Who Qualifies For Recovery Rebate Credit

US citizens or residents with a social security number who did not receive one or more of the stimulus checks or did not receive the full amount of the checks, may qualify for the recovery rebate credit. You will need to file your 2020 taxes for the first and second payments and your 2021 taxes for the third payment, even if you are not required to, in order to receive the rebate credit.

The Recovery Rebate Credit does start to decrease at $75,000 adjusted gross income . We’ll calculate the correct credit based on your income and any stimulus payments already received.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by . The second round had to be sent out by .

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Line 30 And The Recovery Rebate Credit

You will, however, have to take action if you think you were eligible for the stimulus checks and either didn’t receive them or didn’t get the right amounts.

As a refresher: The first round of stimulus payments, nicknamed EIP 1, went out in spring 2020. Taxpayers earning $75,000 or less qualified for $1,200, while married couples earning $150,000 or less qualified for $2,400. People could also receive an extra $500 per dependent under age 17.

The second round of stimulus payments, or EIP 2, went out in the beginning of this year. The income thresholds were the same, but the checks themselves were different: $600 for single taxpayers and $1,200 for couples filing jointly. Dependent payments rose to $600.

On paper, the stimulus checks were technically advance payments on what the IRS deemed a Recovery Rebate Credit. So if you got the full amounts, you’ve effectively already claimed the credit.

If you didnt get the first and/or second stimulus checks or got less than the full amounts because your income, filing status or family size changed you may qualify to claim the Recovery Rebate Credit on your 2020 taxes. To do this, you have to submit a tax return . Specifically, you have to fill out Line 30 on Form 1040 or 1040-SR.

This requires some math. Most online tax preparers will calculate the credit for you, but you may also fill out the Recovery Rebate Credit worksheet.

Recommended Reading: Do You Pay Taxes On Donating Plasma

File Electronically And Choose Direct Deposit

The amount of the 2021 Recovery Rebate Credit will reduce the amount of tax owed for 2021, or, if it’s more than the tax owed, it will be included as part of the individual’s 2021 tax refund. Individuals will receive their 2021 Recovery Rebate Credit included in their refund after the 2021 tax return is processed. The 2021 Recovery Rebate Credit will not be issued separately from the tax refund.

To avoid processing delays, the IRS urges people to file a complete and accurate tax return. Filing electronically allows tax software to figure credits and deductions, including the 2021 Recovery Rebate Credit. The 2021 Recovery Rebate Credit Worksheet on Form 1040 and Form 1040-SR instructions can also help.

The fastest and most secure way for eligible individuals to get their 2021 tax refund that will include their allowable 2021 Recovery Rebate Credit is by filing electronically and choosing direct deposit.

Anyone with income of $73,000 or less, including those who don’t have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited contactless and free into the individual’s financial account. Bank accounts, many prepaid debit cards, and several mobile apps can be used for direct deposit when taxpayers provide a routing and account number.

Is The Recovery Rebate Credit Refundable

The credit is refundable. A refundable credit is a credit that will reduce your tax and may add to your refund even if you don’t have any tax at all. So if your credit is more than the amount of your tax, you can get the excess amount in your refund.

For example, if your tax calculation comes out to $1,500 and you have a refundable credit of $2,000, your tax would be reduced to zero and you would receive the extra $500 as a refund.

Also Check: Pin Number To File Taxes

Why Is The Irs Sending Me Letter 6475

“The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return,” the IRS said in a January release, including personal information — like your name and address — and the total amount sent in your third stimulus payment.

This could include “plus-up” payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans’ Affairs or the Railroad Retirement Board.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but that’s not what you want to use to prepare your 2021 return.

Enter $1 For Your Income If You Didnt Earn Anything

If you earned money for the year youre filing for, report that amount. Since your earnings were low enough that you werent required to file a tax return for the year, you shouldnt worry about owing income tax.

And if you didnt earn income? Youd put $1, Allec said. Dont worry. Youre not going to owe taxes on that dollar.

Also Check: Amend Tax Return Online For Free

What Do I Do With Letter 6475

Hold onto it until you or your tax preparer are ready to file your 2021 federal return, then use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

“Having the wrong amount on your return could trigger a manual review,” according to the H& R Block website, which could delay a refund for weeks.

Who Will Receive The Stimulus Check Automatically Without Taking Additional Steps

Most eligible U.S. taxpayers will automatically receive their Economic Impact Payments including:

- Individuals who filed a federal income tax for 2018 or 2019

- Individuals who receive Social Security retirement, survivors, or Social Security Disability Insurance benefits

- Individuals who receive Railroad Retirement benefits

Read Also: Ein Number Lookup Irs

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

TAX SEASON DELAYS:Mistakes with child tax credit, stimulus can trigger refund tax delays, IRS warns

Get Your Stimulus Check: File With The Irs

As part of the Coronavirus Aid, Relief and Economic Security Act Americans will be receiving economic impact payments to provide some financial relief during the COVID-19 pandemic.

The IRS has begun to distribute these payments. However, in order to receive these payments individuals and couples must have filed with theInternal Revenue Service .

Also Check: Payable Doordash 1099

Plans For A $400 Gas Prices Check

As a result of the rising gas prices, local politicians are looking for solutions and Democrats in California are discussing a possible 400 dollar tax rebate stimulus check, which will go to all Californians who pay state income taxes. With this, the idea is that it will offset the extra costs at the pump.

There is still some way to go for this to become a reality, however. “Our goal is to be able to do this in the spring, and all the folks here are going to be pushing really, really hard to make that happen,” California politician Cottie Petrie-Norris explained.

You can read more here on how the $400 Gas Prices Check would work.

Irs Letter 6475 Notice 1444

You’ll need to know the total amount of your third stimulus check payment and any “plus up” payments actually paid to claim the recovery rebate tax credit on your 2021 tax return. You can get this information from a few different sources. First, you should have received Notice 1444-C from the IRS shortly after receiving your third stimulus payment. If you received a joint payment with your spouse, the notice shows the total amount of the payment. If you’re married but file separate 2021 tax returns, each spouse must enter half of the payment amount shown on Notice 1444-C. People who received a plus-up payment should have received a separate Notice 1444-C after your payment was sent. Save Notice 1444-C with your other tax records.

The IRS is also mailed Letter 6475 in January. This letter confirms the total amount of the third stimulus check and any plus-up payments you received for the 2021 tax year. Again, if you received a joint payment with your spouse, the letter shows the total amount of payments. If you file separate 2021 tax returns, each spouse must enter half of the amount shown on Letter 6475. Save this letter, too.

Also Check: Plasma Donation Taxable Income

College Tax Credit 202: What Is The Income Limit For American Opportunity Tax Credit

Another important tax break for families with a child or dependent who is currently studying in collage is the American Opportunity Tax Credit .

It isn’t available for all, as it is designed to help those families who need the support, but it can see those who qualify claim a maximum credit of 2,500 dollars per year per eligible student. If the AOTC reduces the amount of tax owed to zero, eligible students can have 40 percent of any remaining amount of the credit refunded, but up to 1,000 dollars.

It is also explained in the IRS documentation that the amount of the credit is 100 percent of the first 2,000 dollars of qualified education expenses paid for each eligible student and 25 percent of the next 2,000 dollars of qualified education expenses paid for that student.

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms “Letter 6475” on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a “Notice 1444-C” that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

Recommended Reading: Tax Deductible Home Improvements

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Recommended Reading: Doordash Driver Tax Calculator

Use The Recovery Rebate Credit Worksheet To Calculate How Much You Are Due

by John Waggoner, AARP, January 13, 2021

En español | The Internal Revenue Service issued about 160 million stimulus checks to eligible Americans for the first round of economic impact payments that began in April. Millions more payments, dubbed EIP 2, started going out in late December for the second round of stimulus. Nevertheless, some people never got their first-round stimulus checks, while others didn’t receive the full amount to which they were entitled. The same will be true for the second round of stimulus payments.

If you didn’t receive money from the first or second round of stimulus payments or you didn’t get the full amount you should have don’t give up. You’ll need to file the standard 1040 federal tax return form, or the 1040-SR tax return for people 65 or older, to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund.

All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

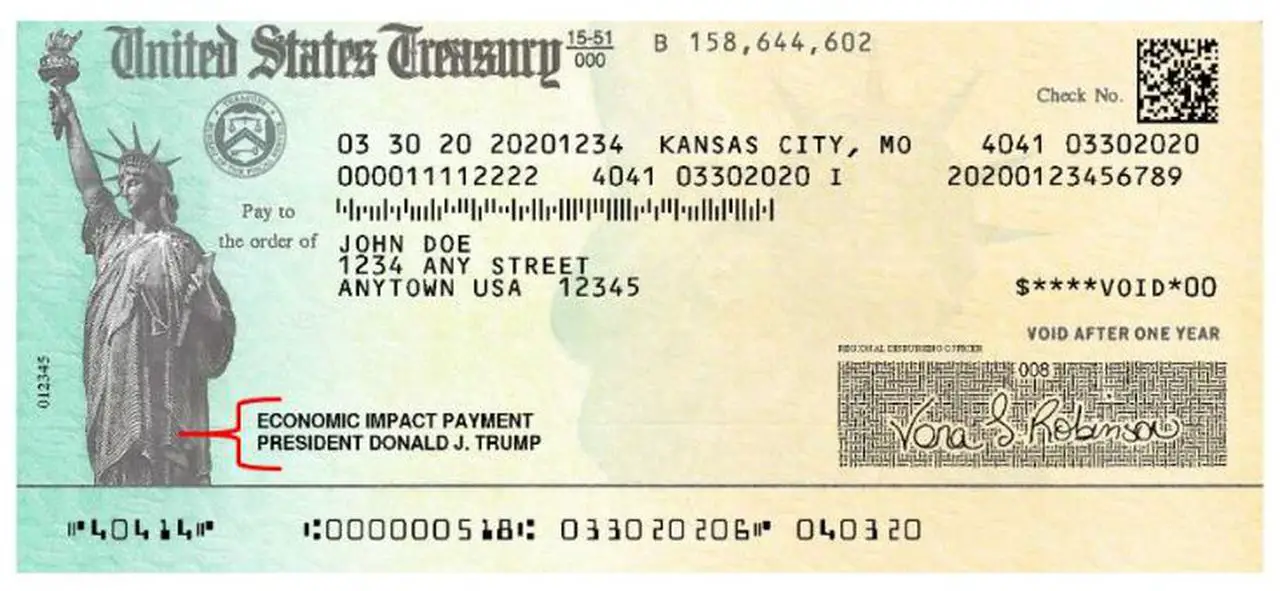

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

Read Also: Doordash File Taxes

Using The Irs’s Online Tool

If you’re not receiving any of the government benefits listed above, you can use the “Non-Filers: Enter Your Payment Info Here” tool to provide the IRS with the information it needs to send you a stimulus check. If you want your payment directly deposited into your bank account, which is faster than getting a paper check, you can also provide your account information through the tool.

The IRS tool is intended for Americans who aren’t required to file a federal income tax return for 2019, such as people with income under the tax return filing threshold . If you filed a 2018 or 2019 return, you should not use the tool.

If you use the IRS tool, you’ll be asked to provide your:

-

Full name, current mailing address, phone number and email address

-

Date of birth

-

Social Security number

-

Bank account number, type and routing number if you want payment by direct deposit

-

Identity Protection Personal Identification Number , if you have one and

-

Driver’s license or state-issued ID number, if you have one.

To get an extra $500 for a qualifying child who is 16 years old or younger, you will also need to provide his or her name, Social Security number or Adoption Taxpayer Identification Number, and his or her relationship to you or your spouse.

When Do I Need To File A Stimulus Credit On My Taxes

According to the IRS, you’ll be able to claim a missing payment on your taxes now with any payments going out after you file. You can prepare your taxes now — through the IRS’ Free File tax preparation service, if you qualify to use it — or through a tax-preparation service. The tax-filing deadline is April 15 this year, but you can file a tax extension if you can’t make the deadline.

Read Also: Www.1040paytax.com Official Site