What To Do About A Missing Or Lost Tax Return

Finishing your tax return is sometimes a struggle. It feels like a relief when you click the Submit To NETFILE button or pop your taxes into the mailbox. But sometimes things dont go smoothly, and somehow, your tax return gets lost on its way to Canada Revenue Agency . In this post well let you know what to do if your return goes missing, as well as other important information about filing your tax return.

Checking The Status Of Your Tax Return

It is your responsibility to ensure your tax return is received on time, otherwise you could face stiff late filing penalties and interest if you owe a balance.

If you are sending your tax return by mail, you can check the status of your return on the CRAs website. To do so, visit the CRA My Account page and log in. If the status of your tax return is listed as not received, it means that the CRA has not officially received your tax return. You can check on a daily basis leading up to the tax deadline of April 30 to make sure your tax return is received.

Returns filed by mail can take up to six weeks to process.

Hut Renewal For 24th Series Decals

23rd series highway use tax and automotive fuel carrier Certificates of Registration and decals expire December 31, 2021. To ensure your 24th series decals arrive by January 1, renew your credentials and pay your renewal fees online today with One Stop Credentialing and Registration .

Recommended Reading: How Much Will I Owe In Taxes For Doordash

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary withholding taxes is not required. If you ask us to withhold taxes, we will withhold 10 percent of the gross amount of each payment before sending it to you.

To start or stop federal tax withholding for unemployment benefit payments:

- Choose your withholding option when you apply for benefits online through Unemployment Benefits Services.

- Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page.

- Review and change your withholding status by calling Tele-Serv and selecting Option 2, then Option 5.

Extended Filing And Payment Due Dates For New Yorkers Impacted By Post

If you were affected by Post-Tropical Depression Ida, we may have extended your due date. For more information, view N-21-5, Announcement Regarding Extension of Certain October 15 Deadlines for Taxpayers Affected by Post-Tropical Depression Ida.

If you applied for an extension of time to file your personal income tax or New York C corporation tax return but were not affected by Post-Tropical Depression Ida, your return is still due October 15, 2021.

You May Like: Is Doordash Taxable Income

The Irs Says Your Tax Refund May Be Late This Year Heres How To Get It Asap

The IRS is warning taxpayers to prepare for another year of tax refund delays. The agency says the best way to prevent a refund delay is filing an accurate tax return electronically as early as possible.

The IRS is promising to send tax refunds in fewer than 21 calendar days if you file online and choose direct deposit, but some tax experts arent too optimistic. Even as late as December 2021, the agency was still working through a backlog of millions of 2020 returns.

We definitely saw that refunds were slower last year than usual, and that was probably related to the reconciliation of the stimulus payments, says , lead manager for tax practice and ethics at the American Institute of Certified Public Accountants.

Other factors can also contribute to a delay, like stimulus payments. We asked experts how to make sure youre not waiting months for your 2021 refund.

My Address Has Changed I Want To Change The Address/ E

Login in the Income Tax e-Filing website and go to My Profile Settings Update Contact details. Provide the new Address/ e-mail ID/ Mobile Number and submit. Once submitted, your Address / e-mail ID / Mobile number is updated in your profile and also sent to the CPC to update on the Income Tax Return.

Not Determined

What does this mean?

This means that the Income Tax Department has still not processed your Income Tax Return or determined the refund yet.

Please check your refund status after a month to see if it has been updated.

Refund Paid

Step 1. What does this mean?

This means:

-

The Income Tax Department has sent the refund to you .

Step 2. What do I do now?

-

If you received your refund, congrats! See you again next year

-

If your refund status is Refund Paid, and you havent received it yet, heres what you need to do:

If you had opted for direct debit to your bank account while filing and you havent received your refund, you need to immediately contact your own bank or the State Bank of India to check for any errors.

You can contact SBI

b. On phone at 1800 425 9760

c. By post at Cash Management Product, State Bank of India, SBIFAST, 31 Mahal Industrial Estate, Off: Mahakali Caves Road, Andheri , Mumbai 400093

If you opted for refund via cheque while filing, but havent received the cheque check out the Speed Post tracking reference number for your cheque on the Refund Bankers website.

No demand no refund

Step 1. What does this mean?

This could mean either:

Recommended Reading: Payable Account Doordash

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if you’re expecting a refund and you want it as soon as possibleyou can file your 2020 return as early as Feb. 12, 2021.

That’s a little later than usual, and the reason is important: If you didn’t receive the economic stimulus check approved by Congress by the end of 2020, you can claim it on your 2020 return.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

How To Get A Copy Of Your T1 General From A Past Tax Year

You filled out a T1 General Form for every year you submitted taxes. You can find a copy of your submitted T1 General if you have registered for a CRA My Account. Your account should have the records of T1 General for the current year and the past 11 years that you filed under the tax returns view section. Anything older, you will need to contact the CRA directly at 1-800-959-8281 to request a copy.

If you used TurboTax to file your taxes for the year that you need, you simply log onto your TurboTax portal and access the return for the year you are interested in.

Also Check: 1040paytax Customer Service

Ssn Where Can I Get It

In order to get an SSN, youll need to fill out an application form. This form is known as SS-5, and can be found at the SSAs forms page online. As well as this form, you should prepare to submit proof of identity, age, and U.S. citizenship or lawful alien status. If you need further information, you can read this article on applying for a personal taxpayer identification number.

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

You May Like: Doordash Taxes For Drivers

When Will Your Tax Refund Arrive Here’s How To Check

Not sure how to track your income tax refund using the IRS tools? We can help.

Katie Teague

Associate Writer

Katie is an Associate Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

To get your refund faster, the IRS highly recommends filing online and using direct deposit.

If you’ve already filed your 2021 tax return with the IRS, you could be getting your refund this month, assuming it was filed correctly. But how do you know when it’ll arrive? Once the IRS has accepted your return, you can begin tracking the progress of your refund to determine when to expect your money to arrive.

Just like in 2021, the IRS is again expecting numerous delays in processing tax returns due to the COVID-19 pandemic. The agency recommends filing electronically and setting up direct deposit this year, as it can help get your refund issued within 21 days, assuming there are no errors. “Filing a paper tax return this year means an extended refund delay,” IRS Commissioner Chuck Rettig announced in a .

We’ll explain how to track your refund online using the Where’s My Refund? tool and how to check your IRS account for further details. For more tax info, learn how to create an online IRS account, how to get the rest of your child tax credit money, how you can file your taxes for free and 10 tax changes that might change the size of your refund this year. This story is updated frequently.

Cbdt Chairman Says Itr Filing Glitches Resolved

As per the statement given by the chairman of the Central Board of Direct Taxes , JB Mohapatra, around 2.5 lakh Income Tax returns are filed every day and all the issues faced by the taxpayers during IT filing have been resolved.

During the inauguration of the Taxpayers’ Lounge at IITF, Mohapatra added that the number of ITR filed by December is expected to reach 4 crores. He also said that the lounge wishes to boost trust between the taxpayer and department, and educate the taxpayer about the new efforts being taken.

17 November 2021

Read Also: Do You Have To Pay Taxes On Donating Plasma

If You Must Amend Your Return

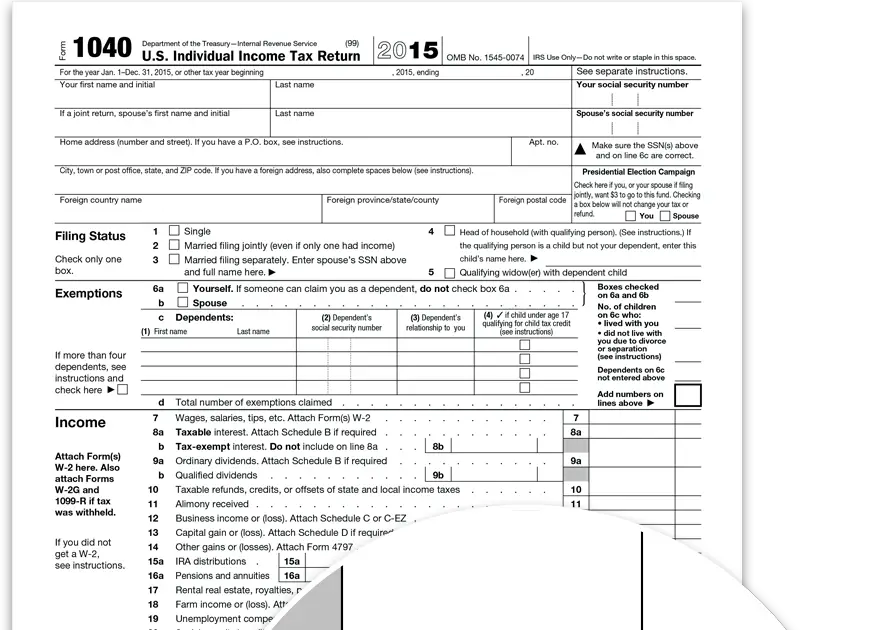

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

However, you dont have to amend a return because of math errors you made the IRS will correct those. You also usually wont have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed the IRS will normally request those forms from you.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Read Also: Do I Have To Claim Plasma Donation On Taxes

What Do I Need A Tin For

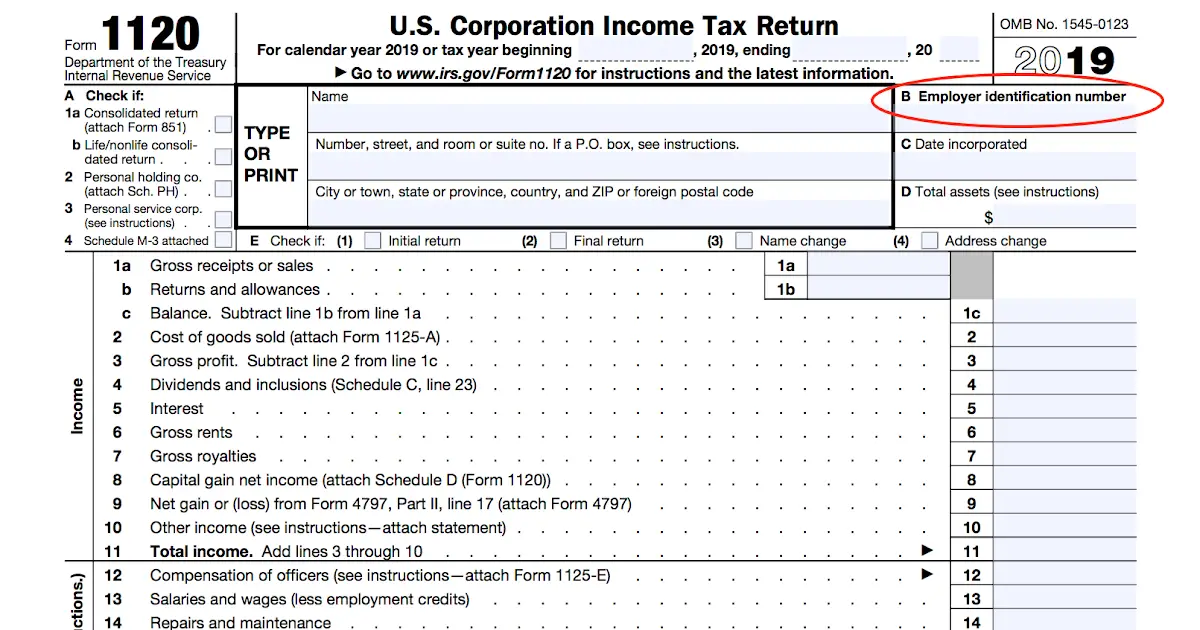

Once you know what your TIN is, you may be wondering when and why youll need it. You as a taxpayer will need to provide your TIN on all tax returns and other documents sent to the IRS. Even if you do not have a number issued to you by the IRS, your SSN must be on forms submitted to it. You have to provide your taxpayer identification number to others who use the identification number on any returns or documents that are sent to the IRS this is especially the case for business transactions that may be subject to Reverse-Charge procedures. This may also be the case when you are interacting with a bank as an entity.

Aside from using your EIN for tax returns and business to business transactions also known as B2B youll need to keep your SSN in mind for other purposes too. As well as for personal tax returns, your Social Security number is vital in daily life, because without it you wont be able to get a job or collect Social Security benefits if necessary. It is also a confidential piece of identity information, so avoid just telling anyone what it is. Keep it safe with other important documents.

Click here for important legal disclaimers.

- 06.12.19

Completing Online Tax Forms

In the tax year 2018, the government changed Form 1040 and the supplemental forms many taxpayers file along with it. Instead of forms 1040, 1040-A, and 1040-EZ, theres Form 1040 for most filers, plus a different form you can choose to file if you’re a senior: Form 1040-SR.

Taxpayers who take the standard deduction and have simple returns dont need to file any other forms.

The IRS provides a fillable PDF of Form 1040 and Form 1040-SR online. You can type in your information and then print the form, but a safer option is to download it first, then save it to your hard drive as you fill it out so you dont lose your entries if your browser crashes or you accidentally close it. After filling out and printing the form, you’ll sign it, attach copies of any required forms , and mail it in.

This process is simple and inexpensive youll need to pay for postage, preferably a method you can track to prove you submitted your return on time. If youre due a refund, the IRS says it will process your payment within six to eight weeks for a paper return submitted by mail.

People who need to report information not included on Form 1040 will need to submit additional schedules. These might include one or more of the following:

For a complete list, see “Schedules for Form 1040 and Form 1040-SR.” You can fill out these schedules just as we described above for Form 1040.

You May Like: Doordash Write Offs

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Two Other Factors That Could Influence Your Refund Are:

- Canada Pension Plan contributions on self-employed earnings: If you have self-employed income and have to pay a pension contribution, your refund is reduced by that amount.

- The Canada Workers Benefit : The CWB is a refundable tax credit available for low-income individuals in the workforce and if you qualify will be shown on Line 45300 Canada Workers Benefit.

References & Resources

Read Also: Pay Taxes On Plasma Donation

Electronic Pitfalls To Avoid

If you do file your tax forms electronically, dont complete them on a public computer, and dont transmit your return over public WiFi.

Use a personal computer with antivirus and firewall software and a secure, password-protected private WiFi network, such as your home or work network. Dont transmit your tax returns over an unsecured coffee shop, airplane, or library network.

What If You Made Or See A Mistake On Your T1 General Form

Mistakes happen to the best of us. If you notice a mistake on your T1 General Form and you have not yet submitted it, you simply need to fill out a new version of the form or input new information into your tax software to correct the mistake. If you have noticed a mistake after youve sent your taxes, you should notify the CRA immediately. If you do not notice a mistake until 90 days after you have received your assessment, you may not be able to change it. However, you can contact the CRA to advise you directly.

You may be advised to make an adjustment or amendment to that particular tax return, or even ReFile it using your tax software. The CRA will then process a reassessment to that particular tax year and depending on the situation, you may receive a refund cheque or have to pay back an amount.

For Quebec residents If you need to amend your provincial return, please click here for instructions directly from Revenu Quebec.

If you have made a mistake on your return, you should also be aware of the Voluntary Disclosures Program This program gives you a second chance to correct a tax return you previously filed or to file a return that you should have filed. If you file a VDP application and it is accepted by the Canada Revenue Agency you will have to pay the taxes owing, plus interest in part or in full. However, you would be eligible for relief from prosecution and, in some cases, from penalties that you would otherwise be required to pay.

Read Also: Does Doordash Deduct Taxes