When To File Your Small Business Taxes

Corporations must make estimated tax payments on the 15th day of the fourth, sixth, ninth and 12th month of its fiscal year. Owners of pass-through businesses must make estimated tax payments, which are generally due April 15, June 15, Sept. 15 and Jan. 15 of the following year. If any of those dates fall on a weekend or legal holiday, the due date moves to the following business day.

Some payroll, accounting or tax preparation software will estimate the businesss tax liability and send estimated tax payments to the IRS on their behalf. Just make sure to regularly set money aside for taxes, so its available when payments are due.

The Complete Guide To Filing And Paying Small Business Taxes

One of the most complex parts of running your business is understanding and fulfilling your tax responsibilities. Unlike your personal tax returns, which are usually completed with a few forms once a year, theres a lot more involved with preparing and filing your business taxes. Especially if this is your first time filing small business taxes, you likely have a number of questions about how you go about it, which forms to fill out, and when. Were here to help.

In this guide, well explain everything you need to know about small business taxesâincluding the types of taxes you may be responsible for, how to identify your tax responsibilities based on your business structure, and finally, when and how to pay and file your business tax return.

Finding An Accountant For Your Business Taxes

With some time, effort, and patience, any small business owner can navigate the process of filing business taxes on their own. But as a small business owner, youâre juggling a lot of things at once, and you might not want to sacrifice any of your time managing your business to also serve as your businessâs accountant.

Therefore, if you donât have the time to do your small business taxes right , you should absolutely consider hiring an accountant to help you out.

Here are some tips for searching for an accountant:

Also Check: How Much Do You Pay In Taxes Doordash

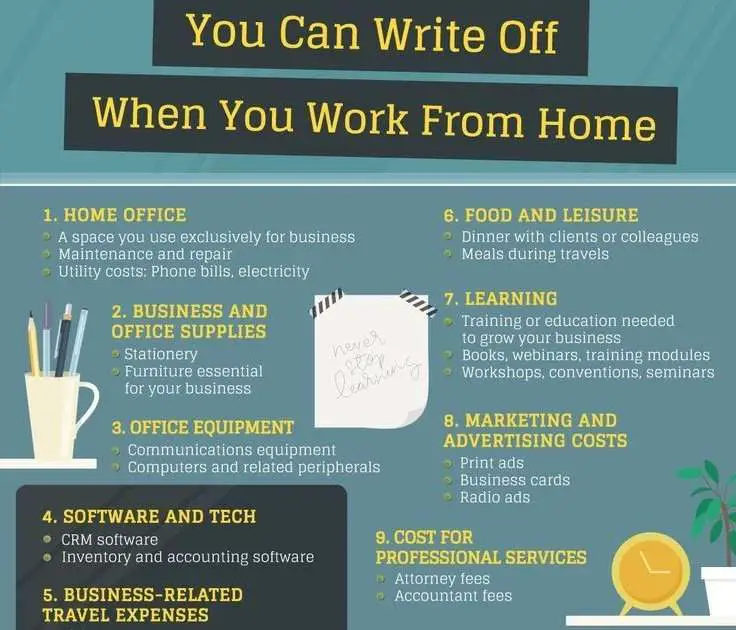

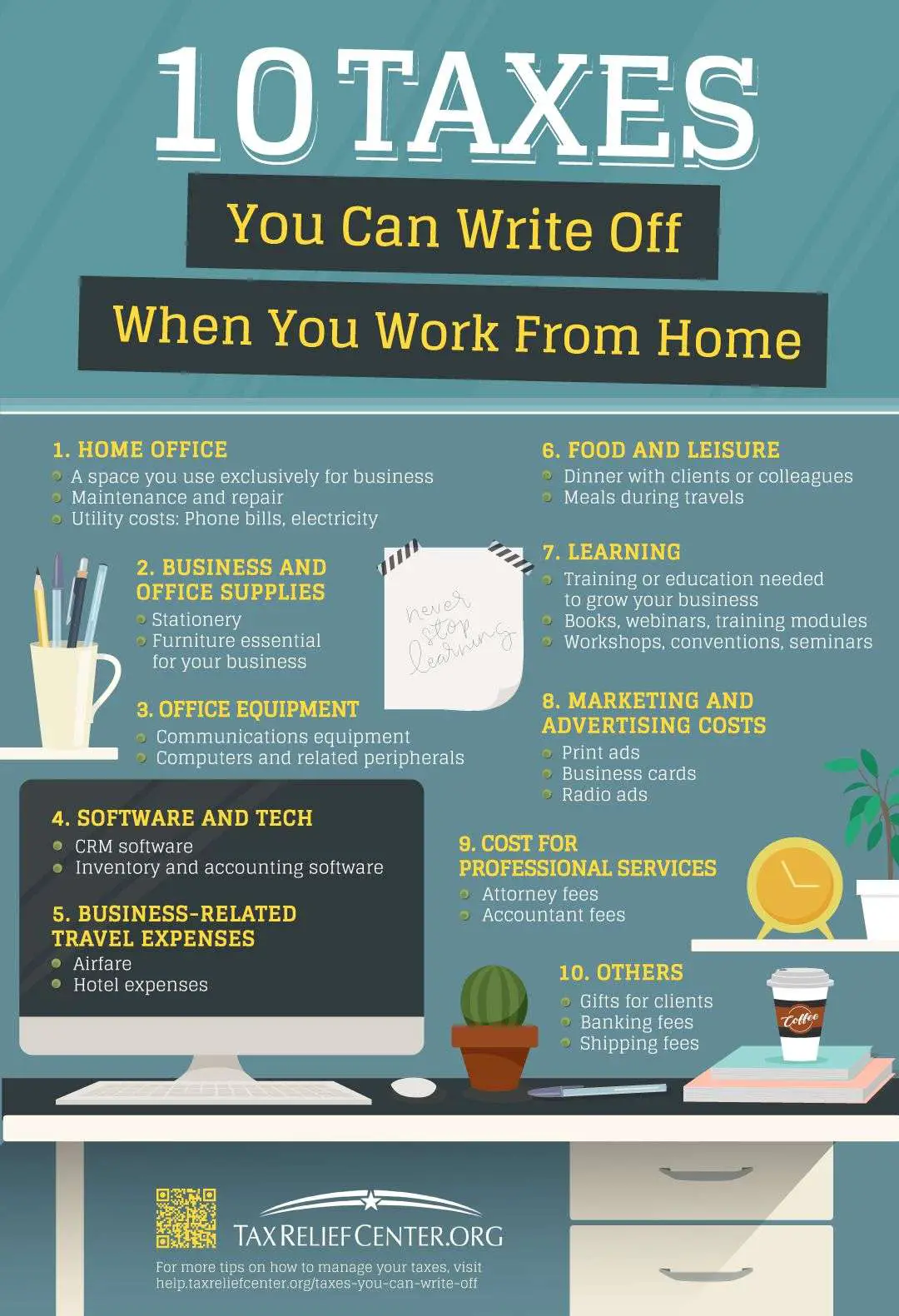

Complete List Of Small Business Tax Deductions

Which small business tax deductions are you eligible for? The following list gives you the complete rundown of possible deductions you can take when filing your 2021 taxes. Be sure to consult a CPA or other tax professional before sending your return to the IRS.

- Business meals

- Employee and client gifts

How To Pay Sales Tax For Your Small Business

Knowing how to pay taxes for a small business is complicated and, with the continually changing world of sales tax regulations, can quickly lead to a headache.

Understanding the basic rules of sales tax, avoiding some common stumbling blocks, and finding a comprehensive tax solution to help you move forward, will bring continued success and growth, no matter your industry.

Also Check: How To Pay Quarterly Taxes Doordash

Business Income Tax Rate For Corporations

C corporations have paid federal income taxes at a flat rate of 21% since 2018, as a result of the Tax Cuts and Jobs Act . Prior to 2018, C-corps paid taxes on a tiered structure, with rates ranging from 15% to 35%. Only about 5% of businesses in the U.S. are C corporations.

Taxes on corporate dividends

Corporations pay their shareholders dividends, and shareholders then have to pay taxes on those dividends on their individual tax returns. This is referred to as double taxation, because the income is taxed twice once at the corporate level, and again when paid out as dividends.

The tax rate shareholders pay on those dividends depend on whether the dividends are ordinary or qualified. Ordinary dividends are taxed at the same rate as the shareholders other income, and rates range from 10% to 37%. Qualified dividends are taxed at lower capital gains tax rates, ranging from 0% to 20%.

Although corporations face double taxation, the flat corporate tax rate is lower than the personal income tax rate in several tax brackets.

Tax Obligations Can Be Confusing And Change Often Here’s What To Expect In 2022 If You’re A Small Business Owner

- Tax obligations can be confusing and change frequently, so its important to take time to review the latest tax laws and codes.

- Major tax legislation in 2018, and the COVID-19 legislation that followed, resulted in many changes for small businesses, some of which are still in effect while other policies are expiring.

- You should work with a certified public accountant to ensure you are complying with current regulations and paying the right amount.

- This article is for small business owners who want to know what to expect for their tax obligations this year.

As a small business owner, its important to stay up to date on tax laws so you pay the right amount each year. There are several changes to the federal tax code that will impact small businesses in 2022 for the 2021 tax year. Read this guide to find out the most important things to know about filing taxes this year.

Read Also: 1040paytax

Business Taxes For Limited Liability Companies

A limited liability company is a business entity that keeps the owners legally separate from the companyâs debts or liabilities. As the owner of an LLC, youâll have the liability protection of a corporation with the tax benefits of a sole proprietorship or partnership.

If you operate an LLC, youâll be subject to pass-through taxation, just as you would be as a partnership. In other words, with LLC taxes, youâre not taxed twice like corporations are. Instead, as an owner of an LLC, youâll make quarterly tax payments on your personal income tax forms. On top of that, youâll also have to submit Form 1065 each year for informational purposes.

Furthermore, LLCs offer you additional tax flexibility compared to other business entities. From a legal standpoint, you can exist as an LLC. However, from a tax standpoint, you have the option to be taxed as an S-corporation or partnership.

Online Sales And Sales Tax

Online sales have changed the sales tax landscape, and the situation continues to evolve as taxing agencies figure it out. More and more businesses, even small home-based ones are now remote sellers meaning they sell their goods in other states where they dont have a nexus. The U.S. Census Bureau has tracked online sales from 2010, and theyve risen steadily, with 14% of all sales in the first quarter of 2020 taking place online. The upsurge in marketplace sellers, like Shopify, Etsy, Bookshop.com and other places where entrepreneurs can sell goods without having to manage their own selling website, has boosted online sales for small businesses and the shutdowns from the coronavirus pandemic have spurred many small businesses that were focusing on bricks-and-mortar sales to sell online.

After several years of confusion, the 2018 Supreme Court South Dakota vs. Wayfair decision determined that online sales are subject to sales tax. The court left it to the states to determine how to tax online sales, since the states are already setting their own tax rates and rules.

In most states, online taxes dont apply to smaller businesses, with size determined by sales, number of transactions, or in some cases, both.

The general maximum is $100,000 in sales, or 200 transactions, but that differs widely depending on the state.

The sales dollar amount is $500,000 in California and New York. Other states, like Tennessee and Arizona, are reducing it by year until it reaches $100,000.

Recommended Reading: How Much Is Sales Tax On A Car In Nc

Property Tax On Business Property

Property tax is a local tax. If your business owns real property , like a building, it must pay property tax to the local taxing authority, which is usually the city or county where the property is located.

The tax is based on assessed value, the same as for personal assets, like a house.

There are special considerations for paying federal taxes when you sell a piece of business property. You may have to pay capital gains taxes on the difference between your initial cost and the selling price.

Always get help from a tax professional before you sell business property.

Rent And Business Maintenance

Rent for your business building counts as a business expense for a tax deduction. You can also deduct minor repairs and maintenance performed on your business property, such as changing out light bulbs or mowing the lawn. You cant deduct the value of your own labour, nor can you deduct any improvements that provide a long-term benefit, such as a major renovation. Expenses you incur for telephone service and utilities at your business building also count toward a deduction.

Also Check: How To Get Pin To File Taxes

What Is A 100 Percent Tax Deduction

A 100 percent tax deduction is a business expense of which you can claim 100 percent on your income taxes. For small businesses, some of the expenses that are 100 percent deductible include the following:

- Furniture purchased entirely for office use is 100 percent deductible in the year of purchase.

- Office equipment, such as computers, printers and scanners are 100 percent deductible.

- Business travel and its associated costs, like car rentals, hotels, etc. is 100 percent deductible.

- Gifts to clients and employees are 100 percent deductible, up to $25 per person per year.

- If youre self-employed and pay your own health premiums, you can deduct those at 100 percent.

- Your annual business phone bills are 100% deductible.

How Do I Manage My Business Finances

While you may be an expert in your business, you may not necessarily have an in-depth understanding of Canadian tax regulations. Luckily, there are tools and experts you can turn to for help.

There are several softwares on the market that make it easier to manage your small business finances and keep track of your income and expenses, such as QuickBooks Self-employed. You can also file self-employed income tax using software such as H& R Block software, TurboTax, Freshbooks, Ufile, or TaxTron.

Depending on the size of your business, you may also want to consider hiring an accountant, bookkeeper, or professional organization to look after your finances on an ongoing or periodic basis, such as for tax season.

Whether or not youre in-charge of your businesss finances, its important that you review your businesss financial reports regularly to oversee how it is performing, to adapt your business plans, and ensure youre meeting your goals.

Recommended Reading: Is Door Dash Self Employed

Business Interest And Bank Fees

If you borrow money to fund your business activities, the bank will charge you interest on the loan. Come tax season, you can deduct the interest charged both on business loans and business credit cards. You can also write off any fees and additional charges on your business bank account and credit card, such as monthly service fees and any annual credit card fees.

Choosing The Right Small Business Accountant

As we mentioned, in the best cases, a business accountant does more than just file your small business taxes.

Theyâll have an understanding of how your business operates and manages its money, so a great business accountant can give valuable advice and guidance for managing your businessâs financials.

Therefore, when youâve found a few good business accountants to consider, youâll want to take the time to figure out which one will be the best match for your business.

When youâre interviewing a candidate, here are a few questions you can ask:

- Whatâs your experience working in my industry?

- Have you worked with a similar business entity before?

- What are your services beyond small business taxes?

- How often will we communicate?

- What are your rates?

Although not a comprehensive list of questions, you can ask these first to get a sense of whether the accountant will be a good match for your business.

This being said, if you donât want to go through the process of finding a specific business accountant for help with your taxes, you might choose to utilize an online service, like BenchTax from Bench Accounting, for example, that matches your business with a professional or team of professionals to provide you with tax assistance, advice, and even file your taxes on your behalf.

Recommended Reading: How Does Doordash Work For Taxes

Small Business Tax Resources

Here are some additional resources for learning about taxes:

- The Small Business Administration maintains a guide on navigating the tax code and staying up to date on your tax responsibilities as a business owner.

- The IRS website has information about how the Affordable Care Act affects small business owners taxes, although the policies are subject to change.

- If you can choose which state your business will operate in, then you may want to consider the small business tax rates by state. Additional information and recommendations are available at the Tax Foundation.

- The SBA has a helpful guide on choosing the right business structure if youre just starting your business this year.

- The IRS website has additional details on the Small Business Health Care Tax Credit, which provides a tax credit to small businesses that offer healthcare coverage to their employees. You can learn if youre eligible and how to calculate and claim your credit.

- The IRS maintains an information center on self-employed and small business taxes.

How Much Can A Small Business Make Before Paying Taxes

All businesses must submit an annual income tax return, according to the IRS. The exception is partnerships, which have to submit an information return instead. And if you have employees, employment taxes are mandatory.

Business owners who earn less than $400 can skip paying the self-employment tax. But thats the only tax you can avoid.

Thankfully, the IRS probably wont be interested in auditing your small business until you turn a profit. But its important to still file your taxes even if youre sustaining losses in order to take advantage of deductions and avoid legal issues down the line.

Also Check: Do You Pay Taxes On Doordash

What Is An Input Tax Credit

If you are a registrant for GST/HST purposes, you may recover the GST/HST paid or payable by you for property and services you acquired, imported or brought into a province in the course of your commercial activities by claiming an input tax credit on your GST/HST return.

When you complete your GST/HST return, deduct your input tax credits from the GST/HST you charged your customers. If the total amount of the GST/HST you charged is more than the amount of your input tax credits, you remit the difference. If the total amount of the GST/HST you charged is less than the amount of your input tax credits, you are eligible for a refund.

Note that before you can claim an input tax credit, you must obtain the necessary documentation from your supplier to support your claim and the documentation must be made available to the CRA for inspection if requested.

Regulations concerning claiming an input tax credit for the provincial portion of the HST paid or payable on inputs vary from province to province.

Visit the Canada Revenue Agencys site for more information on input tax credits.

Business Taxes: When To Pay

No matter what type of small business entity you have, you have to pay quarterly estimated taxes if you expect to owe income taxes of $1,000 or more. Corporations only have to pay quarterly estimated taxes if they expect to owe $500 or more in business taxes for the year.

Before you owned a business, filing taxes was a once-per-year occurrence. But as a small business owner, on the other hand, youâll have to pay the IRS four times per year. Although this means there are four deadlines to keep track of, it also means by the time your yearly tax deadline comes around, youâll have already paid three-quarters of your tax return.

This being said, though, to make things even more complicated, if your businesses has employees, it must deposit federal income tax withheld from employees, federal unemployment taxes, and both the employer and employee social security and Medicare taxes. Depositing can be on a semi-weekly or monthly schedule.

Don’t Miss: How Do You Do Taxes With Doordash

How Do I Manage Sales Tax Questions Successfully

Most sales tax questions and issues arent one-time problems. The most common pain points for small business owners are concerns that come up again and again. While you cant avoid paying sales tax, you can find a comprehensive solution that makes how you deal with taxes smarter and more efficient.

- Save time. When all your information is in one place, it saves you valuable time. A comprehensive sales tax solution allows you to look up sales tax rates, identify appropriate product taxability statuses, get due dates, and search sourcing rules easily, putting all your sales tax answers in one place.

- Stay organized. Gone are the days of managing multiple stacks of paper, hoping you remembered to file the one you need in the exact moment you need it. A comprehensive tax solution helps you stay organized, save time, free up capital, and keep ahead of upcoming legislative changes without risk to your business.

- Lower risk. You want to see a problem before it becomes a problem. Having industry leading, up-to-date information at your fingertips is critical to success. The ability to access step-by-step tax guidance, automated compliance, and exemption forms in a single space allows you to work confidently while minimizing risk.

How Are Small Businesses Taxed

You might be surprised to learn that most small businesses dont pay the corporate rate for income tax.

In fact, 75 percent of small businesses arent considered corporations but something called unincorporated pass-through entities. This means that they pay the owners personal tax rate, according to the National Federation of Independent Businesses.

Owners include income from their small business in their personal taxes, so their income tax rates are calculated based on the business owners total earnings.

Use the 2018 Federal Income Brackets to see what percent tax youll owe based on your income:

- For example, if you make $38,701 to $82,500 per year, youll be taxed $4,453.50 plus 22% of your income over $38,700. The average small business owner makes $59,776 per year. A $4,453.50 base fee plus $4,636.72 means an owner making $59,776 will be taxed $9,090.22.

The $59,776 average small business owner salary is reported by Payscale.

Then use this state tax calculator to estimate what youll be taxed at a state level.

- For example, in New York the state income tax would be $3,033.35.

So in New York, youd be taxed $12,123.57 on $59,776 per year. Dont worry if this number seems high! There are plenty of deductions you can claim.

Partnerships are businesses with more than one owner and the owners each individually report their income on their personal taxes.

List of taxes for small businesses owners:

Recommended Reading: 1040paytax Com Legitimate