Example Of Tax Brackets

Below is an example of marginal tax rates for a single filer based on 2021 tax rates.

- Single filers with less than $9,950 in taxable income are subject to a 10% income tax rate .

- Single filers who earn more than $9,950 will have the first $9,950 taxed at 10%, but earnings beyond the first bracket and up to $40,525 will pay a 12% rate .

- Earnings from $40,525 to $86,375 are taxed at 22%, the third bracket.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2021:

- The first $9,950 is taxed at 10%: $9,875 × 0.10 = $995.00

- Then $9,950 to $40,525, or $30,575, is taxed at 12%: $30,250 × 0.12 = $3,669

- Finally, the top $9,475 is taxed at 22%: $9,475 × 0.22 = $2,084.50

Add the taxes owed in each of the brackets:

- Total taxes: $995.00 + $3,669+ $2,084.50 = $6,748.50

The individuals effective tax rate is approximately 13.5% of income:

- Divide total taxes by annual earnings: $6,748.50/$50,000 = .1350

- Multiply .1350 x 100 to convert to a percentage, which yields 13.50%.

Tax Filing Season: Options For Improvement

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills.

Inflation is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

An individual income tax is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

An Example Of How Canadas Federal Income Tax Brackets Work

If your taxable income is less than the $48,535 threshold you pay 15 percent federal tax on all of it. For example, if your taxable income is $30,000, the CRA requires you to pay $4,500 in federal income tax.

However, if your income is $200,000, you face several tax rates. This example shows how much federal tax you will pay on your 2020 taxable income. You need to make a separate calculation for your provincial tax due.

- The first tax bracket $0 to $48,535 is taxed at 15%, plus

- The next tax bracket over $48,535 to $97,069 is taxed at 20.5%, plus

- The following tax bracket over $97,069 to $150,473 is taxed at 26%, plus

- At this point, $150,473 of your income has been taxed. The final bracket on your remaining $49,527 is taxed at 29%.

- If you earn more than $214,368 in taxable income in 2020, the portion over $214,368 is taxed at the federal rate of 33%. This is called the top tax bracket and a common misconception is if your taxable income is in this top bracket, you will be taxed at 33% on your entire income.

Recommended Reading: 1040paytaxcom

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, most of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

How Do Tax Brackets Work

The federal income tax is a progressive system. People who make higher incomes are taxed at progressively higher rates.

The federal government divides your income into blocks of money. Each block is a tax bracket. Each bracket of income is taxed at a progressively higher rate.

Not all of your income is taxed at the highest rate for your income. Each block of income is taxed at the rate for that particular bracket.

Take a look at the 2021 tax brackets if you filed single with $60,000 in taxable income.

2021 Tax Rates and Tax Brackets

| TAX RATE |

|---|

| $40,526 to $86,375 |

Recommended Reading: Taxes With Doordash

Australian Income Tax Rates For 201617 And 201718

| Income thresholds | Tax payable from 201617 and 201718 |

|---|---|

| $0 $18,200 | |

| 19c for each $1 over $18,200 | |

| $37,001 $87,000 | $3,572 plus 32.5c for each $1 over $37,000 |

| $87,001 $180,000 | $19,822 plus 37c for each $1 over $87,000 |

| $180,000 + | $54,232 plus 45c for each $1 over $180,000 |

Are you with a top performing super fund?

Our simple free tool makes it easy to compare super funds, including 5-year returns, fees, features, awards and more.

Note: Special rules apply to income earned by those under 18 years old, who may pay tax at a higher rate on certain types of income such as a distribution from a family trust.

Continue reading to learn how Australian income tax is calculated including offsets, levies, surcharges and that may reduce or increase your income tax.

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,950 he makes then 12% on anything earned from $9,951 to $40,525 then 22% on the rest, up to $80,000 for a total tax bill of $13,348.

Effectively, this filer is paying a tax rate of 16.69% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 13.28% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Bottom Line On Income Tax By State

You must pay state income tax on a regular basis as long as you are earning income in the U.S., whether you are an employee working for a company or an entrepreneur operating your own business. Nevertheless, computing your annual income tax by state can be a daunting process, especially since different states have varying tax requirements.

When Do Ontario Tax Brackets Change

Any changes to tax rates or income brackets must be announced in a budget. Both federal and provincial governments can make changes to their level of taxation, tax deductions or credits, programs and exemptions, but they are always done in a budget announcement. They do not come into force until the budget bill receives Royal Assent.

Also Check: Can I Write Off Mileage For Doordash

How To Get Into A Lower Tax Bracket

Americans have two main ways to get into a lower tax bracket: tax credits and tax deductions.

Tax credits are a dollar-for-dollar reduction in your income tax bill. If you have a $2,000 tax bill but are eligible for $500 in tax credits, your bill drops to $1,500. Tax credits can save you more in taxes than deductions, and Americans can qualify for a variety of different credits.

The federal government gives tax credits for the cost of buying solar panels for your house and to offset the cost of adopting a child. Americans can also use education tax credits, tax credits for the cost of child care and dependent care and tax credits for having children, to name a few. Many states also offer tax credits.

While tax credits reduce your actual tax bill, tax deductions reduce the amount of your income that is taxable. If you have enough deductions to exceed the standard deduction for your filing status, you can itemize those expenses to lower your taxable income. For example, if your medical expenses exceed 10% of your adjusted gross income in 2021, you can claim those and lower your taxable income.

There Have Been Some Significant Changes To The Irs Tax Brackets

- The standard deduction for married taxpayers filing jointly has been increased to $25,100. This is a $300 increase from the previous year.

- For heads of households, the standard deduction will be $18,800, up $150.

- The personal tax exemption hasnt changed from 2018. The Tax Cuts and Jobs Act stipulated that the personal exemption has been removed.

- For married couples filing jointly, the top rate of tax has remained the same at 37%. To qualify for the maximum rate of tax, you must have earned more than $628,300.

You May Like: Doordash Payable Account

Tax Rates Vs Tax Brackets

Although tax brackets and tax rates may appear to be similar, they are distinctly different from each other but are used to calculate the total taxes owed.

A tax rate is a percentage at which income is taxed, while a tax bracket has a different tax rate, such as 10%, 12%, or 22%, referred to as the marginal rate. However, most taxpayersall except those who fall squarely into the minimum brackethave income that is taxed progressively, meaning they’re subject to multiple rates beyond the nominal rate of their tax bracket.

A taxpayer’s tax bracket does not necessarily reflect how much will be owed in total taxes. The term for this is the effective tax rate.

Regressive Progressive And Proportional Taxes

These are the three main categories of tax structures in the U.S. .

Here are definitions that include how they impact people with varying levels of income.

Whats a Regressive Tax?

Because this tax is uniformly applied, regardless of income, it takes a bigger percentage from people who earn less and a smaller percentage from people who earn more.

As a high-level example, a $500 tax would be 1% of someones income if they earned $50,000 it would only be half of one percent if someone earned $100,000, and so on. Examples of regressive taxes include state sales taxes and user fees.

Whats a Progressive Tax?

This kind of tax works differently, with people who are earning more money having a higher rate of taxation. In other words, this tax is based on income.

This system is designed to allow people who have a lower income to have enough money for cost of living expenses.

Whats Proportional Tax?

This is another way of saying flat tax. No matter what someones income might be, they would pay the same proportion. This is a form of a regressive tax and proportional taxes are more common at the state level and less common at the federal level.

Read Also: How Does Doordash Work For Taxes

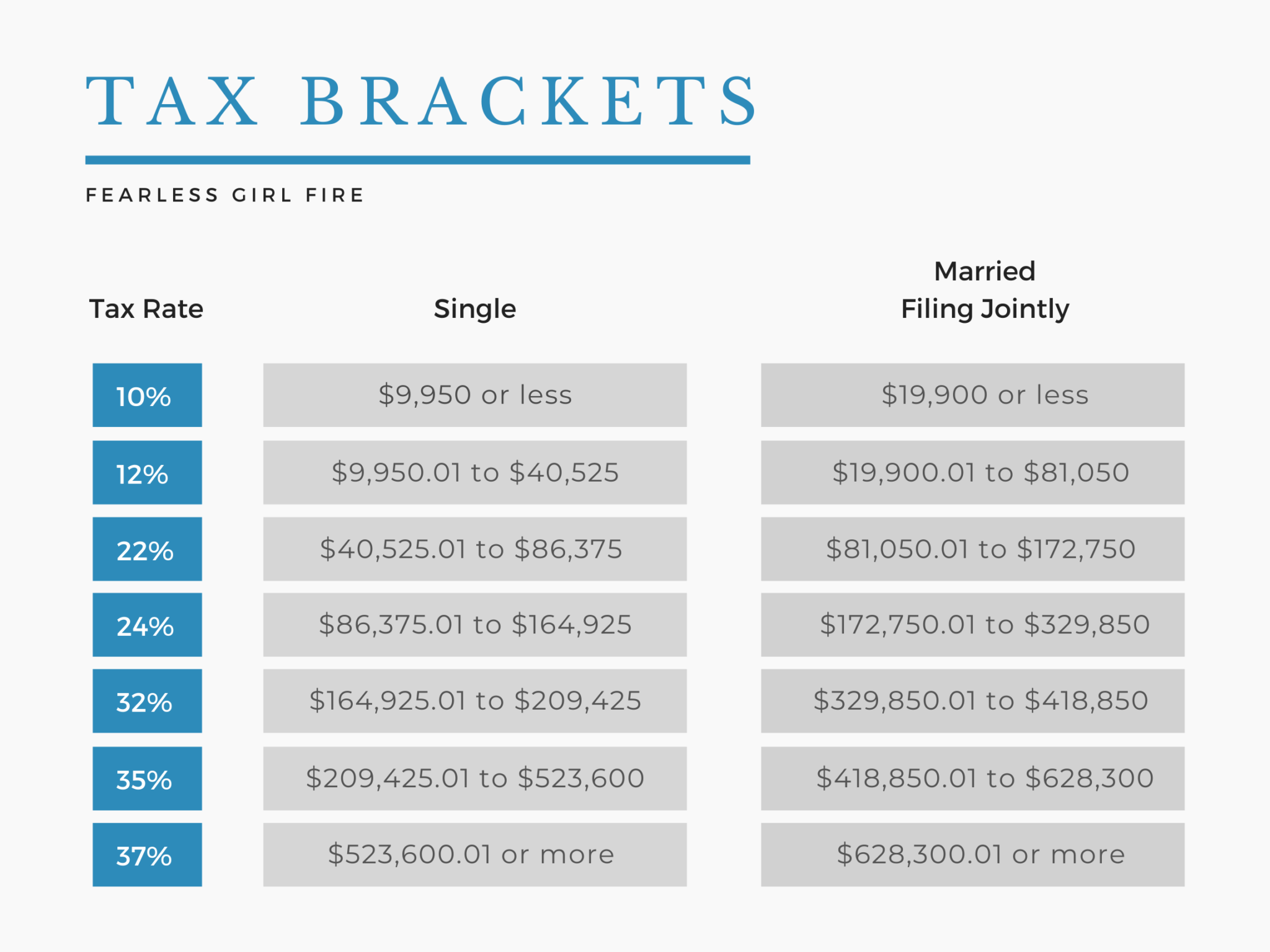

What Are The Us Federal Tax Brackets For 2021

Your bracket is determined by how much taxable income you receive each year and your filing status. There are four filing statuses and seven graduated tax rates for 2021 taxes due on April 18, 2022.

Federal Income Tax Filing Statuses

- Single

- You can file as single if you are not married or are divorced as long as you are not claimed as a dependent on someone elses tax return.

- Head of household

- You can file as head of household if you are unmarried, divorced, have a qualifying child or dependent and paid more than half the costs of running the household where the child or dependent lived for at least half of the year.

- Couples married by December 31 have the option to file a joint tax return for that year.

- Couples married by December 31 have the option to file separate tax returns for that year.

Each of these filing statuses has its own tax brackets. The brackets are beginning and end points at which your income is taxed at a specific rate. Understanding how tax brackets work and which bracket your income falls into can be helpful in your overall personal finance strategy.

2021 Tax Brackets by Filing Status

| TAX RATE |

|---|

Where Tax Brackets Apply

| “Taxable Income” above is really Regularly Taxed Income minus Adjustments, Deductions, and Exemptions. |

Payroll Tax , andQualified Dividends and Long Term Capital Gains are separate calculations.

The obvious way to lower your tax bill is to increase the untaxed area at the bottom of the diagram.Contributions to deductible retirement accounts count as adjustments mortgage interest and contributions to charity count as deductions.

You May Like: Doordash How To File Taxes

Tax Brackets: Do You Really Know How Youre Taxed

One question we often get asked is how do tax brackets work. A lot of people arent sure how income is taxed and how to determine which tax bracket they actually fall into. Taxpayers are often confused by how their income tax is calculated and then they dont understand why they owe more money than they thought. Tax brackets, unfortunately, are confusing to those who dont deal with taxes every day. Heres what a lot of people need to know when it comes to income taxes and tax brackets.

One thing you need to understand is that not all your income is taxed in the same bracket. For example if you make $100,000 a year, you fall into the 24% tax bracket. That doesnt meant your $100,000 in income is all taxed at 24%. Tax brackets work almost like a ladder. Part of your income is taxed at each step and with each step the tax on your income increases. For 2019, the tax brackets are as follows for single filers:

- 10% tax rate for $0 to $9,700.

- 12% tax rate for $9,701 to $39,475

- 22% tax rate for $39,476 to $84,200

- 24% tax rate for $84,201 to $160,725

- 32% tax rate for $160,726 to $204,100

- 35% tax rate for $204,101 to $510, 300

- 37% tax rate for $510,301 or more

So, for example, let us say you are a single filer making $75,000 a year from your salary job. We wont add in tax credits or deductions for this example, but those can lower your taxable income and lower the tax bracket you are in.

Australian Income Tax Rate Changes Between 202021 And 202425

| 202021, 202122, 202223 and 202324 | From 202425 | ||

|---|---|---|---|

| 19% for amounts over $18,200 | $18,201 $45,000 | 19% for amounts over $18,200 | |

| $45,001 $120,000 | $5,092 + 32.5% for amounts over $45,000 | $45,001 $200,000 | $5,092 + 30% for amounts over $45,000 |

| $120,001 $180,000 | $29,467 + 37% for amounts over $120,000 | ||

| $51,667 + 45% for amounts over $180,000 | $200,001 and over | $51,592 + 45% for amounts over $200,000 |

Note: These amounts do not include Medicare levy or the impact of LITO or LMITO

Try SuperGuidesincome tax calculator to understand the offsets and levies that apply to you, and discover your effective tax rate.

Read Also: Calculate Doordash Taxes

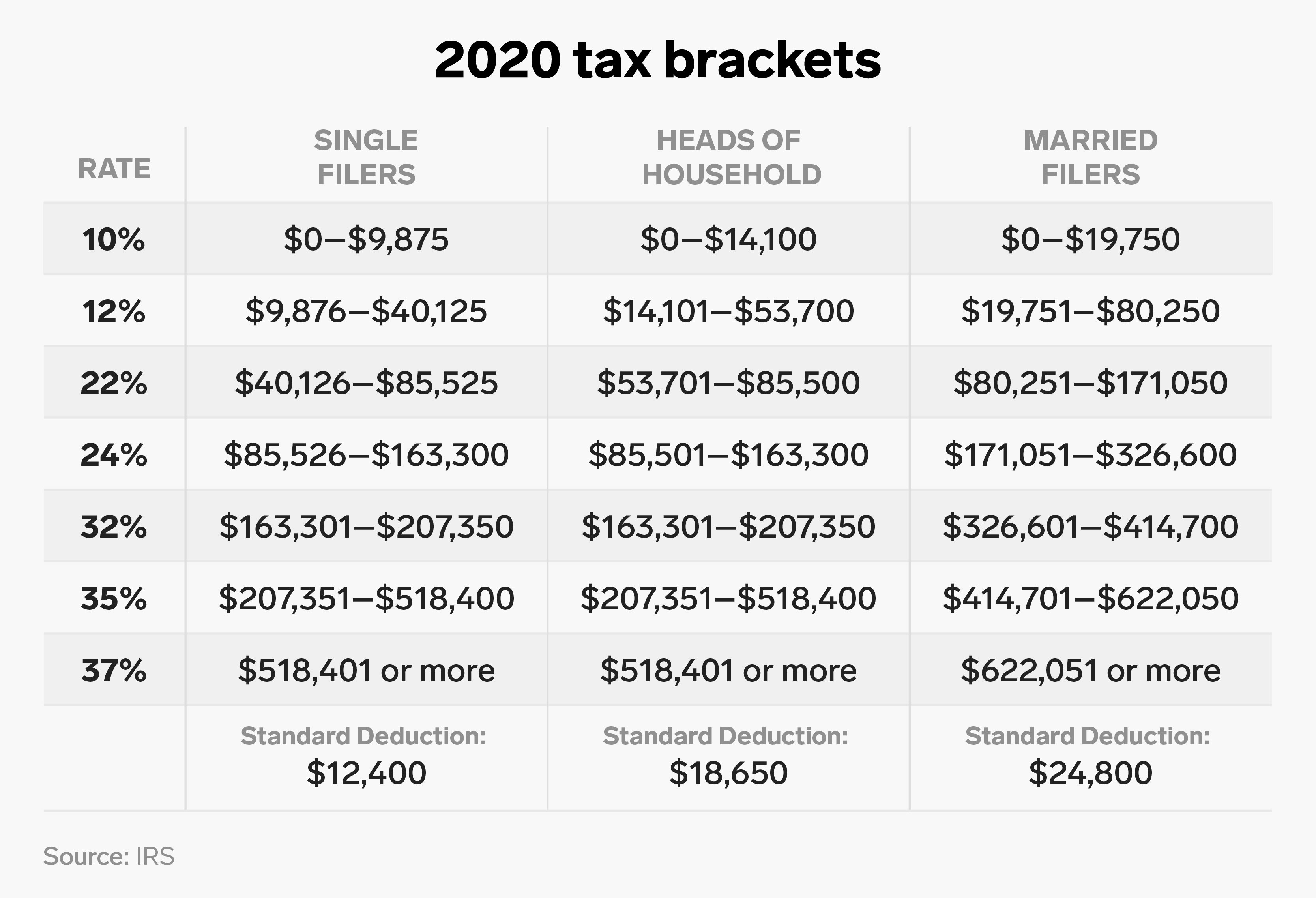

Federal Income Tax Brackets For Tax Years 2020 And 2021

The federal income tax rates remain unchanged for the 2020 and 2021 tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income brackets, though, are adjusted slightly for inflation. Read on for more about the federal income tax brackets for Tax Year 2020 and Tax Year 2021 .

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

Tax Credit And Deduction Changes

The Earned Income Credit has been increased for married couples filing jointly to $6,728 for 2021. This represents a minor increase from the maximum in 2021.

The maximum amount can be claimed if you have three or more qualifying children. There are also other factors to take into account, such as your income.

A significant change is to the financial penalty levied for not maintaining a minimum level of health coverage. Under the Tax Cuts and Jobs Act , this is now $0, a reduction of $695 from 2018.

Read Also: Do You Pay Taxes On Plasma Donations

Income Tax Brackets Words You Need To Know

In talking about income tax brackets, you may hear a few of these words, too. Heres a quick list of definitions for your reference.

Base amount: On your tax form, this is the BPA, also known as the basic personal amount. This amount is not taxed, and it was created to avoid taxing individuals with income below this amount. The base amount for 2020 is $13,229.

Gross income: Your full income, untaxed and without deductions.

Income tax bracket: The range of annual income and the income tax rate that is to be applied.

Income tax rate: Amount owed as a percentage of income.

Federal income tax: Payment to the Government of Canada, which is used to fund the federal level of government and programs.

Net income: The amount of personal income you earn, after deductions.

Provincial/territorial income tax: Payment to the levels of government for the provinces and territories, which are used to fund more local levels of government and programs than the federal income tax.

T1 Income Tax and Benefit Return: The form used to create, calculate and file an individuals income, deductions and taxes owed.

Taxable income: A persons gross income, which is taxable by the federal and provincial/territorial levels of government. If you are self-employed, this is net income.

What does the * mean?