No Exemption For Age Or Occupation

Whether youre 9 or 90, age has no effect on your requirement to file a tax return. If you meet one of the above requirements, the CRA expects to receive an income tax return from you.

Students are not exempt from filing either. If your 17-year-old child is an entrepreneur who made over $3,500 running a small business last summer, they must file an income tax return even if theyre still in school. All working children should file a tax return as soon as they start earning income.

Special Rules For Taxpayers Age 65 And Older

Taxpayers who are age 65 or older have different, more generous filing thresholds. You would be considered age 65 for tax purposes if you were born on Jan. 1, 1957. However, the age-65 rule doesn’t apply to you if your income for the tax year was $5 or more and you were married but don’t file a joint return.

For most people, Social Security benefits dont count toward your income. However, they will if:

- You lived with your spouse at any time during the tax year and are submitting a married-filing-separate return.

- Half of your Social Security benefits plus your other gross income and tax-exempt interest exceeds $25,000

When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer whos only income is earnings of $2,500 from a job, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return. So if you want to claim a tax refund then you should file a tax return.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Recommended Reading: What Will I Get Back In Taxes

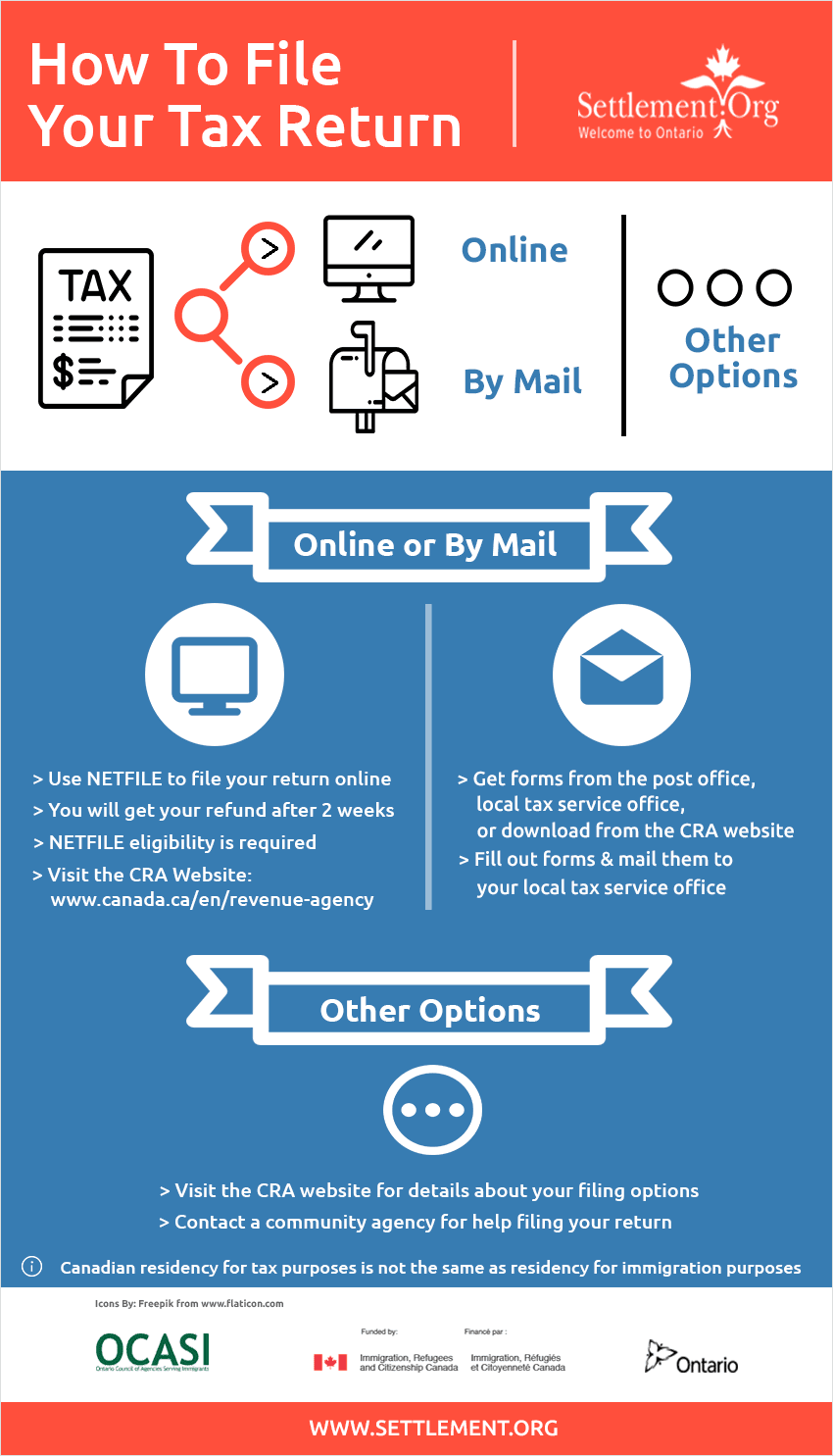

How Can I File My Taxes

The IRS accepts tax returns filed one of two ways:

A reported 88% of individual tax returns are e-filed per year. Any tax return filed by a tax professional in an H& R Block tax office, using the H& R Block tax software, or through the H& R Block online filing program is usually e-filed. However, you can always choose to have your return printed to mail yourself.

E-file is the quickest filing method and typically helps you receive a tax refund faster.

Do I Need To File A Tax Return

You may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Find out if you have to file a tax return.

You May Like: Do I Have To Pay Taxes On My Unemployment

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

Are My Social Security Benefits Taxable

As a very general rule of thumb, if your only income is from Social Security benefits, they wont be taxable, and you dont need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

If youre married and file a joint return, both spouses must combine their incomes and Social Security benefits when figuring taxable amounts. This applies even if the spouse did not have any benefits.

The IRS offers a worksheet to calculate taxable benefits.

Read Also: Where To Drop Off Tax Return

What If Im Self

As a small business owner, you may be required to file additional returns, such as those for payroll and GST/HST remittances and withholdings. Failure to meet the CRAs payroll obligations results in penalties and interest there are several types of penalties for payroll accounts. Failure to deduct can result in a penalty of 10% for the first failure, and will go up to 20% with any additional failures. Late filing or non-payment penalties start at 3% and will go up to 20%.

Individual Tax Forms And Instructions

Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year.

- Restart Safari, then try opening the .PDF in the Safari browser.

Tax Forms Containing 2-D Barcodes

Adobe Reader for Mobile

For information about Adobe Reader on mobile platforms, visit

General Instructions for downloading .PDF Files

The following instructions explain how to download a file from our Web site and view it using ADOBE Acrobat Reader.

Read Also: Do You Have To File Taxes If Your On Ssdi

Things To Know Before You File Your Tax Return This Year

Jamie Golombek: Tax season is in full swing and those who’ve already filed and claimed a refund are getting an average of $2,145 back

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Recommended Reading: How To Check Last Year Tax Return

More Tax Planning Tips

Filing and refund dates aren’t the only deadlines that taxpayers have to concern themselves with. Certain payments and reporting requirements are sprinkled over the calendar year, and missing any of them could cause a headache. Here are a few other deadlines you may want to keep in mind:

- Sole proprietors and independent contractors who aren’t subject to tax withholding by an employer should make quarterly estimated payments on January 15, April 15, June 15, and Sept. 15 of each year. The date in January 2022 is actually Jan. 18, and its payment is especially important because it’s the last payment for the 2021 tax year.

- Employees who earn more than $20 in tips in the month of December 2021 should report them to their employers on Form 4070 by Jan. 10, 2022, and every month going forward.

- You can make 2021 IRA contributions until April 18, 2022.

Security Of Personal Information

We accept responsibility for the security of information once we receive it. We take precautions to ensure that there is no unauthorized access to your data, and ensure the confidentiality of data you send using NETFILE. We use sophisticated security and encryption to protect this website and your personal information.

We are also responsible for making sure personal and financial information is sent in an encrypted format between your computer and our servers. This ensures that computer hackers and other Internet users cant view or alter the data you send to us.

Tax software companies whose products are certified for NETFILE are not representatives of the CRA. You are not obliged to send personal information directly to the tax software company when you ask for software assistance. Email is not a secure method of communication. Sending personal information by email is a big concern and increases the risk of identity theft.

Don’t Miss: How To Pay Less Taxes High Income

When Can You File For An Extension On Your Taxes

You can file an extension for filing your federal taxes up to the tax due date. Filing for an extension is free and it gives you until Oct. 17 to file your return. Note that this only extends when your tax returns are due. If you owe taxes, your payment is still due on the federal tax filing deadline .

It Can Depend On The Tax Credits You Claim

The Protecting Americans from Tax Hikes Act of 2015, commonly known as the “PATH Act,” began delaying some refunds in 2017.

If you’re expecting a refund because you claimed the earned income tax credit or the refundable portion of the child tax credit, the IRS isn’t permitted to issue your refund before mid-February, regardless of when you file your return. The PATH Act provides that the IRS needs time to examine returns claiming these refunds so it can prevent fraud.

You can check the status of your refund and get a more exact date after that time by visiting the IRS “Where’s My Refund?” page on its website.

You’re still subject to this delay even if your refund is only due in part to the EITC or the child tax credit. The IRS wont send you one refund for $1,000 and hold the EITC portion of your refund until mid-February if you overpaid $1,000 in taxes and are also entitled to a $1,000 EITC refund for a total of $2,000. Your entire refund will be delayed.

Read Also: How Much Tax Is Taken Out Of Social Security

Tax Filing Deadline For Individual Tax Returns

The tax filing deadline for your 2021 tax return is May 2, 2022.

The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. If April 30 falls on a weekend, the CRA extends the deadline to the following business day.

If you want to file early, the CRA will open its NETFILE service on February 21st to electronically receive submitted returns

Mailed responses must be received or postmarked by the due date, and electronically submitted returns must be submitted by midnight local time of the date they are due.

Federal Tax Return Deadline Still April 30th

Although federal tax returns still must be filed by the Friday April 30, 2021 duedate, some taxpayers who received CERB, CESB, CRB, CRCB, CRSB,EI benefits, or similar provincial emergency benefits will not required to payinterest on any outstanding tax debt for the 2020 tax year until April 30, 2022.

For more information see:

You May Like: How To Find Your Business Tax Id Number

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out what’s new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

How To File Late Tax Returns In Canada

Wondering how far back you can file taxes in Canada? Looking for information on how to file your tax returns late? We can help. Our team is made up of experienced ex-CRA, accounting, and legal professionals who understand CRA processes and know how to resolve tax situations.

If you want to file previous year returns, there are options available to you. One option is the CRAs Voluntary Disclosure Program . This program is designed as a second chance to correct prior year returns or to file returns that have not been filed.

In order to file your back taxes through the VDP, certain conditions must apply:

- You must be making a voluntary disclosure

- To qualify for the VDP, you must disclose information to the CRA before it contacts you for the information. This means that, if the CRA has already contacted you about previous year returns, or if the agency has taken compliance actions against you for not filing your taxes, you cannot use the VDP.

- A penalty must apply

- The VDP only applies if you owe money on previous returns. If you do not owe money, you should still file previous year taxes, but you do not need to use the Voluntary Disclosure Program to do so.

- The information must be at least a year overdue

- The VDP only applies to returns that are more than a year late. If your return should have been filed in the last year, you cannot submit it using the VDP.

Head Office:1220 Sheppard Ave. E, Suite 300 Toronto, OntarioM2K 2S5

Also Check: Why Did I Get Less Taxes Back This Year

S Of Filing Your Tax Returns In Canada

Are you a resident of Canada and the deadline for paying your taxes is quickly approaching, but youre not sure what to do? You have no notion of how to file a tax return or what the methods of filing tax returns are. Then you dont need to worry at all you are at the right place.

In this blog, we will discover modern and novel techniques to file Canadian tax returns. Additionally, you will get a general overview of how to determine whether you need to submit a tax return and what paperwork you would need to do so.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

You May Like: How To View Previous Tax Returns

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

When Is The Earliest I Can File

Because so many of our clients are excited to get their refunds, we get asked all the time, When is the earliest I can file my federal tax return?

You cannot technically file your federal taxes until the IRS starts accepting returns. However, you can begin to prepare your return with a pay stub, and complete it when you have your W-2 form or other necessary tax documents. Tax-preparation services can also help with this.

You can prepare and submit your return as soon as you receive your W-2s from your employers and have all the relevant information and documents. Most W-2s arrive in mid-January, but employers have until January 31, 2020 to send W-2s and Forms 1099, so you could receive yours as late as early February.

Read Also: How Much Do Charitable Donations Reduce Taxes

At What Age Should You Start Filing A Tax Return

The CRA tax law code requires filing a tax return based on income levels. If you earn more than the amount of the personal exemption allowed by the Canada Revenue Agency within one tax year, you will need to report that income on an annual tax return. Special rules apply to income received by children who are claimed as dependents by other taxpayers.

Children can be six months, six years, or 16 they still have to file a tax return in Canada depending upon their income level. It depends on whether their earned, unearned, or combination income exceeds certain limits. The applicable standard deduction is also a factor. Earned income is what they make from a job. Unearned income sometimes referred to as passive income, would be interest or dividends from investments.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

You May Like: How To Track E File Tax Return