Essential Tax Forms For The Affordable Care Act

OVERVIEW

The Affordable Care Act , also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Where To Mail Form 8962

If youre filling out a paper tax return and mailing your forms to the IRS, you include Form 8962 with your Form 1040. You then mail your forms to the IRS regional office that covers your state of residence. The IRS offers a helpful table that breaks down where to send your Form 1040 and any accompanying forms, such as Form 8962, on its website.

Who Fills Out Form 8962

You need to obtain a copy of the Form 1095-A from the person who enrolled the individual. If you are claimed as a dependent on another person’s tax return, the person who claims you will file Form 8962 to take the PTC and, if necessary, repay excess APTC for your coverage. You do not need to file Form 8962.

You May Like: Where Is My State Tax Refund Ga

How To Reconcile Your Premium Tax Credit

If you had a Marketplace plan and used advance payments of the premium tax credit to lower your monthly payment, youll have to reconcile when you file your federal taxes. This means youll compare 2 figures:

-

The amount of premium tax credit you used in advance during the year.

-

The premium tax credit you actually qualify for based on your final income for the year.

Any difference between the two figures will affect your refund or tax owed.

- You should get your Form 1095-A in the mail by mid-February. It may be available in your HealthCare.gov account as soon as mid-January. If you don’t get it, or it’s incorrect, contact the Marketplace Call Center. See how to be sure the information is correct.

What Are The Income Limits For Premium Tax Credit

Income Criteria To be eligible for the premium tax credit, your household income must be at least 100 but no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable federal poverty line.

You May Like: Oregon Tax Preparer License Renewal

Handy Tips For Filling Out 8962 Form 2019 Online

Printing and scanning is no longer the best way to manage documents. Go digital and save time with signNow, the best solution for electronic signatures. Use its powerful functionality with a simple-to-use intuitive interface to fill out 2019 Form 8962 for 2019 online, eSign them, and quickly share them without jumping tabs. Follow our step-by-step guide on how to do paperwork without the paper.

Premium Tax Credit Form 8962 And Instructions

Here are the current Premium Tax Credit forms and official IRS instructions. See below for our simplified breakdown of form 8962.

8962 IRS forms:

Other IRS forms related to the PTC forms can be found here.

NOTE: You may also need to file additional 1040 forms, like a Schedule 2 , due to the way the 1040 was changed for the 2018 tax year forward.

TIP: The above forms are all you need for your taxes as they related to marketplace tax credits taken in advance. The information below is just about offering extra insight.

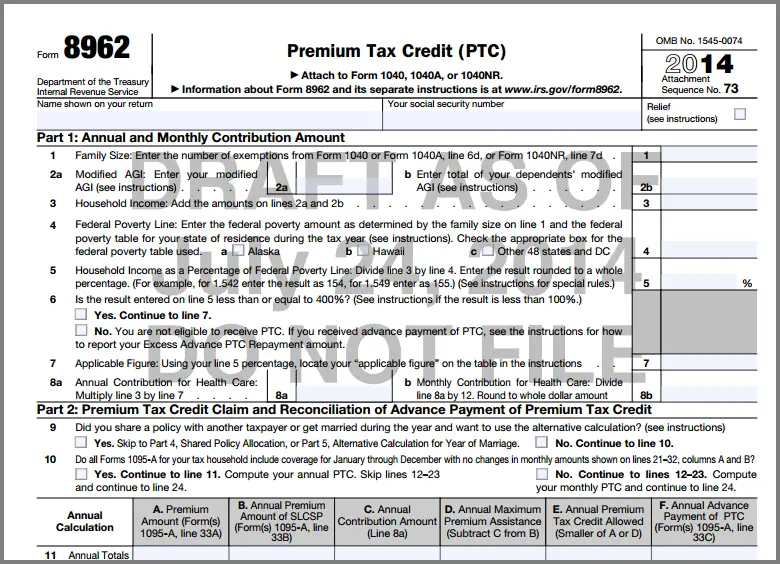

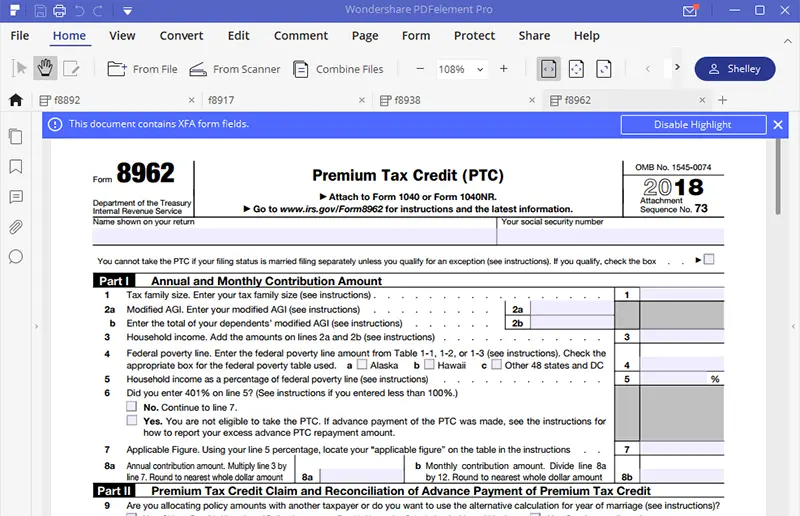

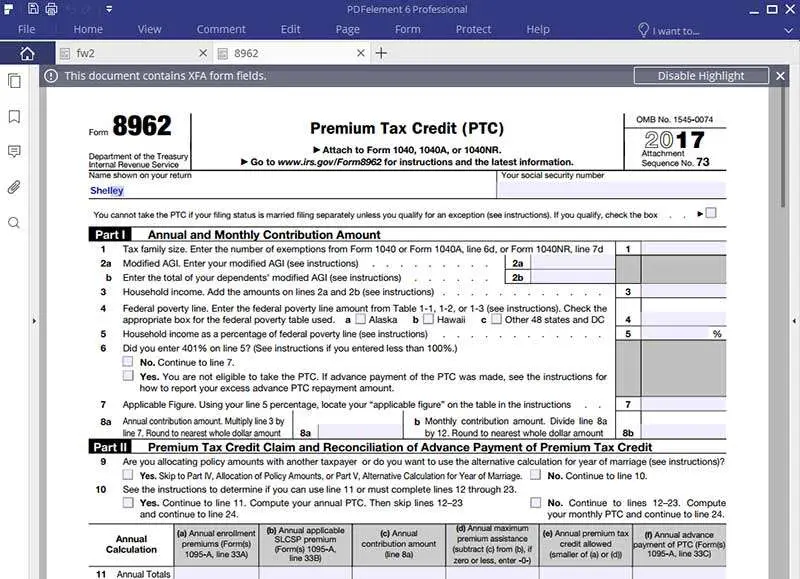

This is an example of what the 8962 form looks like. Some specifics change each year, but the general layout will be recognizable in any year.

Don’t Miss: How Can I Make Payments For My Taxes

The Way To Generate An Esignature For A Pdf Document On Android Devices

In order to add an electronic signature to a form 8962 instructions, follow the step-by-step instructions below:

If you want to share the 8962 instructions with other people, you can easily send it by electronic mail. With signNow, you can eSign as many documents in a day as you require at a reasonable cost. Begin automating your eSignature workflows today.

Quick Steps To Complete And Esign 8962 Instructions Online:

We understand how stressing filling in documents can be. Get access to a HIPAA and GDPR compliant service for maximum simpleness. Use signNow to electronically sign and share 2018 form 8962 instructions for collecting eSignatures.

Create this form in 5 minutes or less

You May Like: Can You File Missouri State Taxes Online

What Is Form 8: Premium Tax Credit Used For

Advance premium credits are paid directly to your health insurance plan provider, reducing your monthly premium payments. Form 8962 is used along with Form 1095-A to reconcile the difference between the amount of advanced premium tax credit you received and the amount of premium tax credit youre eligible to receive, which is based on your income for the year.

This calculation matters because it determines whether or not you owe money to the IRS. If the amount of advanced premium tax credit received is less than the amount of the premium tax credit youre eligible to receive, then youre owed the difference. On the other hand, if the amount of advanced premium tax credit received exceeds the amount of the premium tax credit youre eligible to claim, you owe money back to the IRS. The sum you owe could either reduce the size of your overall tax refund or mean that you have to pay money to the IRS.

The American Rescue Plan Act of 2021 removes the cap on income for the advanced premium tax credit for 2021 and 2022. The act limits the premiums for these plans to 8.5% of the payers modified adjusted gross income on the top-end .

Form 8962 is also used to claim what is called “net Premium Tax Credits”. These apply to eligible individuals who can elect to pay their insurance premiums out-of-pocket throughout the year, and then claim the PTC at the end of the tax year, instead of benefitting from an APTC.

Second Lowest Cost Silver Plan

To calculate your subsidy amount correctly, youll need to know the cost of the second-lowest-cost sliver plan in your states marketplace. You can find that info your 1095a form. If you didnt get a 1095, or if you got the wrong one, you should wait until you get the right one and follow up with the Marketplace. If, however, you need to fill out the form on your own, you can use the Second Lowest Cost Silver Plan tax tool from HealthCare.Gov to help.

Recommended Reading: What Does Agi Mean In Taxes

How To Finish A Irs Form 8962

PDF editor lets you to definitely make adjustments to your Form Steps to Fill out Online 8962 IRS from any on-line linked device, personalize it in keeping with your needs, indicator it electronically and distribute in different techniques.

The Forms Needed If You Got Marketplace Tax Credits Under The Affordable Care Act

Find out how to fill out Premium Tax Credit Form 8962, the form for reporting ObamaCare Tax Credits. Well review MAGI, FPL, and Adjusting credits. The information on the 8962 Premium Tax Credit form below is updated for 2019 plans and 2020 tax filing.

IMPORTANT

NOTE: The forms for this years tax filing are featured below. New forms are posted up every year, and the links will generally update automatically. Still, always make sure to check the dates on the forms you are filing to avoid filing old forms. Please note, some of the images we used for informational purposes are from past years. Use them for reference, but make sure to refer to the official up-to-date forms from the IRS found in the links below.

You May Like: How Can I Make Payments For My Taxes

Do You Have To Pay Back The Obamacare Tax Credit

The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. … If you owe no tax, you can get the full amount of the credit as a refund.

Get A Notice Telling You To File And Reconcile 2019 Taxes

If you were enrolled in a 2020 Marketplace plan but didnt file and “reconcile” your 2019 taxes, youll get a notice saying you may lose the financial help youre getting for your 2021 plan. You may also get Letter 0012C from the IRS.

- If you havent filed your 2019 tax return or filed a return but didnt “reconcile” the premium tax credit for all household members you must do so immediately.

Your notice will provide details. If you confirm that you filed your 2019 tax return, you wont need to do anything else.

Also Check: How To Get Tax Preparer License

The Best Way To Make An Esignature For A Pdf File In Google Chrome

The guidelines below will help you create an eSignature for signing form 8962 instructions in Chrome:

Once youve finished signing your 8962 instructions, choose what you wish to do after that – download it or share the doc with other parties involved. The signNow extension provides you with a variety of features to guarantee a better signing experience.

How To Claim Your Rightful Premium Tax Credit:

In order to qualify for Advance Tax payments on your health insurance, you need to file a tax return.

Therefore, you have to submit the Form 8962, failing which makes the IRS ask and demand for your PTC information.

This is a time-consuming process and can easily be averted by being vigilant and proactive with your filing.

Additionally, you require to report a taxable income in order to receive a tax return. In case you do not have income, you can report it to be $1.

If you are looking for a tax expert to help you streamline your Form 8962, and know the correct filing and submission procedures, worry no more!

Our team of tax experts at Accounts Confidant have you covered. To know more on how we can help you in your tax filing, you can call us on our number +1-866-301-2307 and get started today!

Wrapping Up:

Form 8962 is an essential tax form that not only helps relieve the pressure of your return, but also makes affordable health insurance through the marketplace, viable to everyone. The deadline for the IRS Form 8962 for the year 2020 is 15 April 2020.

We hope that with the help of this blog, you are able to figure whether you are eligible to file the form, the specified instructions and the points of caution. If you need any further assistance, you can contact our team at Accounts Confidant today!

Read Also: How Much Does H& r Block Charge To Do Taxes

How To Generate An Esignature For The 2019 Form 8962 Premium Tax Credit Ptc On Android Os

In order to add an electronic signature to a form 8962, follow the step-by-step instructions below:

If you need to share the 2019 form 8962 with other people, you can send the file by e-mail. With signNow, it is possible to eSign as many files daily as you require at an affordable price. Begin automating your eSignature workflows right now.

Form 8962 Filling & Submission Guidelines

- you purchase your insurance on the Health Insurance Marketplace

- your income is limited to the established size

- you dont have the right to be dependent another US citizens tax return

- your employer and the government dont provide coverage.

- fill the header of the form

- fill lines 1 29

- avoid common mistakes

- behave in your particular situation.

You May Like: How Much Does H& r Block Charge To Do Taxes

The Best Way To Make An Esignature For A Pdf File Online

Follow the step-by-step instructions below to eSign your form 8962 instructions:

After that, your 8962 instructions is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a range of extra features like Add Fields, Merge Documents, Invite to Sign, and so on. And because of its cross-platform nature, signNow works well on any device, personal computer or mobile, irrespective of the operating system.

Instructions For How To Complete Irs Form 8962

The following step by step instruction given below will guide on how to complete the IRS Form 8962.

Step 1: You can get the IRS Form 8962 from the website of Department of the Treasury, Internal Revenue Service or you can simply download IRS Form 8962 here .

Step 2: Download the form and open it using PDFelement and start filling it.

Step 3: At the top of the form enter the name shown on the top of your return and your social security number.

Step 4: Begin with Part I. Enter the number of exemptions from Form 1040 or Form 1040A on line 1. Enter the amounts related to modified AGI on line 2a and 2b. To get Household income add the amounts on line 2a and 2b and enter it on line 3. Select the appropriate choice and enter the value on line 4. Enter Household income as a percentage of federal poverty line on line 5. If you entered 401% on line 5, then directly proceed to line 7 other wise select yes on line 6. Find the applicable figure and enter it on line7. On line 8, enter the Annual contribution amount by following the method shown.

Step 6: Enter the amounts on Part III. It is titled as Repayment of Excess Advance Payment of the Premium Tax Credit. On line 27, enter Excess advance payment of PTC. Enter the Repayment limitation on line 28. For line 28, enter Excess advance premium tax credit repayment.

Also Check: Do I Need W2 To File Taxes

Premium Tax Credit Claim And Reconciliation Of Advance Payment Of Premium Tax Credit

Tax Credit Amounts and Premium Amounts. To fill out a lot of the form, youll need forms 1095-A, 1095-B, or 1095-C, which show minimum essential coverage. These are sent by your insurer or employer. Not all insurers and employers are required to send forms, but if you got marketplace cost assistance, you should get this form. Youll use this to calculate premium amounts and Tax Credit amounts. Open this form as well.

Line 9. Did you Meet Certain Requirements that would affect your calculation? If you share a policy, got married, or want to use an alternative calculation due to a life circumstance, you wont use the standard calculation methods and will instead follow the alternative calculation instructions.

Line 10. Did you maintain minimum essential coverage? If you maintained coverage for each month of the year, then youll answer yes. If you are using multiple forms or had coverage gaps, you answer no. You can find this information on your 1095 forms. Many people will have short coverage gaps. Up to three months in a row is exempt. < starting in the 2019 tax year this wont matter in most states, but it still matters for 2018 since the mandate to have coverage was still in effect.

Line 11-23. Calculating APTC Owed Amounts. Youll fill out the chart of Premium amounts and assistance per month as seen below. All of this information can be found on form 1095 or will require calculations. See page 9 of the instructions for details.