Copy Of Return/print Return

Once you have signed in to your prior year return, if you would like to print a copy of your return for your records:

Note. If you see a message indicating you have not paid your return fees, click the View/Pay your return fees link, which will direct you through the Paper Filing steps. Continue through the screens until you have processed the payment for your product fees and then repeat the steps to print.

Note. TaxAct Online returns are available for editing for two years, the current tax year and one year back . For tax years 2016-2018, you may print or save a copy of Form 1040 ONLY by following these steps:

Changing The Control Which Forms Print Option

If ProSeries transferred the preferences and settings that you used with last year’s program, then the Control Which Forms Print settings for the Client Copy and Preparer Copy options are set the way they were set in last year’s program. However, the Control Which Forms Print settings for the Filing Copy aren’t transferred from last year’s program.

Consider Filing Online To Avoid Delays

If you choose to file by paper, file before the deadline to avoid any interruptions to any benefit and credit payments. Our service standard is to issue your notice within two weeks of receiving your digital return. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper returns. The CRA will process them in the order they are received. Taxpayers who file electronically and who are signed up for direct deposit may get their refund in as little as eight business days.

We encourage you to file your taxes online and sign up for direct deposit and My Account early. Filing online is the fastest and easiest way to do your taxes. If youre registered for My Account, you can also use Auto-fill my return to quickly fill in parts of your return with information the CRA has on file. Filing online also helps you get your refund faster and avoid any delays. If youre registered for direct deposit, youll receive your payments without delay.

You can file as early as February 21, 2022 with NETFILE. If you chose to file online using NETFILE, youll need an eight-character alphanumeric access code before filing. This unique code can be found to the right, beneath the Notice details box on the first page of your notice of assessment. Your access code will let you use information from your 2020 tax return when confirming your identity with the CRA. Your access code isnt mandatory, but without it youll have to rely on other information for authentication purposes.

Read Also: How To Find A Companys Ein

Mailing Instructions: Where When And How

If your return cannot be e-filed, you must submit it to the IRS by post

TFX will e-file your return whenever possible. In certain cases, however, the IRS does not allow taxpayers to e-file their returns.

For example:

- If youre filing an amended return,

- If youre filing using the Streamlined Procedure, or

- If youre filing an older return .

Printing Your Return And Individual Forms

For the security of your personal information, a printed or digital copy of your TaxAct® Online return is only available by signing into your account and printing or saving it yourself. We cannot mail, fax, or e-mail a paper or electronic copy. If you do not remember the username or password, you can use the appropriate links on the sign-in page.

Using your Online account, the print process will generate a Portable Document Format file which can be viewed, printed, or saved from a PDF reader.

IMPORTANT: You must first have Adobe Acrobat Reader installed.

Recommended Reading: Grieved Taxes

Cover Your Bases With Registered/certified Mail Or Private Delivery Services

If youre sending in your taxes by regular mail, you cant ever be sure if the IRS received it. Consider using registered or certified mail to file your tax returns, allowing you to trace your mail easily. The IRS also considers registered mail the best evidence to show the correct date you filed your return, so its a good way to cover your bases.

You can also use private delivery services designated by the IRS to mail and file your taxes on time. If necessary, you can contact the private delivery service to get written proof of the mailing date, or you can track the delivery online. If you opt for a private delivery service, make sure they are IRS-approved, which include the following:

- UPS Next Day Air Saver

- UPS 2nd Day Air

- UPS 2nd Day Air A.M.

- UPS Worldwide Express Plus

- FedEx International Priority

- FedEx International First

Private delivery services cannot deliver items to P.O. boxes, so if you only have an IRS P.O. box for delivery, you must use the U.S. Postal Service.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

You May Like: Buying Tax Liens In California

To Force Printing Of The Federal Information Worksheet Pages:

- At the top of the Federal Information Worksheet pages 2 through 5, a check box is available to force printing for each page of the Federal Information Worksheet.

- ProSeries Professional only: If you always want to print all pages of the Federal Information Worksheet, as well as page 2 of other forms, the Print Page 2 Always selection in the ProSeries options will result in all 5 pages of the Federal Information Worksheet printing.

Schedules And Extra Forms

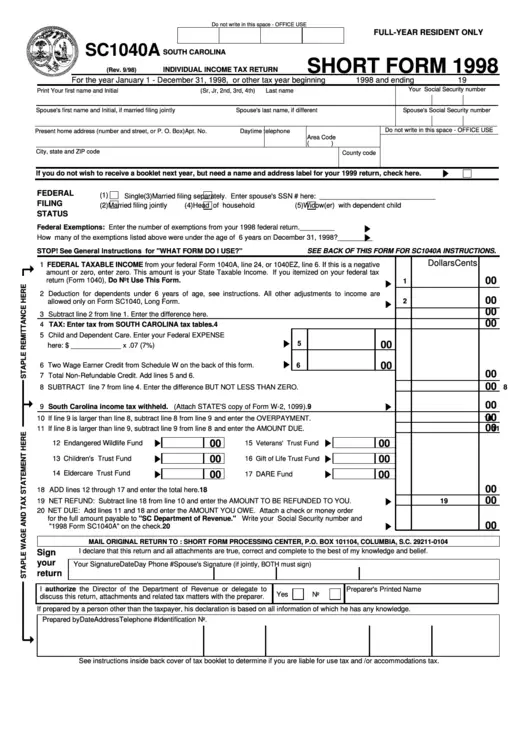

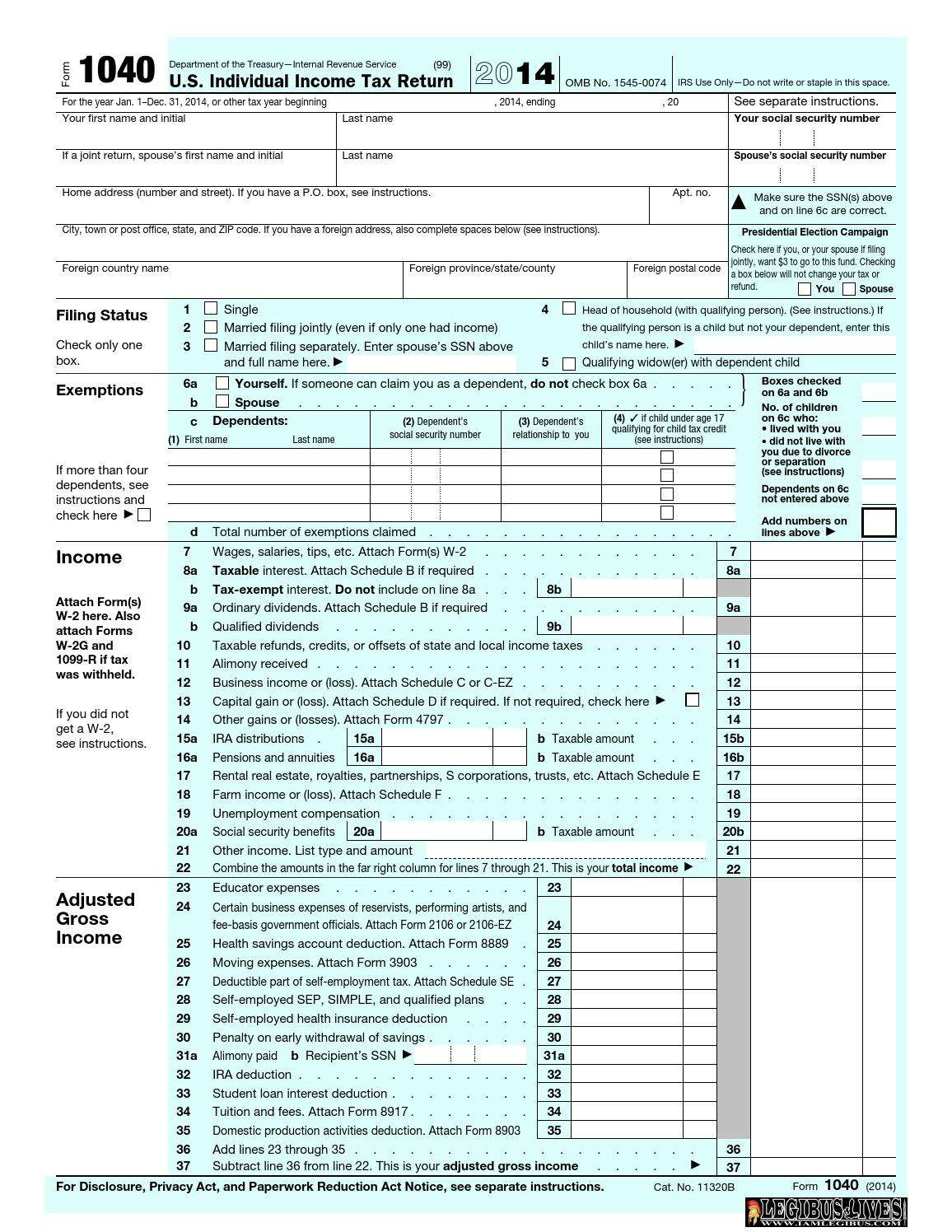

Since 1961 Form 1040 has had various separate attachments to the form. These attachments are usually called “schedules” because prior to the 1961, the related sections were schedules on the main form identified by letter. Form 1040 currently has 20 attachments, which may need to be filed depending on the taxpayer. For 2009 and 2010 there was an additional form, Schedule M, due to the “Making Work Pay” provision of the American Recovery and Reinvestment Act of 2009 .

Starting in 2018, 1040 was “simplified” by separating out 6 new schedules numbers Schedule 1 through Schedule 6 to make parts of the main form optional. The new schedules had the prior old 1040 line numbers to make transition easier.

In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return. Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules.

| Type |

|---|

In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Actâthe premium tax credit and the individual mandate.

Recommended Reading: How To File Doordash Taxes

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Print Tax Return Double

More Americans are becoming environmentally conscious, especially in a time when an average worker prints 10,000 sheets per year . Many taxpayers want to know if they can print two-sided IRS forms to save paper. Its generally preferred that both sides of the paper are used for substitutes and reproduced forms since this results in the same page arrangement as that of official forms.

While each form can be double-sided, different forms cannot share the same page so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004. Additionally, certain tax preparation software services are not set up to print each form separately if you use two-sided mode, so its important to double-check all your forms when using two-sided printing.

The IRS will also accept forms if only one side of the paper is used. So, if youre unsure where each form belongs, its best just to print single-sided pages. Many people also prefer printing single-sided to make sure they dont accidentally skip a page.

Read Also: Efstatus.taxact 2014

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors’ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Omb Control Number Controversy

One argument used by tax protesters against the legitimacy of the 1040 Form is the OMB Control Number of the Paperwork Reduction Act argument. Tax protesters contend that Form 1040 does not contain an “OMB Control Number” which is issued by the U.S. Office of Management and Budget under the Paperwork Reduction Act.

The relevant clauses of the Paperwork Reduction Act state that:

- § 1320.6 Public protection.

- Notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information that is subject to the requirements of this part if:

- The collection of information does not display, in accordance with §1320.3 and §1320.5, a currently valid OMB control number assigned by the Director in accordance with the Actâ¦

- The protection provided by paragraph of this section does not preclude the imposition of a penalty on a person for failing to comply with a collection of information that is imposed on the person by statuteâe.g., 26 U.S.C. §6011 â¦

The Courts have responded to the OMB Control Number arguments with the following arguments. 1) Form 1040, U.S. Individual Income Tax Return has contained the OMB Control number since 1981. 2) As ruled in a number of cases, the absence of an OMB Control number does not eliminate the legal obligation to file or pay taxes.

Cases involving the OMB Control Number Argument include:

- United States v. Wunder

- United States v. Patridge

Recommended Reading: Payable Account Doordash

Filing Your Income Tax And Benefit Return On Paper

Important notice

Remember to file by the deadline to avoid interruptions and delays to your benefit and credit payments including the Canada child benefit, GST/HST credit, related provincial and territorial benefit programs, child disability benefit, or guaranteed income supplement.

If you filed on paper last year, the Canada Revenue Agency will automatically mail you the 2021 income tax package by February 21, 2022.

The package you will receive includes:

- a letter from the Minister of National Revenue and the Commissioner of Revenue

- the Federal Income Tax and Benefit Guide

- an information guide for your province or territory

- two copies of the income tax and benefit return

- Form 428 for your provincial or territorial tax

- File my Return invitation letter and information sheet, if youre eligible for the service

- personalized inserts or forms, depending on your eligibility

- a return envelope

If you havent received your package by February 21, you can:

- view, download, and print the package from canada.ca/taxes-general-package

- order the package online at canada.ca/get-cra-forms

- order a package by calling the CRA at 1-855-330-3305

It can take up to 10 business days for publications and forms to arrive by mail.

For orders placed before February 14, 2022, your order will be mailed to you as soon as the 2021 tax products are printed and ready to ship.

Irs Tax Forms And Instructions In Large Print

This page contains large print versions of IRS tax instructions. Each instruction is a compressed ZIP file, which contains a Portable Document Format file or set of files. Large print files are produced in 20-point Arial font and can be printed on standard letter-size paper. Some files include inserts that are printed on tabloid paper. These pages will appear in a smaller font unless you print them on tabloid paper.

The files on this page are for print purposes only and are not Section 508 compliant. If you need a Section 508 compliant version, visit the Browser-Friendly Instructions page for instructions in HTML format.

Read Also: Appeal Taxes Cook County

Printing Copy Of Tax Return

- Float this Topic for Current User

- Bookmark

Most copies of my my Wisconsin state tax returns are not printing properly. Sections of the form are randomly left blank. Is anyone else having this problem?

Thanks,

Do the forms come out clean if you print to pdf?

Ukraine – hang in there

Yes, the forms print correctly when printing from PDF.

Yes, having the same issue. Most of page 3 is missing the text and randomly printing the numbers. Page 4’s text is printing blurry/wavy. I’ve updated my program several times however that doesn’t help. I can’t find any reference to this issue in Support. ???????

Can you print a clean copy to pdf?

Ukraine – hang in there

Then print to pdf and then print to paper from there until things get figured out. It’s an extra step but it keeps you trucking down the road for now.

– more printing issues.

Can you provide details of the printer you are using ?

Historically, i’ve heard printer driver issues have been a chronic problem. I’d love to figure out what we can do this year to fix things, starting with collecting data on what printers we see issues with and what it takes to fix it.

Note the technology to print to pdf is vastly different than the technology to print to printer.. but if the PDF programs can subsequently print, I’m sure we can dig in and figure out why we’re having issues.

I Need To Print My Tax Return So I Can Send It To The Irs Do I Need To Print All 104 Pages To Send To Them

You only print the Form 1040 and any other forms and schedules that have tax data entered. The forms and schedules to include will have an Attachment Sequence Number in the upper right corner of the page. All the other pages in the PDF are for your use only and are Not sent with the tax return.

You will need to sign and date the Form 1040, include all form W-2’s and form 1099’s that have income taxes withheld.

Read Also: Doordash Calculator

Printing A Watermark On A Tax Return

ProSeries now offers the capability to print customizable watermarks on the filing copy and the client copy of a printed return. This new feature can be accessed from the ProSeries Print Center when you print a return. The watermark text may be edited on this same screen and will print on both paper and PDF copies when selected.

Printing a watermark is only available in ProSeries Professional, not ProSeries Basic.

Mailing Your Tax Return

When you mail a paper copy of your tax return, you need to attach all supporting documents and forms that support your claims. Although the printed return has a code on the front page that allows CRA to access the schedules and the forms you used, you need to attach detailed schedules or receipts to verify them. Here is a list of what you might need:

- Information slips especially if you have received an amended copy: T4, T4A, T3, T4RSP, T4RIF, RL-1, RL-2, etc.

- Forms, certifications, and schedules: T1135, T776, T778, T2125, schedule 2, schedule 5, T2202, etc.

- Provincial claims: form 428, 479, BEN, etc.

- Receipts: medical receipts, charitable donations, RRSP contributions, professional and union dues not reported on T4s, child care expenses, foreign income, repayment to the Employment Expenses, student loan interests, legal fees to establish a right to your salary, renovations to accommodate a person with a disability, moving expenses, attendant care, etc.

References & Resources

Recommended Reading: How To Get Doordash Tax Form