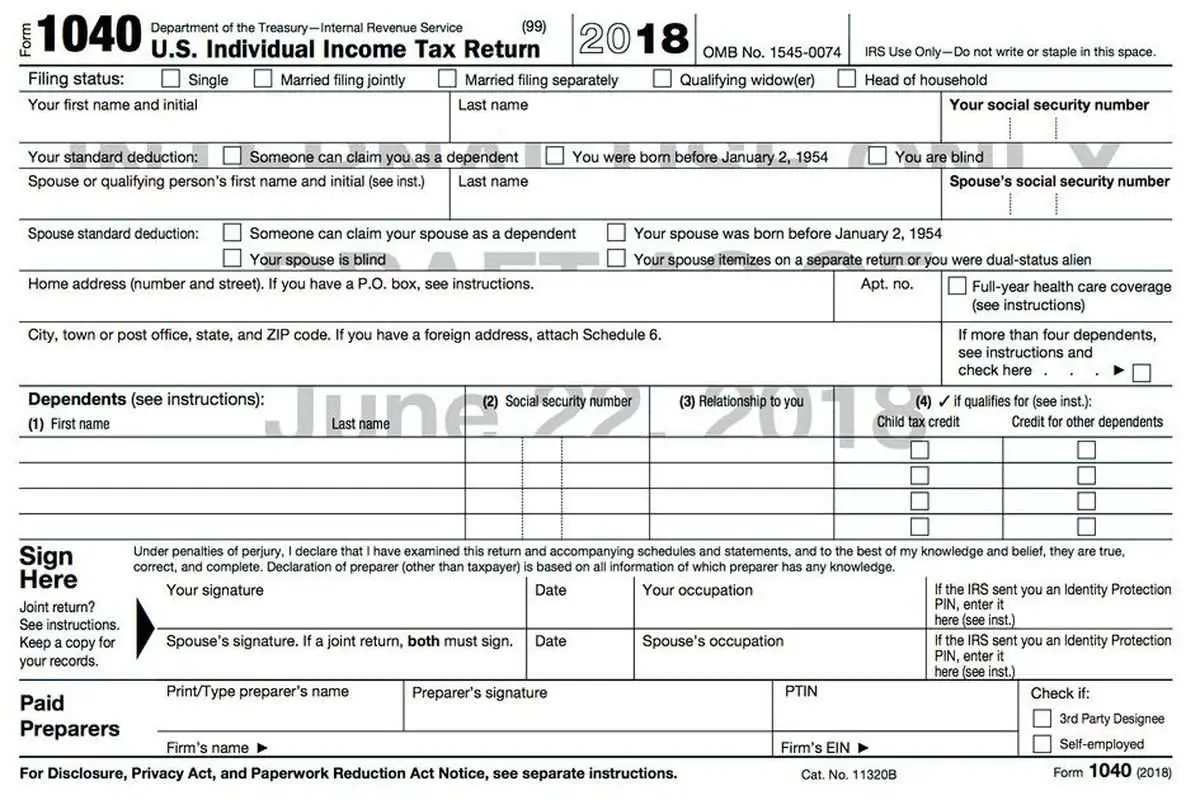

How To Print A 1099 Tax Form Off The Computer

Can you print tax forms off the internet? Yes. And with more and more work shifting to contract, gig or solopreneur work, more people and businesses need to issue and receive a 1099 tax form.

The IRS has different versions of 1099 forms, so you’ll need to make sure you use the correct form. Once you know which form you need, you’ll need to know how to print a 1099 tax form off the computer.

Video of the Day

If you find yourself asking, “How can I print 1099 forms?” following a few simple steps, you should be able to fill out and print the correct form, or print one and then fill it out.

Read More: 10

Read More:Tax Filing Status: How to Choose the Correct Filing Status

Other Rules And Quirks To The Request Process

There are some rules and quirks that could affect your transcription request process.

How you filed your return and whether you owe unpaid taxes on that return can affect how quickly you can get transcripts for the current year. Your current-year transcripts most likely will not become available for two to four weeks after you e-file a return, and up to six weeks if you mail in a paper return. You wont be able to access your transcript if you owe taxes, until you pay the balance due or otherwise arrange to pay it through a finalized agreement with the IRS.

The IRS no longer faxes transcripts to taxpayers.

Finally, if youve placed a credit freeze with Experian because you are a victim of identity theft, you may have to temporarily lift that so the IRS can verify your identity you can put the freeze right back in place after this is accomplished.

Online Irs Transcript Access

The easiest way to get your transcript is to access it online through the IRS Get Transcript website page. Youll have to register first, and to do that youll need:

- Your Social Security number

- The filing status you used on your most recent tax return

- The mailing address you used on your most recent tax return

- An email account and the address

- An account number for a credit card, mortgage, auto loan, or personal loan that is in your name

- A cellphone with an account in your name

You must also tell the IRS why you want the transcript, but that is mostly just to guide you to the type of transcript you need.

You can get any of the five transcripts online. You can simply view them on your computer or tablet, or print them out or download them theres no waiting period for delivery. The IRS will confirm your identity first, however, by both emailing and texting a verification code to the cellphone and email account information you provided.

The text and email will only provide a verification code. It wont ask you to provide any further information by email or text. Any request for information from the IRS received via text or email is almost certainly a scam, whether it comes to you immediately or weeks later. You can report phishing scams on the IRS website.

You May Like: Federal Tax Return Irs

How To Order One 1099

- Float this Topic for Current User

- Bookmark

I erroneously sent out electronically one 1099-misc which should have been 1099-NEC. For months unable to reach 1-800-829-FORM so as to mail a correction. “Due to high volume call back later.” I’m too cheap to buy an entire packet from a supply store. Any other number to call?

Last time I had to file 1099’s I printed my own with a color laser printer. They weren’t sent back and I didn’t go to jail. However, for the when-IRS-says-jump-I-ask-how-high crowd, the 1970s technology of IRS does require extra time and expense. If I were correcting a 1099 already filed, as in zeroing out a 1099-MISC, I would make sure that it could be processed so that the recipient wouldn’t get dinged twice for the same amount.

Zeroing out the erroneous 1099-misc does worry me. I don’t have a typewriter to type in the corrected info. I have a suspicion that handwritten 1099s don’t get processed — clients who receive handwritten 1099s and never filed for years and years also never got letters from the IRS for rather big 1099 amounts.

I’ve always handwritten mine, except one year for a client, I bought the 25 laser pack.

Of course, for 5 or more, it might be worth buying an online service that allows you to e-file them.

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

The following information on your correspondence will help us generate a quick response to your inquiry:

You May Like: Irs Taxes Due

How To Request Irs Forms By Mail

In most cases, individual taxpayers and businesses use several different forms to complete their tax returns. If you don’t have the required forms on hand, or you made a mistake on a form and you’d like a new form to replace the old one, you can contact the Internal Revenue Service and have the forms mailed directly to you. There are a few ways to get the IRS tax forms by mail, including ordering them online or over the phone.

Get The Right Irs Tax Forms Automatically

You can find free fillable Federal tax forms at the website of the IRS, or you can use online tax filing to supply the correct tax forms for you automatically.

You can be assured that you are preparing and filing the correct tax form using online tax software. Filing your tax return can be a nerve-wracking feeling, but it doesnt have to be if you let the tax software guide you through the tax filing process.

You May Like: Doordash Taxes California

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

You May Like: Doordash Pay Calculator

Connecticut State Department Of Revenue Services

– The Department of Revenue Services will be closed on Friday, February 11, 2022, a state holiday.

– DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. Electronic filing is free, simple, secure, and accessible from the comfort of your own home. for Income tax filing information.

– If you filed 2020 Schedule CT-EITC, Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040, Connecticut Income Tax Return, on or

before December 31, 2021, you may be eligible for the 2020 EITC Enhancement Program, for more information.

– Sales tax relief for sellers of meals:

– Learn more about myconneCT

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

You May Like: What Tax Form Does Doordash Use

How To Order 1099 Forms From Irs

Ordering 1099 forms isnt as difficult as you might think. If you need to order 1099 forms from IRS, simply use the agencys website. Employers should note that there are some quantity limits. If youre running short on time, most employers should be able to buy 1099 forms without ordering directly from the IRS. They are widely available at office supply stores during tax season we just recommend calling ahead to make sure theyre in stock.

However, accounting technologies make it possible to avoid ordering 1099s from the IRS altogether. Software tools from Advanced Micro Solutions are great for preparing tax and wage forms, but users can also electronically file instead of printing off copies. Well show you how.

How to Back-Order 1099 Forms from IRS

Tax products for the next year often become available on December 1 of the prior year. In other words, tax materials for 2020 became available on December 1 of 2019. When the year ends, those tax materials are no longer available to order. Instead, employers and individuals who are catching up on past forms need to follow a different process. The IRS has a page devoted to prior year forms and filing instructions. These forms are available to download, and specific instructions are provided for forms

A Note on Ordering 1099 Forms for 2020

Streamline Your Accounting with an Electronic Filing Software

Other Tax Forms And Records

Its a good idea to have access to your bank and credit card statements for the year, because you might be able to deduct some of the items you purchased. If you needed other, extra forms last year, you might need those forms again.

Tax time is never fun, but being prepared by having a tax documents checklist will make that task go more quickly, so you can get that refund sooner.

More From GOBankingRates

You May Like: What Can I Write Off As A Doordash Driver

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

Should You Have 1098 Forms

If you paid interest on a mortgage or on a student loan, paid college tuition or donated a vehicle, you should get a 1098 form. Your mortgage lender will send a 1098 so you can deduct the interest paid on your mortgage or home equity loan. If you paid student loan interest, youll get a 1098-E and, if you paid tuition, youll get a 1098-T, so you might qualify for education credits.

Related: New Homeowners, Heres What You Need to Know for Your Taxes

Recommended Reading: Best Taxes Company

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

Individual Income Tax Forms

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2022 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS upon e-file season opening. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Also Check: How To Find Your Employer’s Ein

What A Tax Transcript Includes

Your transcript will include all the same information that appears on your tax return, although its not laid out in the same format. Youll see your filing status, income, and any deductions and credits you claimed. However, your personal information wont appear on the transcriptat least not in its entirety.

The IRS has been actively taking steps to combat fraud and identity theft, and it now masks or blacks out portions of information on your transcript that thieves might like to know, such as the first five digits of your Social Security number and your complete telephone and account numbers. All of your tax financial information is displayed in full, however.

As of January 2019, your accountant or any other individual or entity who has a rightand your permissionto access your transcript must now enter a customer file number on line 5 of IRS Form 4506-T, the official Request for Transcript of Tax Return. Generally, the third party can assign the number. For example, a potential lender that wants a copy of your transcript might assign it with your loan number. What third parties cant use is your Social Security number. The IRS will enter the new number into its transcript database when it receives a Form 4506-T.

Its A Simple Process And You Can Do It Online

You probably know youre supposed to keep copies of your filed tax returns for a period of years, but life happens. The Internal Revenue Service provides tax transcripts if you need to lay your hands on an old return that you lost or didnt save. The IRS is also glad to provide you with other forms and information about your tax history, free of charge.

Keep reading to learn more about the documents the IRS can provide you with, and how to get them.

Read Also: Taxes On Doordash

Order 1040 Forms And Instructions By Mail

You can order 1040 forms and instructions by mail direct from theUS Internal Revenue Service. The IRSwill no longer print and mail 1040 forms and instructions booklets automaticallyon an annual basis. You must order 1040 forms and instructions from their websiteif you want them mailed to you.

How To Order By Mail

- Visit the IRS order forms by mail web page.

- Enter the form name or number into the search box, 1040 for example.

- Select the forms and instructions you want to order by mail, then click Add To Cart.

- View your cart and click the Checkout button when ready.

- Enter your shipping address and confirm your order.

The IRS will process and ship your 1040 forms and instructions by mail order in 7 to 15 days.If the form, instructions booklet, or publication is not available when you place yourorder, they will mail it to you when it becomes available. There is an order by mail limitof 10 different products. You will receive two copies of each ordered form, and onecopy of each ordered publication. Instructions are automatically included whenever youorder an income tax form.