Turbotax Business 2021 Tax Software Federal Tax Return Only With Federal E

$119.99& Return this item for free

|

| Intuit | |

| Operating System | Windows 8.1, Mac OS Monterey 12, Mac OS Catalina 10.15, Mac OS Big Sur 11, Windows 11, Windows 10 |

| Hardware Platform | |

Can I Use Turbotax Business For People Who Own And Don’t Own Businesses

If I purchase 1 CD version of TurboTax Business, I am allowed to efile 5 federal tax returns.

Can I apply for 2 family members who own businesses and 3 who don’t own businesses using just 1 copy of TurboTax Business?

(Will the family members who don’t own businesses be able to use the same CD to enter their investments, jobs etc using TurboTax Business?

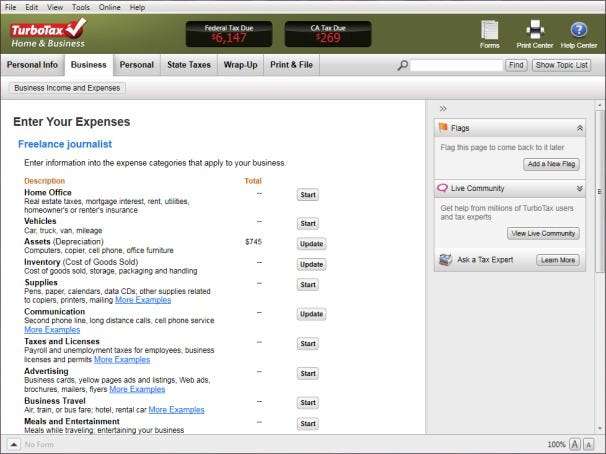

Detail Of Asset Purchases

Major assets you buy for the business generally must be depreciated over a number of years rather than expensed during the current year. Have the following information available for these assets:

- Cost of the asset, including any sales tax paid

- Description of the asset

- Date put into service

- Amount of time the asset is used for the business , stated as a percentage of total use

Also Check: Doordash 1099

When Is The Tax Filing Deadline

The final tax deadline for the US is Monday, April 15th. However, you should aim to file your taxes earlier, so you can take the weight off your mind. You can file your taxes with TurboTax the moment you get the relevant forms from your employer for this tax year.

Even if the IRS is not yet accepting filings, TurboTax will keep your tax return on file and submit it at the earliest possible opportunity.

Cons For Using Turbotax

I will admit that Turbo Taxs attempt to engage with their clients is admirable, but how can we trust this CPA that just popped up in the corner of my screen. Pretty much linking up with a stranger that knows nothing about your tax and financial history.

Another con of using Turbo Tax is that it cant think outside the box. It can only function at the ability or number of the algorithms that are programmed in it.So finding those unique deductions are out of the question.

I cant deny that taking a picture of a tax form and having the data be inputted into a document is not so totally AWESOME, but how is a client to know that the information is in the right place.

Lets call on Box in the corner Bob to clarify that for us.

I understand that as a practicing CPA, my heart lies in the good ole face to face interaction with a client. Getting down to the meat of their financial problems and creating a game plan for them to have more and more success but I see the easiness that comes with Turbo Tax.

Just do the research and find out what is best for you.

If you need any assistance implementing these strategies or any other tax-saving strategies in your business? Give our NJ tax consultants a call at 732-566-3660 or to schedule a FREE 30 Minute Tax Minimization and Profit Maximization Strategy Session.

Also Check: How To File Doordash Taxes

How We Chose The Best Tax Software For Small Business

This review was based on information gathered on 10 different tax software options for small businesses. The winning software programs offered a good user experience including important features to prepare an accurate tax return in a timely fashion. Additional factors reviewed include cost, customer reviews, software popularity, and available options for both technical and tax support.

Best Overall: H& r Block

H& R Block

We chose H& R Block as best overall because it is a trusted name in tax preparation, and its tax software for small businesses and business owners offers an excellent user experience and covers a wide range of tax situations. It offers a straightforward user interface that makes it easy to do your taxes accurately the first time.

-

Online version includes self-employment and small business income on your personal tax returns

-

Option to upgrade for on-demand assistance from a tax expert

-

Mobile app allows you to upload tax documents and track filing status

-

Business editions are priced higher than competitors

-

Some functionality may not be available on mobile

H& R Block is a well-known brand in personal and business tax preparation. It was founded in 1955 and has prepared more than 800 million tax returns. If you want to do your own taxes, you can choose between online and downloadable versions of H& R Blocks tax software. For the 2019 tax year, H& R Block prepared almost 22 million tax returns and nearly 9 million people used H& R Block Online to do their taxes.

The software program does a good job of walking you through complex tax situations. If you think youll need extra help, you can upgrade to Online Assist, which allows you to do your taxes on any device with unlimited, on-demand help from a tax pro. It costs $159.99 for Premium or $194.99 for Self-Employed, plus $49.99 per state.

Recommended Reading: Opi Plasma Center

Integration With Quickbooks Self

TurboTax Self-Employed offers seamless integration with QuickBooks Self-Employed, which tracks invoices, helps separate personal expenses from business expenses, tracks mileage automatically, and helps track any quarterly taxes due.

Any information tracked in QuickBooks Self-Employed can be easily exported into TurboTax Self-Employed, eliminating the need to re-enter the information.

Turbotax Versions For Online Use

You can use TurboTax without buying a CD or download by using an online version. All the software and all your information is stored on Intuit’s server, though you are encouraged to save a pdf of your return. The same four tiers exist though they have some different names.

- As with the CD, Basic is for simple tax filings and includes e-filing.

- As with the CD, Deluxe includes added features relating to deductions.

- As with the CD, Premier includes features in Deluxe plus features relating to rental properties and investments.

- As with the CD, Self-Employed includes features in Deluxe plus support for self-employment income .

- As with the CD, Home & Business has added features related to self-employment and home deductions.

- An added tier, “TurboTax Live,” includes real-time handholding and review from a certified expert.

You May Like: Efstatus.taxact.com 2019

Am I Really A Small Business Owner

When you think of the term small business what comes to mind?

- A small mom & pop store?

- Or, the little deli on the corner that sells those amazing wraps?

Being a small business owner does not require a store-front, nor does it require employees. You are a small business owner if you own a small business.

You are self-employed if you operate a business where you are the business, such as:

- Freelancers

- Ride-share drivers

- Contract writers

Whether you do dog walking as a side gig or sell your veggies at the local farmers market, congratulations, you are self-employed, and you likely have a small business.

A Critique Of The Turbotax System

As TurboTax is improved, and more and more data about your investments and employment and education and history is effortlessly captured in its interface, you begin to wonder: what would it be like if this process was not only automated but free and available to everyone?

In some European countries, the government gathers this data on its own and “populates” tax forms with it. You just sign off on it, and that’s how you file. The reason we don’t have such a process here, according to Dylan Mathews of Vox, is that Intuit and H& R Block lobby hard against any move to simplify the federal tax process.

Mathews argues that if you give them money, you are ultimately making tax time harder for everyone, even though you are buying yourself a more pleasurable tax time experience. It’s up to you.

This article is accurate and true to the best of the authorâs knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

Recommended Reading: Donating Plasma Taxes

Extra Fees Will Apply If

- You need state filing. If you live in one of the majority of states that require you to do state income taxes as well, you’ll have to pay an additional $39 per state. If you lived or worked in more than one state, you may have to pay for multiple state returns.

- You upgrade to TurboTax Live. For a premium price, you can pay for instant, live access to a tax expert.

- You opt for TurboTax Live Full Service: For about double the cost of filing yourself, you can hire a tax expert to take care of it all for you. The all-in cost is between $0 and $259 for a federal return.

- You pay TurboTax from your refund. If you’re expecting a tax refund, TurboTax will ask if you want to use part of it to pay for its tax prep services. It sounds more convenient than pulling out a debit or credit card on the spot, but beware: a $39 processing fee applies.

Note:TurboTax has two free filing options. The version outlined above has no income restrictions, but includes a limited number of tax forms. There’s another free version offered through the IRS Free File portal, which covers all tax forms for people with incomes below $39,000. In addition, all active duty military and reserve personnel are eligible to file their federal and state returns for free.

Best For Partnerships And Corporations: Taxact

TaxAct

TaxAct includes an option to complete tax filings for partnership and corporations completely online and is the only place you can prepare taxes for a partnership or S corporation with either a PC or Mac online, which is why it’s our choice as best for partnerships and corporations.

-

Completely online federal and state taxes for partnerships, C corporations, and S corporations

-

Unlimited free support from tax specialists and technical support by phone and email

-

Choose between online and downloadable versions

-

Discounts available for bundling personal and business taxes

-

Limited options for audit support

-

State forms may not be available to file electronically

TaxAct is a large provider of online and downloadable tax software that has completed over 80 million tax returns since 2000.

Business owners who file online will pay $124.95 plus $49.95 per state. That includes sole proprietors who file with a Schedule C, partnerships that require Form 1065, corporations that file with Form 1120 or Form 1120s. However, tax-exempt organizations that file Form 990 must by the downloadable version though..

The download version , which includes 5 federal e-files is $109.95. States cost $50 each. You can bundle personal and business for a total of $200.

You May Like: Doordash Payable 1099

Which Turbotax Do I Need To File A Return For A Trust

If it’s a living trust, you can use whichever TurboTax personal program that suits your tax situation. There is no special tax form for living trusts the trust’s income and deductions are reported on your personal tax return.

All other trusts need to file Form 1041 , which is supported in TurboTax Business.

TurboTax Business also generates the trust beneficiaries’ Schedule K-1 forms, which the beneficiaries then report on their personal tax returns.

TurboTax Business is a Windows-only software program available as a CD or download.

Related Information:

How To File Your Taxes Simply And Easily

We recommend TurboTax as the number one tax preparation platform for the average American. If you want to file your taxes for free and you have relatively simple tax affairs, theres no better alternative.

With a guarantee of accuracy and perfection, you can have peace of mind when you file your taxes this year.

Recommended Reading: Property Tax Protest Harris County

Can I Use Turbotax Home And Business If I Do Not Have A Business

Yes, you can still use TurboTax Home and Business without having a business. You will just skip over the Business tab portion during the interview and you can enter your income and any deductions/credits you have under the Personal tab. The program will fill out the normal Form 1040 and associated forms for you based on your entries.

What Turbotax Version Can I Use To File Both Corporate And Personal Tax Returns I Own A Business In Wa

TurboTax Business is for filing a tax return for a non-breathing non-living separately taxable entity. TurboTax business can not be used to file a personal tax return of any type, because it does not include any version of the 1040. TurboTax Business is not available as an online product, or for MACs. It’s for the Windows platform only. You must purchase the program and physically install it on a Windows computer. TurboTax Business can be purchased online at After you pay for the program, you can download the installation file and double click the downloaded file to install the program on your Windows computer. After installing, there will be a “TurboTax Business 2017” icon on your desktop, which is used to start the program.

Note that you *MUST* complete the business return *FIRST* before you can even start your personal tax return. That’s because the business will issue a K-1 to all owners of the business, which each owner will *need* in order to correctly and completely complete their 1040 personal tax return.

TurboTax Business is used for the following types of tax returns:

The TurboTax Business program *DOES* *NOT* include IRS Form 1040, 1040-A or 1040-EZ and can not be used to file a personal tax return for any kind of breathing, living person.

Recommended Reading: Do I Pay Taxes On Plasma Donations

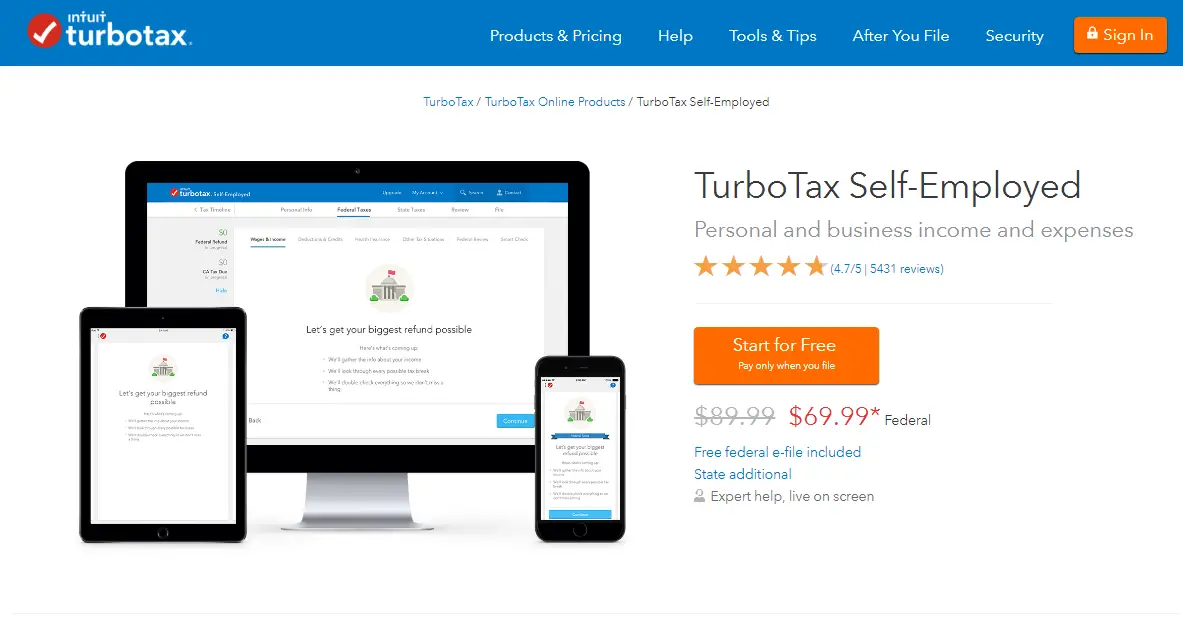

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Iv: Information On Your Vehicle

In this section, you give the IRS information about any vehicles for which you’re deducting expenses in Part II. The IRS uses the answers in this section when reviewing your vehicle deduction to see if it seems legitimate. So it’s important, for example, to be able to answer YES to the question about whether you have written documentation for your deduction. If you answer NO, dont be surprised if the IRS asks you to justify the deduction.

You May Like: How Does Taxes Work With Doordash

Filing Using Turbotax Self

- When you prepare your tax return, you will just enter all of your businesss details into the self-employed section of TurboTax Self-Employed.

- All the business-related information is entered into the T2125, Statement of Business Activities, which informs the CRA of your self-employment income and deductions as well as deductions.

- The T2125 is sent to the CRA along with your other tax forms which make up your T1 General return.

- If you own your unincorporated business with a partner , the same T2125 is filled out, however, there is some additional information relating to the partners which is required, and TurboTax Self-Employed takes care of that too.

If, on the other hand, you have chosen to incorporate your business, then you are required to file a separate return, a Corporation Tax Return, or T2, for the business itself. All of your personal income and credits stay on your return and the businesss income and credits stay on its own return.

Choosing your businesss structure is an important decision. Incorporating has its advantages and disadvantages. To learn more about choosing a business structure, check out our tax tip Taking the Leap from Employee to Owner.

Can I File My Taxes For Free With Turbotax

TurboTax free file service is aimed at the average American with simple tax affairs.

More complex tax affairs will require you to purchase the upgraded service. There are three paid packages you can take advantage of.

Furthermore, youll be able to enjoy the benefits of specialist support and the chance to take advantage of filing your state taxes at the same time.

However, even with the free service, you get the guarantee of 100% accuracy with no mistakes. Plus, you can still take advantage of the live chat feature, which is run by professional tax preparers who know what theyre doing. You always have a limited amount of support, even with the free service.

Recommended Reading: Door Dash Driver Taxes

Tax Treatment Of An Llc

The IRS assumes that LLCs with more than one member are partnerships for tax purposes. That means the LLC itself pays no tax, but taxable profits and deductible losses are passed through to the members,who are treated as partners under the tax rules.

So at tax time to keep the IRS happy an LLC files Form 1065: Partnership Return of Income. The annual Form 1065 must also include a Schedule K-1 for each member. Schedule K-1 reports the members share of LLC income, deduction, and tax credit items. These amounts are then included on the members personal tax return.

If you choose to have your LLC file taxes as a corporation, you must tell the IRS by filing Form 8832: Entity Classification Election. At tax time you’ll use Form 1120: Corporation Income Tax Return, or the short form, 1120-A.

If you have a single-member LLC, you’ll file as a sole proprietorship using Schedule C .

A rather sticky issue for LLC members is whether they owe self-employment tax on their share of the company’s earnings. In general, members who are actively engaged in the business must pay this tax.

There is a special rule for LLC members who are the equivalent of Limited Partners and don’t take an active role in the business: They don’t pay self-employment tax on profits the company passes through to them, only on compensation they receive for any services they provide to the LLC.