File With Approved Tax Preparation Software

If you don’t qualify for free online filing options, you can still file your return electronically with the help of commercial tax preparation software. View approved software options.

To file on paper, see Forms and Paper Filing below. If you do choose to file on paper, please note that, due to COVID-19 workplace protocols and mail delays, it will take longer for us to process your return.

Kansas Customer Service Center

Using the Kansas Customer Service Center you can securely manage your tax accounts online. With one login â the email and password, you can securely access Kansas Department of Revenue accounts. You can make electronic payments, view your online activity and file various returns and reports including your sales, use, withholding, liquor drink and liquor enforcement tax returns.

Consequences Of Not Filing

State tax penalties can be just as harsh as those imposed by the IRS. In the most severe cases, the state can even prosecute you for a crime if it believes that your failure to file tax returns was part of a fraudulent scheme. Just like other crimes, the punishment can include time in jail.

However, the majority of taxpayers who dont file their state returns are only subject to penalties, interest and other fees in addition to the amount of tax due. And since your account is charged on a monthly basis, the longer you wait, the more youll pay. Some states can even put liens on your property, seize your assets, garnish wages and intercept a federal tax refund if too much time passes without any tax return or tax payment.

Remember, with TurboTax, well ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Also Check: Where Can I Get Taxes Done For Free

You May Like: When Will The First Tax Refunds Be Issued 2021

Adhd And Tax Disability Benefits

If you have been diagnosed with attention deficit hyperactivity disorder , you could be eligible for tax disability benefits. That said, a diagnosis is not an automatic approval for a tax credit. The reason being that ADHD comes in varying degrees and it needs to be established how this condition affects your daily life. All of the factors need to be considered during the application process. If you or a loved one with ADHD display a certain behaviour which is disruptive to daily life, this could result in a tax credit being approved.

The most important concern is determining the difference between mild and severe ADHD since this will determine whether or not you are eligible. Although this disability is not as clearly visible as, lets say, somebody suffering from paralysis, it can still be debilitating. The Canadian government recognizes this and offers financial support in the form of the Disability Tax Credit.

What If I Am In The Military And My Spouse Is Not

Spouses who are not in the military can claim a state of domicile just like their military spouse. This can be the same Home of Record as their military-spouse or a different one. The important fact is that the non-military spouse much actually establish residency in the state that is to be the Home of Record.

Read Also: How To Find Tax Rate

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

File Your Virginia Return For Free

Made $73,000 or less in 2021? Use Free File

If you made $73,000 or less in 2021, you qualify to file both your federal and state return through free, easy to use tax preparation software.

Are you a member of the military? Try MilTax

MilTax is an approved tax preparation software that provides free tax services for members of the military.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Read Also: What Happens If You Cannot Pay Your Taxes

The Taxation And Revenue Department Encourages You To File Electronically Whenever You Can

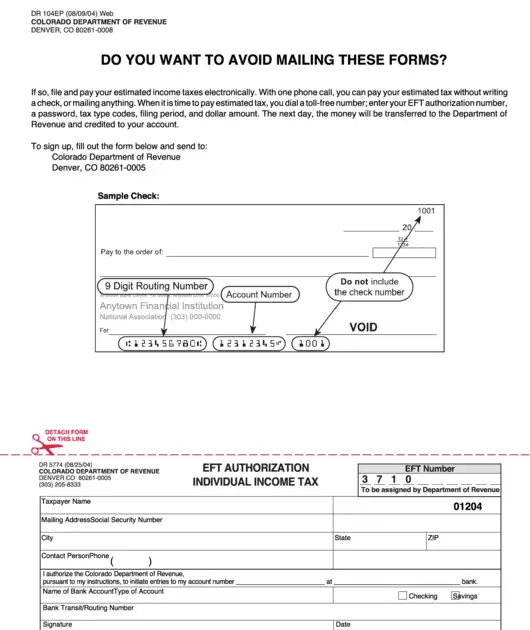

Electronic filing is safe and secure, and it offers the fastest service for a refund. Access online filing to file over the internet at no charge . You may choose to file electronically through your tax preparer or by using approved software on a personal computer. Individuals who both file and pay their income tax electronically using our website, a personal computer or a tax professional have an extended filing deadline of April 30. If April 30th is on a Saturday, Sunday or legal state or national holiday, the due date is the next business day.

The Department offers two ways to file a return electronically, both allowing you to file either a refund return or a tax-due return. File electronic returns through the Departments internet website or the Federal/State Filing Program. Certain restrictions on who may file and the types of returns eligible for electronic filing depend upon the electronic filing program used by the Taxation and Revenue Department and Internal Revenue Service websites contain information about the electronic filing options.

You may pay taxes over the internet with Visa, MasterCard, Discover or American Express cards. A convenience fee covers the costs that the companies bill the state when a credit card is used. There is no charge if you pay by electronic check. An electronic check authorizes the Department to debit a checking account in the amount and on the date specified.

For additional information refer to our forms and publications.

Latest News

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Also Check: Where’s My Income Tax

Free State Income Tax Filing

It isnt too difficult to find a place to file your federal tax return for free, but finding a way to get free state income tax filing is another story.

So if you are asking where can I file my state taxes for free? you are in for good news!

I did a little digging and found a few options to consider . . . .

Get Your Federal Tax Refund Fast

Not only have we tried to make it as painless as possible to prepare and file your return, filing electronically will also get your tax refund much faster. After all, it’s your money. Why wait any longer than necessary to get it back.

At E-file.com, we work to get your federal tax refund as fast as possible thanks to the electronic filing program with the IRS. Filing electronically with the IRS and selecting to have your refund direct deposited to your bank allows you to get your refund as fast as possible.

Don’t Miss: How To Get Tax Return From Turbotax

Basics To Know About Filing State Taxes For Free

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance.

Here’s A Few Things For Taxpayers To Know About Filing State Tax Returns Through Free File

- Most people make less than the $72,000 income limit. So, most people can use Free File.

- Generally, taxpayers must complete their federal tax return before they can begin their state taxes.

- More than 20 states have a state Free File program patterned after the federal partnership. This means many taxpayers are eligible for free federal and free state online tax preparation.

- The states with a Free File program are Arkansas, Arizona, Georgia, Idaho, Indiana, Iowa, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, New York, North Carolina, North Dakota, Oregon, Rhode Island, South Carolina, Vermont, Virginia and West Virginia, plus the District of Columbia.

- IRS Free File partners feature online products, some in Spanish. They offer most or some state tax returns for free as well. Some of them may charge so it’s important for taxpayers to explore their free options.

- Free File partners will charge a fee for state tax return preparation unless their offer says upfront the taxpayer can file both federal and state returns for free. Taxpayers who want to use one of the state Free File program products should go to their state tax agency’s Free File page.

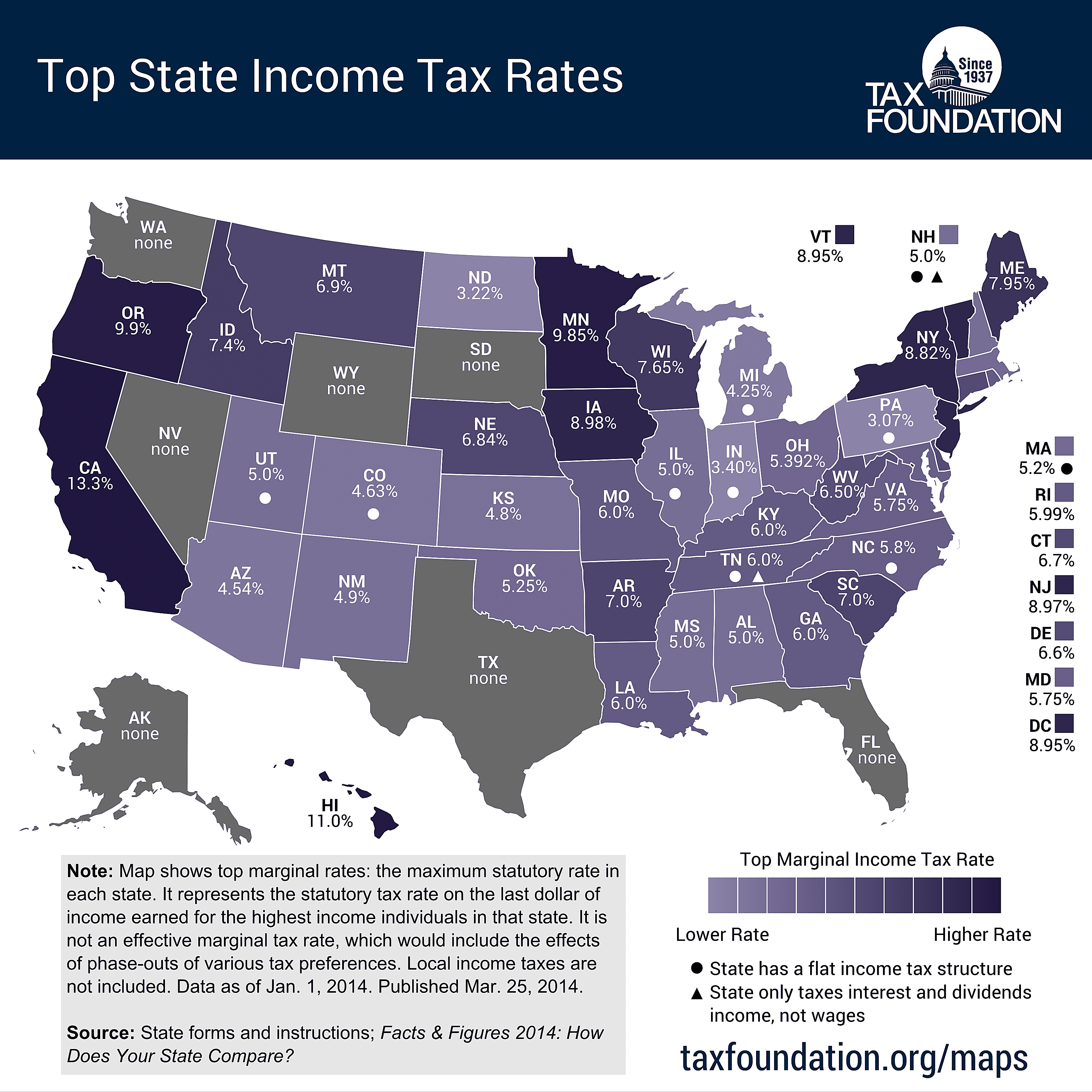

- Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming don’t have an income tax. So, IRS Free File for a federal return may be the only tax product people in those states need.

Recommended Reading: Do Seniors Have To File Taxes

How To File Your State Tax Return For Free

As you have probably noticed, many places offer a free filing of a Federal return but dont offer free state filing.

But there are a few ways to get your state income tax returns done for free and in this article, I am showing you free file programs that I found

TurboTax has rolled out their TurboTax FREE file program where you can get your Federal, State, and filing all done free.

They still offer paid options for more complicated tax returns, but if you dont have too much craziness going on with your taxes you will probably be eligible for their free program.

TurboTax has a long history of offering free Federal returns but people were always asking Is TurboTax free for state filing? and now the answer is a yes!

I personally love how simple and intuitive TurboTax is to use. You just answer their simple questions and they tax care of the rest.

You can read more about the details of who is eligible on their website and get started on the TurboTax Website.

Filing A State Return

TaxACT’s state modules are not standalone applications. They require the federal software to run.TaxACT allows you to prepare your state return, but first you need to prepare your federal return. All the data that flows to the state return originates from the federal return. The State Q& A interview section then prompts you for additional information that is specific to your state. Depending on your state, your filing options may be limited if you have already filed your federal return . If you are in a “Piggy Back” state , you will be required to print and mail your return if not submitting it along with the Federal return. For all other states you can electronically file by selecting State Only when going through the filing steps.

State Only Filing: To file only your state return, click on the blue Filing tab and select E-File My Return. Select the state-only return you wish to submit and then complete the filing steps.

If you do not see the option to file only your state return when going through the filing steps, please follow the instructions below:

Don’t Miss: How Are Reit Dividends Taxed

Why Is Turbotax Charging Me

If you make less than $36,000 a year and TurboTax is telling you it costs money to file, you are probably using the wrong version of TurboTax. Dont worry, there is a way to access the truly free version.

As ProPublica reported last year, TurboTax purposefully hid its Free File product and directed taxpayers to a version where many had to pay, which is called the TurboTax Free Edition. If you clicked on this FREE Guaranteed option, you could input a lot of your information, only to be told toward the end of the process that you need to pay.

You can access TurboTaxs Free File version here. This version is offered through the Free File agreement.

TurboTaxs misleading advertising and website design directed users to more expensive versions of the software, even if they qualified to file for free. After our stories published, some people demanded and got refunds. Intuit, the maker of TurboTax, faces several investigations and lawsuits because of this. The company has denied wrongdoing.

Following ProPublicas reporting, the IRS announced an update to its agreement with the tax-preparation companies. Among other things, the update bars the companies from hiding their Free File offerings from Google search results. It also makes it so each company has to name their Free File service the same way using the format: IRS Free File Program delivered by .

Be Aware Of Two Points In Going To These Sites:

The offers below are listed in alphabetical order, by company. To take advantage, read the descriptions, choose one of the offers, and click on the link. When you click, you will leave the Division of Taxation’s website.

1040NOW

With 1040NOW, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if:

- You live in Rhode Island and your federal adjusted gross income for 2021 was $32,000 or less.

Access 1040NOW’s dedicated Free File website by clicking on 1040Now’s Free File logo below. Otherwise, fees or charges may apply.

FreeTaxUSA

With FreeTaxUSA, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if:

- Your federal adjusted gross income for 2021 was $41,000 or less or

- You are active duty military with federal adjusted gross income for 2021 of $73,000 or less.

Access FreeTaxUSA’s dedicated Free File website by clicking on the logo below. Otherwise, fees or charges may apply.

Online Taxes at OLT.com

- Your federal adjusted gross income for 2021 was between $16,000 and $73,000 or

- You are active duty military with federal adjusted gross income of $73,000 or less.

You May Like: How To File Taxes Online

Many Taxpayers Can File Their State And Federal Tax Returns For Free

IRS Tax Tip 2021-10, February 1, 2021

As taxpayers get ready to file their federal tax returns, most will also be thinking about preparing their state taxes. There’s some good news for filers wanting to save money. Eligible taxpayers can file their federal and, in many cases, their state taxes at no cost.

Taxpayers whose adjusted gross income was $72,000 or less in 2019 can file their 2020 federal taxes for free using IRS Free File. Many of them can also do their state taxes at no charge. They do so through Free File offered by the IRS.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Recommended Reading: Can I File My Taxes Now 2021

Electronic Filing Options For Individual Income And Business Taxes

Being sensitive to the changing economic climate, the Kansas Department of Revenue no longer produces and distributes a large number of paper documents. Instead, instructions, sample tax forms, and schedules can be accessed on the Department’s website by going to the forms and publications page. The Department also offers the following alternative electronic reporting and filing options.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterdays audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldnt have asked for more. I cannot thank you enough for your help.

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

You May Like: How To File State Taxes Online