Hot Springs Arkansas Sales Tax Rate

hot springs Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Hot Springs, Arkansas?

The minimum combined 2021 sales tax rate for Hot Springs, Arkansas is . This is the total of state, county and city sales tax rates. The Arkansas sales tax rate is currently %. The County sales tax rate is %. The Hot Springs sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Arkansas?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arkansas, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Hot Springs?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Hot Springs. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Do You Pay Sales Tax On A Used Rv

Paying taxes is part and parcel of our everyday life. RV tax deductions is not an exception. Tax deductions varies and you need tax tips on how to do taxes while still managing your digital nomad finances.

So, do you pay sales tax on a used RV? Yes. Most, although not all, states require you to pay sales tax when purchasing a used RV. No tax deductions are applicable in non-tax state.

Besides, the sales tax vary depending with your area of permanent residency resulting in variations in tax deduction list.

Even when engaging in RV life, be sure to abide by the tax laws. Self employed tax deductions are also applicable and no one has an excuse not to pay taxes.

Keep in mind that police can search your RV without a warrantand you need to show the needed documents including abiding by tax laws. Be safe and do not be found on the wrong side of the law.

Arkansas Alcohol And Tobacco Tax

Arkansas has several sin taxes, including both a cigarette and alcoholic beverages tax. The cigarette tax is a relatively low $1.15 per pack. The alcohol tax varies depending on the variety and alcoholic content of the beverage. Distilled spirits, which have an alcoholic content of at least 40%, are taxed at a rate of $2.50 per gallon. Beer is taxed at a rate of $0.23 per gallon and wine is taxed at a rate of $0.75 per gallon.

- Former president Bill Clinton was born in Hope and spent most of his childhood in Hot Springs.

- Walmart, the worlds third largest employer and largest retailer, is headquartered in Bentonville, Arkansas.

- There are two mountain ranges in Arkansas: the Ozarks and the Ouachita Mountains.

Don’t Miss: How To Pay Back Taxes Online

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least quarterly. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

You May Like: How To Determine Taxes On Paycheck

What Transactions Are Generally Subject To Sales Tax In Arkansas

In the state of Arkansas, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of exceptions to this tax are certain items which are used in pursuits like agriculture and construction.This means that someone in the state of Arkansas who sells textbooks would be required to charge sales tax, but an individual who sells agricultural equipment might not be required to charge sales tax.

Arkansas Sales Tax Rates By City

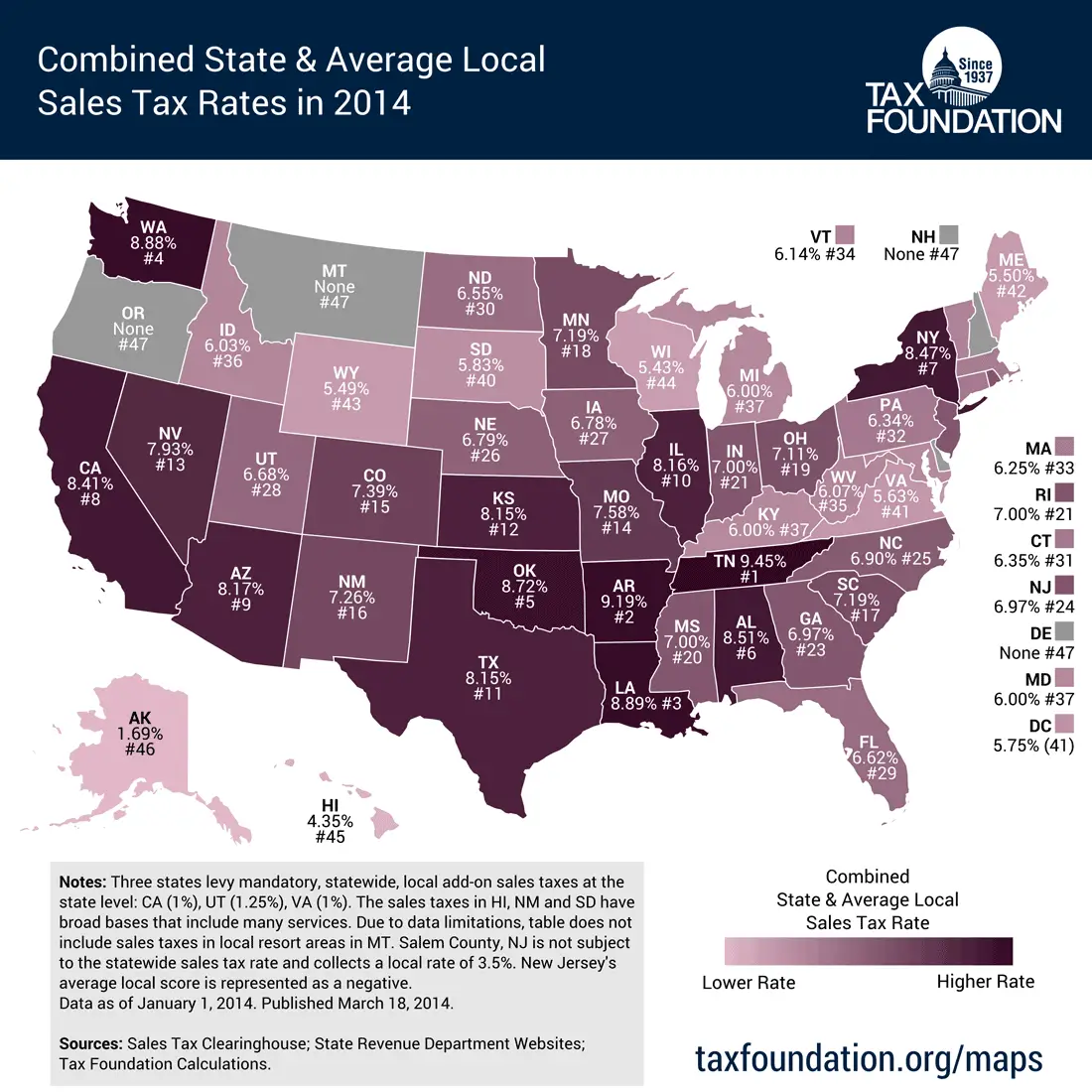

The state sales tax rate in Arkansas is 6.500%. With local taxes, the total sales tax rate is between 6.500% and 12.625%.

Arkansas has recent rate changes .

Select the Arkansas city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Arkansas was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Read Also: Will The Stimulus Checks Be Taxed

Arkansas Sales Tax Holiday Starts Saturday Computers Phones Added To List Of Eligible Items

LITTLE ROCK, Ark. The annual tax-free holiday will return in Arkansas this weekend, and for the first time, some electronics are included in the items eligible for tax-free purchases.

According to officials from the Department of Finance and Administration, the need to add electronic devices came after students heavily relied on technology to get through school during the COVID-19 pandemic.

Throughout Arkansas, students relied on all of this technology last school year due to the unique limitations caused by COVID-19, DFA communications director Scott Hardin said. We anticipate the need for this technology will remain in education going forward, whether or not COVID-19 is a factor.

Earlier this year the state legislature made it possible for electronics to become a part of the list of qualified tax-exempt items. However, there are limitations on what electronics are eligible.

All electronic items commonly used by a student in a course of study, including cell phones, computers and tablets, are exempt from sales tax.

According to the DFA, the sales tax for Arkansas is 6.5 percent, but shoppers can save money by waiting to shop during the sales tax holiday. For instance, shoppers could save approximately $18 in taxes on a $200 purchase.

For shoppers looking to make their purchases online, the tax-free option is also available, as long as the items are being delivered to an Arkansas address.

Little Rock Arkansas Sales Tax Exemptions

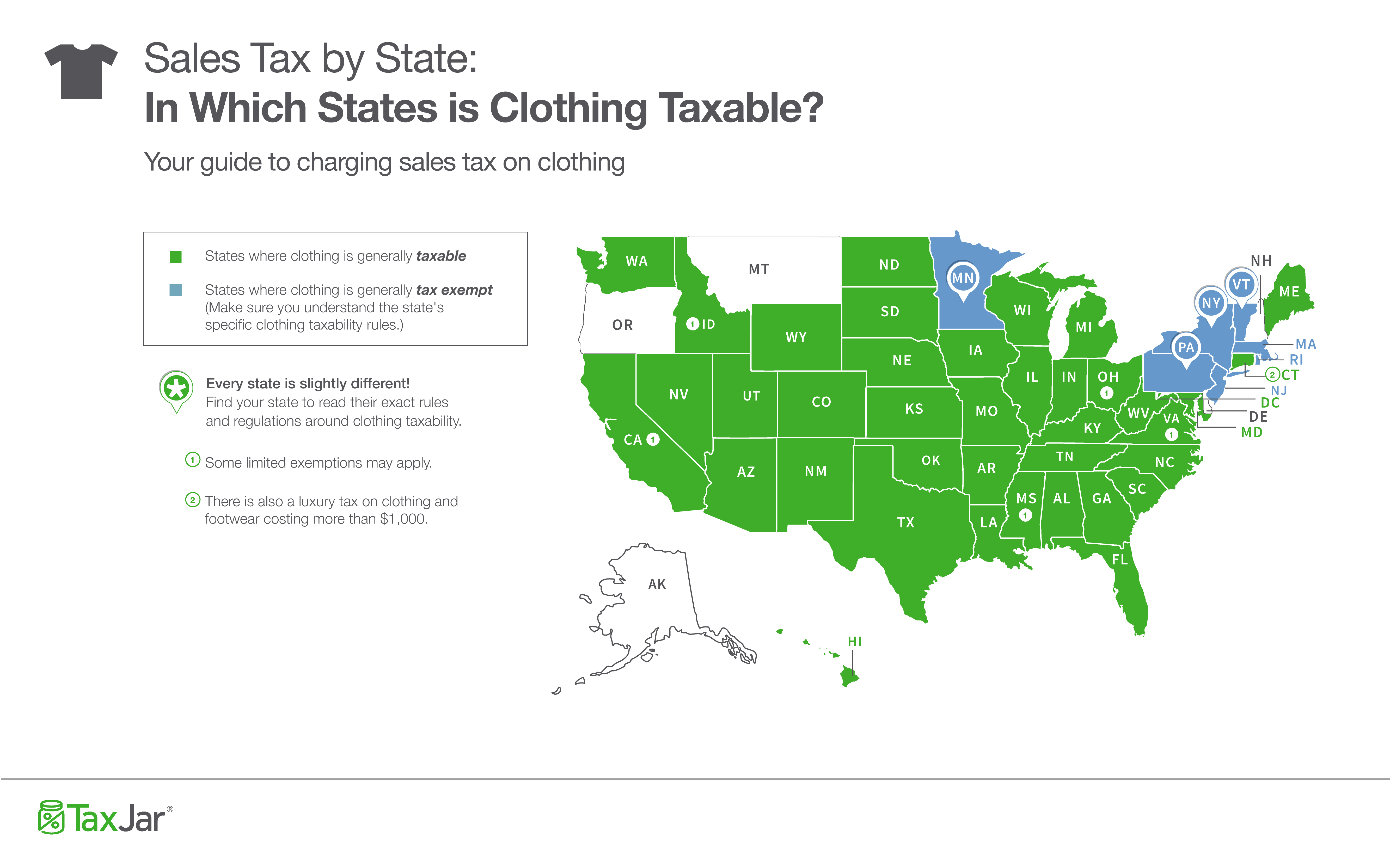

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.Many municipalities exempt or charge special sales tax rates to certain types of transactions. Groceries is subject to special sales tax rates under Arkansas law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Arkansas state excise taxes in addition to the sales tax.

Note that in some areas, items like alcohol and prepared food are charged at a higher sales tax rate than general purchases. Arkansas’s sales tax rates for commonly exempted categories are listed below. Some rates might be different in Little Rock.

Groceries:

Read Also: What’s The Sales Tax In Florida

Distinguishing Goods From Nontaxable Items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the “true object” or “dominant purpose” of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service , the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

Sales Tax Credit For Sale Of A Used Vehicle

Simply complete a claim form and provide the documentation requested on the form. Separate forms must be used for each vehicle sold. No refund may be issued unless all of these items are entered completely and accurately. You may obtain a Claim for Sales or Use Tax Refund form at any local Revenue Office or you can download the form below: Note:

If a vehicle is sold prior to registering your new vehicle, you receive the tax savings immediately upon registering the new vehicle. If you sell your vehicle after registering the new vehicle, then you must submit a claim for refund.

| Title |

Don’t Miss: What State Has The Cheapest Taxes

Origin Versus Destination Sales Tax

In calculating your sales tax youll deal with the important difference of destination states versus origin states. Although in the past most states have tended to be destination-based, the rise of ecommerce has seen a shift to origin-based sales tax, which allows the state the product is shipped from to retain more of the tax revenue collected by businesses operating in that state.

How To Calculate Arkansas Car Tax Carsdirect

Calculating Arkansas Car Sales Tax: To begin with, a vehicle has to be registered with the DMV no later than 30 days from the day it was purchased. The sales tax is calculated on the total amount of the sale . This holds true for private car sales or vehicles purchased from car dealers in Arkansas.

Don’t Miss: What Tax Return Does An Llc File

File Your Return And Remit Sales Tax

After collecting sales tax, youll need to file a return with the states youve collected for, and turn over the taxes to them. This is also referred to as remitting sales tax. One important thing to note is that if you are registered to collect tax in a state, but make no sales for a given period, you should still file a $0 return, to avoid being penalized for not filing.

But when it comes to filing schedules, things get complicated each state makes their own rules, so they all have a different schedule for when sales tax returns must be filed. For many states, the requirement to file monthly, quarterly, or annually, depends on your average monthly tax liability.

The bottom line is, if you are handling your own sales tax and youre starting to have nexus in multiple states, set up a system of due dates and reminders for each.

Not Paying Sales Tax But Should Be

Start with a nexus study. If youve got more time than money, you could try to do it yourself, but if you have a large volume of sales, I dont recommend it.

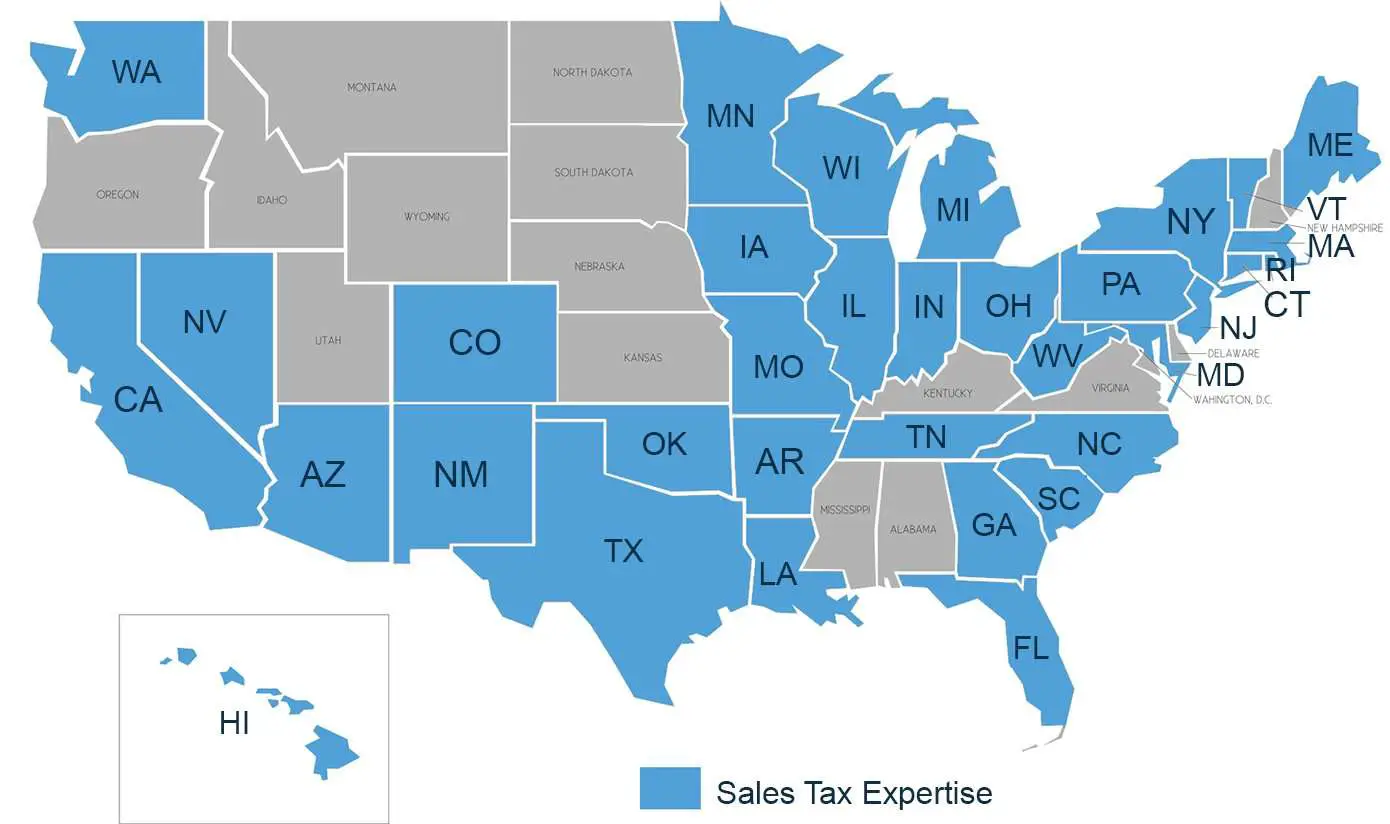

A Sales Tax Nexus study will use all of your sales data to tell you where you have economic nexus, according to current regulations. It can also take into account exemptions for products like food and clothing . Generally a CPA or sales tax expert will conduct the study. At ECOM CPA, we have a dedicated sales tax specialist for this.

This study will allow you to find out if there are states where you may be delinquent and should file a past sales tax return. If so, your next steps will be to get the necessary permits in order, & start collecting sales tax.

Also Check: When Are Us Taxes Due This Year

Online Sales Tax For Retailers

If youre an online seller, there are some items to take into consideration for sales tax collection. In 2018, the U.S. Supreme Court ruled to close online sales tax loopholes in its landmark South Dakota v. Wayfair decision. The Supreme Court ruled that sales tax on internet retailers can be imposed by states, even if the retailer has no physical in-state presence.

In 2019, the Arkansas Department of Finance & Administration moved to begin taxing online retailers, excluding companies with annual sales of less than $100,000 or less than 200 transactions in Arkansas. The businesses that fall outside of these exclusions are subject to all state and local sales taxes.

What Isthe Best State To Buy An Rv In

Since different States offer different sales tax, the prices of the RV whether new or used fluctuate from on Sate to another.

However, you can consider purchasing the RV in a non-tax State where the price could be cheaper than in a State that offers a sales tax.

Possible ideal places to purchase an RV is from a Non-tax State including Alaska, Delaware, District of Columbia, Lowa, Maryland, Montana, New Hampshire, New Mexico, North Carolina, North Dakota, Oregon, South Carolina, and South Dakota States.

The best ideal State to purchase your RV or the best State to register an RV is the State of Montana.

It is because it offers 0% city, county, and general sales tax. Most interesting is that you dont have to be a resident of Montana.

However, with a small fee the service providers will assist you with the whole registration process. Another State you can consider is South Dakota.

Besides, some non-tax States require proof of your permanent residence to be that State for you not to pay the taxes.

It is worth keeping in mind that at times insurance brokers may give you a difficult time to register the RV in case your RV is not registered in your State of your primary residence.

However, keep in mind that the sales tax to be paid by a buyer are based on the State the RV was registered and not the State in which the RV is to be bought.

Furthermore, the RV registration is to be linked to the registration of your State of your primary residence.

You May Like: How Do I File Colorado State Taxes

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Arkansas Sales Tax Rate & Rates Calculator Avalara

Sales tax is a tax paid to a governing body for the sale of certain goods and services. First enacted in the United States in 1921, sales tax dates back to ancient Egyptian times where paintings depict the collection of tax on commodities. Arkansas first adopted a general state sales tax in 1935.

Recommended Reading: Do You Need Bank Statements To File Taxes

Digital Goods Or Services

A digital good or service is anything electronically delivered, such as an album downloaded from iTunes or a film purchased from Amazon.

Arkansas does not require businesses to collect sales tax on the sale of digital goods or services.

However, Arkansas has one exception to this policy. Businesses must collect sales tax on pre-written computer software that is sold online.

Fayetteville Arkansas Sales Tax Rate

fayetteville Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

Fayetteville, Arkansas sales tax rate details

The minimum combined 2021 sales tax rate for Fayetteville, Arkansas is . This is the total of state, county and city sales tax rates. The Arkansas sales tax rate is currently %. The County sales tax rate is %. The Fayetteville sales tax rate is %.

South Dakota v. Wayfair, Inc.

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arkansas, visit our state-by-state guide.

COVID-19

The outbreak of COVID-19 may have impacted sales tax filing due dates in Fayetteville. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arkansas and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Read Also: Have My Taxes Been Accepted