How To Make An Esignature For A Pdf Document In Chrome

Google Chromes browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to eSign how to fill out income tax forms right in your browser.

The guidelines below will help you create an eSignature for signing how to fill out income tax forms in Chrome:

Once youve finished putting your signature on your how to fill out income tax forms, decide what you wish to do next – download it or share the file with other parties involved. The signNow extension provides you with a range of features for a much better signing experience.

Benefits And Earnings Taxable Only In Quebec

Revenu Québec considers certain benefits and earnings to be pensionable earnings for employees working in Quebec. These include:

- employer-paid private health benefit plan premiums

- assumed earningspersons 55 years of age or older whose hours of work are reduced by reason of phased retirement may choose, with their employers, to make contributions to the QPP on all or part of the amount of the reduction in remuneration

For more information, see Guide TP-1015.G-V, Guide for Employers: Source Deductions and Contributions, or brochure IN-253-V, Taxable Benefits, which you can get from Revenu Québec.

The following examples show how to fill in boxes 14 and 26 of the employee’s T4 slip when you provide a benefit or earnings to an employee that is only taxable in Quebec. For information on how to complete the RL-1 slip, consult Guide RL-1.G-V, Guide to Filing the RL-1 Slip: Employment and Other Income.

Example 1 Quebec taxable benefit, unpaid leave

Marion works for her employer in Quebec and is on an unpaid leave of absence. Her employer pays $750 in premiums to an employer-paid private health benefit plan on her behalf. Since the benefit is not taxable outside of Quebec, it is not income. When preparing Marion’s Quebec T4 slip, her employer will leave box 14 blank. Since the premiums are QPP pensionable her employer will report $750 in box 26, the QPP contributions withheld on the benefit in box 17, and fill in any other boxes on her T4 slip as applicable.

Note

How To Claim 1 On W

Although the Tax Cuts and Jobs Acts of 2017 is a few years behind us, we often still hear clients ask about how to claim 1 on a W-4 or how to fill out their W-4 claiming 0. These concepts have to do with allowances, which no longer apply to W-4s after tax reform.

Starting with the 2020 Form W-4, you can no longer request an adjustment to your withholding by increasing or decreasing allowances. Instead of using allowances, you will use other parts of the W-4 to tell your employer how much to withhold from your paycheck .

Also Check: How Do I Pay My New York State Taxes

Form 8283 Noncash Charitable Contribution

After viewing, if Form 8283 Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

Notes

B. There are no calculated fields on this form. Everything is manual entry except the name and social security number in the header.

- Line 1 column – Use the separate fields in column for name and address entry.

- Line 1 column has the date format mm/dd/yyyy.

Fill Out A 1095 Tax Form What Is A 1095 Form

The following are the ways how to fill out a 1095 Tax Form:

7, 8, and 9. Enter the recipients spouses details, if applicable, if advance credit payments were received for coverage.

1215. Enter the address of the receiver.

Also Check: What Tax Forms Do I Need

If Your Employer Isn’t Withholding Enough

The W-4 form has a place to indicate the amount of additional tax that you would like to have withheld each pay period.

If youve underpaid so far, subtract the amount that youre on track to pay by the end of the year, at your current level of withholding, from the amount that you will owe in total. Then divide the result by the number of pay periods that remain in the year.

That will tell you how much extra you want to have withheld from each paycheck.

You could also decrease the number of withholding allowances that you claim, but the results wont be as accurate.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: Where Do I Go For My Taxes

How Do I Fill Out A W

How to fill out Form W-2

Box 20 Rpp Contributions

Enter the total amount the employee contributed to a registered pension plan . If the employee did not contribute to a plan, leave this box blank. Do not include amounts transferred directly to an RPP from an employee’s registered retirement savings plan .

Enter any deductible retirement compensation arrangement contributions you withheld from the employee’s income. Do not include amounts that are not deductible. If the amount in box 20 includes RPP contributions and deductible RCA contributions, attach a letter informing the employee of the amounts.

If the amount you report includes current contributions and past service contributions for 1989 or earlier years, enter, in the “Other information” area, the following codes along with the corresponding amount:

- code 74 for past service contributions while the employee was a contributor

- code 75 for past service contributions while the employee was not a contributor

To determine if the employee made past service contributions while a contributor or while not a contributor, see archived Interpretation Bulletin IT-167, Registered Pension Funds or Plans Employee’s Contributions.

Include instalment interest in box 20. This includes interest charged to buy back pensionable service.

Also Check: Can You Get The Stimulus Check Without Filing Taxes

Form 8606 Nondeductible Iras

After viewing, if Form 8606 Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

Notes

B. There is a Form 8606 for the “Taxpayer” and another for the “Spouse.” If the wrong name and SSN appears in the header, you have selected the wrong Form 8606.C. Complete the top section of the form before entering other information.D. Statement – You must mail in your return if you are required to attach a statement to this form. This program does not support attaching statements.E. Forms 8915-C and 8915-D are not supported in the program. If you need these forms to complete Form 8606, you must mail in the return.

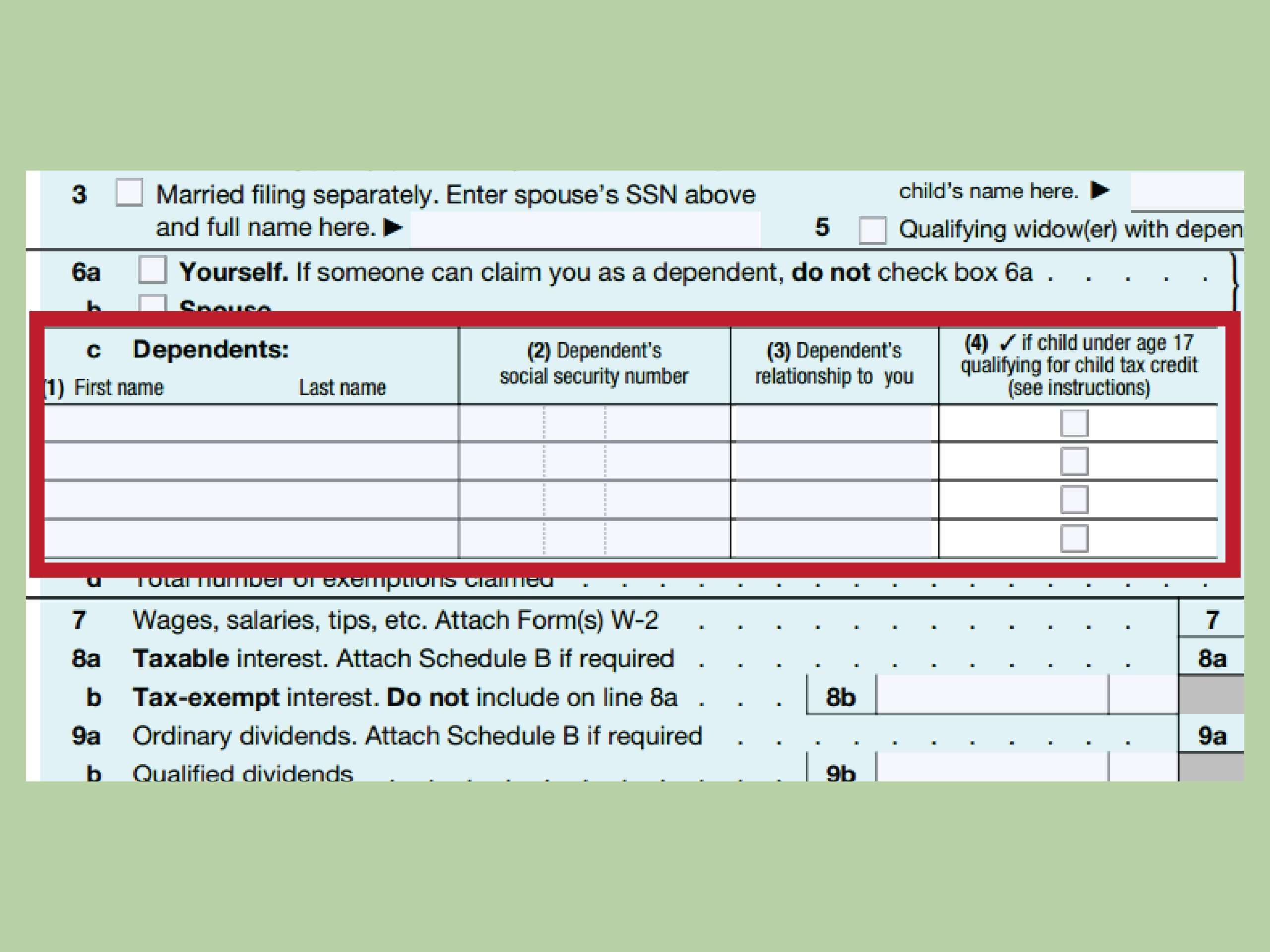

Look Through Possible Taxes And Credits

Once youve made necessary adjustments and found your AGI, there are some other taxes and credits to consider. First of all, you need to enter on Line 9 either your standard deduction or the amount of your itemized deductions. If you have a qualified business income deduction, you will enter that on Line 10.

Lines 11 through 14 allow you to enter the amounts of certain credits if you qualify for them. For instance, you can enter the amount of your child tax credit on Line 13a.

If you already had some federal tax withheld from your income, you can enter that amount on Line 17. You will also need to attach Schedule 4 if you have paid other taxes.

Also Check: Why Do I Owe Taxes If I Claim 0

File Jointly Or On Your Own

Like most married couples, Samuel and Felicity are filing jointly . Their five exemptions are on Line 6. Felicity, a designer, has a salary of $103,500 that is reduced by a $10,000 contribution she made to her 401 retirement plan. Her net salary of $93,500 is reported on Box 1 of her W-2 and on Line 7 of the 1040. The 401 contribution appears on her W-2, but not on their tax return. Samuel is a self-employed consulting engineer. His net income, $91,561 after office rent and other expenses, is transferred from Schedule C to Line 12.

Avoiding Tax Season Frustration

If the idea of wrestling with a bunch of Internal Revenue Service forms makes you want to tear your hair out you can always seek help. A tax accountant can take over the job of filling out your taxes for you, but youll still need to provide him or her with the necessary information and documentation. Or, if youve been doing your taxes by hand, consider splurging on some tax preparation software that can make the process easier for you.

The biggest change that can decrease the stress of doing your taxes is to start earlier. No, we dont mean filling out your name and address on your 1040 form in February and then waiting until the second week in April to do the rest. We mean actually starting early.

Also Check: How Much Does H& r Block Charge To Do Your Taxes

Schedule H Household Employment Taxes

After viewing, if Schedule H Line-by-Line instructions do not answer your question, you may contact us, only if you are using the Free File Fillable Forms program.

Manually select the appropriate Yes/No checkboxes A C and follow the instructions per your response. Your selection of the checkboxes will affect calculations and which lines transfer to Schedule 2 and/or Schedule 3.

Note: You cannot e-file Schedule H by itself. You must e-file it as an attachment to Form 1040. Select the “Yes” checkbox and leave the address and signature portion of Schedule H blank.

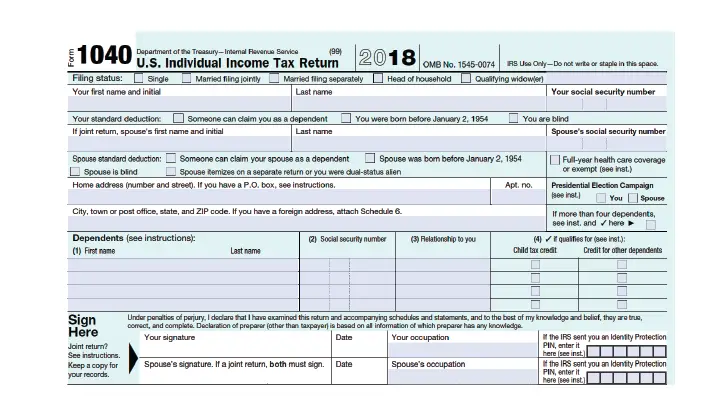

How To File Form 1040

This is the most basic form used for filing your income taxes via the IRS. It doesnt matter what situation youre in because Form 1040 is the base form, so every taxpayer must submit one to the IRS at the start of the year.

Finally, if you want to make filing your 1040 easy, you should consider using some online tax preparation software. Youll be able to follow some step-by-step instructions on how to fill out Form 1040. The software will plug all the numbers into the right places, thus taking all the stress and hard work out of filing your taxes.

You May Like: How Long To Keep Tax Records

Preparing To Fill Out Irs Form 1040

When Do I Need To File

Prepare and submit the annual report to the IRS, followed by offering the statements to individuals by January 31, 2022, or earlier if practicable.

Protects, as a prerequisite, the need to deliver a message to private parties during the calendar year 2021. Requirements will be met if Form 1095-A contains the required data and is provided or accessible , including whether they have opted to receive electronic receipts on or before the due date.

If the expected due date falls on a weekend or holiday, the payment is past due. Please send the statement before the next working day following a legal holiday.

Every day other than Saturday is considered a business day. Sunday, or a legal holiday.

You May Like: How Do Independent Contractors File Taxes

New Form 1040 Instructions

Here are the new 1040 form instructions as of 2019 from the IRS:

You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Many people will only need to use Form 1040 and none of the new numbered schedules. However, if your return is more complicated , you will need to complete one or more of the new numbered schedules. Below is a general guide to which schedule you will need to use based on your circumstances. See the 1040 instructions for the schedules for more information. If you e-file your return, you generally wont notice much of a change and the software will generally determine which schedules you need.

Box 10 Province Of Employment

Before you decide which provincial or territorial abbreviation to use, you need to determine your employee’s province or territory of employment. This depends on whether you required your employee to report for work at your place of business.

Enter one of the following abbreviations:

List of provinces and territories and their abbreviations| Province or territory | |

|---|---|

| US | |

|

Other Enter ZZ if an employee worked in a country other than Canada or the United States, or if the employee worked in Canada beyond the limits of a province or territory . |

For any employee who had more than one province or territory of employment in the year, fill out separate T4 slips. For each location, indicate the total remuneration paid to the employee and the related deductions, such as CPP/QPP contributions, EI premiums, PPIP premiums, and income tax.

Read Also: How Do I Know If I Have To Pay Taxes

Misconceptions About Form Td1

Misconception #1: You send the TD1 form to the government yourself.

This is wrong. You give it to your employer.

Misconception #2: The information you enter on the form changes how much tax you end up owing the government.

This is wrong. The amount of tax you owe is detailed when you fill out your tax return, and is determined by your total income, minus your credits and deductions, multiplied by your average tax rate. If the CRA deducted too much at the source, youll get a refund if it deducted too little, youll have to pay the difference.

Can I Get A Copy Of The De 4 Form Online Or From My Employer Or Do I Have To Print It Out Myself From The State Website

The DE 4 form can be obtained from your employer or printed out from the state website by clicking Here. You will need to provide your personal information, including your Social Security number, on the form. Your employer will also need to provide their information, such as their Federal Employer Identification Number.

Once you have completed the form, you will need to submit it to your employer. They will then send it to the state for processing.

Don’t Miss: Have My Taxes Been Accepted

What Is The W

Form W-4 is a tax document used by the IRS to inform employers about an employees tax situation in the US.

When you start a new job, you will be required to fill it out, so that the employer can deduct the appropriate amount of federal income tax from your paycheck.

For more information, check out everything you need to know about Form W-4 in our blog.