If your return is over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

When Can I Expect My Refund

If you file electronically and choose direct deposit, the IRS says you can expect your refund within 21 days, assuming there are no problems with your return.

The IRS has already processed more than 70 million returns for fiscal 2021 and issued nearly 52 million refunds. But the agency has also warned about delays in processing returns, especially as the 2022 tax season involved complications like stimulus payments and an expanded child tax credit.

“The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays,” IRS Commissioner Chuck Rettig said in a statement.

Experts agree direct deposit is the fastest way to get your refund from the IRS.

Also Check: Doordash 1099 Example

What Happens If I Miss The Tax Deadline

If you’re owed a refund, there is no penalty for filing federal taxes late, though it may be different for your state taxes. Still, it’s best to e-file or postmark your individual tax return as early as possible.

If you owe the IRS money, however, penalties and interest start to accrue on any remaining unpaid taxes after the filing deadline. The late filing penalty is 5% of the taxes due for each month your return is behind, with fees increasing to up to 25% of your due balance after 60 days have passed.

You may also incur a late-payment penalty, which is 0.5% of the taxes due for each month your return is late, with penalties increasing to up to 25% of your unpaid tax, depending on how long you take to file.

Notice: Automatic Extension For Individual And Composite State Income Tax Returns Due On April 15 2021

This notice provides taxpayers with information on the extensions of time to file returns and remit tax and the waivers from penalty and interest that the Department will grant in conformity with IRS Notice 2021-59.

IRS Notice 2021-59. On March 17, 2021 the IRS issued Notice 2021-59 providing extensions to May 17, 2021 for any individual with a return or payment due on April 15, 2020. IRS Notice 2021-59 did not extend the first quarter estimated tax payment due on April 15, 2021.

Michigan conformity with IRS Notice 2021-59. To conform to the automatic extensions granted through IRS Notice 2021-59, the Department will extend individual and composite State income tax returns and payments of 2020 taxes due on April 15, 2021 to May 17, 2021. Because the extension is limited to the 2020 taxes, first quarter estimates for tax year 2021 remain due on April 15, 2021. The extension is limited to the state individual and composite income tax annual return and does not apply to fiduciary returns or corporate income tax returns. This notice does not apply to city income taxes. City income tax taxpayers should contact their respective tax administrators for information regarding that city’s potential conformity with IRS Notice 2021-59.

1. Extension of Annual Return Filing and Payment Date for Individuals

2. Extension of Date for Application and Payment for Extension Requests

Also Check: Ein Number Lookup Irs

Will The Irs Tax Deadline Be Extended

The IRS did not return Money’s request for comment. But current IRS Commissioner Chuck Rettig said in February there were no plans to extend the deadline, adding that it “it creates a lot of confusion for taxpayers” and “backs up” the IRS.

Bill Smith, a managing director for CBIZ MHM’s National Tax Office, points to Rettig’s remarks as evidence the date won’t be moved. He also says this year’s filing season doesn’t pose the same problems as last year’s did.

“There’s a lot going on, but don’t expect them to put off the April 15 filing deadline,” Smith adds.

Regardless, if you need more time to do your taxes, you can always request an extension. This typically delays your filing deadline to Oct. 15. But remember: If you owe the government money, you still have to pay on time.

This story has been updated to reflect that President Joe Biden signed the American Rescue Plan into law.

If I Dont Qualify For The Third Stimulus Check Based On My 2019 Income But I Do Based On 2020 Can I Appeal To The Irs If Theyve Already Sent My Check

The IRS has until the end of the year to issue the stimulus payments for 2021 and will be reviewing returns for 2020. As the agency continues processing tax returns, additional payments will be made, tax experts say.

If you havent filed your 2020 taxes, but believe you qualify based on your income levels you should file your 2020 taxes to ensure the IRS has the latest information.

The IRS will continue to process stimulus payments weekly, including any new returns recently filed. If you still dont receive a stimulus, the IRS said they will reconcile this sometime this year, according to Curtis Campbell, President of TaxAct, a tax preparation software.

If the 2020 return hasn’t processed for some reason, the IRS will go off 2019 return information. Then, after tax season, if someone files their 2020 tax return and it is processed, the IRS will do a ‘true-up’ of the check between 2019 data and 2020 data, says Campbell.

For those who didn’t get a check based on their 2019 income, file a 2020 return and the IRS will recover their payment based on their updated return, IRS Commissioner Charles Rettig said Thursday during testimony on Capitol Hill.

The IRS will do a redetermination the earlier of 90 days after the tax filing deadline, which includes extensions, or Sept. 1, Phillips added.

Read Also: How To Find Employer Ein Number Without W2

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can count this on your tax return and make the actual contribution by the new deadline.

What If I Can’t Afford To Pay My Taxes When They’re Due

If you aren’t able to pay your taxes on the day they are due, you may qualify for an online payment plan that allows you to pay off an outstanding balance over time.

Once your online application is complete, you’ll receive immediate notification of whether your payment plan has been approved.

Those payment plans can include:

- Short-term payment plan The payment period is 120 days or less and the total amount owed is less than $100,000 in combined tax, penalties and interest.

- Long-term payment plan The payment period is longer than 120 days, paid in monthly payments, and the amount owed is less than $50,000 in combined tax, penalties and interest.

Recommended Reading: Is Freefilefillableforms Com Legit

Tax Day Arrives: What You Need To Know

Monday marks the deadline for Angelenos to get their taxes filed or request an extension.

The Internal Revenue Service began accepting 2021 tax returns in January. And while Tax Day is normally April 15, Monday marks the third year in a row the Internal Revenue Service has extended the filing date for federal tax returns.

Because of the COVID-19 pandemic, the deadline for tax returns in 2020 was extended to July 15. The federal government extended the tax deadline again last year to May 17. This year, the deadline has been pushed forward because of Emancipation Day, a government holiday celebrated in the District of Columbia.

Last-minute filers will need to submit their 2021 tax returns by Monday or request an extension, which would give them six more months to get their fiscal declaration in order.

An extension of time to file is not an extension of time to pay, however, and taxpayers must estimate their tax liability and pay any amount due by the filing deadline to avoid penalties and interest.

A free tax preparation site at the Koreatown Youth and Community Center was busy early Monday morning. The site was set up by Free Tax Prep of Los Angeles to help low-income filers.

If you’re owed a refund, there is no penalty for filing federal taxes late.

Even while your local post office may offer extended hours on Tax Day, the fastest way to receive a refund is to file electronically and use direct deposit, the IRS says.

- In:

Filing For A Tax Extension: Form 4868

If you need an extension of time to file your individual income tax return, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

The deadline is the same as the date your tax return is normally due. In most years, that’s April 15 or the next weekday.

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were automatically granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

Requesting an extension is free and relatively simple, and it can be done either electronically or on paper. Either way, you will need to provide identification information and your individual income tax information .

There are also checkboxes to indicate if you are either a U.S. citizen or resident who is out of the country or if you file Form 1040-NR, which is an income tax return that nonresident aliens may have to file if they engaged in business in the U.S. during the tax year or otherwise earned income from U.S. sources.

Like all other tax forms, Form 4868 is available on the IRS website. Visit the “Forms, Instructions & Publications” section for a list of frequently downloaded forms and publications, including Form 4868.

Read Also: How To Buy Tax Liens In California

Taxes Due Today: Last Chance To File Your Tax Return Or Tax Extension On Time

It’s tax deadline day, and tax returns filed after will be considered late. Get the details and tips for quick filing.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

The time to file your 2021 tax return or a tax extension has nearly expired.

Monday is your final opportunity to complete and file your 2021 tax return on time . Midnight — in your local time zone — marks the deadline for electronically filing or postmarking a tax return.

If you can’t complete and file your tax return by Monday, you’ll want to file a tax extension, particularly if you owe. The IRS could charge a 5% failure to file penalty, plus additional interest and fines on top of that. Free tax software like Cash App Taxes can help you file an extension as well as finish your return. If you are expecting a refund, there’s no penalty for filing late.

Most state income tax returns are also due on April 18, although a handful of states have different deadlines. And, of course, some states don’t require you to file income taxes at all.

What Should I Do If I Havent Filed My Return Yet But Want To Claim The Waiver

The IRS issued instructions for those who havent filed a return yet, but want to claim the waiver of $10,200 on unemployment insurance.

For those who havent filed yet, the IRS will provide a worksheet for paper filers and work with software industry to update current tax software so that taxpayers can determine how to report their unemployment income on their 2020 tax return, the IRS said.

The IRS is currently accepting federal returns with the new waiver for those who haven’t filed yet. Depending on your tax company, that function may or may not be available due to software upgrades needed, according to Steber. Jackson Hewitt has made all the changes under the new rule, he added.

Phillips said H& R Block would be ready to implement the changes Friday.

Read Also: What Does It Mean To Grieve Taxes

Tax Day: Understanding The Extended Tax Deadline In Pennsylvania

PITTSBURGH – It is April 15th but that carries a different meaning in this COVID-mangled year.

The Internal Revenue Service pushed back the filing deadline for taxes to May 17th.

However, Michael Herzog, J.D., the tax expert for Eckert Seamans says that’s only for 2020 taxes.

“In the event that there are estimated tax payments that have to be made for 2021, they have to be made by April 15. So even though the IRS extended the filing deadline for the 2020 tax return, that’s going out to May 17, but people still have to remember that first-quarter estimated tax payments still must be made and filed by April 15,” he said.

As for your state taxes…

“Pennsylvania has followed the federal lead,” Herzog explained. “So for Pennsylvania purposes. May 17 is also going to be the due date to file your 2020 personal income tax return, and also to make any payments with respect to 2020.”

Ohio and West Virginia have also extended their filing deadline to May 17.

WATCH: Filing Your Local Taxes This Year

But it gets a bit more complicated when it comes to filing your local tax return.

“It’s really going to be determinative on where you live and you’re going to want to be absolutely certain to check whether the April 15 deadline is still hard and fast for local municipalities,” Herzog said.

In some cases, municipalities set their own rules, others use tax collection agencies.

The tax experts are hearing about it.

- In: