Do Employers Use The Standard Mileage Rates

If your employer reimburses mileage, they can use a reimbursement rate thatâs higher or lower than the federal guidelines. Just know that any reimbursement above the standard mileage rates is taxable. You will need to pay income tax on it and thereâs always the possibly it pushes you into a higher tax bracket.

Can You Claim Mileage To And From Work My Scheme Foiled

Initially, I had this great scheme. Since I have a home-based business , I had a plan to commute down the stairs to the home office, then drive between my businesses to the hospital and back to my home office, then commute back up the stairs. Unfortunately, it turns out you can’t do this. If one of your sites of business is your home office, there is an additional requirement. Both jobs have to be in the same industrymine are not. It’s too bad since it would be worth at least a few hundred dollars a year to me.

I did manage to get a few miles for each business, but it was nowhere near the mileage I drive between my home and the hospital.

Calculate The Mileage For The Drive To Your First Meeting

On a given day you can see where you began your first trip or ended your last trip, and how far away it is from your home. Its a tedious process, but if you calculate the mileage between those two points, and can document your exact starting and ending locations, you can calculate your deductible mileage from that information. For example, if you go online with your Uber app at home in Oakland, but drive to San Francisco before you get your first passenger, you can calculate how many miles you drove to the city and include those in your deduction.

Don’t Miss: Doordash Payable Account

Is There An Easier Way To Claim Car Mileage Allowance

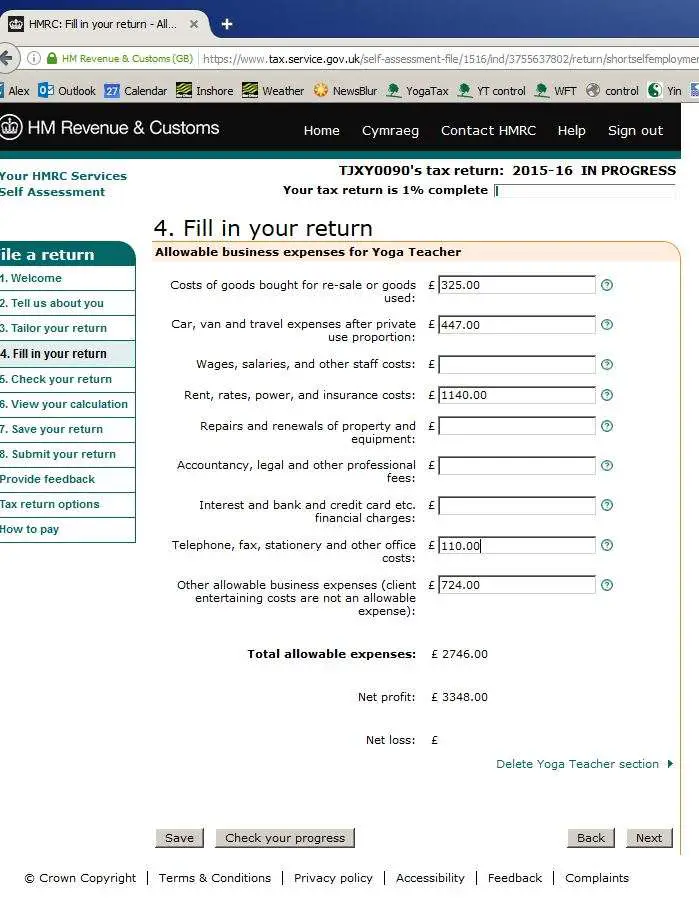

Calculating car mileage can prove difficult for those who arent tax experts, especially if you dont use simplified mileage expenses. The team at GoSimpleTax are committed to making your tax experience as trouble-free as possible.

Our tax return software works out the sums for you so that you can pay tax with ease. And when there are savings to be made, well tell you about it with our tax-saving suggestions. It can also be accessed from any device, including smartphones, so you can keep on top of your tax on the go. This is particularly beneficial if you need to keep track of your mileage.

Claiming car mileage allowance and business travel expenses is just one of the many areas in which our Self Assessment software can help. To discover the benefits first-hand, take a free 14-trial today.

Trusted by over 15,000 subscribers

You don’t need to be an expert to complete your self assessment tax return.

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It’s written to help you understand your Tax’s and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone’s circumstances. For additional help please contact our support team or HMRC.

Managing your tax return has never been so easy.

Start your self assessment tax return today for free.

What If You Didnt Track Your Expenses

If you found out about this deduction partway through the year, you can still deduct your travel, even if you dont have excellent records. However, you need to be careful it is up to you to prove your expenses if you are audited. A good way to get a reasonable estimate of your travel is to use Google Maps, MapQuest or another online map service to determine the distance from your home to your unit.

Be sure to document the days you traveled and the number of trips, and you should have a fairly accurate estimate of your miles traveled. It would be more difficult to determine how much you may have paid for food, tolls and other expenses if you dont have good records. It may be a good idea to forget about the other expenses if you cant come up with a reasonably accurate list of expenses. Just work on keeping records from this point forward.

Read Also: How Do You Pay Taxes With Doordash

Topic No 510 Business Use Of Car

If you use your car only for business purposes, you may deduct its entire cost of ownership and operation . However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use.

You can generally figure the amount of your deductible car expense by using one of two methods: the standard mileage rate method or the actual expense method. If you qualify to use both methods, you may want to figure your deduction both ways before choosing a method to see which one gives you a larger deduction.

Standard Mileage Rate – For the current standard mileage rate, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses or search standard mileage rates on IRS.gov. To use the standard mileage rate, you must own or lease the car and:

- You must not operate five or more cars at the same time, as in a fleet operation,

- You must not have claimed a depreciation deduction for the car using any method other than straight-line,

- You must not have claimed a Section 179 deduction on the car,

- You must not have claimed the special depreciation allowance on the car, and

- You must not have claimed actual expenses after 1997 for a car you lease.

To use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. Then, in later years, you can choose to use the standard mileage rate or actual expenses.

Can You Use Either Deduction Tracking Method

If you use standard mileage in your first year of driving for Uber or Lyft, then you can choose whether you want to use actual car expenses or standard mileage in the future. If you use actual expenses the first year, then you must continue to use actual car expenses for as long as you drive with that vehicle. The exception is leased carswhatever method you pick the first year you must stick with for the duration of the lease period.

Read Also: Plasma Donation Taxable

Understand The Standard Mileage Rate Vs Actual Expenses

You can deduct your vehicle expenses in one of two ways. You can track all your car expenses, including gas, oil, repairs, insurance, and depreciation, and deduct the portion of your total car expenses that apply to business miles. Or you can deduct a flat rate for every business mile you drive, which is called the standard mileage deduction. The standard deduction for use of a car in 2018 is 54.5 cents per mile for business miles. You may want to calculate mileage for taxes both ways to see which method gives you the biggest deduction.

You may not be able to use the standard mileage deduction for claiming mileage in all cases. For example, if you use actual expenses the first year you own a car, you must use actual expenses for as long as you own the car. If you use the standard mileage rate the first year, you can switch back and forth between actual expenses and the standard mileage rate in the following years.

Additionally, be aware that some depreciation deductions are limited by luxury auto rules.

What Happens If I Don’t Have A Mileage Log

Keeping a logbook for your vehicle guarantees that the information you need when it’s time to claim expenses will be there. Without one:

- You won’t be able to back up your claims should you face an audit by the CRA

- It will be very difficult to keep personal use and business use separate

- You won’t have the information you need to claim a vehicle deduction if the allowance arrangements you have with your employer ever change

- You might miss out on potential vehicle expense deductions if you don’t have the records to back them up.

Recommended Reading: Doordash On Taxes

Keep Records Of Your Deductible Miles And Total Mileage

To take a deduction for business mileage, you must show that you kept records of business miles driven. This is easy to do with a small notebook you keep in your car or through an app, like Everlance, on your phone. You can also reconstruct miles driven from a logbook. No matter which method you choose, you will need to know your total miles driven for the year.

Remember, you can only count business mileage on taxes, not commuting miles. For example, when you drive to your regular office, dont count those miles. But if you drive for business purposes such as visiting a clients office, temporary work location or an office supply store, you can count those business drives towards the IRS mileage deduction.

Learn The Rules For Deducting Your Local Business Travel Expenses Using The Standard Mileage Rate

Some business people, like real estate agents and brokers, spend a good deal of time behind the wheel of their car. Indeed, it’s not uncommon for real estate agents to drive over 20,000 miles per year for business. Fortunately, local transportation costs are deductible as business-operating expenses if they’re ordinary and necessary for your business. Obviously, such expenses are ordinary and necessary for many business people who do their work away from their office. It makes no difference what type of transportation you use to make the local tripscar, SUV, limousine, motorcycle, taxior whether the vehicle you use is owned or leased.

If you drive a car, SUV, or van for business, you have two options for deducting your vehicle expenses: You can use the standard mileage rate, or you can deduct your actual expenses for gas, depreciation, and other driving costs. Most people use the standard mileage rate because it’s simpler and requires less recordkeeping you only need to keep track of how many business miles you drive, not the actual expenses for your car, such as the amount you pay for gas.

You May Like: Protest Taxes Harris County

Lodging And Other Expenses

Its always a good practice to keep all related receipts if you are taking a tax deduction, particularly if you will be adding up multiple months worth of expenses. The amount of expenses you can deduct on Form 1040 is limited to the regular federal per diem rate and the standard mileage rate , plus any parking fees, ferry fees and tolls.

In some cases, you may not get receipts for all expenses, such as parking and tolls. In these cases, be sure to document the expenses in your travel notebook or by other means. For example, you could print a receipt for your tolls if you have a toll pass that tracks each toll you pass.

How To Track And Keep Records Of Your Mileage

The IRS defines adequate records. For all transportation, the IRS asks that you log the following:

- “the mileage for each business use”

- “the total mileage for the year”

- the time , place , and purpose

The record must also be “timely” – in other words, recorded at or near the time of the expense . Weekly diaries, logs, trip sheets, account books, or similar records are deemed adequate.

In addition, you need to be able to show the business vs. personal use of your vehicle as a percentage. That means keeping a log of all trips and then calculating the share used for business. See how to do the calculation in the section below.

In today’s digital world, you can take advantage of a mileage tracking app to save a lot of time. Driversnote and other similar apps not only log your miles for you but also store and generate adequate records whenever you need them.

Read Also: How To Get A 1099 From Doordash

How Reserve Travel Deductions Impact Your Taxes

The deduction for travel-related expenses is a top-of-the-line tax deduction to your gross income, meaning it directly reduces your income before your taxes are calculated. As an example, if your income for the year was $50,000 and you had $2,500 in travel-related expenses, you would subtract the $2,500 from your $50,000 income, leaving your taxable income at $47,500. Of course, this does not include other tax deductions you may be eligible to receive. So you may be taxed on a lower percentage of your income after accounting for all eligible tax deductions.

How To Track Mileage For Taxes In Canada

If you drive for work, you may be eligible to claim a vehicle expense deduction on your next CRA tax return. To do this, you will need to make sure to keep an accurate mileage log of all business trips to back up your claims. Now that MileIQ for Canada is live, it’s easier than ever to claim the mileage deduction you deserve. Keep reading to find out more about CRA mileage log requirements, along with how to claim them on next year’s taxes.

Don’t Miss: Where Can I Amend My Taxes For Free

Deducting Mileage That Exceeds 2% Of Your Agi

If youâre in the reserves and want to take this deduction, you will need to have expenses for travel thatâs more than 100 miles from your home. Then you will need to fill out Form 2106 and Schedule 1. You do not need to itemize your deductions.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

Qualified performing artists can also deduct mileage and other business expenses without itemizing by completing Form 2106 and Schedule 1. You may be a qualified performing artist if you meet the following:

-

Youâre a performing artist with at least two W-2 forms, each with at least $200 from an entertainment company.

-

Your AGI, before this deduction, is $16,000 or less.

-

The performing-related deductions youâre making equal at least 10% of your AGI.

Government officials can qualify to deduct mileage if theyâre employed by a state or political subdivision of a state at least partially on a fee basis. You will need to fill out Form 2106 and Schedule 1.

Workers with disabilities who had impairment-related expenses at work must itemize, using Schedule A, to deduct driving expenses.

Using Your Own Vehicle For Work

If you use your own vehicle or vehicles for work, you may be able to claim tax relief on the approved mileage rate. This covers the cost of owning and running your vehicle. You cannot claim separately for things like:

- fuel

- MOTs

- repairs

To work out how much you can claim for each tax year youll need to:

- keep records of the dates and mileage of your work journeys

- add up the mileage for each vehicle type youve used for work

- take away any amount your employer pays you towards your costs,

You May Like: Irs Employee Lookup

Who Can Get Miles Reimbursed On Their Taxes

In the past, if you had unreimbursed business expenses , you could deduct it on your federal tax return if it exceeded 2% of your adjusted gross income . You just needed to itemize your deductions.

The 2017 tax reform limited this deduction to reserve members of the U.S. Armed Forces, qualified performing artists, fee-based state and local government officials, and individuals with physical or mental disabilities who pay for attendant care at their place of employment.

Aside from those mentioned above, there are three other situations where you can get reimbursed for mileage on your tax return:

-

You are self-employed and use your car for business.

-

Your mileage was necessary for medical or dental care.

-

You incurred mileage volunteering for a nonprofit.

Learn more about other deductions and credits you can take in 2022.

How Do I Submit A Mileage Claim

There are 2 different ways to submit a claim:

If youre an employee and claiming less than £2,500: fill in a P87

Self-employed taxpayers, or employees claiming over £2,500: use the self-assessment system, this means submitting a self-assessment tax return

FreshBooks makes self-assessment easy for you in terms of record keeping and submission, whether youre self employed or an employee.

You May Like: Doordash Tax Withholding

Choosing Standard Mileage Rate Or The Actual Expense Method

Whether you opt to deduct the standard mileage rate or use the actual expense method depends one which approach saves you more money. Your best bet is to spend one month tracking your vehicle expenses, as well as business mileage on your vehicle. Then do the calculations to find out what you can deduct using each method.

Calculating Your Mileage Deduction

Your mileage deduction isnt hard to calculate if youve kept accurate records in your logbook.

Youll need two figures:

Once you have these two numbers, you simply plug them into the CRA formula for calculating your mileage deduction. You can deduct the full amount of allowable expenses for the car . So, if you had $5,000 in total car expenses and drove 10,000 miles for business out of 20,000 miles total for the year, your deduction for vehicle expenses would be $2,500.

Other Deductible Expenses

In addition to mileage expenses, the CRA also allows self-employed individuals to add other vehicle expenses to the total motor vehicle deduction.

Additional expenses include:

- Lease expenses,

- Maintenance and repairs.

Similar to the mileage expenses you deduct you can only claim the costs associated with your business travels. For some expenses, like repairs and maintenance, you may not be able to determine the cost directly related to your business use. In this instance, youll need to apply the percentage you use in your mileage calculations to these other costs.

For those self-employed Canadians who want to ensure that they claim every eligible deduction possible, the QuickBooks Self-Employed App is exactly what you need to track your mileage for business, for personal use and even those dead kilometres which are not claimed on your drivers summary, in the case of ride share driving.

Read Also: Do You Get A 1099 From Doordash