Owing The Irs Mistake #: Not Setting Up A Payment Plan

The IRS really doesnt want to have to come after you to get the money you owe. To make it easier for taxpayers to pay up, Uncle Sam offers payment plans. If you owe taxes and you cant pay, its a good idea to find out whether you qualify for an installment plan. You may be eligible for an online payment plan if you owe the IRS less than $50,000 in income taxes, penalties and interest. If you fit that criteria, you can apply for a payment agreement online. Otherwise, youll need to fill out Form 9465 and mail it to your local IRS office to see what kind of plan you qualify for.

The IRS gives eligible taxpayers up to 72 months to get their tax debt paid in full. Keep in mind that interest and penalties will continue to pile up until the balance is paid off. If youre owed a refund in any subsequent tax years while youre on the plan, the IRS can subtract those payments from what you owe.

If You Lose Tax Returns

The IRSâs recommended periods for saving tax returns are really just minimums. Tax records include a wealth of information about your finances, so you may want to keep all of them indefinitely. The IRS keeps returns it receives for seven years, after which it is required by law to destroy the information. If youâve thrown out a return from the past seven years and now need it, you can request a copy from the IRS by filing Form 4056. Itâll cost you $50. Or you can file Form 4506-T and get a transcript of your return a printout of all the data from the return, but not an actual copy of the return. Transcripts are free. If you worked with a paid preparer or used online tax prep software, you may be able to get a copy from the preparer or software provider.

References

Balance Of $10000 Or Below

If you owe less than $10,000 to the IRS, your installment plan will generally be automatically approved as a “guaranteed” installment agreement.

- Under this type of plan, as long as you pledge to pay off your balance within three years, there is no specific minimum payment required.

- For balances above $10,000, you may have to provide additional information in order to qualify.

You May Like: Why Have I Still Not Gotten My Tax Return

How Much Tax Do You Pay When You Sell A Commercial Property

If you are selling a commercial property, you will need to pay taxes on the sale. The amount of tax you will pay will depend on the profit you make on the sale, as well as the tax rate in your jurisdiction.

An improper commercial transaction may result in millions of dollars in tax liabilities if it is not properly planned. An investment in commercial real estate is a significant one. Taxation can be a factor to consider when purchasing or selling a piece of commercial real estate. You will be taxed on the entire profit from your purchase of commercial property if the property has appreciated since you first purchased it. If you write off $300,000 in depreciation and sell it for $1.1 million, you will make a $100,000 capital gain. Gains made under Section 1250 are taxed at 25% in the United States. If you sell a home in a state where an income tax is levied, you must also pay state tax on any gains.

Figuring Out How Long You Work For The Tax Man

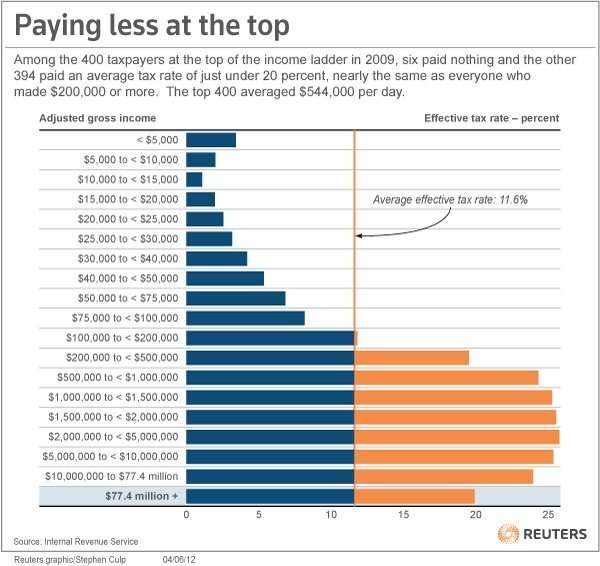

If taxes were simple, then it would be a trivial exercise to figure out how long you’re essentially working for the IRS every year. For instance, if there were a flat tax rate of 10% that applied to all income without any deductions, you’d know that you’d be working 10% of the year, or 36.5 days, to make enough money to pay your taxes for that year.

However, taxes aren’t simple. Even when incomes are similar, various deductions give some people tax breaks that others can’t get. Progressive tax rates mean that higher-income taxpayers often pay higher tax rates than lower-income taxpayers, but there are also exceptions to that rule for those who get most of their income from tax-favored sources like dividend income or long-term capital gains. As a result, some people work a much larger portion of the year toward paying their tax bill than others.

Image source: Getty Images.

Read Also: Does Washington Have Income Tax

When Is A Home Sale Fully Taxable

Not everyone can take advantage of the capital gains exclusions. Gains from a home sale are fully taxable when:

- The home is not the sellers principal residence

- The property was acquired through a 1031 exchange within five years

- The seller is subject to expatriate taxes

- The property was not owned and used as the sellers principal residence for at least two of the last five years prior to the sale

- The seller sold another home within two years from the date of the sale and used the capital gains exclusion for that sale

Household Employer Withholding Tax

Employers of certain household employees have the option of reporting and paying the Virginia income tax withheld from those employees on an annual basis. For the employer to qualify, the employment must consist exclusively of domestic service in the private home of the employer, as defined in the Federal Employment Tax Regulations.

The annual filing provision is a filing option for qualified employers. It does not establish a new requirement for withholding. Unlike the federal “nanny tax,” the Virginia household employer’s withholding tax is filed on a separate return, and is not included in the employer’s personal income tax filing. If you choose to register for this annual filing option, you will be required to file Form VA-6H, the Virginia Household Employer’s Annual Summary of Income Tax Withheld, by Jan. 31 each year to report and pay the Virginia income tax withheld for the preceding calendar year. You must file Form VA-6H online, either through your online services account or through eForms.

Basic Instructions for Household Employers

Before you begin, make sure you are liable to withhold Virginia income tax from the wages of your household employee. If the wages are not subject to federal withholding, they are not subject to Virginia withholding.

Registration

How to File and Pay

Form VA-6H must be filed by each year, with copies of each W-2 issued to a household employee during the previous calendar year and payment for the tax due.

Don’t Miss: Can You Claim Rent On Your Taxes

How To Avoid Capital Gains Tax On Home Sales

Want to lower the tax bill on the sale of your home? There are ways to reduce what you owe or avoid taxes on the sale of your property. If you own and have lived in your home for two of the last five years, you can exclude up to $250,000 of the gain from taxes.

Adjustments to the cost basis can also help reduce the gain. Your cost basis can be increased by including fees and expenses associated with the purchase of the home, home improvements, and additions. The resulting increase in the cost basis thereby reduces the capital gains.

Also, capital losses from other investments can be used to offset the capital gains from the sale of your home. Large losses can even be carried forward to subsequent tax years. Lets explore other ways to reduce or avoid capital gains taxes on home sales.

The Louisiana Tax Deadline

Almost all Louisiana debts have a 10-year statute of limitations. Louisianas labor laws provide that 75% of wages cannot be garnished. Personal property in Louisiana cannot be liens. If you owe taxes to the state of Louisiana, you have three years from the date on which the taxes are due to file a return to do so. You must submit your fiscal year tax return by May 15th if you are a fiscal year filing taxpayer. If you want to file an extension, you have 15 days from the close of the taxable year to do so. If you do not file by the deadline, your extension request will be denied. If you are a nonresident professional athlete and are required to file an extension, you have until June 15th to do so. In Louisiana, there is no statute of limitations for collecting debts, but most debts must be in good standing ten years or older. In theory, if you owe taxes to Louisiana and do not file a return or pay the taxes by the deadline, the IRS has the authority to collect the debt after ten years.

Also Check: Where Can I File My Taxes

What Happens If You Don’t File Your Taxes On Time

If a significant amount of time passes since the tax deadline, and you owe the IRS money, it could potentially seize a portion of your wages until the debt is settled.

If you’re expecting a refund, you risk losing the money the government owes you. Taxpayers must file within three years of the return due date, or else they forfeit any cash the IRS owes them. The same rule applies to claim tax credits such as the Earned Income Credit .

In 2022, the deadline to file your 2021 taxes is Apr. 18. If you haven’t already filed, you should e-file today using an online tax filing program like TurboTax or H& R Block.

-

Costs may vary depending on the plan selected

-

Free version

For simple tax returns only. See if you qualify.

Terms apply.

If you’re concerned your tax bill may be steep, you can set up a payment plan with the IRS. The service fees for setting up tax payment plans range from $0 to $149 and will include interest on the balance until the payment is paid in full. Plus, there is a non-payment penalty, up to a maximum of 25% of the unpaid tax amount, for paying late. You can learn more about IRS payment plans on its website.

How Long Should Businesses Keep Tax Returns And Other Business Tax Records

Fortunately, the IRS cannot assess additional tax once a certain periodcalled the statute of limitationshas passed. The federal income tax statute of limitations equals:

- three years from the filing dateor the due date, if laterfor most tax returns

- four years after the tax becomes dueor gets paid, if laterfor employment tax returns

- six years from the filing dateor the due date, if laterfor tax returns that underreport gross income by more than 25%

- seven years from the filing dateor the due date, if laterof the related tax returns for losses from worthless securities or bad debt

- Forever for unfiled or fraudulent tax returns

Some state taxing authorities follow IRS rules, while others use different periods. Creditors and investors may have their own requirements.

Creating different retention policies for each possible scenario may prove impractical. Retaining tax returns and other records for seven yearsstarting from the later of the filing date and due date of the related tax returnoffers a convenient rule of thumb. This covers almost all documents for businesses that file all required tax returns without fraud.

You May Like: How To File Your Taxes For Free

Sign In To Pay And See Payment History

Taxpayers can use their Online Account to securely see important information when preparing to file their tax return or following up on balances or notices. Taxpayers can make a same-day payment for a 2021 tax return balance, an extension to file, or estimated taxes, which are all due by April deadline for most taxpayers. They can also view:

- Their Adjusted Gross Income, Economic Impact Payment amounts and advance Child Tax Credit payment amounts needed for their 2021 return,

- Payment history and any scheduled or pending payments,

- Payment plan details and

- Digital copies of select notices from the IRS.

When Are Taxes Due In Your State

Be sure to find out when your local tax day is. Most taxpayers face state income taxes, and most of the states that have an income tax follow the federal tax deadline. Ask your state’s tax department: When are taxes due?

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

-

However, getting a tax extension only gives you more time to file the paperwork it does not give you more time to pay.

-

If you can’t pay your tax bill when it’s due, the IRS offers installment plans that will let you pay over time. You can apply for one on the IRS website.

If you request a tax extension by April 18, you can have until October 17 to file your taxes.

Also Check: How To Pay Income Tax

File By April 18 2022 For Most Taxpayers

The most important thing everyone with a tax bill should do is file a return by the April 18 due date, for most taxpayers . Taxpayers may also request a six-month extension to file by October 17, 2022, to avoid penalties and interest for failing to file on time.

Though automatic tax-filing extensions are available to anyone who wants one, these extensions don’t change the payment deadline. It is not an extension to pay. Visit IRS.gov/extensions for details.

Usually anyone who owes tax and waits until after that date to file will be charged a late-filing penalty of 5% per month. So, if a tax return is complete, filing it by April 18 is always less costly, even if the full amount due can’t be paid on time.

IRS Free File is an easy, quick way to file that is available to eligible individuals and families who earned $73,000 or less in 2021. IRS Free File is available on IRS.gov.

What Happens If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2021 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2021 tax returns, the window closes in 2025. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

Don’t Miss: Can You Turn In Taxes Late

Should You Shred Old Tax Returns

With that timeframe, California residents should keep their state tax records for at least four years. What Should I Do with My Old Tax Returns? Once you have scanned your tax documents, make sure to dispose of them in a secure manner. At the very least, shred them before throwing them in the trash.

What Do I Do If I Owe The Irs Over 100000

The IRS may take any of the following actions against taxpayers who owe $100,000 or more in tax debt:

Recommended Reading: How To Find Delinquent Property Tax List

Unpaid Property Taxes Louisiana

If you dont pay your property taxes in Louisiana, you will eventually lose your home. The tax collector can sell your home at a public auction to recoup the unpaid taxes. You will be given a certain amount of time to pay the taxes before the sale, but if you dont pay, you will lose your home.

If you do not pay your property taxes in Louisiana, you will be subject to a tax sale. You can pay off your tax bill by selling part of your property in an auction. You will not be able to own your home right away if the winning bidder is disqualified after the sale. However, if the sale proceeds, you will be permanently barred from holding onto the property. Tax sale certificates are issued to taxpayers by the tax collector, and they can be found in public records after a property is sold. The buyer is given limited ownership of the property if he or she has the right to redemption. If you want to prevent the sale from going ahead, you can pay the amounts due up until the day before the event.

No Comments

Individual Tax Forms And Instructions

Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year.

- Restart Safari, then try opening the .PDF in the Safari browser.

Tax Forms Containing 2-D Barcodes

Adobe Reader for Mobile

For information about Adobe Reader on mobile platforms, visit

General Instructions for downloading .PDF Files

The following instructions explain how to download a file from our Web site and view it using ADOBE Acrobat Reader.

Don’t Miss: When To File Tax Return

Example Of Capital Gains Tax On A Home Sale

Consider the following example: Susan and Robert, a married couple, purchased a home for $500,000 in 2015. Their neighborhood experienced tremendous growth, and home values increased significantly. Seeing an opportunity to reap the rewards of this surge in home prices, they sold their home in 2020 for $1.2 million. The capital gains from the sale were $700,000.

As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. Their combined income places them in the 20% tax bracket. Therefore, their capital gains tax was $40,000.