What Is An Ein

An Employer Identification Number is a tax identification number issued by the IRS to business organizations in the US. Companies primarily use this number for taxation purposesit also needs to be included on all bank accounts, employment reports, payrolls, and applications for licenses and permits.

Estates and trusts also need to file returns if the estate generates income higher than $600.00 per year, must be reported on the 1041 form. Its a good idea for estate owners to consider the top-rated tax software for form 1041 and simplify the filing process.

Whats the difference between federal tax ID vs EIN? They are virtually the same, except a tax ID number can be issued on the state or federal level, but an EIN is exclusively federal.

When Should My Business Consider An Ein

Some businesses may be able to operate without an EIN. However, according to the IRS, you may need to apply for one if your business plans to:

- Pay employees

- Operate as a corporation or partnership

- File employment, excise, tobacco, firearms or alcohol tax returns

If youre unsure whether your business needs an EIN, you can talk to a certified accountant or tax professional for guidance regarding your individual situation.

Is There A Difference Between Ein And Tax Id Number

Frequently Asked Questions | FAQs

Yes, there is a technical difference between an EIN and a tax ID number in the sense that a Tax ID number can be issued on the state or the federal level, but an EIN is strictly federal . The IRS has given different names to the same employer identification number, EIN number and Tax ID Number. All tax identification numbers have nine digits, such as 98-7654321. An employers EIN number is an identifying tax ID number. A private individuals social security number is also an identifying number.

Recommended Reading: Do You Need To Claim Unemployment On Taxes

Check Your Ein Confirmation Letter

The IRS will notify you when it approves your EIN application. Depending on how you apply, you may receive a confirmation letter with your EIN online at the time it was issued or via mail or email.

Look back through your paper and digital business files. You or whoever helped you apply may have saved a copy of it for future reference.

Ein Lookup: How To Find A Business Tax Id

An employer identification number is like a Social Security number for a business. The IRS assigns an EIN also known as a federal tax ID number to any business that is eligible. EINs aren’t always necessary, but we’ll walk you through why having one can benefit your business and how to do an EIN lookup when you cant find yours.

Also Check: How Do I Find Last Years Tax Return

Federal Employer Identification Number

Sole proprietors who do not have employees, who are not required to file information returns, who do not have a retirement plan for themselves, and who are not required to pay federal excise taxes in connection with their business generally may use their social security number as their federal employer identification number ). Single-member limited liability companies that have elected to be taxed as a sole proprietorship may follow that rule, too.

All other business entities are required to obtain a federal employer identification number by filing Form SS-4 with the Internal Revenue Service. Note also that an independent contractor doing commercial or residential building construction or improvements in the public or private sector is considered to be, for workers compensation purposes, an employee of any person or entity for whom or which that independent contractor performs services unless, among other things, that independent contractor has a federal employer identification number.

Form SS-4 may be obtained from the Internal Revenue Service by calling the IRS at the telephone number listed in the Resource Directory section of this Guide. The form and instructions can also be printed directly from the IRS website at Forms and Publications, go to Forms, Instructions & Publications.

To obtain a federal employer identification number from the Internal Revenue Service :

Types Of Tax Identification Numbers

There are five different types of tax identification numbers:

- EIN or Employer Identification Number

- SSN or Social Security Number

- ITIN or Individual Taxpayer Identification Number

- ATIN or Adoption Taxpayer Identification Number

- PTIN or Preparer Taxpayer Identification Number

The EIN Filing Service website of the IRS can help you decide the type of TIN you need to obtain for your business. You can then fill out the corresponding form and apply for a tax ID.

Also Check: How Much Should I Take Out For Taxes 1099

Is State Tax Id Same As Resale Number

Resale Certificate. Even though its important for your taxes, your resale number isnt the same as a tax ID number. Your businesss TIN goes on federal tax returns, and if you need to pay state taxes on your business income, you can apply for a state TIN. The resale number involves state sales tax.

Is The Fein The Same As A Tax Id

An FEIN can work as a tax identification number. However, not all businesses need an FEIN. In particular, if you dont have employees and if your business is not incorporated, you often dont need an FEIN. In these cases, you simply use your personal Social Security Number as your tax ID.

Additionally, as indicated above, the FEIN is for federal tax forms. You may need to obtain a state EIN or EAN for state tax forms. Those numbers work as your state tax ID number.

Also Check: How Much Do Employers Pay In Payroll Tax

Understanding Employer Identification Numbers

Employer identification numbers are issued to identify business entities in the United States the same way Social Security Numbers are used to identify individual residents of the country. The EIN is also known as a Federal Tax Identification Number.

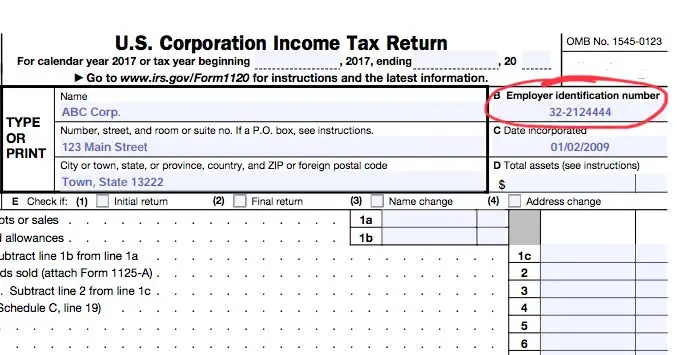

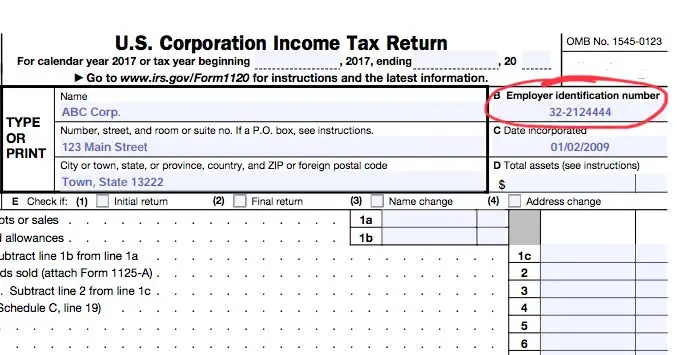

As noted above, EINs are unique nine-digit numbers that are formatted as XX-XXXXXXX. EINs are issued by the IRS and include information about the state in which the corporation is registered. The agency uses EINs to identify taxpayers that are required to file various business tax returns.

You need an EIN if you have employees, operate as corporations or partnerships, file certain tax returns, or withhold taxes from income other than wages. Business entities must apply for an EIN by phone, online, fax, or mail before they can begin operations. All forms of businesses can apply for and be issued EINs, including:

- have a Keogh plan.

- are involved with a number of types of organizations including but not limited to trusts, estates, or non-profits.

What Is A Tin

When noting the difference between TIN and EIN, a TIN, or taxpayer identification number, includes all numbers used for reporting taxes. Each TIN has specific purposes when used on a tax form. These include:

- EIN: Employer identification number

- ITIN: Individual taxpayer identification number

- ATIN: Adoption taxpayer identification number

- PTIN: Preparer taxpayer identification number

When comparing an EIN vs TIN, keep the above information in mind. While an EIN is a type of TIN, a TIN is a generic term for several types of taxpayer numbers.

You May Like: Do Veterans Pay Property Taxes In Florida

What Is The Difference Between An Ein Tin And Itin

1 minute read â¢Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

The acronyms that the IRS uses to identify the different types of taxpayer identification numbers can be confusing, and we get a lot of questions about these three in particular.

The acronyms that the IRS uses to identify the different types of taxpayer identification numbers can be confusing, and we get a lot of questions about these three in particular. Let’s break it down:

What Is An Entity Number

State Entity Number is a number that is assigned to a corporation or LLC by the State in which it is registered.

This number is used to identify the business entity in state filings and transactions.

The State Entity Number can be found on the Articles of Incorporation or Certificate of Formation for a corporation, or on the Articles of Organization or Certificate of Organization for an LLC.

In some states, the State Entity Number is also referred to as the State File Number or State Identification Number. For example you can use California Secretary of State Business Search Link to find an Entity Number for a particular CA entity.

You May Like: Can I Claim Donations On My Taxes

Minnesota Taxpayer Identification Number

A business needs to obtain a Minnesota tax identification number if it is required to file information returns for income tax purposes, has employees, makes taxable sales, or owes use tax on its purchases. Most businesses need a Minnesota tax identification number. However, a sole proprietorship or single member limited liability company which does not have any of these tax obligations does not need a Minnesota tax identification number. See the Minnesota Department of Revenue Minnesota Sales and Use Tax Business Guide.

You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration, by phone at 651-282-5225 or 800-657-3605, or by filing a paper form Application for Business Registration .

To apply online, youll need your federal employer ID number , if applicable business name or if applicable, Certificate of Assumed Name business owner’s Social Security Number contact phone number and email address the North American Industry Classification Code and business begin date. You will need your federal employer ID number , if applicable the legal name or sole proprietor name and business address the business name if applicable NAICS names and social security numbers of the sole proprietor, officers, partners or representatives and address and name of a contact person. If you do not have Internet access, call 651-282-5225 or 800-657-3605 to speak to a business registration representative.

Other Types Of Tins : Itin Atin Ptin

A TIN is a broad umbrella term that refers to a nine-digit number assigned by the federal government to individuals and businesses to identify them for tax purposes. There are actually five types of TINs. They include EINs, as well as Social Security Numbers , Individual Taxpayer Identification Numbers , Taxpayer Identification Numbers for Pending U.S. Adoptions and Preparer Taxpayer Identification Numbers . There are also State level Tax ID Numbers, which vary from state to state, and require a separate filing with your individual state you are located in or the state you form your business in. Each of these can be obtained by filling out the proper form for each corresponding TIN. IRS EIN Filing Service only processes applications for a general TIN, or EIN.

Also Check: How To Track Your Taxes

How To Get A Tax Id Number

To get a Social Security Number, use this Social Security Administration web page on Social Security Numbers and Cards.

You can apply for an Individual Taxpayer ID Number by completing IRS Form W-7 and mailing it to the IRS, or you can apply in person.

To apply for an Employer ID Number , use one of these four easy application methods, including an online application.

How Long Does It Take To Get An Ein

The amount of time it takes your business to receive an EIN can vary. Your results will depend on how you apply for your business tax ID number in the first place.

- Online: If you apply for an EIN online, you may get an EIN number right away.

- Fax: With faxed applications, you should receive a fax back with your EIN within four business days.

- Mail: Send in your EIN application via mail and youll have to wait around four weeks for processing.

Read Also: How Do I Claim Mileage On My Taxes

How Do I Apply For An Ein

When you incorporate your business, a registered agent like IncNow can often secure an EIN for your Delaware LLC after the Certificate of Formation is approved by the Secretary of State.

To obtain the number, you can fill out a simple online form at IRS.gov/EIN or ask an incorporation service to assist you. You will need to have a signed and completed IRS Form SS4. Should you want help getting the EIN, you can name a third party designee on the IRS Form SS4.

Should you have a social security number, the IRS will often provide the EIN right away online to you or the third party designee. Without a SSN, the IRS will ask that a Form SS4 be faxed in to their office. Faxing in the information is a slower process. When faxed in, the EIN usually takes 3-5 weeks for the IRS to assign. In around that same amount of time, two to five weeks, you will also receive a hard copy of your tax ID from the IRS in the mail.

Employee Identification Number Vs Taxpayer Identification Number

A Tax Identification Number is a broad term used to describe any type of identification number. An EIN is a specific type of TIN. A TIN is a generic descriptor for an assortment of numbers that can be used on a tax form including but not limited to:

Depending on the nature of the particular taxpayer, the EIN may or may not be the TIN used by the IRS. For sole proprietors, the TIN is often their Social Security number. For corporations, partnerships, trusts, and estates, their TIN is often an EIN.

You May Like: When Is The Extended Tax Deadline

Q: Under What Circumstances Am I Required To Change My Employer Identification Number

A: If you already have an EIN, and the organization or ownership of your business changes, you may need to apply for a new number. Some of the circumstances under which a new number is required are as follows:

Do You Require Ein Assistance

IncParadise is one of the most reputable companies when it comes to new business formation and we can help you with converting your idea into a fully functional startup by providing all incorporation services as well as help in maintaining your business as the registered agent. We not only provide services towards the incorporation process but also assist with various business related processes including EIN services. We have a team of experts who can provide you with information on EIN and how to obtain it. The IncParadise team is easily accessible and can help you with both EIN and EDGAR filings. Our team also holds expertise in providing additional incorporation services like S Corporation filings that will enable your business to enjoy tax benefits.

Recommended Reading: What If I Filed My Taxes Wrong

How To Find Your Ein If Youve Forgotten It

Your business EIN is the equivalent of an individual’s social security number. In the same way that you guard your social security number, you should take care to safeguard your EIN to reduce your risk of business identity theft. In fact, in its effort to reduce the risk of a taxpayer’s identifying number getting stolen, there is no automated look-up for EINs. However, the IRS has provided guidance on how to find your number if you’ve forgotten it. The IRS’s suggests that take these steps:

- Find the confirmation that the IRS sent when you applied for your EIN

- Contact your bank, state agency, or local agency if you supplied your number to open a bank account or obtain a business license

- Locate a previously filed tax return, which should have your EIN on it.

If these measures are not successful, you will need to contact the IRS directly to ask the IRS to search for your EIN number. You will need to provide identifying information. In addition, you must be a person that is authorized to receive the number on behalf of the business. For example, you must be a corporate officer of a corporation or a manager of an LLC. If you provide the requisite identification and proper proof of authorization, the IRS employee will give you your EIN number over the phone.

Ein Vs Tin: Final Thoughts

By distinguishing the difference between EIN vs TIN tax identification, you circumvent any confusion about TINs in general. Besides an EIN, the IRS lists 4 other basic TINsSSN, ITIN, ATIN, and PTINthat you can use while preparing federal taxes. Regardless of their specific purpose, each tax ID number makes it possible for the IRS to identify the taxpayer, dependent, or preparer on a federal tax return form. But the importance of obtaining an EIN for your business doesnt stop at tax season. There are a host of crucial merchant services, such as a merchant account, for which you must provide your EIN to obtain.

Also Check: When Do You Pay Quarterly Taxes

Check Other Places Your Ein May Be Recorded

Aside from confirmation letters from the IRS, you may be able to find a copy of your EIN on other important documents. For example, you might want to take a look at previously filed tax returns. Or you might look over old financing documents, like applications for business loans or lines of credit.

The IRS also suggests that you might be able to get a copy of your EIN by contacting institutions with which you shared that information in the past such as your business bank or local and state business license agencies.