Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

How To File Your Return

For accurate and efficient processing, the Department strongly recommends taxpayers use an electronic eFile option to file their returns.

For taxpayers filing using paper forms, you should send us…

- Your North Carolina income tax return .

- Federal forms W-2 and 1099 showing the amount of North Carolina tax withheld as reported on Form D-400, Line 20.

- Federal Form 1099-R if you claimed a Bailey retirement deduction on Form D-400 Schedule S, Line 21.

- Form D-400 Schedule S if you added items to federal adjusted gross income on Form D-400, Line 7, or you deducted items from federal adjusted gross income on Form D-400, Line 9.

- Form D-400 Schedule A if you deducted N.C. itemized deductions on Form D-400, Line 11.

- Form D-400 Schedule PN if you entered a taxable percentage on Form D-400, Line 13.

- Form D-400 Schedule PN-1 if you entered an amount on Form D-400 Schedule PN, Part B, Line 17e or Line 19h.

- Form D-400TC and, if applicable, Form NC-478 and Form NC-Rehab if you claimed a tax credit on Form D-400, Line 16.

- A copy of the tax return you filed in another state or country if you claimed a tax credit for tax paid to another state or country on Form D-400TC, Line 7a.

- A copy of your federal tax return unless your federal return reflects a North Carolina address.

- Other required North Carolina forms or supporting schedules.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Don’t Miss: Is 529 Plan Contribution Tax Deductible

Mailing Addresses For Massachusetts Tax Forms

Use the following addresses for either an original or an amended return.

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Where Do I Mail My Amended Tax Return

Use IRS Form 1040-X to file an amended tax return. You can e-file this return using tax filing software if you e-filed your original return.

If you are filing Form 1040-X because you received a notice from the IRS, use the address in the notice. Otherwise, use this article from the IRS on where to file Form 1040X. Find your state on the list to see where to mail your amended return.

Recommended Reading: Do I Need To File Federal Taxes

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

Example For A Return Beginning With An Alpha Character:

To find Form SS-4, Application for Employer Identification Number, choose the alpha S.

Find forms that begin with Alphas:C, S, W

Note: Some addresses may not match a particular instruction booklet or publication. This is due to changes being made after the publication was printed. This site will reflect the most current Where to File Addresses for use during Calendar Year 2022.

Don’t Miss: What Is The Tax In Tennessee

Where To Mail Paper Tax Returns

Depending on where you live, which form you are filing and whether you are including a payment or not the IRS has different addresses where you will need to send your papers, and payment if necessary. The IRS provides a handy link to where you can check where your documents need to go broken down by category. You can check by state or outside the 50 states and the District of Columbia for Forms 1040, 1040-SR, 1040ES, 1040V, amended returns 1040-X, and extensions 4868. Or you can check where to send your documents by specificreturn type.

Looking for the status of your tax refund? Use Where’s My Refund? to start checking the status of your refund 24 hours after #IRS acknowledges receipt of your e-filed tax return:

IRSnews May 12, 2021

How Much Do You Have To Make To File Taxes

The IRS has several criteria for determining who must file a tax return. It depends on your filing status , the amount of federal income tax withheld from your earnings, and your gross income for the year. Even if your income is low enough to avoid filing, you may want to file to claim the earned income tax credit or other tax credits or to get a refund for the year.

You can use the interactive tax assistant on the IRS website, which takes you through a process of answering questions to help you figure out if you need to file a tax return

Also Check: Which Pages Of Tax Return To Print

Mailing Your Tax Return

When you mail a paper copy of your tax return, you need to attach all supporting documents and forms that support your claims. Although the printed return has a code on the front page that allows CRA to access the schedules and the forms you used, you need to attach detailed schedules or receipts to verify them. Here is a list of what you might need:

- Information slips especially if you have received an amended copy: T4, T4A, T3, T4RSP, T4RIF, RL-1, RL-2, etc.

- Forms, certifications, and schedules: T1135, T776, T778, T2125, schedule 2, schedule 5, T2202, etc.

- Provincial claims: form 428, 479, BEN, etc.

- Receipts: medical receipts, charitable donations, RRSP contributions, professional and union dues not reported on T4s, child care expenses, foreign income, repayment to the Employment Expenses, student loan interests, legal fees to establish a right to your salary, renovations to accommodate a person with a disability, moving expenses, attendant care, etc.

References & Resources

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agency’s General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

You May Like: How Much Inheritance Tax Do You Have To Pay

Some Taxpayers Given Automatic Extension

The IRS takes into consideration that circumstances may be more difficult for some taxpayers giving certain groups more time to file without requesting an extension. Though our advice would always be to file as soon as you can gather together all the necessary paperwork.

#IRS has resources on filing, paying electronically and checking on your tax refund online:

IRSnews May 13, 2021

Those taxpayers serving in a combat zone or a qualified hazardous duty area or those living outside of the United States, should be aware that they may be subject to different rules for when they need to file.

As well the IRS gives taxpayers a little more time to file in areas hit by severe weather and where FEMA has made a disaster declaration. Check the link to the IRS press release below for your state to see how it affects your filing in 2021.

Where Do I Mail My Provincial Tax Return

If you dont live in Québec, you dont need to file a return to your provincial government. The federal return you file with the CRA covers both your federal and provincial taxes.

If you live in Québec and choose to print and mail your provincial return, mail your return to one of the addresses listed on Revenu Québecs website.

Note: For tax year 2021, TurboTaxs print feature becomes available on February 21 when NETFILE opens.

More like this

- 64Updated 5 days ago

- 12Updated 4 days ago

Recommended Reading: Where Can I Get An Income Tax Loan

Deadlines For Small Business Tax Returns

- Sole proprietors and single-member limited liability company owners filing Schedule C along with their personal returns

- Partners in partnerships and multiple-member LLC members filing a partnership Schedule K-1

- S corporation owners filing an S corporation Schedule K-1

Mailing addresses for business filing partnership returns on Form 1065. corporations filing Form 1120 returns, and S corporation returns filing Form 1120-S are provided on a .

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail return receipt requested, when you’re sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. The date of the registration is the postmark date if you use registered mail. The date stamped on the receipt is the postmark date if you use certified mail.

Make sure the return is sent out no later than the date due if you use an IRS-approved private carrier.

You May Like: How Much Is The Gas Tax In California

What Do I Need To Send In With My Paper Tax Return

If youre mailing your return to the Canada Revenue Agency and/or Revenu Québec, youll need to attach the following documents to your return . Be sure to keep copies for your records!

Note: You only need to send documents that the CRA requires in support of certain credits and deductions. For example, youll need to submit your T4 slip in support of your employment income for the year and not your paystubs. Keep all other supporting documents for your records in case the CRA askes to see them later.

- Information slips such as your T4, T4A, T3, T5, RL-1, RL-2, RL-3, RL-16

- All completed schedules and forms that are a part of your return, including the Schedule 1 and your provincial or territorial Form 428 or your Québec tax return

Note: When you download the mail-in copy of your return from H& R Blocks tax software, it will already include the forms and schedules that apply to you and which either agency needs.

- Tuition fees certificates for the tuition amounts you paid such as your T2202A or TL11A/TL11B/TL11C/TL11D

- Official receipts for:

- RRSP contributions, including those you arent deducting on your return for the year and those you are designating as Home Buyers Plan or Lifelong Learning Plan repayments

- Federal political contributions

- Other proof of payment for:

- Amounts of Employment Insurance you repaid

- Amounts paid for non-resident dependants

- Interest paid on your student loans

Where can I learn more?

How Do I Fix My Tax Return If It Gets Rejected

If the IRS computers look at your return and something just doesnt add up, your tax return gets rejected. The issue could be as simple as a typo in a Social Security Number or an address.

The good news is that you can simply file your taxes againno amended return process needed. Just log back into 1040.com to see which part of your return needs to be fixed, make the change, and refile .

Here are a few of the most common errors:

- A name doesnt match Social Security records

- An address was entered incorrectly

- An Employer Identification Number was entered incorrectly

- A date of birth was entered incorrectly

- A child was already claimed on someone elses return

- Using the married filing separately status in a community property state AZ, CA, ID, LA, NM, NV, TX, WA, or WI which is not allowed

- An incorrect number was used to identify yourself to the IRS, such as an incorrect prior-year AGI or Employer Identification Number

Also Check: Which Hybrid Cars Are Eligible For Tax Credits

Filing Your Income Tax Return

Annually, you need to complete the T1 General Income Tax and Benefit Return as well as associated territorial or provincial forms. In order to complete your return, you also will likely need to complete schedules or additional forms that request more information. Schedules should be attached to your income tax return in most cases.

For example, if you split pension income with your spouse, the CRA requires you to complete and submit form T1032. In most cases, you need to attach these forms to your income tax return when you file it, and you should make copies for your records.

However, in cases where a form establishes a long-lasting condition, you typically do not have to file it each year.

- For example, if you are applying for the Disability Tax Credit , you only need to submit Form T2201 for the first year.

- Once you are approved for the credit, you do not have to submit the form for subsequent years unless CRA requests you to do so. Quite often the DTC will only be approved for a limited number of years, such as 5 or 10. CRA will send you a letter stating that your period of approval has ended and that you need to submit a new T2201 before filing your next tax return.

- You can check the status of your Disability Tax Credit approval at any time by signing into your CRA My Account and clicking on Benefits & Credits.

Where To Mail Your Personal Tax Return

The IRS has more addresses than you might imagine because its processing centers are located all around the country. The address you’ll use depends on what you’re mailing and where you live. Go to the Where to File page on the IRS website if you’re sending a personal tax return, an amended return, or if you’re asking for an extension of time to file. The page includes links for every state.

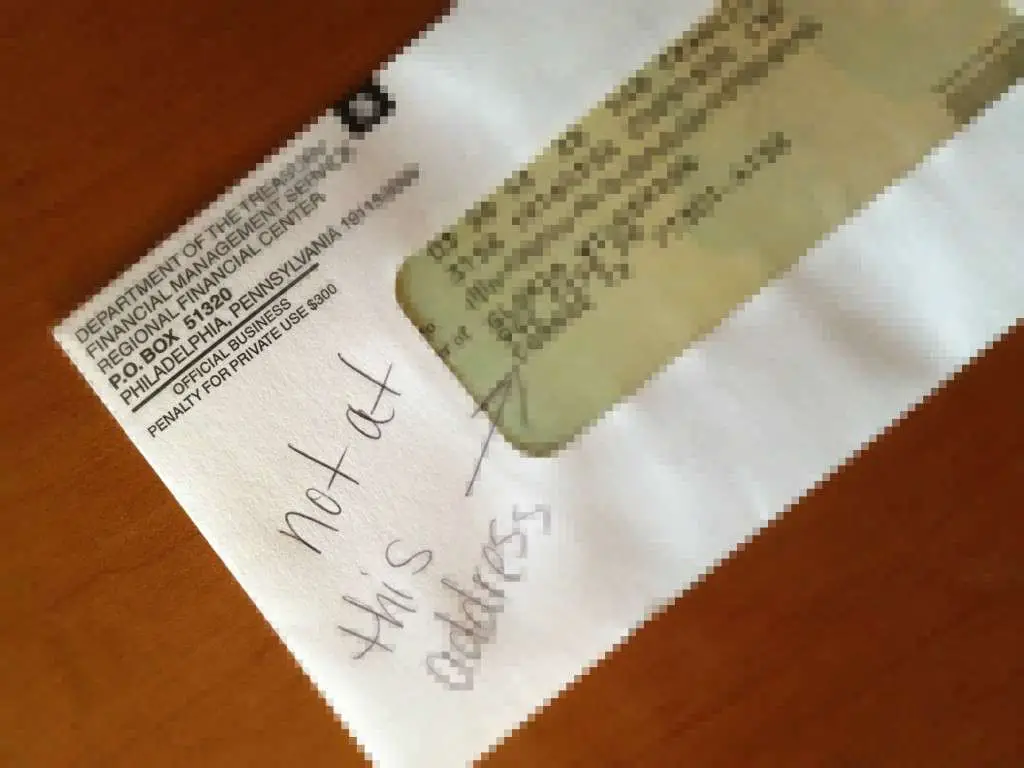

Note that the mailing address is usually different if you’re submitting a payment with your return. You’ll typically mail returns withpayments to the IRS. Returns without payments go to the Department of the Treasury.

IRS addresses change periodically, so dont automaticallysend your tax return to the same place you sent it in previous years.

Note that the IRS uses ZIP codes to help sort incoming mail. Make sure your return gets to the right place as quickly as possible by including the last four digits after the five-digit zip code. For example, the correct address for a California 2021 Form 1040 mailed with a payment in calendar year 2022 is:

Internal Revenue Service45280-2501

Don’t Miss: How Much Does H& r Block Charge To Do Your Taxes

Make Sure You Mail On Time

The postmark on your envelope is what counts when mailing your tax return. Some post office locations offer extended hours and late postmarking before Tax Day.

You can purchase a certificate of mailingat the post office to prove that you mailed your return on a specific date. Keep the certificate the post office doesn’t keep copies.

Before you mail that return, make sure you have the correct IRS, and include your return address on your mailing label and that you have enough postage.