What Can I Do If I Owe Taxes

If you cant pay your entire tax bill when its due, there are a number of options available to help you avoid serious consequences. Some involve working out payments directly with the IRS, while others involve finding alternative ways to pay your taxes.

Here are some payment options to consider:

- Apply for a full-payment agreement if you can pay your taxes within 120 days

- Sign up for an IRS installment plan

- Make an offer in compromise

- Consider a loan or other financingto make a tax payment

Each of these options comes with different eligibility requirements and consequences. This is especially true when you think about taking out a personal loan, home equity loan or another type of financing to take care of your tax bill.

What Is A W

A W-4 form, formally titled “Employee’s Withholding Certificate,” is an IRS form employees use to tell employers how much tax to withhold from each paycheck. Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees.

You do not have to fill out the new W-4 form if you already have one on file with your employer. You also don’t have to fill out a new W-4 every year. If you start a new job or want to adjust your withholdings at your existing job, though, you’ll likely need to fill out the new W-4. Either way, it’s a great excuse to review your withholdings.

Take Extra Steps If You Want A Big Tax Refund

Typically, financial planners would suggest that it’s better to get your money upfront and not use your income tax withholding as some sort of forced savings account.

But many people bank on big refunds every year if they’re trying to save for a vacation or home improvements.

It’s always possible to have extra dollars withheld to ensure a large refund, Steber said. If needed, you can submit another W-4 form in a given year to reach the amount of withholding that you’d want.

You’d need to look for a line for “extra withholding” on the new W-4, if you want more money withheld from each paycheck. That’s under Step 4, Line C.

A quick trick to update withholdings is to divide what you owe in for income taxes by the number of remaining paydays in the year and enter this amount on line 4C of the W-4 form, Steber said.

For example, if a taxpayer owed $3,000 and they have 22 paydays left this year, they should divide $3,000 by the 22 and request to have an additional $136.36 each payday.

“This wont guarantee a refund next year, but if there is a balance due it will be small and not subject to an under-withholding penalty,” he said.

ContactSusan Tomporat313-222-8876 or . Follow her on Twittertompor. Read more on business and sign up for our business newsletter.

Read Also: How Much Will A Roth Ira Reduce My Taxes

Account For Multiple Jobs

If you have more than one job, or you file jointly and your spouse works, follow the instructions below to get more accurate withholding.

If youre single and have multiple jobs, or youre married and file jointly and both of you work:

-

You typically have to have a W-4 on file for each job.

-

For the highest paying jobs W-4, fill out steps 2 to 4 of the W-4. Leave those steps blank on the W-4s for the other jobs.

-

If youre married and filing jointly, and you both earn about the same amount, you can check a box indicating as much. The trick: Both spouses need to do that on each of their W-4s.

If you dont want to reveal to your employer that you have a second job, or that you get income from other non-job sources, you have a few options:

-

On line 4, you can instruct your employer to withhold an extra amount of tax from your paycheck.

-

Alternatively, dont factor the extra income into your W-4. Instead of having the tax come directly out of your paycheck, send estimated quarterly tax payments to the IRS yourself instead.

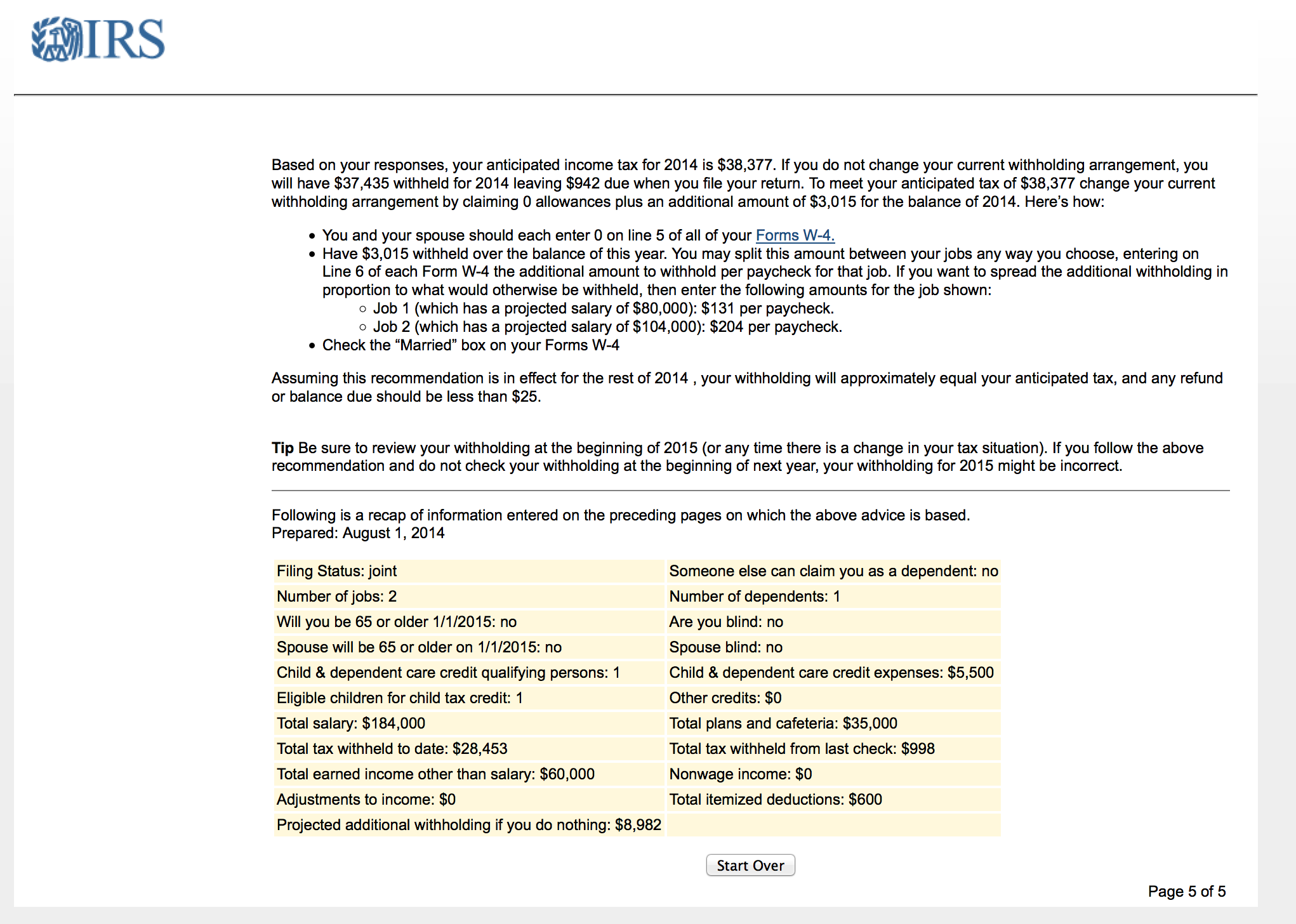

Estimate What You’ll Owe

If you are a salaried employee with a steady job, it’s relatively easy to calculate your tax liability for the year. You can predict what your total income will be.

Millions of Americans don’t fall into the above category. They work freelance, have multiple jobs, work for an hourly rate, or depend on commissions, bonuses, or tips. If you’re one of them, you’ll need to make an educated guess based on your earnings history and how your year has gone so far.

From there, there are several ways to get a good estimate of your tax liability.

Read Also: Www Aztaxes Net

What Should You Put On Your W

The information you should put on your W-4 depends on how much you would like taken out of your every paycheck and put toward taxes. If you would like to avoid owing taxes at the end of the and potentially racking up a large tax bill, you should use the IRS Tax Withholding Estimator tool to determine how much you should have withheld from each paycheck. Make sure to complete the Multiple Jobs Worksheet if applicable. Consider submitting extra withholdings in line 4 or decreasing your number of dependents to ensure you are not greeted with a tax bill at the end of the year. Increasing your withholding will make it more likely that you end up with a refund come tax time.

If you got a large refund last year, or are in a situation where you would rather receive all of your money now and pay your taxes at the end of the year, then consider using the W-4 form to reduce your tax burden. You can reduce the amount of taxes taken out of your paycheck by increasing your dependents, reducing the amount of non-job income or untaxed income that you are accounting for in your withholding in lines 4 or 4, or increasing the figure for itemized deductions in line 4.

What If Your Federal Income Tax Withheld Is Blank

If Box 2, Federal income tax withheld, is blank on the W-2 form you file with your annual tax return, your employer either didnt withhold taxes or an error occurred in transferring the information to the form. If you didnt have money withheld, you must pay your federal tax when you file a return.

Read Also: Can Home Improvement Be Tax Deductible

What To Claim To Get A Bigger Refund

It is not uncommon for taxpayers to knowingly overpay the IRS by claiming zero allowances. This is often done in anticipation of a larger lump sum refund that can then be used to pay off large bills, take a family vacation or pay an extra mortgage payment. Not everyone is good at saving, and some filers claim zero allowances to help squirrel away some extra money every pay period to spend as they please, or to assist in paying off debt. Theres nothing wrong with this approach, and it works well for many taxpayers. Whether or not you should claim zero allowances is a personal one, but there are online calculators available that help you calculate payroll deductions so you know how much you’ll be taking home every paycheck.

Bear in mind, if you were due a tax refund but owe back taxes or past-due child support payments, then you may have all or a portion of your tax refund intercepted to settle any arrears.

If You’ve Been Overpaying

Unless you’re looking forward to a big refund, try increasing the number of withholding allowances you claim on the W-4.

Note that the IRS requires that you have a reasonable basis for the withholding allowances you claim. It doesn’t want you fiddling with its form just to avoid paying taxes until the last minute.

If you don’t have enough tax withheld, you could be subject to underpayment penalties.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You can do that by making sure your withholding equals at least 90% of your current year’s tax liability or 100% of your previous year’s tax liability, whichever is smaller.

You’ll also avoid penalties if you owe less than $1,000 on your tax return.

Read Also: How Much Does H& r Block Charge To Do Taxes

Multiple Jobs Or Spouse Works

The second step applies only if you have more than one job at the same time or are married filing jointly and you and your spouse both work. If one of these scenarios applies to you, then you have three options:

- Use the IRSs Tax Withholding Estimator tool which most accurately calculates the additional tax you need to have withheld. Apply these withholdings in step 4C of your W-4.

- Use the IRSs Multiple Jobs Worksheet, located on page 3 of the W-4 if you and/or your spouse work either two or three jobs at the same time. After filling out the worksheet, enter this amount into 4C on your W-4.

- If you and/or your spouse work a total of only two jobs, you can simply check the box located at 2C of the form . By checking the box, your standard deduction and tax brackets will be cut in half for each job to calculate withholding. According to the IRS, this option is somewhat accurate for jobs with similar pay otherwise, more tax than necessary may be withheld, and this extra amount will be larger the greater the difference in pay is between the two jobs.

How Do You Have Less Tax Taken Out Of Your Paycheck

You can use the W-4 form to reduce your tax burden, as well. To do this, decrease the figure that affects your withholdings. That includes additional withholdings indicated in line 4, as well as non-job related income identified in form 4. You can also submit a new W-4 if you have a new dependent, which will reduce your withholdings.

Don’t Miss: Cook County Assessor Deadlines

Withholding Too Little From Your Paycheck

The amount taken out of your paycheck throughout the year is an estimate of what youll owe when it comes time to file your taxes. If you overpay, youll receive a tax refund. But if you dont pay enough throughout the year, youll end up with a bill come tax season.

Related: How To Minimize Tax Debt

How Do You Have More Taxes Taken Out Of Your Paycheck

In order to have more taxes taken out of your paycheck, indicate on the W-4 that you would like to have your employer withhold more money or update the form with new information that will result in more money being withheld. This can be done by indicating that you have fewer dependents than you did on a previous W-4 filing. You can also submit more withholdings in line 4, which will indicate to your employer that you would like them to withhold more than they currently are.

Don’t Miss: Harris County Property Tax Protest Services

Common Reasons Why You Might Owe Taxes This Year

Although most types of income are taxed, there are several reasons why you might owe the Internal Revenue Service, despite having money withheld from your paycheck all year. Explore some of the most common explanations for owing taxes and how you can avoid making underpayments in the future. Plus, find out what to do if your tax bill is exceptionally large and what payment options you have to get yourself out of tax debt with the IRS.

It’s Easy To Account For Tax Credits And Deductions

The W-4 form makes it easy to adjust your withholding to account for certain tax credits and deductions. There are clear lines on the W-4 form to add these amounts you can’t miss them. Including credits and deductions on the form will decrease the amount of tax withheld, which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return.

Workers can factor in the child tax credit and the credit for other dependents in Step 3 of the form. You can also include estimates for other tax credits in Step 3, such as education tax credits or the foreign tax credit.

For deductions, it’s important to note that you should only enter deductions other than the basic standard deduction on Line 4. So, you can include itemized deductions on this line. If you take the standard deduction, you can also include other deductions, such as those for student loan interest and IRAs. However, do not include the standard deduction amount itself. It could be “a source of error if folks just put in their full amount,” warns Isberg.

If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form. To get the most accurate withholding, it should be the form for the highest paying job.

Also Check: Turbo Tax 1099q

What You Should Know About Tax Withholding

To understand how allowances worked, it helps first to understand how tax withholding works. Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck. This withholding covers your taxes, so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. Employers in every state must withhold money for federal income taxes. Some states, cities and other municipal governments also require tax withholding.

Withholding is also necessary for pensioners and individuals with other earnings, such as from gambling, bonuses or commissions. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. You can do this by paying estimated taxes.

Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. You can also list other adjustments, such as deductions and other withholdings.

When you fill out your W-4, you are telling your employer how much to withhold from your pay. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child.

How Much Money Do You Need To Make To Owe Taxes

How Much Do You Have to Make to Owe Taxes?Filing StatusUnder Age 65Age 65 and OlderSingle$12,200$13,850Married, filing jointlyIf both spouses are under age 65: $24,400If one spouse is 65+: $25,700 If both spouses are 65+: $27,000Married, filing separately$5$5Head of Household$18,350$20,0001 more rowOct 1, 2019

Read Also: How To Report Ppp Loan Forgiveness On Tax Return

What Does Going Exempt Mean

Youve probably heard the term going exempt from time to time, but you may be unclear exactly what it means. Going exempt is the opposite of claiming zero allowances. Claiming zero allowances means that you are having the most withheld from your paycheck for federal income taxes. When you go exempt, you are claiming complete exemption from any allowances, therefore, having no federal income taxes withheld from your paycheck.

This means you will receive your entire paycheck, without any federal income taxes withheld, but your employer will still likely withhold Social Security and Medicare taxes every time you are paid. There are a few requirements that must be met before you can go exempt, such as your previous years tax obligation, and it is advisable that you consult with a qualified tax preparer, or visit the IRS website, for more information regarding tax withholdings.

References

Understand Your Tax Situation

Even if you owe taxes this year, use it as a learning opportunity to understand your finances better for the future. Keep track of how much you earn, what methods you use to earn money, and how your life changes over time. Its also smart to stay on top of tax-related news so you know about major changes that might affect you. Of course, anytime youre in doubt about how much you owe or what your payment options may be, talk to a professional. Its the best way to protect yourself and keep the IRS happy.

Recommended Reading: Buying Tax Liens In California

What Happens If I Dont Pay My Taxes

Unfortunately, not paying your taxes doesnt make this debt go away. Assuming you didnt file for an extension, if you dont pay your taxes by the due date, youll end up owing back taxes. Whether its intentional or not, prioritize paying your back taxes as soon as you realize that you owe them.

The IRS should send you a letter explaining how much you owe. If your situation is complicated, you can also consult with a tax professional or financial planner to help you understand your options. The worst thing to do is to not do anything at all. Take action so you can work something out and get your tax bill behind you once and for all.

How Many Allowances Should I Claim If Im Single

If you are single and have one job, you can claim 1 allowance. Theres also the option of requesting 2 allowances if you are single and have one job. That allows you to get close to your break-even amount. However, you need to be cautious as this could result in some tax due.

If you have more than one job and are single, you can claim 2 at the first job and 0 at the second job. Alternatively, you can split your allowances, which means claim one at the first job and another at the second job.

You May Like: How Much Does H& r Block Charge To Do Taxes