What Should You Do With Your Paycheck Stub

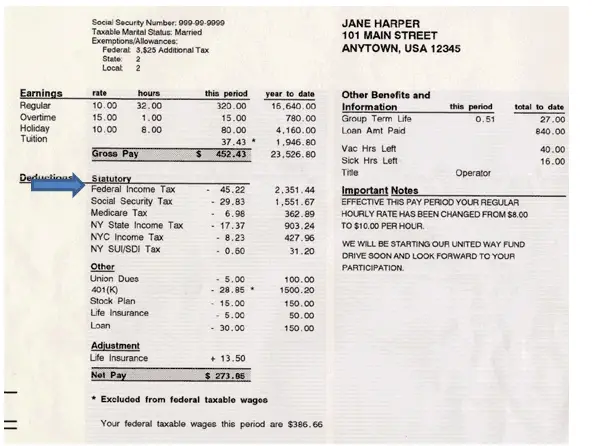

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

How Much Social Security Income Is Taxable

Not all taxpayers are required to pay federal income taxes on their Social Security benefits. Typically, only those individuals who have substantial income in addition to their Social Security benefits are required to pay federal income taxes on Social Security Benefits. If you do have to pay taxes on your Social Security benefits, you can either make quarterly estimated tax payments to the IRS or elect to have federal taxes withheld from your benefits.

How much of your Social Security income is taxable is based on your combined income. Your combined income is calculated by adding your adjusted gross income, nontaxable interest, and one-half of your Social Security benefits.

If you file your federal income taxes as a single person, and your combined incomeis between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of your benefits may be taxable. If your combined income is below $25,000, all of your Social Security income is tax-free.

If you are married and file a joint return, and you and your spouse have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits. If your combined income is more than $44,000, up to 85% of your benefits may be taxable. If your combined income is below $32,000, all of your Social Security income is tax-free.

Factors That Affect Tax Rates

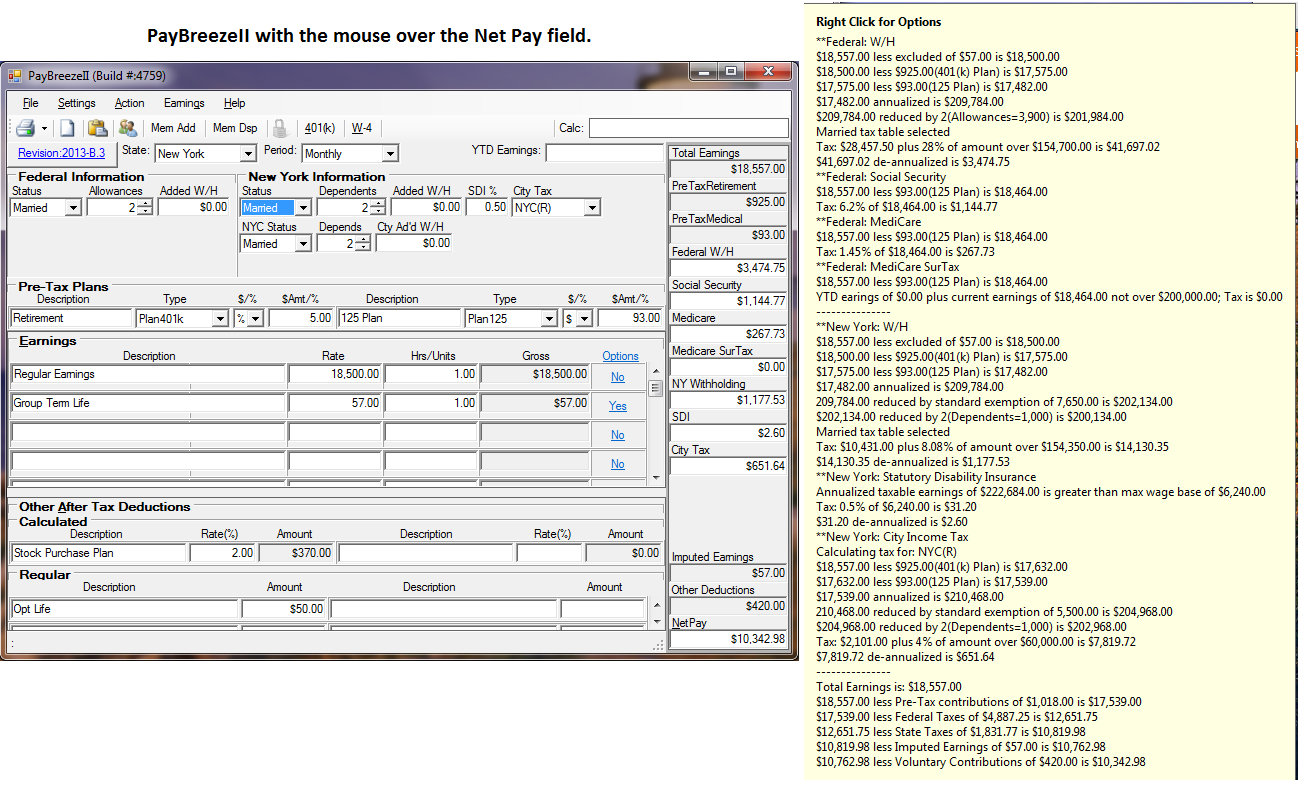

The money your employer takes out of your check is an estimate of how much taxes you owe on your earnings for the pay period. Your earnings determine the size of your payroll tax deductions. Your tax filing status and the number of withholding allowances you claim on your W-4 form also affect your payroll deductions.

Also Check: How Can I Make Payments For My Taxes

Paycheck Deductions For $1000 Paycheck

Looking at a simple example can help clarify exactly how federal tax withholding works. For a single taxpayer, a $1,000 biweekly check means an annual gross income of $26,000. If a taxpayer claims one withholding allowance, $4,150 will be withheld per year for federal income taxes. The amount withheld per paycheck is $4,150 divided by 26 paychecks, or $159.62. In each paycheck, $62 will be withheld for Social Security taxes and $14.50 for Medicare . Depending on the state where the employee resides, an additional amount may be withheld for state income tax.

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

Also Check: How To Appeal Property Taxes Cook County

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2010 | 35.00% |

When it comes to tax withholding, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information. While those hired before Jan. 1, 2020, aren’t required to complete the form, you may want to do so if you’re changing jobs or adjusting your withholdings.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

What Do I Do With My Pay Stubs

Keep your pay stubs for a year. Your employer will send you a W-2 form each year. A W-2 form says how much money you earned during the year. Your W-2 also says how much money your employer took out for taxes. When you see that your W-2 is right, you can get rid of your pay stubs for that year.

Shred your pay stubs before you throw them away. Your pay stubs might have your Social Security number on them. Someone could use that to steal your identity.

Don’t Miss: Have My Taxes Been Accepted

Six: Calculate Social Security And Medicare Deductions

You must withhold FICA taxes from employee paychecks.

Be sure you are using the correct amount of gross pay for this calculation. This article on Social Security wages explains what wages to take out for this calculation.

The calculation for FICA withholding is simple.

| FICA Taxes – Who Pays What? | |

|---|---|

| FICA Taxes | Employee Pays |

| 0.9% on gross pay over $200,000 | 0% |

Withhold half of the total from the employee’s paycheck.

For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% for a total of $114.75.

Be careful not to deduct too much Social Security tax from high-income employees, since Social Security is capped each year, with the maximum amount being set by the Social Security Administration.

You will also need to consider the additional Medicare tax deduction due by higher-income employees, which begins when the employee reaches a $200,000 in earnings for the year. The additional tax is 0.9% of the gross pay based on the employee’s W-4 status. No additional tax is due from the employer.

Most states impose income taxes on employee salaries and wages. You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority.

Your responsibilities as an employer for deducting, paying, and reporting these taxes are discussed in this article.

Workers Don’t Need To Submit A W

Workers aren’t required to file a W-4 form with their employer every year but you might want to anyway. If you’re happy with your current tax withholding, then do nothing and leave your current Form W-4 in effect with your employer. You’re not required to periodically submit a new W-4 form.

However, if you start a new job, you’ll have to complete a W-4 form at that time. That’s the only way your new employer will know how much federal income tax to withhold from your wages. There’s no way around that requirement.

You’ll also have to file a new W-4 form if you want to adjust the amount of tax your current employer withholds from your paycheck. Ideally, you want your annual withholding and your tax liability for the year to be close, so that you don’t owe a lot or get back a lot when you file your return. We recommend an annual check using the IRS’s Tax Withholding Estimator to make sure you’re on track as far as your withholding goes . If your tax withholding is off kilter, go ahead and submit a new W-4 as soon as possible. This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home.

Read Also: Www Michigan Gov Collectionseservice

Minnesota Median Household Income

| 2010 | $55,459 |

In Minnesota, your employer will deduct money to put toward your state income taxes. Like federal income taxes, Minnesota income taxes are pay-as-you-go. Money comes out of each of your paychecks throughout the year rather than you getting one giant tax bill in the spring.

As mentioned earlier, Minnesota has one of the highest top tax rates in the country. However, that top rate of 9.85% only applies to a high level of income . And because no Minnesota cities charge local income taxes, you dont have to worry about getting hit with any other rates.

Minnesota also has a tax form thats similar to the federal W-4 form, but for Minnesota taxes. Its called the W4-MN and its where you claim allowances and exemptions from state taxes. Though you won’t be able to claim allowances on the new federal W-4, workers in Minnesota can use the Form W4-MN to determine their Minnesota withholding allowances. However, you only have to give your employer a W4-MN if one of the following applies to you:

- You claim more than 10 Minnesota withholding allowances.

- You checked Box A or B under Section 2, and you expect your wages to exceed $200 per week.

- Your employer believes you aren’t entitled to the number of allowances claimed.

If you ask to have additional Minnesota withholding deducted, you can just give your employer a W-4. The Form W4-MN isnt necessary.

How Much Is Social Security Taxed At Full Retirement Age

Even if you work past full retirement age, you still have to make applicable Social Security contributions on your income. However, if you work past full retirement age, you can increase the amount of Social Security Benefits you receive.

Once you start receiving Social Security benefits, your income will determine if you pay income tax on part of your Social Security income. For more information, refer to question #2: How Much Social Security Income Is Taxable?

You May Like: How To Protest Property Taxes In Harris County

Whats A Withholding Allowance

A withholding allowance is a number that your employer uses to determine how much Federal and state income tax to withhold from your paycheck. The more allowances you claim on your Form W-4, the less income tax will be withheld from each paycheck.

The number of allowances you should claim varies. It is based on a number of factors, such as marital status, job status, earned wages, filing status, and child or dependent care expenses.

With the help of TaxAct withholding calculator, you can find the amount of your tax withholding allowances.

How Employers Withhold

When determining payroll tax rates for federal income taxes, employers use tax tables provided by the Internal Revenue Service, found in Publication 15, Employer’s Tax Guide.

Based on the employee’s filing status, how often the employer pays employees weekly, biweekly, semimonthly, monthly, quarterly, semiannual or annual their income and number of withholding allowances, the employer withholds a certain amount of money per pay period to pay the employees.

You May Like: How To Buy Tax Lien Properties In California

What Do I Do On My W

The overhaul of the W-4 form was brought on by the Tax Cuts and Jobs Act of 2017. The new W-4 form was brought into use in 2020 to accommodate the changes required by that act.

Those changes make what once was a straightforward effort to have taxes withdrawn from your paycheck a bit more complicated. But according to the IRS, the new form will reduce both the number and size of taxpayer surprises that occur due to improper withholding.

For those who prefer that less cash be taken out of their paychecks throughout the year, here’s some information about some entries in the new form that will ensure that will happen in 2021.

How Do I Sign Up For Direct Deposit

Many employers will put your paycheck into your bank or credit union account. This is called direct deposit. You do not have to pay fees to cash your check. You will get your money sooner.

Ask your employer if it has direct deposit. To sign up for direct deposit, give your employer information about your bank or credit union account.

Recommended Reading: When Do You Do Tax Returns

Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.

How Are Pensions Taxed

Pensions are fully taxable at your ordinary tax rate if you didn’t contribute anything to the pension. If you contributed after-tax dollars to your pension, then your pension payments are partially taxable. If the payments start before age 59 1/2, you may also be subject to a 10% early distribution penalty.

You May Like: How To Find Your Employer’s Ein

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, your first year of retirement you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

- You or a spouse take on part-time work.

- You pay off a mortgage or take on a mortgage.

- You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock.

- You take withdrawals from an IRA or 401 account.

- You and/or a spouse start Social Security benefits.

- You reach age 72 , and required IRA distributions begin

What Is The Federal Tax On $10000

Income Tax Calculator California

If you make $10,000 a year living in the region of California, USA, you will be taxed $885. That means that your net pay will be $9,115 per year, or $760 per month. Your average tax rate is 8.9% and your marginal tax rate is 8.9%.

You May Like: How Can I Make Payments For My Taxes

Change In Withholding When You Reach Age 72

When you reach age 72, you are required to start taking distributions from traditional IRA accounts and other qualified retirement plans like a 401. These distributions are included as taxable income on your tax return. Usually, you will want to have taxes withheld from these IRA and/or 401 distributions.

Some people take an IRA distribution or cash out an old 401 plan early in the year and forget about it by the time they file their tax return. They are surprised by the amount of taxes they owe. Don’t let this happen to you. Whenever you withdraw money from any accounts in retirement, ask about the tax implications. It is better to plan ahead than to get behind on taxes.

What Should I Do If I Haven’t Gotten Any Child Tax Credit Payments

The 2021 advance monthly child tax credit payments started automatically in July. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money as expected for a few reasons. The IRS may not have an up-to-date mailing address or banking information for you. The mailed check may be held up by the US Postal Service or, if it was a recent payment, the direct deposit payment may still be being processed.

It’s also important to note that if you’ve been a victim of tax-related identity theft, you won’t receive child tax credit payments until those issues have been resolved with the IRS. If the issues aren’t cleared up this year, you’ll get the full amount when you file taxes in 2022. And keep in mind that even if you have unpaid state or federal debt, you should still receive child tax credit money if you’re eligible.

In September, roughly 700,000 families did not receive a payment due to an IRS technical error. Problems with missing payments were also reported in previous months among “mixed-status” families, where one parent is a US citizen and the other is an immigrant, though that issue should have been corrected for later payments.

Don’t Miss: How To Get Tax Preparer License