How To Deduct Cash Donations

One common error taxpayers make is claiming the full amount of a donation to a charitable organization from which they receive a tangible benefit.

Lets say you went to a silent auction and won a prize that was valued at $1,000, but your winning bid and therefore your donation was only $500. You cant claim a tax deduction because you came out ahead $500, Nisall said.

But if you went to a charity dinner and paid $1,000 per plate and the meal was valued at only $500, you get to deduct the difference because you actually paid more than the value you received in exchange for your gift,’ he said.

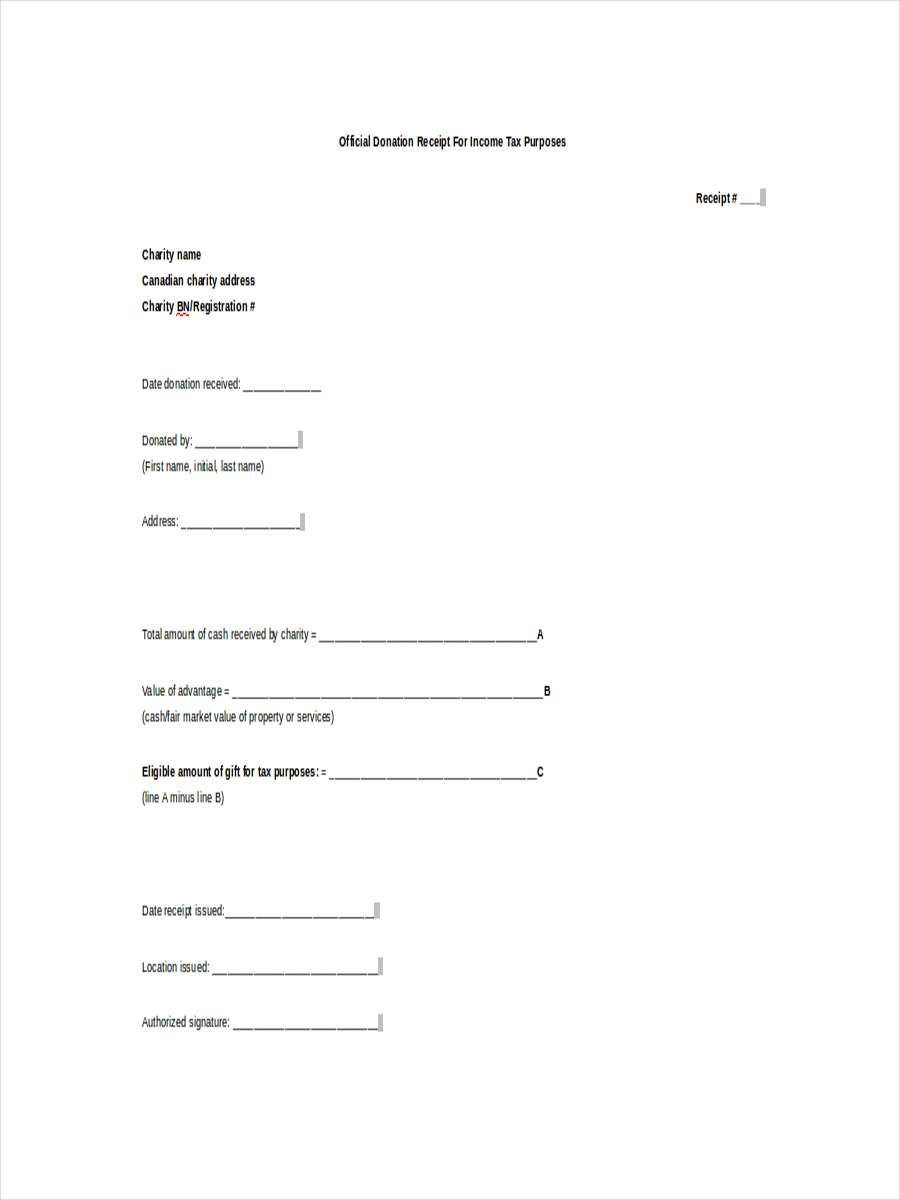

Bell said youll need to keep receipts especially for large donations.

If youre more generous, however, youll need to be sure you get an official acknowledgment document from the charity, she said. In fact, you need to get receipts from all nonprofits to which you give. You dont have to send them with your taxes, but if you dont have documentation and the IRS questions your charitable deduction, it can automatically deny it.

Keep Your Records For Tax Write

Come tax time, youll need to be able to prove your contributions to be able to write them off. Its critical to keep each receipt proving you made charitable donations for tax deductions.

For charitable contributions of $250 or more, youll need a written acknowledgment from a receiving organization confirming the donation either the cash amount or the description of non-cash contributions, according to the IRS.

How Much Can You Claim

In accordance with IRS Publication 526, an individual may deduct a maximum of up to 50% of their Adjusted Gross Income for the tax year the donation was given .

Depending on current legislation, there may be ways to deduct more the limited amount, for example, in 2017 there was no restriction on how much a filer could deduct for donations given to disaster area contributions.

Don’t Miss: Tax Write Offs Doordash

Can You Write Off Charitable Donations In 2020

Under section 170 of the Internal Revenue Code, donations to charitable organizations are tax-deductible as an itemized deduction in 2020. To verify if an organization is eligible for tax-deductible contributions, taxpayers can search the new IRS database, Tax Exempt Organization Search .

Not everyone can claim tax deductions for the charitable donation. The IRS has imposed several rules for claiming the charitable contribution deductions:

- The contribution must be made to a qualified organization under section 170 of the Internal Revenue Code. You must ensure that the organization is a 501 public charity or private foundation

- Gifts made to individuals, political parties and campaigns, labor unions and foreign governments are not tax deductible

- You must actually donate cash or property before the close of the tax year

- For donations other than cash, the fair market value of the property is generally used, though adjustments may be made in some cases

- You must keep records of the donations such as written acknowledgment letters from charities, canceled checks and appraisals of value for the donated property. The internal records must indicate the name of the charitable organization, the date of contribution and the amount

- Itemize your deductions before filing your tax return

What’s The Maximum Amount I Can Claim As A Charitable Tax Deduction On My Taxes

When you make a charitable contribution of cash to a qualifying public charity, in 2021, under the Consolidated Appropriations Act1, you can deduct up to 100% of your adjusted gross income.

1 The Consolidated Appropriations Act temporarily increases the individual AGI limit for cash contributions made to qualified public charities in 2021. The Consolidated Appropriations Act provisions do not apply to contributions to supporting organizations nor public charities that sponsor donor-advised funds, like Fidelity Charitable.

Also Check: Efstatus Taxact 2016

Contributions Donations And Gifts

The words “contribution,” “donation,” or “gift” are typically used to refer to money or property received from a donor. These words mean essentially the same thing and are often used interchangeably. In the nonprofit world, however, people tend to use the word donation for small gifts — say an item of clothing — and reserve the word contribution for larger gifts — real estate, for example.

Charitable deductions are claimed by donors on their individual tax returns . It is up to the donor and his or her tax adviser — not the nonprofit that receives a donation — to determine how much to deduct, and when and how to deduct it. The nonprofit’s role in the charitable tax deduction process is fairly limited. Subject to some important exceptions, a nonprofit is not required to report donations to the IRS or make any tax filings when it receives a donation. The nonprofit’s main responsibility is to make sure it complies with any substantiation and documentation requirements for the donations it receives.

The Charity Must Agree To Keep The Work For At Least Three Years

When you decide to donate a work of art to charity, it’s important to communicate with charity representatives to determine their plans for the artwork. It is not necessary that a charity hold the donated art in its collection forever museums often sell works in order to raise funds to acquire other pieces. But if the artwork is valued at more than $5,000, and the donor plans to receive an income tax deduction for the fair-market value, the charity must keep it for at least three years. There is an exception for emergencies, but in that case, the charity must provide the IRS with an affidavit stating that it used the gifted property for its exempt purpose for a period of time, or that it became impractical to carry out this purpose.

Recommended Reading: 1040paytax.com

Frequently Asked Questions: Tax Information For Donations

Learn more about the tax benefits you may be eligible for when you make a donation to Habitat for Humanity by reading our answers to the questions below.

If you have a question about a specific donation youve made, please fill out our donor inquiry form.

Here is some general information about Habitat for Humanity that may help you:

- Habitat for Humanity International is a 501 organization.

- Receipts for donations made directly to Habitat for Humanity International are available by contacting 1-800-HABITAT or .

- Receipts for donations made to local Habitat for Humanity affiliates must be obtained from the affiliate. You can find the contact information for your affiliate online.

What Does It Mean To Write Off Taxes In Canada

Writing off something on your taxes simply means deducting an amount permitted by the Canada Revenue Agency to reduce your taxable income. You can write-off numerous items on your taxes, ranging from child support payments to employment expenses.

Some tax write-offs also come in the form of non-refundable credits, which reduce the amount of tax you owe. Tax write-offs are beneficial to you as a taxpayer because they can save you money on your tax bill.

You May Like: Pastyeartax.com Reviews

What Is A Qualifying Donee

A qualifying donee is a registered charity or one of several other public organizations, such as an amateur athletic association, a resisted institution, a municipality, a province, or territory which can issue tax receipts. Make sure you obtain a receipt and that the donee issuing it is legally entitled to do so. The Canada Revenue Agency provides a searchable online database that allows you to confirm whether a charity is registered and eligible to issue official donation receipts. You can also determine the status of a registered charity by calling the CRA at 1-800-267-2384.

Be aware of donations schemes. Check the CRA link for tips to avoid fraud before you make the donation.

How Much Of My Donation Can I Claim On My Taxes

The amount you can claim depends on the type of gift. For gifts of money, it is the amount of the gift, but it must be $2 or more. For gifts of property, there are different rules, depending on the type and value of the property.

A tax deduction for most gifts is claimed in the tax return for the income year in which the gift is made.

You need to be aware that the tax deduction claimed for donating a gift cannot add to or create a tax loss. The deduction can reduce your assessable income to nil in the tax year in which the gift is made, but any excess cannot be claimed in that year.

However, in advance of lodging your tax return, you can choose to spread the tax deduction over a period of up to five income years.

Recommended Reading: Do Doordash Drivers Pay Taxes

What If You Give More Money

If you’re itemizing, you can take a bigger deduction for charitable contributions, including donations of clothing, cars, securities and bigger ticket items.

It’s also good to know that pandemic-related relief in Washington temporarilyeliminatedsome restrictions placed on how much money in cash contributions you can deduct, if you itemize, according toLisa Greene-Lewis, a TurboTax CPA and tax expert.

Usually, cash donations that you can deduct are limited to 60% of your adjusted gross income but that limit was temporarilyeliminated for tax year 2021returns, just like it was for 2020.

As a result, “taxpayers can claim a charitable deduction up to 100% of their adjusted gross income or AGI in 2021,” saidSusan Allen, senior manager for Tax Practice & Ethics with the American Institute of CPAs.

Just because you can donate a lot of cash, though, doesn’t mean that’s the best strategy when it comes to tax planning.

Some are better off donating stock that’s been held more than a year andhas built up a good deal of value directly to a charity to avoid capital gains taxes.

Best to talk to your tax professional.

“Donating appreciated stock can be particularly advantageous since you can get a deduction for the fair market value of the donated stock without having to realize the gain on the stock as a taxable capital gain,” Luscombe said.

TAX DELAYS:IRS says stimulus check mistakes are among reasons for tax refund delays

Donations From Previous Years

Since the CDTC is greater for donations higher than $200, it may be worthwhile to accumulate donations and claim them all together in the same year. There are two ways to accumulate donations: you can combine them with your spouse`s on a single tax return or you can claim donations from multiple years together in the same year. Donations can be carried forward for up to five years.

If you need to know if you have claimed donations in previous years, you can find out using the CRAs My Account online service. Once you log into your account, click on the tax returns tab at the top of the page. From there, you can view your tax returns from previous years. Look at line 349 on your previous T1 General tax return prior to 2019 or line 34900 of your Income Tax and Benefit returns of 2019 and onward to determine whether you have claimed donations for each of the past five years.

Recommended Reading: Paying Taxes With Doordash

Charitable Donations: The Basics Of Giving

Remember the adage Its better to give than to receive? With proper planning, its possible to do both at the same time. Your financial goals may include giving to the causes that are most important to you. As you plan, these strategies can help you make the greatest impact while potentially receiving tax savings too.

What Do You Need To Write Off A Donation

To prove how much you contributed, you will need to keep records. The type of record you keep depends upon the donation.

For a tax write-off, you will need to keep a bank record for cash donations. For example, you should keep a copy of a canceled check, bank or credit card statement or receipt. Your receipt should provide the name of the qualified organization, the date and contribution amount.

You may need to keep other records depending on how much you donate if you make a noncash donation. Generally, your record should include the date of your contribution, the name of the qualified organization and amount. You should also request a written statement from the organization to write off your donation.

But keep in mind, if you donate noncash contributions more than $500, you may need to keep additional records. Its a good idea to speak with a tax professional before making a contribution to determine which records youre required to keep.

Read Also: Does Door Dash Tax

When It Comes To Donors’ Charitable Contributions To A Nonprofit Sometimes Deductible Is Debatable

By Stephen Fishman, J.D.

The words “your contribution is tax deductible” are music to a donor’s ears. While getting a tax deduction is not the sole motivation for most charitable donations, it has always been an important factor. Indeed, prior to the enactment of the Tax Cuts and Jobs Act , about 85% of all charitable contributions were made by individuals who deducted their donations. However, as a result of tax changes brought about by the TCJA, far fewer taxpayers will be able to deduct their donations than in the past. This is expected to have a negative impact on charitable giving.

Whether a donation is deductible depends on a number of factors — including who the donation is given to, when the donation is made, the purpose of the donation, and the donor’s particular tax situation. An identical contribution may be deductible by one donor, but not by another.

To complicate matters, the IRS imposes restrictive rules on donations. These rules require thorough documentation and tax filings by both nonprofits and the people making donations to them. In some cases, the rules limit the amount that the donor can deduct.

How Do Goodwill Donation Centers Work

Goodwill accepts items like clothing, appliances, and household items. You can take them to the donation center nearest you. Follow the signs to the item drop-off location there may be an attendant there to help you unload them. Goodwill centers are generally open weekdays, weekends, and evenings. Dont forget to ask the Goodwill associate for the receiptyou’ll need it for tax purposes.

Recommended Reading: Mcl 206.707

Temporary Suspension Of Limits On Charitable Contributions

In most cases, the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage of the taxpayers adjusted gross income . Qualified contributions are not subject to this limitation. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year. To qualify, the contribution must be:

- a cash contribution

- made to a qualifying organization

- made during the calendar year 2020

Contributions of non-cash property do not qualify for this relief. Taxpayers may still claim non-cash contributions as a deduction, subject to the normal limits.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others including health plans affected by coronavirus .

Can My Donor Take A Tax Deduction For In

Your organization just found out it will receive a donation of new laptops for the office. Do you know what type of information to include in an acknowledgment?

A board member just found out that the parking and meals he has been paying for on the nonprofits time may be deductible. What type of information should be on his tax receipt?

Generally, a donor may deduct an in-kind donation as a charitable contribution. And a donor must obtain a written acknowledgment from the charity to substantiate the gift, although the acknowledgment will generally not assign a dollar value to the donation.

Not only are the written acknowledgment requirements complex, especially for non-cash donations, but noncompliance can be costly .

In-kind donations generally fall into one of three categories:

The charity should provide a written communication or acknowledgment to the donor. For a nonprofit, it is a best practice to send the donor a written acknowledgment that includes the name and EIN of the charity, as well as the date received and a detailed description of the in-kind contribution.

In addition, for direct donations, the nonprofit should also provide a statement of the amount donated . The typical donor acknowledgement would therefore read:

About Charitable Allies

You May Like: How Much Do You Pay In Taxes For Doordash

Reliance On Tax Exempt Organization Search

Revenue Procedure 2011-33, 2011-25 I.R.B. 887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Tax Exempt Organization Search to the same extent provided for in Revenue Procedure 2011-33.

Similar reliance provisions apply to an organization’s foundation classification as it appears in the list. See also Revenue Procedure 89-23 PDF.

Restrictions On Deducting Charitable Donations

The IRS limits charitable deductions in certain circumstances, including:

The IRS allows these deductions because they want to encourage charitable giving. Sticking to the guidelines described above will help you ensure that the goodness in your heart translates to goodness on your tax return as well.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: Tax Deductible Home Improvements