How To Request Irs Tax Transcripts

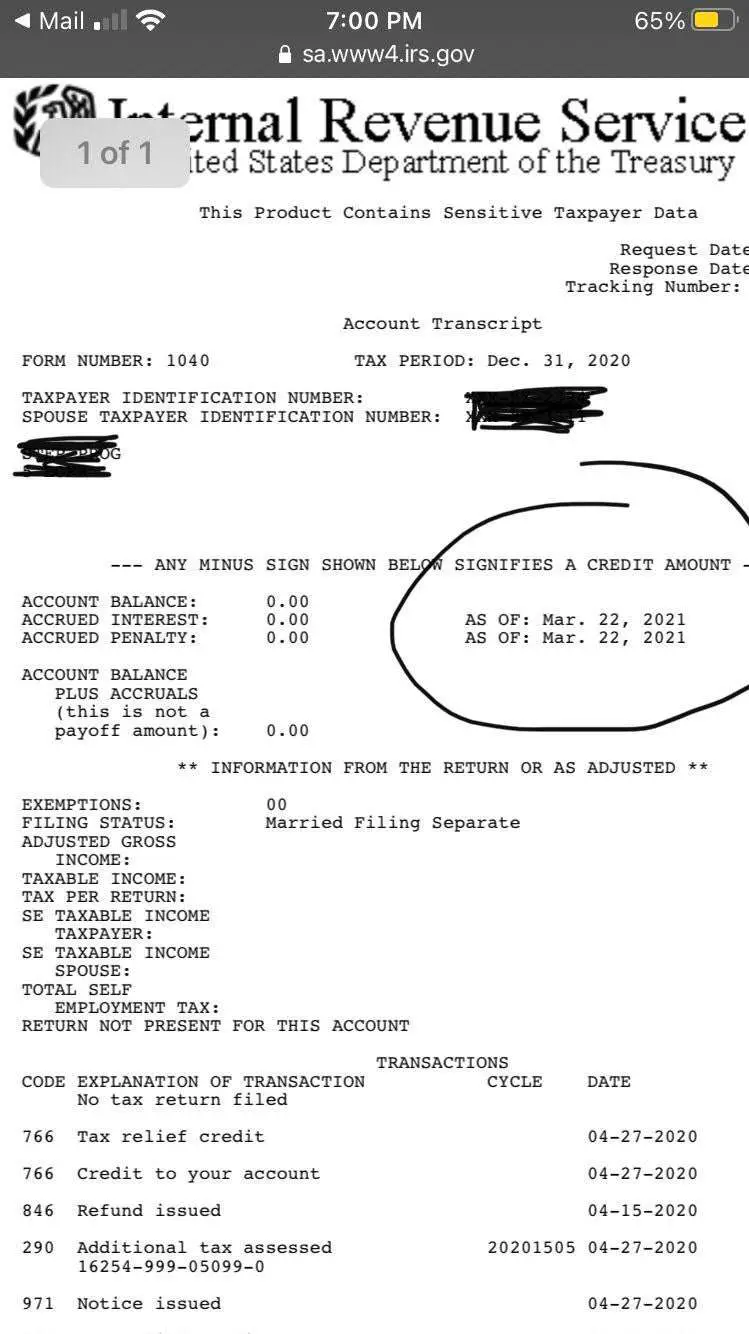

If you filed tax returns, you can request your tax transcripts from the IRS. A tax transcript contains all the crucial details from your previous tax returns. Often, your tax transcripts are proof of income when applying for a mortgage, auto loan, or student loan.

Also, if you owe the IRS, your tax transcript will show if the IRS has issued a Final Notice of Intent to Levy to seize your property or levy your income to settle your tax debt.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the forms instructions. The IRS will process your request within 75 calendar days

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Also Check: Can I File My Taxes Twice

How Can I Get My Tax Transcripts Without A Credit Card

If your previous year tax returns are not available, you can use the IRS Get Transcript tool. Try the online option first. If you are unable to obtain the transcript online, you can have one sent to the address the IRS has on record for you. You can find IRS Get Transcript here.

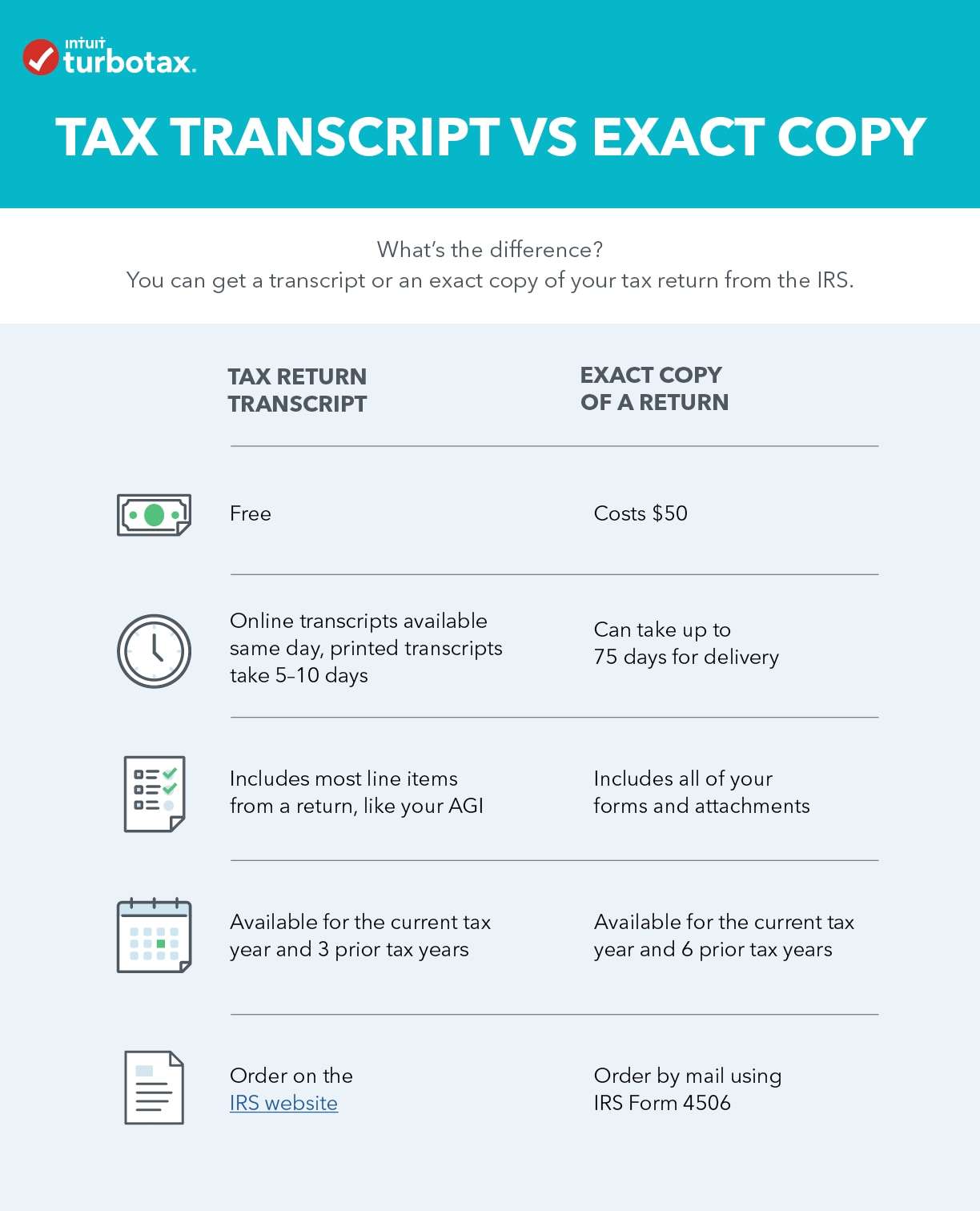

What Is A Tax Transcript And How Can You Get Yours

You may know that it is always helpful and important to keep copies of your old tax returns on file.

However, it can be all too easy for these copies to become misfiled or misplaced, especially if you move or face other challenges with your records.

If you need copies of your old tax returns and do not have them on hand, dont despair. You can get tax transcript, previous returns and other valuable information about your tax history, quickly and at no cost.

If youre getting ready to do your taxes in 2020 and you dont have helpful records, dont hesitate to request the documents that you need.

Recommended Reading: Mcl 206.707

Also Check: How Do I File My Unemployment Taxes

Q5 I Got A Message That Says The Information I Provided Does Not Match Whats In The Irs Systems What Should I Do Now

Verify all the information you entered is correct. It must match whats in our systems. Be sure to use the exact address and filing status from your latest tax return. If you are still receiving the message, youll need to use the Get Transcript by Mail option or submit a Form 4506-T to the IRS at the address or fax number provided in the instructions.

It’s A Simple Process And You Can Do It Online

You probably know you’re supposed to keep copies of your filed tax returns for a period of years, but life happens. The Internal Revenue Service provides tax transcripts if you need an old return that you lost or didn’t save. The IRS will also provide you with other forms and information about your tax history, free of charge.

Keep reading to learn more about the documents the IRS can provide you with and how to get them.

You May Like: Where Can I Get My Tax Returns

Receiving The Transcript By Mail

How To Request Your Transcript By Mail

If you prefer to request your tax return transcript the old fashioned way, you can do so either by phone or mail, to order a copy of your transcripts by phone, call. To request your tax transcripts by mail, you will need to submit form 4506-T or 4506 T-EZ. You can find these forms on the IRS website under forms, instructions, and publications. You can also request a copy of your full tax return by submitting a 4506. Tax returns are available for the previous six years. A $50 fee per copy is assessed.

When ordering a copy of your transcripts or tax returns, having a plan is crucial. If you order your transcript online or via phone, it typically takes 5-10 about 15 days to arrive. It can take as long as 30 days to receive a transcript with a mailed request. Full tax returns take longer. If you order a copy of your full tax return, the turnaround time is 75 days.

Also Check: Notice Of Tax Return Change Revised Balance

Recommended Reading: How Much Do I Need To Make To Pay Taxes

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Dont Miss: How To Get Stimulus Check 2021 Without Filing Taxes

How Do I Get A Copy Of My Tax Return Or Transcript From The Irs

To obtain a full copy of your filed and processed tax return , print and complete IRS Form 4506, Request for Copy of Tax Return. Be sure to follow the instructions on page 2 of the printout. The IRS charges $50 for each copy. Please allow up to 75 days for delivery.

If you can’t wait that long or don’t want to pay the $50 fee, consider a free IRS transcript. A transcript contains most line items from your return and can be used if you need last year’s AGI or other numbers from a previously-filed return. Here’s what a transcript looks like. To order, go to the IRS Get Transcript page and choose an option: online or .

Related Information:

Read Also: How Can I Pay Taxes I Owe

Copy Of Actual Return From The Irs

Cost: $50 Processing Time: Up to 75 Days

To get an exact copy of your tax return from the IRS with all schedules and attachments , you’ll need to complete Form 4506. You’ll also need to write a $50 check or money order to “United States Treasury”. The IRS mailing address and request instructions are included on the form.

How To Get Your Tax Transcript

Getting your tax transcript from the IRS is quite simple.

If you have an online IRS account, you can log into your account, click on the Tax Records tab, and select the tax transcript that you need.

If you do not have an online IRS account, you can contact the IRS to get it.

One option is to ask for the tax transcript using the IRS online tool.

You start the process by clicking on Get Transcript Online.

Another way of getting your tax transcript is to request it by mail .

Youll need to send a letter to the IRS, provide your mailing address, and expect to receive a response from them in 5 to 10 calendar days.

Another option is to call the IRS by phone at 1-800-908-9946 to request the tax transcript.

Don’t Miss: When Should You File Your Taxes

How Do I Download Previous Years Tax Returns

It is summed up in the following steps.

Q3 What If I Can’t Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Recommended Reading: Do You Pay Income Tax On Inheritance

How To Fix Address Matching Problems When Ordering Online

When entering the information into the IRS address matching system note the following:

- The address entered must match the address already on file with the IRS exactly.

- The address on file is typically the address on your most recent tax return.

- Spelling out the word street rather than using the abbreviation st. can be enough to cause an error.

- Addresses on the IRS system are auto-corrected through a post office program and may not match what you put on your tax return.

We suggest the following if you run into problems:

- Have your taxes in front of you and enter the address carefully as it is on your return.

- If you entered your address as it appears on your return and it doesnt work, try using the standardized version of your address.

- To get a standardized version of your address: 1) go to www.usps.com 2) Click Look Up a Zip Code 3) Enter Street Address, City, State 4) Click Find

When Are Tax Transcripts Available Online

If you filed your tax returns electronically, the tax transcript will be viewable online after 2 to 4 weeks. If you mailed your tax returns, it will be up to six weeks before the tax transcript becomes available online. If you owe IRS any tax debt, your tax transcripts wont be available online until May 15th or the week after you settle your full tax debt.

Also Check: Are Uber Rides Tax Deductible

Tax Filers Who File An Amended Federal Tax Return

A student or parent of a dependent student who files an amended federal tax return must submit a signed copy of Form 1040X in addition to the Tax Return Transcript to the Office of Financial Aid to satisfy verification.

Contact Us

- University of South Carolina Aiken 471 University Parkway

- University of South Carolina Aiken650 Trolley Line Road

Q3 How Long Must I Wait Before A Transcript Is Available For My Current Year Tax Return

If you filed your tax return electronically, IRS’s return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks. If you didn’t pay all the tax you owe, your transcript may not be available until mid-May or a week after you pay the full amount owed. Refer to transcript availability for more information.

Once your transcript is available, you may use Get Transcript Online. You may order a tax return transcript and/or a tax account transcript using Get Transcript by Mail or call . Please allow 5 to 10 calendar days for delivery. You may also submit Form 4506-T, Request for Transcript of Tax Return. The time frame for delivery is the same for all available tax years.

You May Like: How To Calculate Pay After Taxes

Where Do I Find My Agi From Last Year

To retrieve your original AGI from your previous years tax return you may do one of the following:

Also, how do you get your AGI from last year?

To retrieve your original AGI from your previous years tax return you may do one of the following: Contact the IRS toll free at 1-800-829-1040. Complete Form 4506-T Transcript of Electronic Filing at no cost. Complete Form 4506 Copy of Income tax Return.

Secondly, where can I find my AGI for 2017? The AGI you should use to sign your 2017 return can be found on the following lines of your 2016 return : Form 1040, Line 38. Form 1040A, Line 21. Form 1040EZ, Line 4.

Correspondingly, how do I find my AGI for 2018?

Here are three ways to locate your 2018 AGI: 1) If you e-filed your 2018 Tax Return on eFile.com, sign into your eFile.com account and download/view your PDF tax return file from the My Account page. Find your prior-year AGI on line 7 of your Form 1040.

Can you get your AGI over the phone?

If you cant find a copy of last years return, you can call 800-829-1040. If you can provide certain information to the IRS, , and current address), you can receive the original AGI amount over the phone.

your W-2your AGIW-2your AGIyour AGIPINIRSIRSThe fivedigit PINfive digitsThe amount can be located on:

Paper Request Form Irs Form 4506t

- Download an IRS Form 4506T-EZ.

- Complete lines 1-4, following the instructions on page 2 of the form.

- Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS. Do not have your IRS Verification of Non-filing Letter sent directly to UNT.

- On line 6, indicate the tax year requesting.

- Make sure you check the box which starts with “Signatory attests that he/she has read…” otherwise the form will not be processed.

- The tax filer must sign and date the form and enter their telephone number.

- Mail or fax the complete form to the appropriate address on page 2 of the 4506T-EZ form.

Don’t Miss: Do You Pay Transfer Tax On Refinance In Florida

Q2 Can I Request A Transcript If I Filed Jointly With My Spouse And My Name And Ssn Was Listed Second On Our Tax Return

Yes, a secondary taxpayer may request any transcript type that is available.

Please note, only the account and the tax return transcript types are available using Get Transcript by Mail. Use Form 4506-T, Request for Transcript of Tax Return, if you need a different transcript type and can’t use Get Transcript Online.

How Can You Get Your Tax Transcript

There are two main ways get your tax transcript from the IRS:

Also Check: What Is Medicare Tax Used For