Drop Off Tax Return Preparation

United Way of Greater Lafayette understands that not all clients have available technology to complete virtual tax preparation so we have made available a drop off option.

- In this model the client will schedule an appointment to drop of their tax documents at United Way of Greater Lafayette.

- The client will call or text when they have arrived at United Way.

- The client will remain in their vehicle and a masked volunteer will provide the necessary paperwork for tax preparation.

- Once the paperwork has been completed the volunteer will retrieve the documents. The client is free to leave at this point.

- When the return is completed, the client will be notified and they will schedule a time to pick up their tax return.

- The client will call or text once they have arrived and will be notified when they can enter the building to complete the tax return process.

United Way of Greater Lafayette is following the Tippecanoe County Health Department health and safety guidelines.

If youre unable to submit your tax documents electronically we have limited spots available for dropping them off in-person. Schedule an appointment below.

Tax Returns We Are Not Allowed To Do

We are not allowed to do tax returns for taxpayers with the following issues:

- Bankruptcy or insolvency during the tax year

- Rental property

- Self-owned business with a loss

- Self-owned business with depreciable property

- Forgiveness of credit card debt with an amount listed in Box 3 of the Form 1099-C

- Tax returns for non-US citizens.

Free Virtual Tax Filing Service

Code for America, in partnership with VITA, has created a fully virtual intake process for free tax assistance. In light of COVID-19, Code for Americas Get Your Refund service is a free and safe alternative to prepare your tax return without the risk of in-person interaction.

Visit Get Your Refund to connect with an IRS-certified volunteer who will help you file your taxes. First, you will upload your tax documents online. Then, an IRS-certified volunteer will call you to discuss, prepare, and review your tax return for filing.

Code for Americas Get Your Refund service is free for those who earn less than about $66,000. This is a good option if you are comfortable using technology, including sending pictures or documents electronically.

You May Like: Can You File Missouri State Taxes Online

Drop Off 2016 Income Tax Return At Local Cra Office

cashinstinct wrote: It’s more like 10% filing paper according to recent data.

total34%

- +3

Out of curiosity, why are you not filing electronically?

HoTiCE_ wrote: I can understand the computer proficiency part but dont agree on the computer not making mistake. Humans are way more prone to it than machines

- +1

You Cannot Receive Free Tax Preparation Assistance If:

- you are filing a tax return in another state

- you have additional deductions, forms or schedules other than those mentioned above or listed in the section What You Need to Have Your Taxes Prepared or

- you have self-employment income , and you incurred deductible expenses to earn your income, except if you are a child-care provider or cab driver with $10,000 or less in expenses.

Don’t Miss: Do You Have To Report Plasma Donations On Taxes

Tax Prep Dispatch: The Drop

Editor’s Note: This edition of the Tax Prep Dispatch was written by Christopher Murphree, Program Director of the Louisville Asset Building Coalition in Louisville, KY. He has worked with VITA programs for the past four years and believes drop off and virtual VITA services can be a powerful tool for programs and a major convenience for clients.

Drop-off, Virtual VITA and Valet VITA are all different names for an alternative service delivery method that can greatly increase your programs capacity to serve taxpayers. At drop-off sites, one or more aspects of the tax preparation process take place without the taxpayer present. Drop-off services provide many benefits to both VITA programs and taxpayers, including decreased wait time, increased flexibility for volunteers, and now, limiting in-person contact with clients.

Just like regular VITA services, drop-off services are adaptable based on the needs of your clients, volunteers, and partner sites. You can tailor a policy and develop resources that will work best for your program. When considering establishing a drop-off site, consider both your taxpayers and your volunteers in establishing an effective program.

Drop-Off Considerations

About LABCs Drop-Off Program

Virtual VITA and COVID-19

Drop-Off Sites and the VITA Grant

Covid 1: Drop Box Available

Due to COVID-19, only the drop boxes located at the Jonquière, Sudbury, and Winnipeg tax centres are currently open.

To protect your sensitive information and make sure your items gets to the CRA quickly and securely, we encourage you to:

- file your tax return online using NETFILE

- mail your paper returns to the appropriate tax centre

- check if a mailing address is printed on the form itself

There is no walk-in counter service offered at these locations.

You May Like: How Much Does H& r Block Charge To Do Taxes

How Long Do We Have To Review Your Return

When we receive your income tax return, we carry out a cursory review and send you a notice of assessment.

We generally have three years from the date of the notice of assessment to carry out a more in-depth review and, if necessary, issue a notice of reassessment . You must keep all documents substantiating the information provided in your return , as we may ask for them if such a review is carried out.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Recommended Reading: How Much Time To File Taxes

Mailing Options & Services

These mailing services apply a postmark to your return. If your return is postmarked by the IRS deadline date, it is considered on time. With , you can pay for postage online and print a shipping label from your own computer. Generating a Click-N-Ship label with postage creates an electronic record for the label on that specific date, so it is important that you send your package on the shipping date you used to create the label. Your online Click-N-Ship account will save your shipping history for six months.

- 12 business day delivery

- USPS Tracking® included

- 13 business day delivery

- USPS Tracking® included

- 13 business day delivery

- Extra services available

How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Don’t Miss: How Can I Make Payments For My Taxes

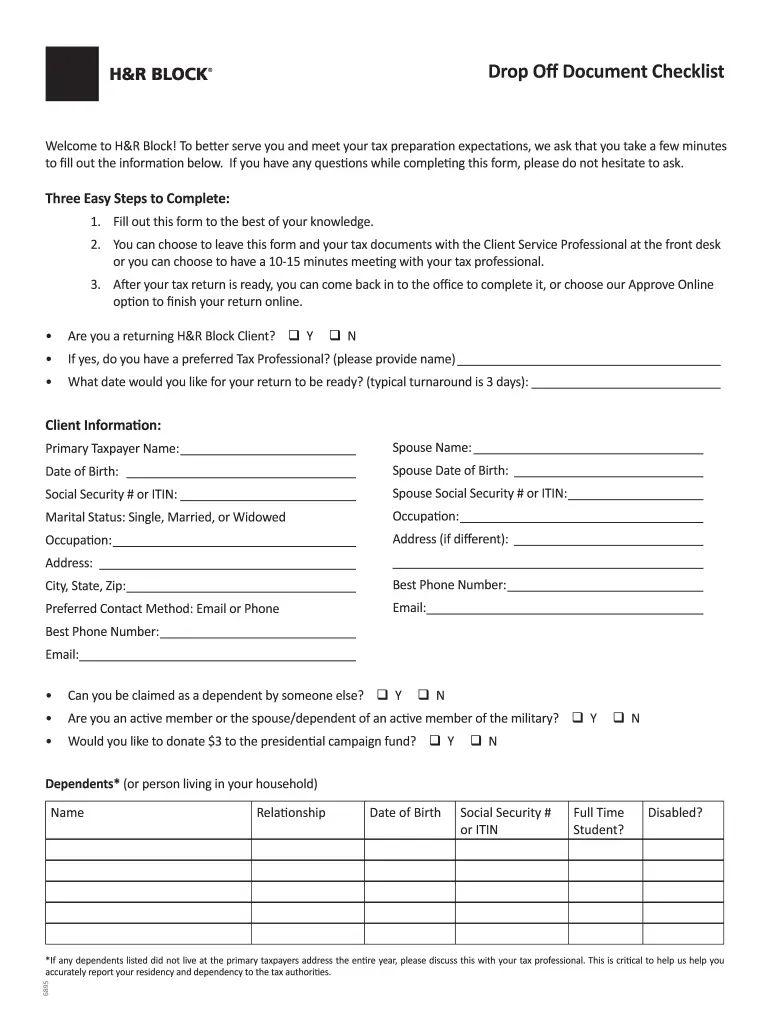

Redstone Accounting Service Inc Now Gives You The Option Of Dropping Off Your Tax Return Information So You Can Spend Your Time Doing Other Things Besides Waiting In A Tax Office Just Print And Fill Out The Client Tax Organizer Attached Below And Drop It Off With Your Tax Forms If We Have Any Questions We Will Email Or Call You When The Return Is Ready We Will Call You To Come In Sign And Pick Up Your Return Everything Will Be E

Step 1: Print and fill out your tax organizer

Step 2: Drop off your tax organizer with all of your tax forms

Step 3: We will call you when your return is ready! Just sign and pick up your return.

Important: If married filing joint, BOTH taxpayer and spouse MUST sign the return

Once your return is signed, we will e-file your tax return.

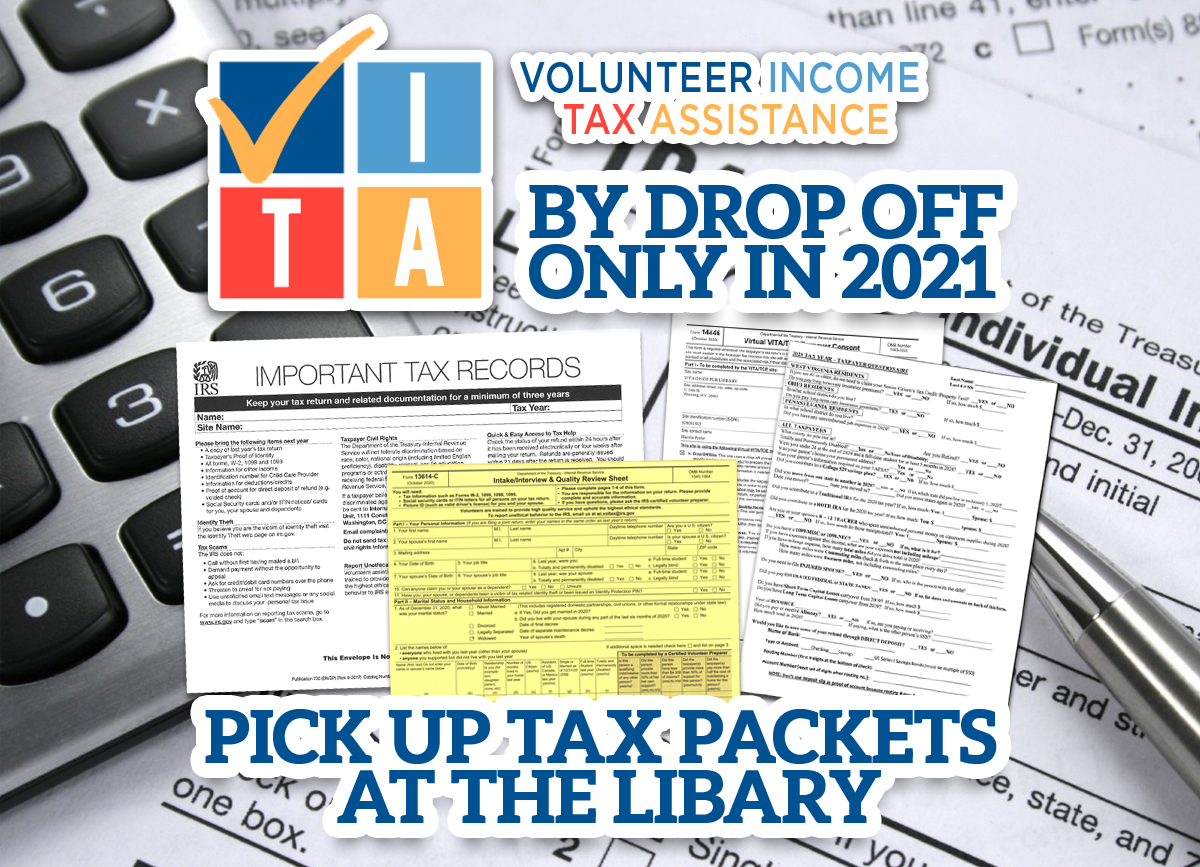

Volunteer Income Tax Assistance

The VITA Program offers FREE tax preparation and filing services to people who make $66,000 or less and need assistance preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals in local communities. United Way of Greater Lafayette, in partnership with Purdue University offers VITA tax preparation services January through April. If your tax return contains any items that are out of scope for our program, we will be unable to prepare your tax return. Please know that the IRS does not begin accepting electronically filed returns until February 12, 2021. If you have any questions about the VITA program call or text 765-421-6163 or email

If you are a Purdue International Student filing as a non-resident for tax purposes looking for tax preparation services you can find information about your taxes here.

Read Also: How To Buy Tax Lien Properties In California

Volunteer Income Tax Assistance Sites Near You

If you cant find a convenient site near you, there are additional Volunteer Income Tax Assistance sites that offer free tax preparation assistance. Just call the VITA Site Locator Hotline at 906-9887 or use the VITA Site Locator Tool to locate your nearest VITA site and find hours of operation and contact numbers.

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Read Also: What Does Agi Mean For Taxes

Drs Forms Instructions & Assistance

This page outlines the expansion of our services to taxpayers, and some changes to the way the Department of Revenue Services delivers information. For the 2021 income tax filing season, DRS does not plan to send paper booklets and forms to community locations. This decision is largely due to IRS tax changes being finalized at the end of the calendar year, which makes it extremely difficult to provide the best, most updated information to partners in a timely manner. In addition, DRS continues to focus on how best to provide services while protecting health and safety during the pandemic.

In place of bulk paper distribution, we have embarked on several initiatives to expand and centralize our services to taxpayers, which we believe are far more efficient and customer-focused. DRS Assistance at Taxpayers’ Fingertips

The DRS website has the answer to many state tax questions, including a Frequently Asked Questions page. Taxpayers are also encouraged to call or email DRS with questions specific to their situation. The fastest and easiest way to access state tax forms and instructions is from the DRS website, where these resources can be downloaded and printed.

Secure Videoconferencing

Hartford Drop Box

DRS has also set up a drop box, where patrons can bring hard copies of their state tax payments and documents, available at our main office in Hartford. The drop box is monitored continually, with distribution to appropriate DRS personnel daily.

File Your State Return Online

Want To Schedule An Appointment With Another Site

Other locations around the Springfield area offer appointments for their free tax assistance. Please call 720-2000 to make an appointment. The phone line opens on January 14, 2021, at 9 a.m.

- This phone line is not staffed by Drury. Drury cannot schedule an appointment for you or connect you.

- Please note that it may be difficult to get through on this line. If you leave a voice message, it may take several days for someone to return your call. If voicemail is full, please keep trying.

You May Like: How Much Does H& r Block Charge To Do Taxes

How Does It Work

Process:

CRA Due date update: As of right now the due date for filing Income Taxes is still however people will not be penalized until September. Therefore, we can still complete individual and couples taxes during this grace period.

Please note:

- Tax returns will only be completed via drop off, no face to face appointments this year

- All Authorization and Information Forms must completed in full and signed in order for us to process them

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Read Also: How To Get A Pin To File Taxes

How Tax Prep Services From Walmart Get You Ready For Tax Season

Preparing your income tax returns can be a breeze when you have everything you need ready, and it’s so easy to do. There are lots of great tools available to help you get your taxes done right, and those tools are available at Walmart’s Every Day Low Prices to help you stay within your budget, too. Whether you need some new tech or an introductory book on how to file your taxes, there’s no better time to start getting everything ready than right now. Organizing tax information and getting ready to file your taxes each year gets a bit easier when you take advantage of tax prep services from the Walmart Money Center offerings.

Help with Learning About TaxesHelp with Organizing Your Records

Preparing a return can involve a lot of paperwork, like receipts and bank statements, just to name a few. Any time you have a lot of paperwork, things like a filing system, binders, label makers and other office accessories make your organizing tasks easier. Our collection of office supplies includes everything you need to stay on top of all the paperwork Uncle Sam requires you to have at tax time. Whether your filing needs are small enough to fit in a small file box or fireproof safe or so big you need a filing cabinet, we have all the office supplies you need to proceed with confidence.

Help with Filling Out Your ReturnHelp When It’s Time to File

Nyc Free Tax Prep Service Options

The filing deadline was May 17, 2021. However, you can still file your 2020 tax return for free with NYC Free Tax Prep if you meet income requirements. NYC Free Tax Prep providers can help you claim important tax credits including the Child Tax Credit. More sites will be added, please check this webpage often. Note: If you owe the government money, be aware that late filing and/or late payment penalties may apply. Please click or press the enter key on a service option to learn more. You can also use our guide to find which NYC Free Tax Prep service is best for you. For all options, make sure to review checklist of documents you need to file your taxes. IMPORTANT: In Person Tax Prep and Drop-off Service have limited capacity. Use Virtual Tax Prep or Self-Prep with Help to save time.

Virtual Tax Prep

Virtual Tax Prep is a safe and reliable online tax prep service. An IRS certified Volunteer Income Tax Assistance /Tax Counseling for the Elderly volunteer preparer will:

- help you file your 2020 tax return during a 60-90 minute virtual call

- use a secure digital system to manage your tax documents

- answer your tax questions.

The following information is for virtual appointments only. Please do not arrive in person.

Self-Prep with Help

Self-Prep with Help is a safe and reliable online tax prep service. Do your own taxes with easy-to-use tax filing software but contact a volunteer preparer for help when needed.

Read Also: How Does H& r Block Charge