Fica Maximum Income Threshold

Both FICA and SECA have maximum thresholds for mandatory deductions. However, this threshold only applies to your contributions to Social Security, according to AARP. The 2020 maximum income subject to Social Security tax is $137,700.

Once you have paid the correct amount into FICA for annual wages or income below this threshold, you wont be subject to Social Security deductions for that year. Your Medicare deduction continues regardless of income.

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

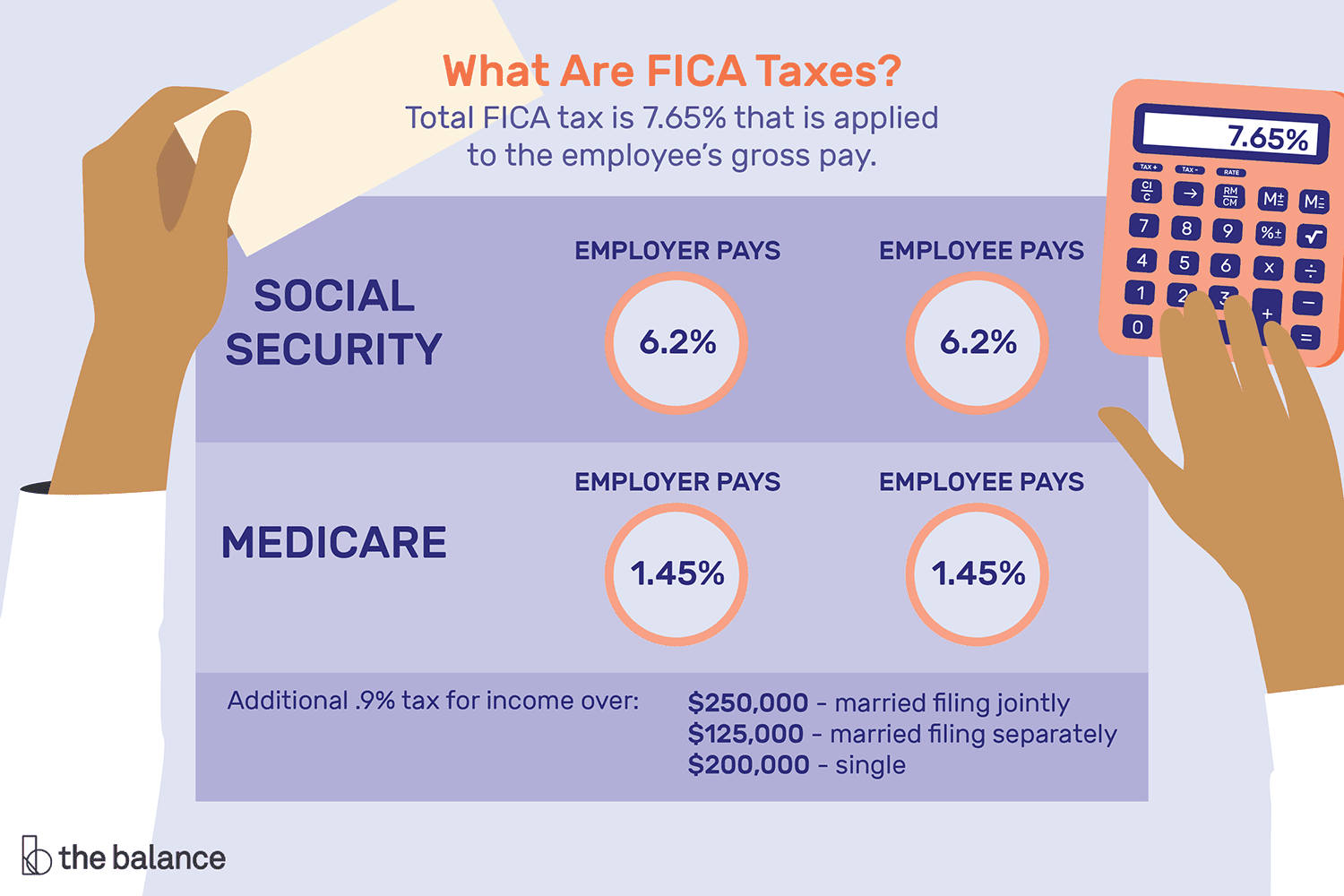

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

Calculating Fica Taxes: An Example

An employee who makes $165,240 a year collects semi-monthly paychecks of $6,885 before taxes and any retirement-plan withholding. Though Medicare tax is due on the entire salary, only the first $147,000 is subject to the Social Security tax for 2021. Since $147,000 divided by $6,885 is 21.3, this threshold is reached after the 22nd paycheck.

For the first 21 pay periods, therefore, the total FICA tax withholding is equal to + , or $526.70. Only the Medicare HI tax is applicable to the remaining three pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,964.27 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee’s take-home pay, the employer must contribute the same amount to both programs.

As mentioned above, those who are self-employed are considered both the employer and the employee for tax purposes, meaning they are liable for both contributions. In the example above, a self-employed person with the same salary pays $17,928.54 to Social Security and $4,791.96 to Medicare.

Don’t Miss: Door Dash Taxes

If You Earn Enough Money For Your Benefits To Be Taxable You Could End Up Paying The Highest Income Taxes In The Country

By Stephen Fishman, J.D.

Social Security benefits are tax free unless you earn too much income during the year. To know whether you might be subject to such taxes you have to figure your “combined income.” This is actually quite easy: Simply add one-half of the total Social Security you received during the year to all your other income, including any tax-exempt interest .

You’ll have to pay tax on part of your benefits if your combined income exceeds these thresholds:

- $32,000 if you’re married and file a joint tax return , or

- $25,000 if you’re single.

If a married couple files their taxes separately, the threshold is reduced to zerothey always have to pay taxes on their benefits. The only exception is if they did not live together at any time during the year in this event the $25,000 threshold applies.

This applies to all types of Social Security benefits: disability, retirement, dependents, and survivors benefits.

How much of your Social Security benefits will be taxed depends on just how high your combined income is.

Individual filers. If you file a federal tax return as an individual and your combined income is between $25,000 and $34,000, you have to pay income tax on up to 50% of your Social Security benefits. If your income is above $34,000, up to 85% of your Social Security benefits is subject to income tax.

Once you start receiving Social Security benefits, to keep your income below the applicable threshold, or at least as low as possible, you should:

Determining If You’ll Owe Social Security Benefit Taxes

The Social Security Administration sets the following thresholds when calculating Social Security benefit taxes based on your combined income and tax filing status:

|

Taxation Level |

|

|---|---|

|

Any amount |

More than $34,000 |

Source: Social Security Administration. Married Filing Separately column assumes you lived with your spouse at any point during the year. If this is not true, refer to the All Other Tax Filing Statuses column.

If you fall into the 0% taxation range for your tax filing status, you won’t have to worry about paying any taxes on your benefits at all. If you land above this range, you will owe taxes on your benefits and you can figure out how much using the formula below.

Things are a little trickier for married couples filing separately than for other tax filing statuses. If you lived together at any point during the year, you will owe taxes on up to 85% of your benefits, regardless of your combined income. But if you didn’t live together at all, you’re subject to the same taxation rules as individuals, heads of household, and qualifying widows.

You May Like: How To Pay Taxes With Doordash

Can You Get Food Stamps On Disability

If you are receiving SSDI and also qualify for SNAP benefits because you have limited income and resources, you can receive food stamps under SNAP. … If you are receiving SSDI, you will be considered disabled for purposes of SNAP, and you may be able to deduct some of your medical expenses from your income.

What Is A Deductable

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

Another reason relates to Congressional action to lower the cost of premiums in 2021, “which resulted in the $3.00 per beneficiary per month increase in the Medicare Part B premium being continued through 2025.”

Don’t Miss: Plasma Donation Taxes

Social Security In The Midwest

Out in the Midwest, only seven of 12 states are free of Social Security taxes. South Dakota doesn’t have an income tax. Meanwhile, Illinois, Indiana, Iowa, Michigan, Ohio, and Wisconsin have full state income tax protection for those receiving Social Security benefits.

On the other hand, Kansas, Minnesota, Missouri, Nebraska, and North Dakota tax Social Security in varying degrees. Minnesota and North Dakota are notable for following the federal rules on taxation.

State Taxes And Social Security Withholding

The tax situation in individual states varies. As of 2015, 13 states were taxing Social Security benefits, either at their own rate or using the same calculation as the IRS. If your state taxes Social Security benefits, you may be on the hook for a payment to the state treasury come tax time. Unfortunately, Social Security does not have the ability to withhold state taxes from its benefits. You would instead need to make estimated tax payments to the state, using a calculation of how much you would owe based on the rate of tax levied.

Also Check: Efstatus Taxact Com Login

What If Social Security Is My Retirement Plan

Do everything possible to keep that from happening. Americans are trying to correct that flawed strategy, though theres plenty of room for improvement.

The countrys retirement score was 83, according to the 2021 Fidelity Investments biennial Retirement Savings Assessment study a three-point improvement over a similar study done three years earlier. That score falls into the good zone. That score means the typical saver was on target to have 83% of the income Fidelity estimated they will need for retirement.

Thats up dramatically from a score of 62 in 2005, but the study also revealed that half of the 3,100 people surveyed probably wont have enough to cover essential retirement expenses.

A 2019 report by The Motley Fool is even grimmer. It found the average retirement savings for American families with some savings was just $65,000.

As insufficient as that number is, there are many other Americans who are headed for disastrous retirements in terms of financial aspects because of their lack of savings. One in four Americans have zero retirement savings, and among the others who are putting money away are likely under-saving. Coupled together, that meant the median for all U.S families was just $5,000 in savings.

Social Security cannot make up for that shortfall. The only strategy is to get your financial house in order and start saving more.

9 MINUTE READ

Is My Social Security Income Taxable The Quick Answer

According to the IRS, the quick way to see if you will pay taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income .

If your combined income is above a certain limit , you will need to pay at least some tax.

The limit is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The limit for joint filers is $32,000. If you are married filing separately, you will likely have to pay taxes on your Social Security income.

Don’t Miss: How Do Taxes Work On Doordash

How Much Social Security Tax Gets Taken Out Of My Paycheck

If you’re working in the United States, you’ll see Social Security and Medicare tax withheld from your regular paychecks. Your income is taxed at a steady rate up to the Social Security tax limit, which generally increases from year to year, and your employer is taxed as well on your earnings. If you’re self-employed, you’re responsible for both the employee and employer portions.

Tips

-

The Social Security rate paid by employees is 6.2 percent, until you hit the maximum income affected by Social Security tax. Employers pay another 6.2 percent of your salary in Social Security tax this means self-employed people pay both parts.

Social Security Tax Rates

The Social Security program provides benefits to retirees and those who are otherwise unable to work due to disease or disability. Social Security often provides the only source of consistent income for people who can no longer workespecially for those with modest earnings histories.

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability.

Social Security benefits are capped at a maximum monthly benefit amount based on earnings history. To prevent workers from paying more in taxes than they can later receive in benefits, there is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap.

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9,114.00. The amount is set by Congress and can change from year to year.

Recommended Reading: Payable Doordash 1099

Do I Have To Pay Unemployment Back

No. Unemployment benefits are yours to keep, except for the amount you may owe in taxes. But make sure youre getting the right amount.

In a few cases that ProPublica found, simple mistakes have led states to overpay unemployment recipients and then demand huge sums of money back. A new bill would shield unemployment recipients from having to repay overpayments made by mistake, but it would only apply to unemployment aid that came directly from the federal government. As of April 2021, the bill is still in committee.

About this guide: ProPublica has reported extensively about taxes, the IRS Free File program and the IRS. Specifically, weve covered the ways in which the for-profit tax preparation industry companies like Intuit , H& R Block and Tax Slayer has lobbied for the Free File program, then systematicallyundermined it with evasive search tactics and confusing design. These companies also work to fill search engine results with tax guides that sometimes route users to paid products. ProPublicas guide is not personalized tax advice, and you should speak to a tax professional about your specific tax situation.

Dont Miss: Can You Draw Unemployment If You Quit A Job

Minimize Withdrawals From Your Retirement Plans

Money that you pull from your traditional IRA or traditional 401 will count as income in the year that you withdraw it. So if you can minimize those withdrawals or even not withdraw that money at all, it will help you get close to the tax-free threshold. Of course, this may not apply if youre forced to take a required minimum distribution that pushes you over the edge.

If youre not forced to take an RMD in a given year, consider taking money from your Roth IRA or Roth 401 instead and avoid generating taxable income.

Also Check: License To Do Taxes

Can I Pay These Taxes Myself

If you do not fill out Form W-4V and specifically ask to have taxes withheld, they will not be. You are responsible for paying them yourself.

Every January, you will receive IRS Form SSA-1099 in the mail. This is your Social Security Benefit Statement. It shows your total earnings in disability benefits for the previous year. When you file your federal income tax return, you must list the amount from your SSA-1099 as income. As mentioned above, your total income from all sources determines if any portion of your benefits are taxable.

If you wish to pay your taxes yourself but do not want to bear the risk of coming up short at the end of the year, you have a third option. You can make quarterly estimated payments to the IRS. If you come up a little bit short, you pay the difference at tax time. If you overpay, you receive a tax refund.

Where Social Security Gets Its Funding

Social Security benefits are funded from three major sources. The largest is tax. Technically, this tax is broken down into two parts. The first, Old-Age and Survivors Insurance , is taxed at a rate of 5.3% . The second, Disability Insurance , is taxed at 0.9% . Combined, these are commonly referred to as the 6.2% Social Security tax.

Other funding comes from interest earned on the balance in the Social Security trust fund as well as the taxation of Social Security benefits.

Also Check: Csl Plasma Taxes

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money, because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But you can use some strategies, before and after you retire, to limit the amount of tax that you pay on Social Security benefits. Keep reading to find out what you can do, starting today, to minimize the amount of income tax that you pay after retiring.

You May Like: Does Doordash Issue 1099

What Is Withholding Tax How Does A Withholding Tax Work

A withholding tax is an income tax that a payer remits on a payee’s behalf . The payer deducts, or withholds, the tax from the payee’s income.

Here’s a breakdown of the taxes that might come out of your paycheck.

-

Social Security tax: 6.2%. Frequently labeled as OASDI , this tax typically is withheld on the first $137,700 of your wages in 2020 . Paying this tax is how you earn credits for Social Security benefits later.

»MORE:See what the maximum monthly Social Security benefit is this year

-

Medicare tax: 1.45%. Sometimes referred to as the hospital insurance tax, this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

-

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4.

-

State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf. The amount depends on where you work, where you live and other factors, such as your W-4 .

-

Local income or wage tax: Your city or county may also have an income tax. This money might go toward such expenses as the bus system or emergency services.

See what else you can do for your business

-

Learn about coronavirus relief options for small businesses and the self-employed.

|

Employer pays |