How Are Capital Gains Calculated How Are They Taxed

Before we dive into the tax part, lets go through how to calculate capital gains on the sale of a property. Essentially, this calculation figures out how much the propertys value grew from when you first bought it to the day you sold it.

CAPITAL GAIN = PURCHASE PRICE SELLING PRICE

This above is a simple-math calculation of the capital gain. But, also can dive even deeper to reduce the amount of capital gains you would claim on your tax return .

So, its not that capital gains are taxed at a rate of 50%, butits that 50% of the capital gains are taxable. And the capital gains tax rate depends on the amount of your income. You add the capital gain to your income for the year, including money you receive from your job, side hustles, dividends in non-registered accounts, any selling of assets and so on.

Capital gains are taxed as part of your income on your personal tax return. Below are the federal tax brackets for 2022, which can give you an idea of how much tax you may owe for the year. You will need to figure out the provincial tax bracket rate for your province or territory, too. Since Canada has a tiered tax system, you will have to do a bit of math to estimate your annual income tax, breaking down your total tax into the brackets, and the amount owed for each bracket.

And, of course, to really get down to the nickel of how much you ultimately owe, you will need to do your tax return and receive a notice of assessment.

| Annual Income |

Your Questions Answered: If I Remodel My Home Will My

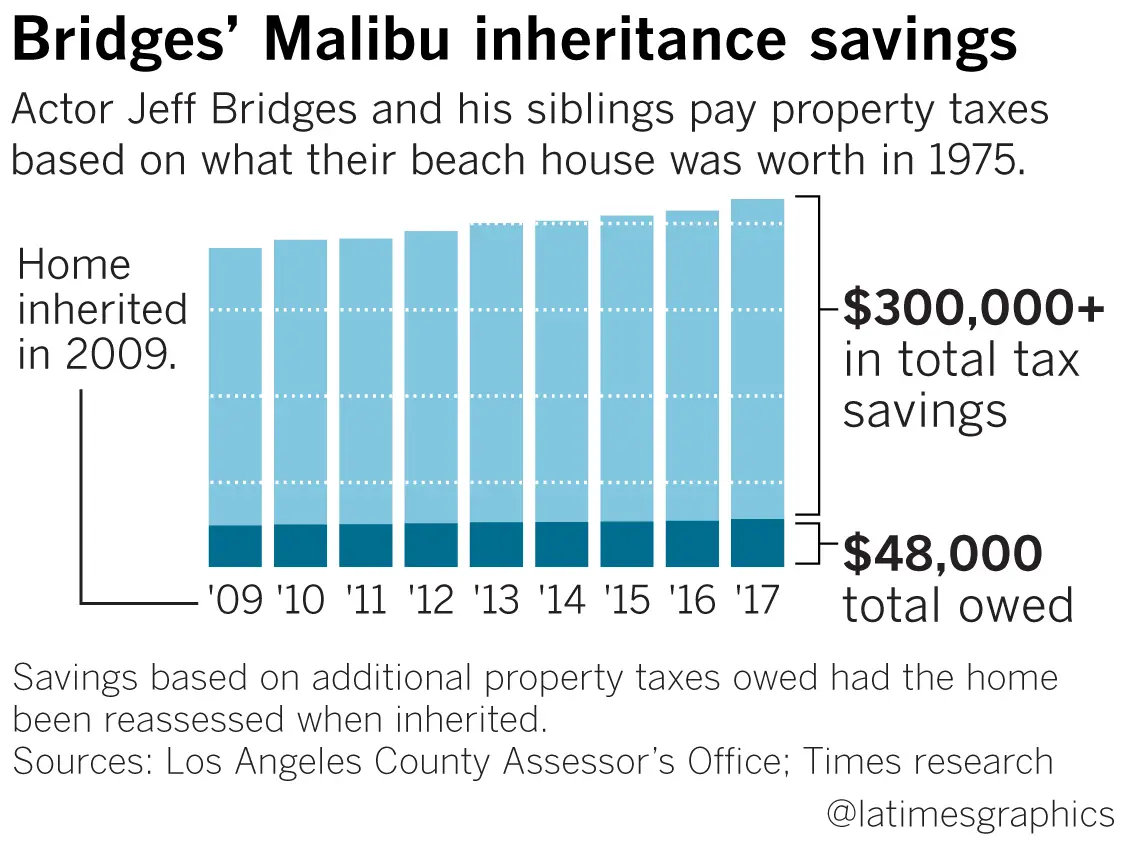

Under Proposition 13, property is assessed for tax purposes at the purchase price, and the assessed value cannot be raised more than two percent per year unless there is a change of ownership or new construction. But what constitutes new construction and how much will the taxes go up? Under California property tax law, new construction …

Why Did My Property Taxes Go Up In 2021 California

The main reason that taxes rose in 2020, and are likely to rise again in 2021, is the soaring housing market. When home prices go up, local government has a larger tax base, leading to higher bills for homeowners. But first, the local tax assessor has to update estimates about how much each home in the area is worth.

Also Check: Protesting Property Taxes In Harris County

At What Age Do You Stop Paying Property Taxes In California

California. Homeowners age 62 or older can postpone payment of property taxes. You must have an annual income of less than $35,500 and at least 40% equity in your home. The delayed property taxes must eventually be paid .

Does California Freeze Property Taxes For Seniors

Neither state has a property tax freeze program. However, two California programs protect seniors from property tax increases. The property tax postponement program gives qualified seniors the option of having the state pay all or part of their property taxes until the owner moves, sells the property, or dies.

You May Like: Is Freetaxusa Legit

Are Impound Accounts Optional

Yes and no. If you have a conventional loan and you have put more than 10% down, youll be able to choose whether you want to have an impound account.

Sometimes though, impound accounts are required…

Most lenders require government loans require property taxes and hazard insurance be impounded and in California, conventional loans with less than 10% down be impounded as well.

What Is The Property Tax System And How Does It Work

Three separate government departments are involved in this system.

First, the county assessor determines the worth of your property. After that, an auditor calculates the tax rates based on the assessed value. This gives you the amount of property taxes youll owe.

Once the propertys value and tax assessments are determined, a percentage of your tax payment is distributed to different state, local, and county services. For example, San Diego County gives 45.6 percent of all property taxes received to public schools for upkeep, programs, and renovations.

Finally, the Treasurer-Tax Collector issues tax invoices and collects property taxes.

Read Also: Doordash State Id Number For Unemployment California

How Much Is My Property Tax In California

Lets talk in numbers: the average effective property tax rate in California is 0.77%. The national average sits at 1.08%. Of course, the average tax rate in California varies by county. If a property has an assessed home value of $300,000, the annual property tax for it would be $3,440 based on the national average. …

What About San Diego Property Investors

In San Diego, if you own or operate a residential rental property, its considered a business activity. This means youll have to pay a Rental Unit Business Tax every year.

You may be exempt from this tax if:

-

The property is your primary residence

-

Youre renting it to an immediate family member

-

Your property is considered section 8/low-income housing

-

You operate as a corporation/LLC

Don’t Miss: Look Up Employer Ein Number

The California State Franchise Tax Board

While most states that charge an income tax do so structured after the IRS, California takes some special interpretations towards tax policy. It is an expensive state in which to do business! It taxes at a higher than average rate for personal state tax, and charges both personal and business taxes to small business owners. The IRS does not collect personal income taxes from business owners, because they see that as double-taxing. California subscribes to no such niceties! To add to that, California also charges non-residents on their income based within the state, if applicable.

The California Franchise Tax Board collects more than $50 billion in annual personal income tax alone, and an additional $9.5 billion in annual corporate income taxes. The California FTB is one of the few US tax agencies which have been convicted for fraud this was 6 years ago in Nevada. It goes to show that sometimes, California has a bit too much weight to throw around.

Three Types Of California Property Tax

There are three types of property taxes that California assesses. The first type is the general tax levy, which has been in place since 1978. The tax rate is currently set at 1% of the property value. Another type involves voter-approved bond debts, which are designed to cover the repayment of local and state bonds. The covering of these debts must typically be approved by a 2/3 majority of the voting public. The third and final type of tax in California is a voter-approved assessment for special districts. These districts usually involve fire and school districts.

Recommended Reading: Tax Write Offs Doordash

Average Taxes Based On Local Home Prices

We talked about the property tax rate for Contra Costa County above. But what about the average amount of taxes paid by homeowners in the area?

The typical or average property tax amount will vary based on:

- The average or median home price in the area

- The total property tax rate for the area

To calculate a rough average for Contra Costa County, we can use the countywide median home price and a typical tax rate of 1.25%. As of late summer 2021, the median home value in the county was around $906,000 . Applying a property tax rate of 1.25% would give us an annual payment of $11,325.

Again, this is just a ballpark figure based on countywide price data. Your tax bill could be lower or higher based on several factors. But this does give us some sense of the average property taxes paid by homeowners in the area.

What Are Property Taxes Used For

When property taxes are collected in California, they can be used for a wide range of different public services. The primary services that taxes are used for include:

- Various government services

- First responders and other forms of law enforcement

- Local levies

- Municipal land and infrastructure construction

- Municipal improvements

- Residential services, the primary of which is garbage pickup

You May Like: How To Appeal Property Taxes In Cook County

California State Income Tax

California has 10 personal income tax rates, ranging from 0% to 13.3% as of 2021. The highest rate of 13.3% begins at incomes of $1 million or more for single filers as of 2021. This increases to incomes of $1,198,024 or more for spouses or registered domestic partners who file jointly. The 13.3% rate is referred to as the “millionaire’s tax.” It’s an added 1% surcharge over the top 12.3% rate that applies to other taxpayers.

The lowest 0% rate is reserved for single earners of less than $8,932 in taxable income in 2021, and of less than $17,864 for married and RDP taxpayers filing jointly and head of household earners.

Income taxes are levied on both residents’ incomes and on income earned in the state by nonresidents. Many states have reciprocity agreements with other states that allow nonresidents to work there without paying income tax except to their home state. But California isn’t one of them. However, the state does offer a tax credit for income taxes paid to another state, so you’re not taxed twice on the same income.

How Much Are Property Taxes In Contra Costa County California

A lot of our readers and clients have questions about the cost of living here in Contra Costa County. One of the most common questions is: How much are property taxes in Contra Costa County, California.

The short answer: The current property tax rate for most homes located within the county is 1% plus any general obligation bond tax rates. This means it can vary slightly from one city to the next. Even so, the average property tax rate for homes in Contra Costa County is somewhere in the low 1% range.

Don’t Miss: Do You Get Taxed On Doordash

Why Am I Paying More Taxes Than My Neighbor

Historically, market values of real property have increased at a significantly greater rate than factored base year values. Because of this, a widening disparity between market values and assessed values has emerged in Santa Clara County.

A property purchased in 1980 with changes in ownership or new construction will usually have a much lower assessed value than a property with similar characteristics purchased in 2011.

For example,Buyer A neighbor bought a property in Year 1 for $100,000 . By Year 6, that property would have a factored base year value of $110, 408. Buyer B bought a similar property in Year 6 for. $150,000. The market value of both properties is $150,000, but the taxable assessed value of Buyer As property purchased in Year 1 is $110,408 while that of Buyer Bs property purchased in Year 6 is $150,000. The factored base year value of the property purchased in Year 1 is not indicative of the market value of the similar property purchased in Year 6.

Common Property Tax Questions

Before you pay your property taxes or purchase a new home, you should be fully aware of what property taxes are, why you need to pay them, and what happens if you dont pay them. The most common property tax questions include:

- When should property taxes be paid?

- What happens with late payments?

- What are impound accounts?

- Are there any exemptions or reductions in property taxes?

As mentioned previously, your annual taxes should be paid in full by November 1. However, this only refers to the first installment of property taxes. The second installment of property taxes must be paid by February 1. If you dont pay the first installment of property taxes in time, the payment will be labeled delinquent on December 10. The same is true if you dont pay the second installment in full by April 10. If you happen to pay your property taxes after the delinquent date, a hefty 10% penalty will be assessed. As such, property taxes of $2,500 would increase to $2,750.

If you want to avoid making late payments altogether, its highly recommended that you make monthly payments with your mortgage bill, which is much more streamlined. An easy way to make sure that you have all the money you need for your property taxes is to divide the annual tax amount into 12 monthly payments. You can then place these monthly payments into your budget, which should make it easier for you to save enough money each month.

Don’t Miss: Reverse Tax Id Lookup

What Are Property Taxes

Simply put, property taxes are taxes levied on real estate by governments, typically on the state, county and local levels. Property taxes are one of the oldest forms of taxation. In fact, the earliest known record of property taxes dates back to the 6th century B.C. In the U.S., property taxes predate even income taxes. While some states don’t levy an income tax, all states, as well as Washington, D.C., have property taxes.

For state and local governments, property taxes are necessary to function. They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself.

You may have noticed already that the best public schools are typically in municipalities with high home values and high property taxes. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. For the latter group, this means funding all county services through property taxes.

To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona.

When Are The Taxes Due

Annual property tax bills are mailed in early October of each year. The bill is payable in two installments.

The 1st installment is due on and is delinquent if the payment is not received by 5:00 p.m. or postmarked by December 10. A 10% penalty is assessed for delinquent payments.

The 2nd installment is due on and is delinquent if the payment is not received by 5:00 p.m. or postmarked by April 10, a 10% penalty and $10.00 cost fee are assessed.

If December 10 or April 10 falls on a Saturday, Sunday, or a legal holiday, the delinquency date is the next business day.

Both installments can be paid at the same time. If you choose to pay both installments in one payment, please include the first and second installment stubs with your payment.

Also Check: Do Doordash Drivers Have To Pay Taxes

How Property Tax Rates Are Determined In Ontario

Municipal property tax rates are determined based on the budget needs of the municipality. Municipalities consider their expected spending and other revenue and use property taxes to make up for the rest. The specific property tax rate for a certain year depends on the budget of the municipality and its total assessment base . If more tax revenue is necessary, tax rates will need to go up, and vice-versa.

The Education Property Tax rate is set by the province. Ontario sets an education property tax rate for each type of property every year. All residential properties are subject to the same tax.

San Diego California Property Tax Rate

Your property tax rate in California is determined based on the assessed value of your property.

This is initially evaluated based on the house’s purchase price, but the assessment may change as a result of annual inflation. In any case, your taxes cannot exceed the 2% limit.

The current property tax rate in San Diego is 0.73 percent. As an example, in San Diego, the median property value is $825,000. In this case, the property tax due would be $6022.5 at the current tax rate.

You May Like: Plasma Donation Income

What State Has No Property Tax

10 States with the Lowest Property Tax in 2020 1) Hawaii Real Estate Market. 2) Alabama Real Estate Market. 3) Colorado Real Estate Market. 4) Louisiana Real Estate Market. 5) District of Columbia Real Estate Market. 6) Delaware Real Estate Market. 7) South Carolina Real Estate Market. 8) West Virginia Real Estate Market.

California Property Tax Rates

Property taxes in California are applied to assessed values. Each county collects a general property tax equal to 1% of assessed value. This is the single largest tax, but there are other smaller taxes that vary by city and district.

Voter-approved taxes for specific projects or purposes are common, as are Mello-Roos taxes. Mello-Roos taxes are voted on by property owners and are used to support special districts through financing for services, public works or other improvements.

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their home’s purchase price by 1.25%. This incorporates the base rate of 1% and additional local taxes, which are usually about 0.25%.

The table below shows effective property tax rates, as well as median annual property tax payments and median home values, for each county in California. Assessed value is often lower than market value, so effective tax rates in California are typically lower than 1%, even though nominal tax rates are always at least 1%.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage payment calculator.

Don’t Miss: How Do Doordash Taxes Work

Calculating Property Taxes In California

California Property Tax Calculator

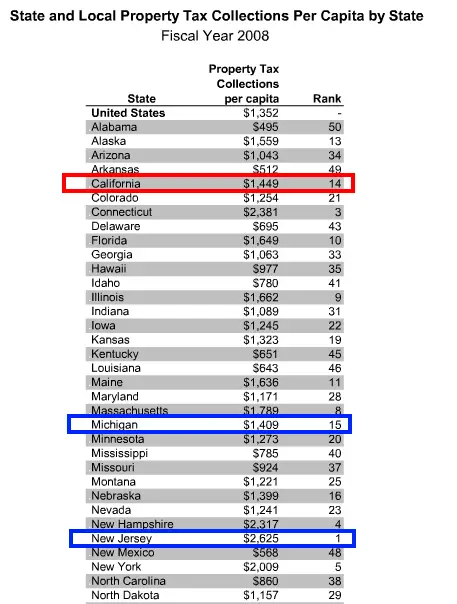

Californias overall property taxes are below the national average. The average effective property tax rate in California is 0.79%, compared with a national average of 1.19%.

The California Property Tax Calculator provides a free online calculation of ones property tax. Simply type in the propertys zip code and select the assessed home value. Instant results include the Average Tax Rate Percentage and the annual Property Tax. Also includes the average property tax rate in the specific county, the State of California, and nationally.

San Diego County

The San Diego County Treasurer Tax Collector website provides an online payment system for property owners to determine their property tax and pay their tax bill online.

Property owners can easily search their tax bill by inputting their mailing address, parcel/bill number, or unsecured bill number. Then, they view the bill and select the installment and add it to their shopping cart for payment.

In addition, the San Diego County Tax Collector site provides a link to a private vendor called ParcelQuest which provides free information from the San Diego County Assessors Office.

Los Angeles County

The Los Angeles County Assessor provides useful information explaining California property taxes on its website.

In addition, their website provides a Supplemental Tax Estimatorcalculatorfor Los Angeles County property owners. This provides estimated taxes for a recently purchased property.