How To Calculate Massachusetts State Tax In 2022

Massachusetts tax is calculated by identyfying your taxable income in Massachusetts and then applying this against the personal income tax rates and thresholds identified in the Massachusetts state tax tables . Please note that certain states do not collect State Income tax, these include Alaska, Florida, Nevada, South Dakota, Washington and Wyoming.

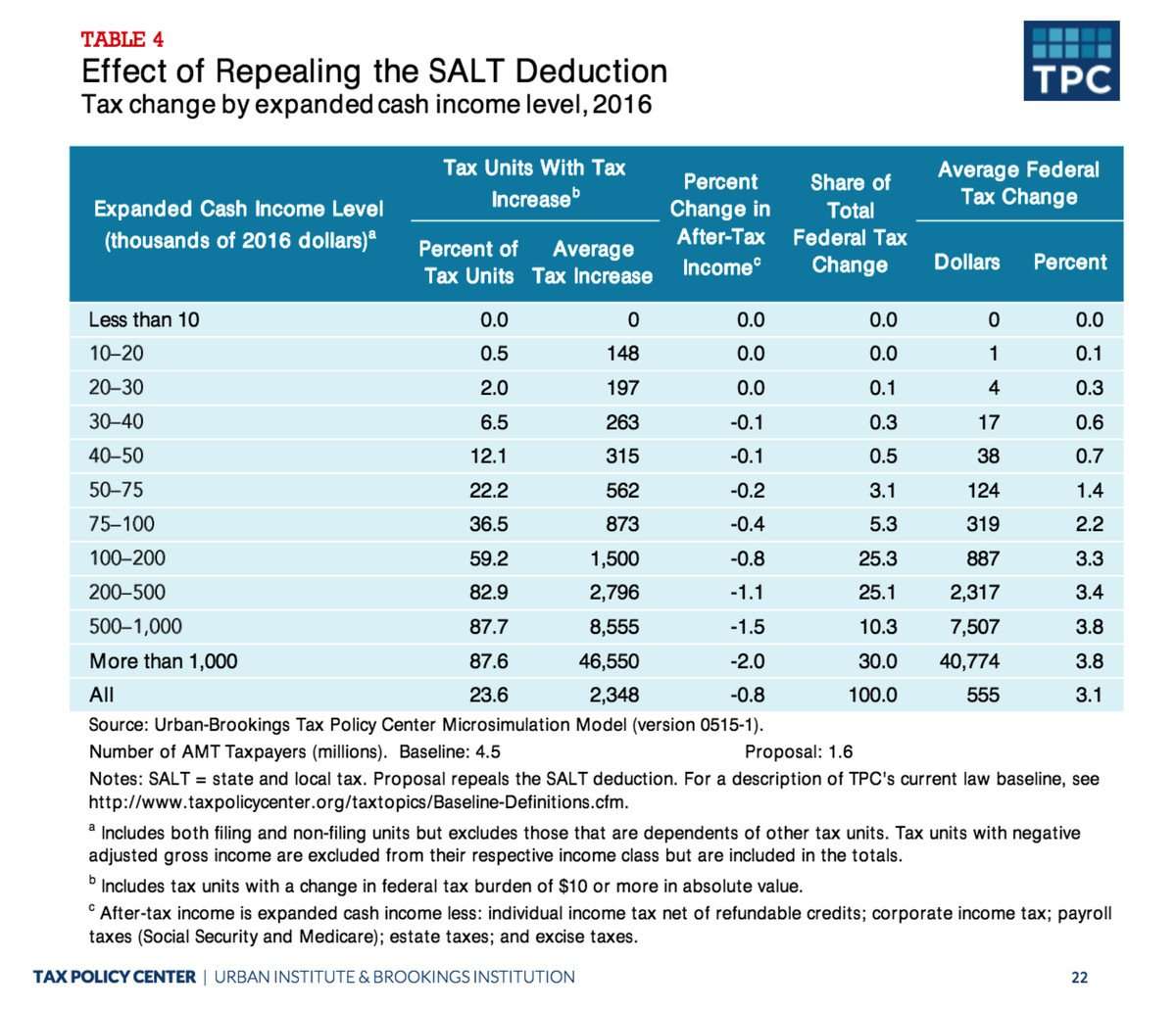

Taxable Income in Massachusetts is calculated by subtracting your tax deductions from your gross income. Incredibly, a lot of people fail to allow for the income tax deductions when completing their annual tax return inMassachusetts, the net effect for those individuals is a higher state income tax bill in Massachusetts and a higher Federal tax bill. So why do people choose not to claim income tax deductions in Massachusetts? The sad truth is that a lot of people fear making a mistake on their Massachusetts tax return and subsequently facing fines and issue with the IRS and or Massachusetts State Government tax administration. Clearly, declaiming deductions can really reduce your tax bill in Massachusetts but this is a personal choice, itemised deductions for the combined Federal and Massachusetts State tax return include Office expenses, Property Maintenance and Repairs, certain trades and jobs are provided special allowances. A full list of tax exemptions and elements which can be claimed as part of an itemised Massachusetts state tax return is available on the Massachusetts Government website.

Top Two Myths About Income Tax In Ma Debunked

It makes that each state has its own rules and regulations about income taxes. Most mirror the federal tax system, but some states tend to follow a different way of doing things. Thus, this can lead to many misconceptions and misunderstandings about the income tax system when it comes to filing state returns! So, lets get some common myths about income tax in MA debunked, right from the experts at abc Payroll.

Register With The Department Of Revenue

Apart from your EIN, you also need to establish a Massachusetts withholding tax account with the Massachusetts Department of Revenue . Massachusetts asks all businesses to register online using the state’s WebFile for Business system. However, if you don’t have access to a computer, the state allows you to register by phone using its Business Telefile system. There is no fee to register your business with the DOR.

You May Like: How Much Does H& r Block Charge For Doing Taxes

How Much Payroll Tax Will I Pay

Heres a Q & A recap of your employer payroll tax responsibilities:

- Do employers have to pay taxes on employees?

- Yes

Never calculate payroll taxes again. Patriots online payroll will automatically calculate taxes so you can keep your time and money for what matters most: your small business. Start your free trial today!

This is not intended as legal advice for more information, please

What Percentage Of My Paycheck Is Withheld For Federal Tax 2021

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether youre filing as single, married jointly or married separately, or head of household.

Don’t Miss: How To Get Tax Preparer License

Summary Of Payroll Taxes

There are two types of payroll taxes: ones that come out of your own pocket, and ones that you just collect from employee paychecks and remit to the government.

Payroll taxes that come out of your pocket:

-

FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees. Review a CPAâs summary in just a 4 minute read.

-

FUTA tax: covers unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%. Get everything you need to know in a 9 minute read.

Payroll taxes that you just collect and remit:

-

Federal income taxes

-

State and local taxes

Weâll cover each of these in detail, beginning with federal income tax withholding, since itâs the most commonly asked about.

How Much Tax Is Deducted From A Paycheck In Ma

Overview of Massachusetts Taxes

| FICA and State Insurance Taxes | 7.80% |

What is the Massachusetts payroll tax rate?

- Payroll Tax Basics. Massachusetts is scheduled to begin collecting the paid family leave payroll tax on July 1, 2019. The payroll tax will be 0.63% of the first $128,400 of an employees annual earnings.

Don’t Miss: Do I Need W2 To File Taxes

States That Have A State Income Tax

Not all states have a state income tax. However, in states that do, the employee must be asked what amount to withhold from the paycheck. That amount is to be withheld by the employer and paid to the state. The income tax rate varies by state and also varies by person based on factors such as their marital status and the number of exemptions they claim.

Employees provide this information on the equivalent of a federal W-4 form, which may be called by a different name in each state. For example, South Dakota has no state income taxes, while North Dakota does and uses the Federal W-4 to track withholdings. New Jersey also has state tax withholdings and tracks them on a Form NJ-W4.

State Payroll Tax Rates

Some states have an income tax others dont. The two states that tax investment income but do not assess personal income taxes are Tennessee and New Hampshire. However, all states have state unemployment taxes.

The percentage of SUTA varies by state. Each state determines the wage base or minimum earnings required for SUTA to be deducted. Others may refer to it as unemployment insurance .

Also, the SUTA rates are affected by an employers specific unemployment history and industry. Besides, some states assign a generic new employer rate that may be higher or lower than what the employer will pay once they have been in business for a period of time, and each state determines the time frame. For example, if one employer has higher unemployment claims than another, that employer will pay a higher unemployment rate.

Here are two examples:

Read Also: Can Home Improvement Be Tax Deductible

How Your Massachusetts Llc Will Be Taxed

The profits of a Massachusetts LLC are not taxed at the business level like those of C Corporations. Instead, taxes for a Massachusetts LLC work as follows:

Employers pay payroll tax on any salaries they pay to employees.

Employees pay federal, state and payroll tax on their earnings.

Items 1, 2 and 3 are taxed as pass-through income for any LLC owners, managers or members who receive profits from the business. Any profits are reported on federal and Massachusetts personal tax returns, and thats where you will pay those taxes.

What Is The Federal Tax In Ma

5.00%The income tax rate in Massachusetts is 5.00%. That rate applies equally to all taxable income. Unlike with the federal income tax, there are no tax brackets in Massachusetts. State residents who would like to contribute more to the states coffers also have the option to pay a higher income tax rate.

Also Check: How To Look Up Employer Tax Id Number

Business Taxes For Massachusetts Llcs

Business taxes are a fact of life, and your MA LLC will need to pay a variety of taxes to both the federal and Massachusetts governments. Well cover all the main taxes in Massachusetts including self-employment, payroll, federal, Massachusetts state tax and Massachusetts sales tax. If you want to get a Massachusetts tax ID, you can acquire one by contacting the MA Department of Revenue.

If you want help with your taxes, Incfile provides a complete Business Tax Filing service.

New York Payroll Tax Rate Example

New employers pay 3.13% in SUTA for employees making more than $11,100 per year. They refer to it as the Unemployment Insurance Contribution Rate . Existing employers pay between 0.06% and 7.9%. Employers with few unemployment claims may pay nearly 10 times less than those with high unemployment claims. In New York, as in most states, it pays to reduce your turnover.

Also Check: Reverse Ein Lookup Irs

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

What Income Gets Reported To Ma

As many in New England know, Massachusetts has an income tax. In 2019 the tax rate was 5.05% but dropped to a flat 5% starting January 1st, 2020. If you live in MA, more or less all income is going to be taxable . However, some income, like Social Security or certain pensions wont be.

Similar to the Federal return, taxpayers are entitled to certain deductions from their income. Everyone receives a personal exemption of $4,400 . This is true whether you live in MA, or just work in it. The same is also true for claiming dependents and for paying into Social Security . These deductions will offset your MA income, and you dont have to live there to take advantage of them!

If you only work in MA and don’t live there, not all income is taxable to you. Generally, only the income earned in MA is taxable to Massachusetts. That means none of your investment income or interest is taxable to Massachusetts. More than that, if you split your working time between MA and NH, usually only a proportionate share of income for the time worked in MA is taxable to the state. As an easy example, if you worked 100 days total during the year and 50 were in MA and 50 in NH only half of your wages would be taxable to Massachusetts.

Recommended Reading: Turbo Tax 1099q

Massachusetts Personal Exemption Amounts

| $8,800 |

Residents of Massachusetts are also subject to a penalty if they do not have health insurance coverage, which is paid through their tax return. There is a three-month grace period for health coverage lapses, after which the penalty accumulates on a monthly basis, up to about $119 per month. The total penalty depends on income.

Massachusetts Income Tax Withholding

Massachusetts requires employers to withhold state income tax from employees’ wages and remit the amounts withheld to the Department of Revenue.

Every employer must withhold Massachusetts tax from wages paid to residents wherever earned, and from wages paid to nonresidents for services performed within the state. Employers are required to withhold under federal law are required to withhold under state law.

Also Check: Protesting Property Taxes In Harris County

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

What Other Laws Do I Need To Know About

MINIMUM WAGE

The Massachusetts minimum wage is $13.50 an hour. It will increase to $14.25 an hour on January 1, 2022.

OVERTIME

Household employers in Massachusetts must pay overtime at 1.5 times the regular rate of pay after 40 hours of work in a workweek. You must also pay overtime if your employee lives in your home.

SALARY OR HOURLY WAGES?

Your employee is entitled to minimum wage and overtime regardless of whether they are paid hourly or salary. If they are paid by salary, it is best practice to document the hours worked included in the salary amount.

PAYSTUBS

Massachusetts law requires employers to give employees an itemized paystub with every paycheck. With Poppins Payroll, you can have paystubs emailed directly to your employee every payday.

PAY PERIODS

Massachusetts household employers are required to pay employees all wages due weekly or bi-weekly. In most cases, hourly employees must be paid within 6 days of the end of the pay period. At Poppins, we comply with this requirement, even for those clients who use direct deposit.

TIME SHEETS

If your household employee works 16 or more hours a week, you must give him or her a timesheet at least every two weeks that shows the number of hours worked each day. The timesheet should be signed or acknowledged by both you and your employee. The state provides sample timesheets in English, Spanish and Portuguese.

WORKERS COMPENSATION INSURANCE

MILEAGE REIMBURSEMENT

TERMINATION WAGES

POSTING REQUIREMENTS

PAYROLL RECORDS

Don’t Miss: Plasma Donation Taxes

Key Actions For Withholding Requirements

For withholding purposes, you need to get the employee’s:

- Full name

- Total number of exemptions, and

- Any additional withholding amounts the employee requests to have withheld.

You should also withhold income from tips. Tips are considered part of an employee’s pay and must be taken into account when determining withholding. Employees must report tips from any one job totaling $20 or more in any given month to their employers by the 10th day of the following month. You should use this reported amount to calculate withholding by adding the reported tips to the employee’s pay.

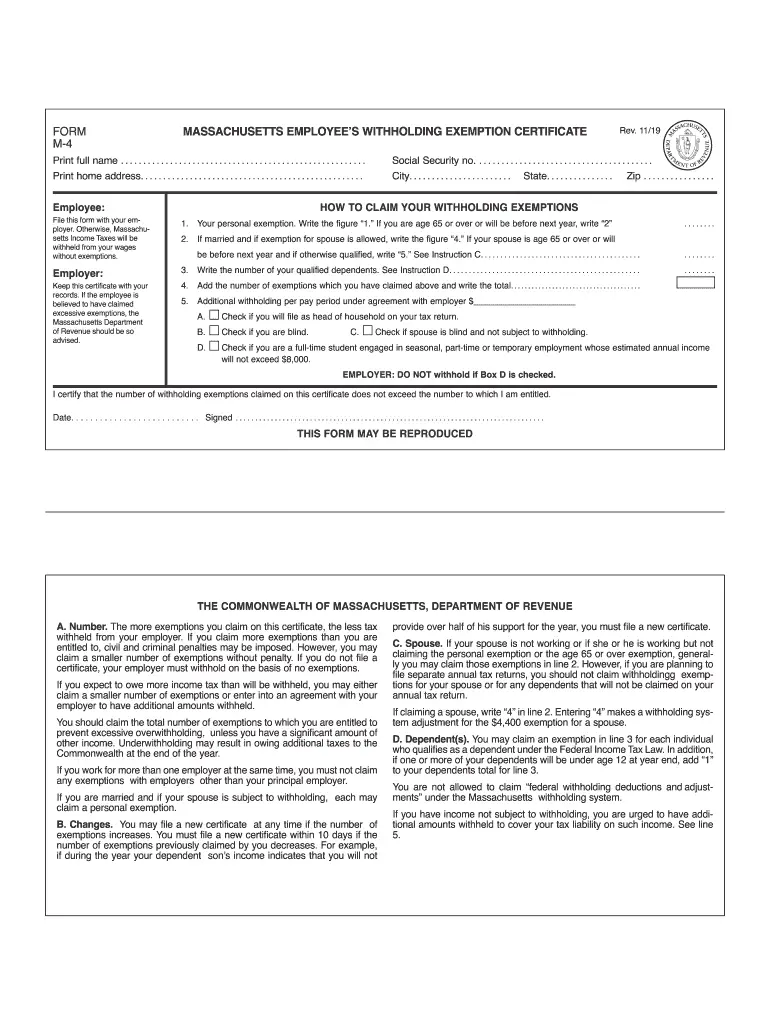

Employees must report the above-listed information on a Form M-4 – Employee’s Withholding Exemption Certificate and claim the proper number of exemptions. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases. If the number of exemptions , they need to file a new certificate within 10 days.

If an employee has more than one job, they may claim exemptions only with their principal employer. Employees who receive other income that is not withheld from can ask their principal employer to withhold extra taxes to cover the additional tax that will be due on that income.

How You Can Affect Your Massachusetts Paycheck

If you got slammed with a big tax bill last year, whether on your federal return or your Massachusetts state return, you have a couple of options to prevent it happening again. You can file a new W-4 or M-4 and request a specific dollar amount of additional withholding from each paycheck. Both forms have a line where you can write in an additional dollar amount to withhold from each paycheck. If you arent sure how much to withhold, use our paycheck calculator to find your tax liability.

If youre already living well within your budget, consider increasing your contributions to tax-advantaged accounts like a 401, HSA or FSA. Your contributions will come out of your earnings before payroll taxes are applied. If your company has an HR department, you can schedule a meeting to discuss your options. You may also be able to shelter money from taxes by enrolling in a commuter benefits program or by authorizing payroll deductions for contributions to a 529 college savings plan.

For those looking to move to Massachusetts, our Massachusetts mortgage guide is a good place to learn about getting a mortgage in the Bay State. It lays out the important information about rates and the different kinds of loans you will be deciding between.

Recommended Reading: How To Buy Tax Lien Certificates In California

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

Also Check: How To Correct State Tax Return