What Is The Penalty For Filing Ohio Income Tax Late

Like with federal and most state tax returns, at least initially, the penalty for failure to file your Ohio Income Tax Return is greater than the penalty for failure to pay. This is why it is extremely important to file or file an extension, even if you cannot afford to pay. You will still owe interest on the amount of taxes that are past due, if you did not pay them by the tax deadline. However, filing your tax return or an extension by the deadline will help you avoid the penalty for failure to file. Also, filing an extension may help you avoid the interest for failing to pay your Ohio Income Tax by the deadline, if you paid 90% or more by the deadline. Typically, the tax deadline is April 15th, but the date can differ, if it falls on a weekend or holiday.

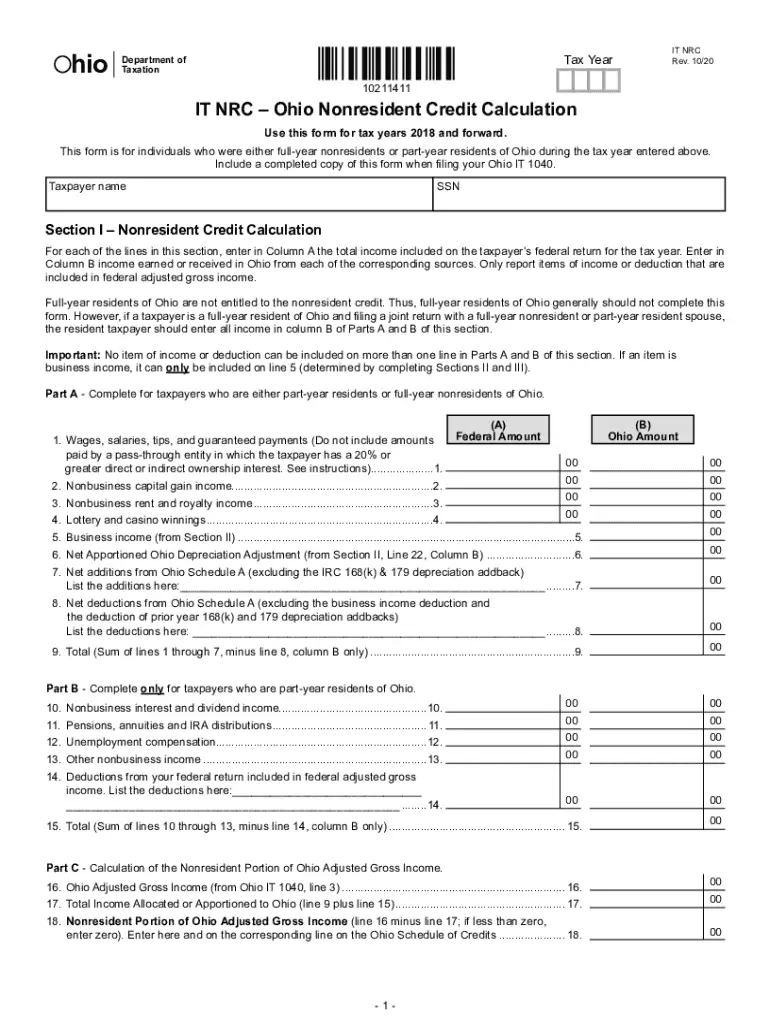

Do I Need To File A Non

Yes, you have to file an OHio state return because you have OHio source income. You do not have to file a City return. You cannot get any local withholding refunded.

Who Must File an Ohio Income TaxReturn?

Every Ohio resident and every part-yearresident is subject to the Ohio income tax.Every nonresident having Ohio-sourcedincome must also file.

Examples of Ohio sourced income include the following:

- Wages or other compensation earned inOhio

- Ohio lottery winnings

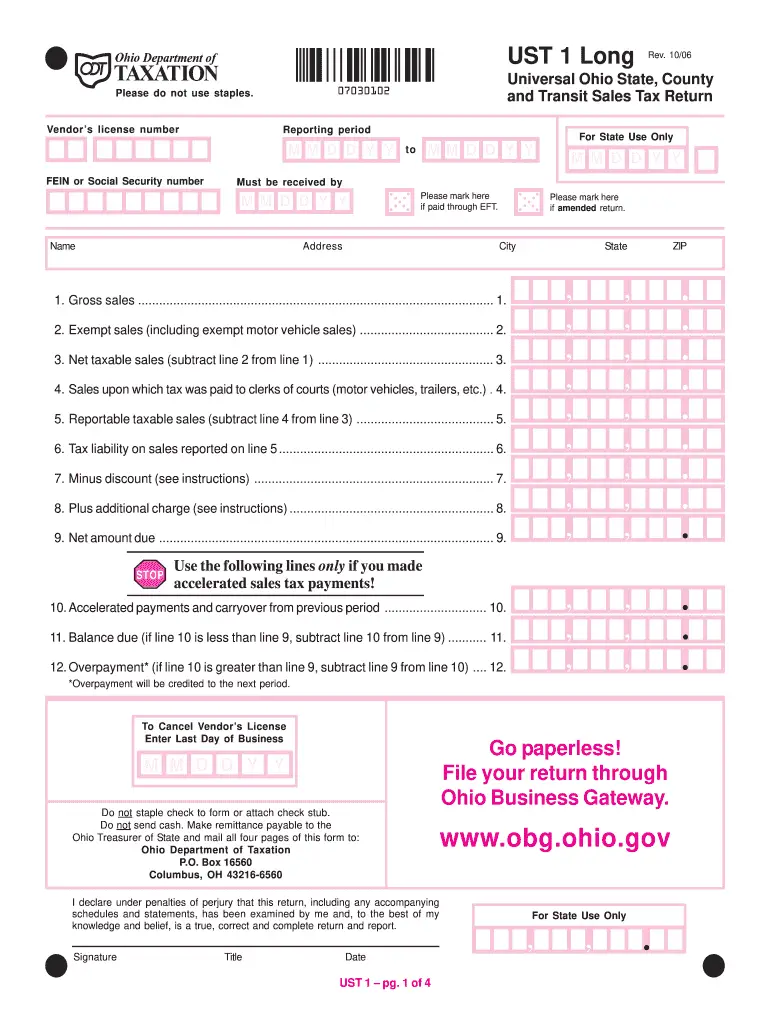

S To Manually Filing A Sales Tax Return In Ohio

Start by opening the Ohio Business Gateway link and logging in.

On this screen, click Ohio Taxation Sales and Use Tax and then, from the drop down, click File/Pay Sales Tax Return You may be asked to acknowledge recent sales tax changes. If so, just click Acknowledge next to each tax change, and then Next.

On the next page, click the Data Entry option to manually file your Ohio sales tax return, then click Next.

On this screen, enter your Ohio vendor license/account number in the field at the top. Then choose All counties. . Click Next.

On this page, choose the following:

- your Account Number from the drop down

- the period for which you wish to file

- whether you are filing an original or amended return

On the next page, youll find a list of all of the counties in Ohio. From there, use your TaxJar Ohio state report to fill in the amount Taxed Sales and Tax Collected from buyers in each county.

When filled out, it will look like this:

On the next page, follow the steps to pay your balance owed to the state.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What To Do If You Made More Than $72000

If your gross annual income was more than $72,000 in 2020, there is another free program that you can access through the IRS, but it requires you to prepare your taxes yourself.

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the IRS or print out and mail to the agency.

Unlike other programs, Free Fillable Forms doesn’t give you any guidance or step-by-step instruction it only does basic calculations of the numbers you put into the forms. It’s also only available for federal taxes though people in certain states can access local programs to file their state returns.

Still, if you have the time and are comfortable preparing your own taxes, the Free Fillable Forms program is a good option. You won’t be able to do much preparation in advance, however the program opens on Feb. 12.

Read Also: Efstatus Taxactcom

Ohio Penalty For Failure To File

To avoid this penalty, even if you cannot pay your Ohio Income Tax balance, it is important you either file your Ohio Income Tax Return or a federal extension by the tax deadline.

If you fail to file your Ohio Income Tax Return or federal extension by the tax deadline, a failure to file penalty of the greater of $50 per month up to a maximum of $500, or 5% per month up to a maximum of 50% of the tax, may be charged. To avoid this penalty, even if you cannot pay your Ohio Income Tax balance, it is important you either file your Ohio Income Tax Return or a federal extension by the tax deadline.

Who Needs To File Tax Forms

Anyone receiving payments from a U.S. source, whether they are U.S. residents or internationals are subject to U.S. taxation. There are specific regulations and processes required for determining the tax withholdings for international persons. In certain situations, there could be a tax treaty that may exist to exempt an international person from taxes or there may be regulations that allow a reduction in taxes. Visit the Office of Business and Finance’s page on Nonresident Alien Taxation to learn more.

The Ohio State University uses a secure online international tax compliance software called GLACIER. Glacier captures the information required to determine the actual tax status of an international person. All international persons who are not U.S. Residents and who are receiving payments from The Ohio State University are required to have a GLACIER record. Therefore, a GLACIER record is required even if an international employee, student, scholar or visitor meets the definition of a Resident Alien for Tax Purposes. Once the university determines that you are a nonresident alien, you will receive an email to your Ohio State email address directing you to the GLACIER website with a username and password for entry.

For questions related to filing taxes, contact .

Read Also: Appeal Property Tax Cook County

How Can I File An Ohio State Tax Return

You have multiple options for filing and paying your Ohio state tax.

- E-file and pay via the Ohio Department of Taxations I-File system. Youll need to create an account.

- Pay with a credit card or electronic check with the Ohio ePayment system.

- E-file through an approved software provider, like .

- including Ohio IT-1040 EZ or IT-1040, Ohios equivalent of the federal 1040 through the Ohio Department of Taxation website and mail a paper return.

If youre mailing a paper return, where you send it depends on which form you use and whether youre making a payment or not.

- IT-1040 EZ without payment: Ohio Department of Taxation, P.O. Box 182294, Columbus, OH 43218-2294.

- IT-1040 EZ with payment: Ohio Department of Taxation, P.O. Box 182850, Columbus, OH 43218-2850.

- IT-1040 without payment: Ohio Department of Taxation, P.O. Box 2679, Columbus, OH 43270-2679.

- IT-1040 with payment: Ohio Department of Taxation, P.O. Box 2057, Columbus, OH 43270-2057.

What Federal Tax Forms Should Be Filed

Most international students and J-1 scholars should file a special tax form along with Form 8843. If a tax treaty exemption is being claimed, form 8233 must also be submitted. These are the tax forms for non-residents.

International students who have been in the U.S. in F-1 or J-1 status for more than five years should review IRS publications to determine if they should instead file form 1040 or 1040-EZ. J-1 scholars who have been in the U.S. in J-1 status for more than two years should review IRS publications to determine if they should instead file form 1040 or 1040 EZ.

H-1B, TN or 0-1 status holders who have been in the United States for more than 183 days also should review IRS publications to see if they should file resident rather than non-resident tax forms.

Don’t Miss: Efstatus.taxact.com.

Tax Time: Free Tax Prep And Financial Resources

If individuals and families are to obtain long-term financial independence, they need tools and resources to help them maximize their income and build assets.

Recognizing the EITCs potential benefit to individuals, families and communities, United Way of Central Ohio partnered with Columbus City Council and the Franklin County commissioners to launch the Franklin County EITC Coalitionnow Tax Timein October 2006.

Each year, Tax Time supports free tax assistance sites throughout Columbus between January and April. In 2013, 47 sites prepared 14,530 tax returns, resulting in $14.8 million dollars in refunds and savings of more than $3.6 million to taxpayers who may have otherwise used a paid tax preparer.

Tax Time works collaboratively to maximize community resources that promote economic self-sufficiency. The program raises awareness of the EITC, provides access to free, high-quality tax assistance and connects people to a network of services, including financial education opportunities that help them plan for their future.

Tax Times lead partners include AARP, HandsOn Central Ohio, Legal Aid Society of Columbus, The Ohio Benefit Bank , and United Way of Central Ohio. For more information, go to

Contact A Tax Time Partner For Reliable Banking Solutions

PNC BankSet up direct deposit for your paycheck or government benefit payments and get access to your money right away. Its easy to complete PNCs Direct Deposit Form . PNC SmartAccess makes it easy to add, access and manage your money. You can track your balance and spending when and how you want to. Contact us today for support in account set up with direct deposit of your tax refund!

PNC Contact information: Elizabeth Vanditta, Organizational Financial Wellness, Financial Sales ConsultantNMLS: 1774406 Phone: 216-222-5544 Email:

Park National BankFinancial Confidence Program: Being healthy financially starts with understanding and practicing a few basic fundamentals. Park National Banks education and guidance services help people look at their personal situations and learn about options and ideas for improvement. Park bankers are friendly and respectful professionals who help people reach their personal goals, however big or small. These simple conversations are free and available in every office.

Personal Checking Accounts: We believe banking should be simple. Our Priority Series offers four personal checking accounts, each has its perks. Just decide how much of the good stuff you want. Debit cards, overdraft protection whatever you need, we have the right choice for you. Use the Account MatchUp tool on our website to see which account fits you just right! You can open your account online or visit any office and a banker will be happy to take care of you.

Read Also: Where’s My Refund Ga State Taxes

Or You Can Use Independent Computer Software Products

You can file both your Maryland and federal tax returns online using approved software on your personal computer. To use this method, you’ll need to know the correct county abbreviation for the Maryland county in which you live. You may need to enter the correct subdivision code for the city in Maryland in which you live.

Deducting Ohio Income Taxes

If you pay Ohio income tax, the IRS allows you to claim a deduction on your federal tax return for them. You can claim a state income tax deduction if you itemize deductions on your federal return.

To determine if you should itemize your deductions, add up your calendar-year deductible expenses, including your state income tax expense, to see if the total is greater than the standard deduction amount for your filing status. If you are single you can claim a standard deduction of $12,400. So, if you pay more than $12,400 in state income taxes and other itemized deductions, then consider itemizing your taxes.

Due to the Tax Cuts and Jobs Act, state and local tax deductions, including state income taxes, are limited to $10,000 per year .

Read Also: Pastyeartax Reviews

Business Return General Information

Most businesses in Ohio are subject to the Commercial Activities Tax with, depending on the circumstances, quarterly, semi-annual, and annual filing and payment deadlines. This tax is filed and remitted exclusively online through the Ohio Business Gateway.

Pass-through entities, such as S Corporations, Partnerships, or LLCs treated as an S Corporation or Partnership, are subject to a withholding tax and to an entity tax based upon each qualifying investors share of the qualifying pass-through entitys profits apportioned to Ohio. There are exceptions, however. See the Form IT 1140 instructions for details.

Due Dates for Ohio Business Returns

Pass-through entities – April 15, or the 15th day of the fourth month after the end of the fiscal year.

Fiduciary – April 15, or same as IRS

Returns on Extension

An entity that receives an extension for filing its federal income tax return automatically receives an extension for filing the corresponding Ohio tax return to the same due date, provided that the federal extension due date is beyond the unextended due date for the corresponding Ohio return. An extension of time to file does not give the entity an extension of time to pay. To indicate that a Federal extension has been granted, in the main menu of the pass-through or fiduciary return select Heading Information > Federal Extension was granted?.

Deadlines for returns on extension:

Amended Business Returns

Mailing Addresses

Ways To File Your State Income Tax Online For Free

It isnt too difficult to find a place to file your federal tax return for free, but finding a service to file your state return for free is another story.

So if you are asking where can I file my state taxes for free? you are in for good news!

I did a little digging and found a few options to consider . . . .

Recommended Reading: How Do I Amend My State Tax Return

Free Tax Return Preparation For Qualifying Taxpayers

The IRS’s Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $57,000 or less

- Persons with disabilities and

- Limited English-speaking taxpayers

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

While the IRS manages the VITA and TCE programs, the VITA/TCE sites are operated by IRS partners and staffed by volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

How To File An Ohio Sales Tax Return

Ohio doesnt make it easy to file sales tax returns, which is why we created TaxJar. TaxJars state reports simplify the process of filing a return and can save you hours spent on managing sales tax. We wrote this post as a step-by-step guide for using TaxJars report to fill in the info you need to file your Ohio sales tax return.

If youd rather not spend time filing a Ohio sales tax return ever again, enroll in TaxJar AutoFile and let us handle it. Never worry about missing a due dates or remember your state login and password again! Learn how TaxJar AutoFile can solve your sales tax headaches.

Read Also: How Can I Make Payments For My Taxes

Ohio State Tax Instructions

How to fill out 2020 Form 1040 Tax Return line by line…

How to file your Federal and State Taxes Online for…

How to Fill 2020 Form 1040 – Instructions for Stimulus…

New 2020 Federal and State Tax Filing Dates -…

Need Help Filing Your 2020 Federal and State Tax…

2020 Tax Changes – Individual Income Taxes 2020…

Ohio State Tax Payments

Ohio has many income tax payment options. Find the option that works best for you below.

Pay with an Electronic Funds Transfer

You can use this payment option when you e-file with us.

Pay with a Credit or Debit Card

Visit Official Payments

Due by May 17, 2021

Pay by Mail

Send Form IT 40P and/or Form SD 40P with a check or money order to the address listed on the form

Due by May 17, 2021

Don’t Miss: Www.1040paytax.com Official Site

What If You Are Owed A Refund

The Ohio penalty for failure to file and interest charged for failure to pay is based on you having a tax liability. If you do not owe taxes, for example, you have paid your Ohio Income Tax in full by the deadline or you are owed a refund from Ohio, the penalty for failure to file and interest for failure to pay will not apply. However, one of the worst things to happen is to think you are owed a refund only to find out in addition to owing taxes, you now owe penalties and interest as well.

To avoid this situation and delinquency billings, even if you do not owe Ohio Income Tax, Ohio Department of Taxation recommends you file an Ohio Income Tax Return, if your federal adjusted gross income is greater than $13,200. Also, if you are owed a refund, you have a limited amount of time to claim it.