You May Have Dreamed Of A Tax

Are Social Security benefits taxable? You can bet your bottom dollar they are at least by the federal government, which taxes up to 85% of your benefits, depending on your income. But what about state taxes on Social Security? Unfortunately, a dozen states can tack on additional taxes of their own.

States have different ways of taxing Social Security, too. For example, New Mexico treats Social Security benefits the same way as the feds. But other states tax Social Security benefits only if income exceeds a specified threshold amount. For example, Missouri taxes Social Security benefits only if your income tops $85,000, or $100,000 for married couples. Then there’s Utah, which includes Social Security benefits in taxable income, but starting in 2021 allows a tax credit for a portion of the benefits subject to tax. Other states have different methods of taxing your Social Security check.

The state-by-state guide to taxes on retirees is updated annually based on information from state tax departments, the Tax Foundation, and the U.S. Census Bureau. Income tax rates and thresholds are for the 2021 tax year unless otherwise noted.

1 of 12

What Is Social Security Tax Rate

How do you calculate taxable social security?

- Social Security is calculated by multiplying an employees taxable wages by 6.2%. For example, if an employees taxable wages are $600 this week: There is a wage base limit for Social Security. For example, in the year 2019, this tax is calculated only on the first $132,900 that is earned.

The Social Security Tax Wage Base

All wages and self-employment income up to the Social Security wage base are subject to the 12.4% Social Security tax. The wage base is adjusted periodically to keep pace with inflation. It was increased from $132,900 to $137,700 in 2020 and to $142,800 for 2021. Here’s how it broke down year by year from 2012 to 2021:

| Social Security Wage Base by Year |

|---|

| 2021 |

Also Check: Do You Have To Pay Taxes On Plasma Donations

Wage Base For Social Security Taxes

For 2022, the Social Security portion of FICA and self-employment taxes will apply to the first $147,000 of wages . Technically, this is the old age, survivors, and disability insurance tax. The same dollar amount also applies for the Social Security portion of self-employment taxes. The Medicare portion will apply to all wages and net earnings from self-employment, without limitation. The tax rate on employees and employers remains unchanged at 6.2% for the Social Security portion and 1.45% for the Medicare portion . The tax rate on self-employed individuals is 12.4% for the Social Security portion and 2.9% for the Medicare portion . Only 92.35% of net earnings from self-employment are subject to self-employment tax. Self-employed individuals may deduct one-half of their tax as an adjustment to gross income ).

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay federal income tax, then you will also need to withhold taxes from your monthly income.

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V . The form only has only seven lines. You will need to enter your personal information and then choose how much to withhold from your benefits. The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit. After you fill out the form, mail it to your closest Social Security Administration office or drop it off in person.

If you prefer to pay more exact withholding payments, you can choose to file estimated tax payments instead of having the SSA withhold taxes. Estimated payments are tax payments that you make each quarter on income that an employer is not required to withhold tax from. So if you ever earned income from self-employment, you may already be familiar with estimated payments.

In general, its easier for retirees to have the SSA withhold taxes. Estimated taxes are a bit more complicated and will simply require you to do more work throughout the year. However, you should make the decision based on your personal situation. At any time you can also switch strategies by asking the the SSA to stop withholding taxes.

You May Like: How Can I Make Payments For My Taxes

The Tax Is Also Subject To An Income Cap

The Old-Age, Survivors and Disability Insurance program taxmore commonly called the Social Security taxis calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

For 2021, the Social Security tax rate for both employees and employers is 6.2% of employee compensation, for a total of 12.4%. Those who are self-employed are liable for the full 12.4%.

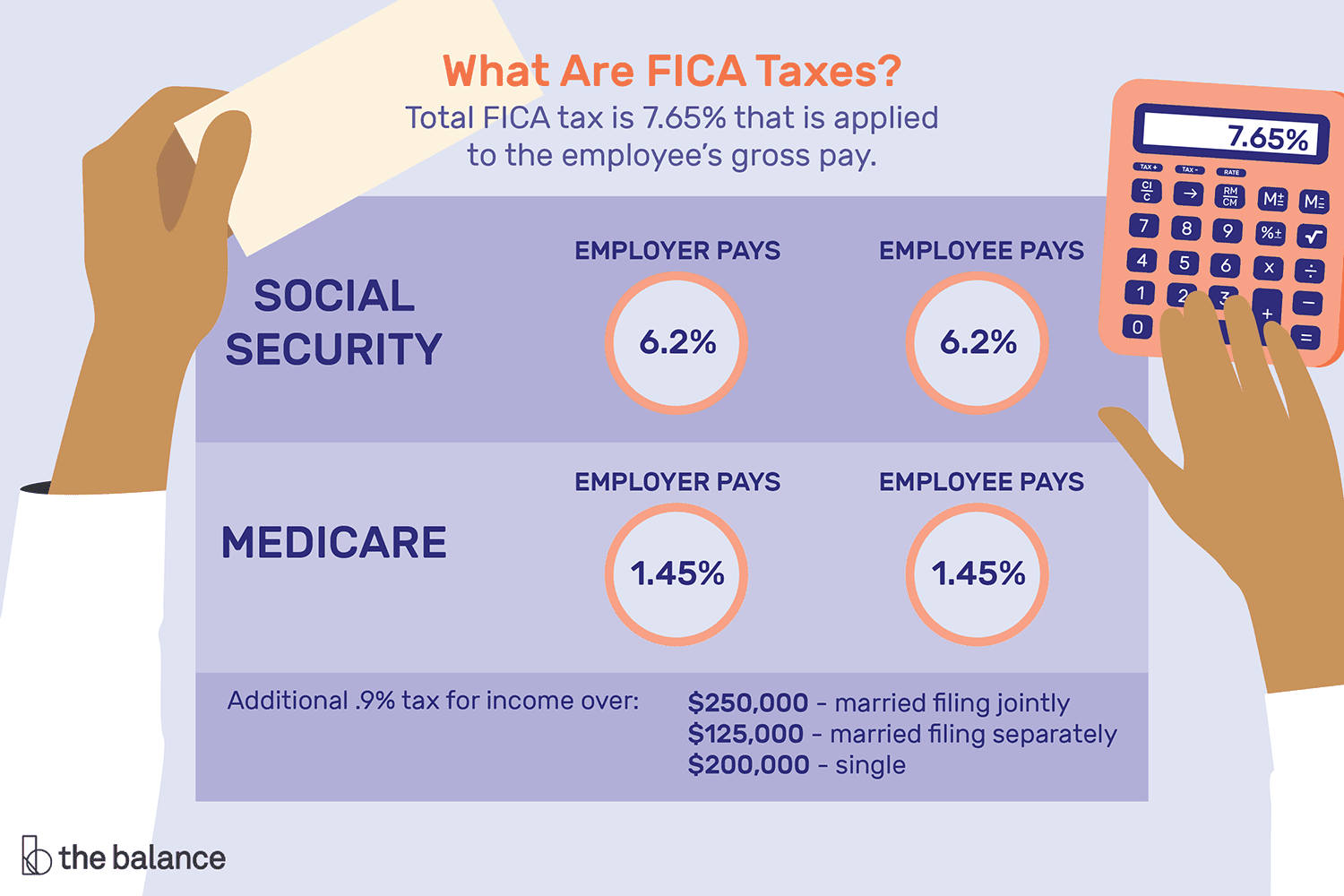

The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act . On your pay statement, Social Security taxes are referred to as OASDI, and Medicare is shown as Fed Med/EE. Both Social Security and Medicare are federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

A Higher Wage Cap For Social Security Tax Purposes

Workers don’t pay Social Security taxes on all of their earnings. Each year, there’s a wage cap put into place that determines how much income gets taxed.

In 2021, earnings of up to $142,800 are subject to Social Security taxes. Come next year, that wage cap will increase to $147,000. Lower earners won’t be impacted by this change, but higher earners could lose more of their income to Social Security.

Don’t Miss: Is Donating Plasma Taxable Income

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65 and Notice 2021-11 for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

Recommended Reading: Efstatus.taxact 2014

Raising Or Eliminating The Tax Cap

Raising or even eliminating the cap on taxable wages would mitigate the erosion of the Social Security tax base. Rising inequality, driven by rapid wage growth among the highest earners, means a greater proportion of wages are above Social Securitys tax cap.

There is precedent for either approach. Policymakers have raised the Social Security payroll tax cap many times, and they eliminated the Medicare payroll tax cap in 1994. Two prominent deficit-reduction committees have proposed raising the tax cap so that it covers 90 percent of all earnings and then pegging it to that level in the future. Others have proposed eliminating the tax cap altogether.

Changes to the tax cap would affect only the highest-earning workers. In any given year, about 6 percent of workers earn more than the current tax cap. Over a lifetime, 20 percent of workers earn more than the tax cap for at least one year. Most of these workers have high lifetime earnings and thus also receive relatively high Social Security benefits. Raising the payroll tax cap to fund Social Security benefits is broadly popular, even among the highest earners about half of millionaires support raising the cap.

Raising the tax cap could affect Social Security benefits as well, as policymakers would face a choice about how to account for any newly taxed earnings specifically, whether and how to include them as part of the average indexed monthly earnings, or AIME, used to calculate benefits. There are three options here:

Is Social Security Taxed At 85%

Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income. For purposes of determining how the Internal Revenue Service treats your Social Security payments, income means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

You May Like: How To Buy Tax Lien Properties In California

Employer Social Security Tax Rates

- Go to bottom of page

- Employer Social Security Tax Rates

The employer social security rates tax table provides a view of tax rates around the world.

Data is also available for: corporate tax rates,indirect tax rates,individual income and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country, jurisdiction or region.

How Much Social Security Tax Do I Have To Pay To Collect Retirement Benefits

Every year you work and pay into social security, you can earn up to four Social Security credits based on your income. For every $1,130 you earn in 2012, you will earn one Social Security credit. Once you have accumulated 40 credits, or ten years worth of work, you become eligible to collect Social Security benefits upon your retirement.

While earning Social Security credits qualify you to collect benefits when you retire, the amount of money you will receive every month depends on how much Social Security tax youve paid in. Your monthly benefit amount is based on the wages you earned in the ten highest-earning years over the course of your career, as well as the age at which you decide to start collecting Social Security.

Don’t Miss: Taxes For Doordash

State Taxes On Social Security Benefits

Everything weve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes.

There are 13 states that collect taxes on at least some Social Security income. Four of those states follow the same taxation rules as the federal government. So if you live in one of those four states then you will pay the states regular income tax rates on all of your taxable benefits .

The other nine states also follow the federal rules but offer deductions or exemptions based on your age or income. So in those nine states, you likely wont pay tax on the full taxable amount.

The other 37 states do not tax Social Security income.

| State Taxes on Social Security Benefits | |

| Taxed According to Federal Rules | Minnesota, North Dakota, Vermont, West Virginia |

| Partially Taxed | Colorado, Connecticut, Kansas, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah |

| No State Tax on Social Security Benefits | Alabama, Alaska, Arizona, Arkansas, California, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, Wisconsin, Wyoming |

History Of Social Security Tax Limits

The Social Security tax rate rarely changesemployees have been paying 6.2% since 1990. However, unlike the tax rate, the Social Security tax limit is adjusted annually.

The federal government increased the Social Security tax limit in nine of the past 10 years. The largest increases were in 2020 and 2021, when the limit increased by 3.6% and 3.7%, respectively.

Don’t Miss: Mcl 206.707

New Hampshire And Tennessee

Of the nine states on this list, seven of them dont levy any personal income tax at all. New Hampshire and Tennessee dont tax wages. They do, however, tax investment income and interest. Those taxes are set to disappear soon but, for now, residents should consider them a component of their financial planning.

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Also Check: How To Get Tax Preparer License

The Tax Rate On Social Security For Most People: 0%

For the majority of taxpayers, Social Security benefits end up being free of tax. Thats because youre allowed to have up to a certain amount of income before you have to include any of your Social Security on your tax return.

Specifically, start by taking your income from other sources wages and salaries, interest and dividend income, and distributions from pension plans, for example and then add in half of your Social Security benefits for the year. That gives you your countable income, and if its less than $25,000 for singles or $32,000 for joint filers, then congratulations! Your tax rate is 0%.

Recommended Reading: When Do We Start Filing Taxes 2021

When To Claim Your Social Security Limit 2021 Benefits

Even if youve earned your 40 credits, you cant begin collecting retirement benefits until youre 62 years old or older, and the longer you wait, the larger the payment will be.

If you wait until you reach your full retirement age, which is 67 if you were born in 1960 or later and is decided by the Social Security Administration, youll receive your primary benefit amount, which is the entire monthly benefit youre entitled to based on your earnings record.

Your monthly payment would be smaller if you applied for Social Security benefits sooner rather than later.

If your full retirement age is 67 and you choose to claim benefits at 62, you will only receive 70% of your primary insurance coverage.

However, if you collect at 65, you would receive 86.7 percent of your monthly benefit. If you wait past your full retirement age, you can receive delayed retirement credits.

Your eventual payout will grow by 8% for every year you wait to claim Social Security benefits. However, because we cap your benefits at age 70, theres no reason to wait any longer.

If youre getting Social Security disability benefits when you reach full retirement age, your disability benefits will convert to retirement benefits automatically, but the amount wont change.

You May Like: How To Buy Tax Liens In California

Also Check: How To Buy Tax Lien Certificates In California

What You Need To Know About The Social Security Tax Rate And Limit

If you earned more than $147,700 in 2021, you wont have to pay any tax on the income above this limit. The Social Security Wage Base means that youll only ever pay Social Security taxes on $147,700 and nothing else. You cant pay more than $18,228 in taxes for Social Security in 2021.

Be aware that this doesnt apply to the 1.45% Medicare tax. Youll have to pay Medicare taxes on every dollar you earn.

If you earn more than $200,000, or $250,000 as a married couple but filing jointly, youll need to pay an Additional Medicare Tax, which brings the total percentage to 2.35%.

Social Security And Fica

Most employees and employers each pay Social Security and Medicare taxes on Social Security and Medicare covered wages. These taxes comprise FICA .

Social Security Portion of FICA

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. Visit Social Security Administration site to learn more about your Social Security Contribution and Benefit Base.

Medicare Portion of FICA

- The Medicare portion of FICA is 1.45% for wages up to 200,000 and 2.35% for wages above $200,000.

- There is no cap on wages for the Medicare portion of FICA.

FICA Refunds

Find out about FICA Refunds as a result of the Doctors Council v. NYCERS court decision.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Just Started Collecting Social Security Heres How To Know Whether Youll Owe Taxes On It

Roughly 1 in every 2 older adults will pay federal income taxes on a portion of their Social Security benefits for the 2020 tax year.

To be sure, this usually happens only if you have other substantial income in addition to your Social Security benefits, such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return, according to Uncle Sam.

Applying Tax Brackets To Social Security Income

It’s impossible to come up with a single rule that will cover every situation involving income taxes and Social Security benefits. However, you can come up with some general observations that can provide some color to the question. For instance:

- The highest rate that you’ll pay in federal income taxes on your benefits is 31.45%. That rate applies if you’re in the top 37% income tax bracket, and the maximum 85% of benefits gets included as taxable income.

- It’s common for seniors who have incomes that are not too far above the thresholds to be in the 12% tax bracket. So that would work out to a 6% tax rate if 50% of your benefits is subject to tax, or a 10.2% tax rate if 85% of your benefits gets taxed.

- Those with incomes in between can expect to have the majority of their benefits subject to tax. That assumption produces tax rates that range from 11% for those in the 22% bracket who have half their Social Security subject to tax, to 29.75% for those in the 35% bracket with 85% of their benefits taxed.

Those numbers are rarely going to be exactly the same for you, but they should give you a sense of where you’re likely to land in your own tax situation.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations