How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Wheres My State Tax Refund Nebraska

Its possible to check you tax refund status by visiting the revenue departments Refund Information page. On that page you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

What If My Return Is Delayed

If your return requires additional review, it may take longer than normal to receive your refund. Some circumstances that may delay your refund include:

- Missing information

- Errors

- A return affected by identity theft

- A return that includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit .

- A return that includes Form 8379, Injured Spouse Allocation, which could take as long as 14 weeks to process

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return.

Read Also: Www.1040paytax.com

Where Does It All Go

The vast majority of the nearly $5 trillion the government will spend this year, or about 60%, is earmarked for mandatory spending, or $620 out of your $1,000. Thats made up mostly of big, expensive, legislatively mandated social programs such as Medicare, Medicaid, and Social Security. Then theres discretionary spending, the part of the budget appropriated by Congress, which accounts for about 30% of federal spending. Thats $300 out of your hypothetical $1,000 in tax money that pays for things such as the military and the Department of Veterans Affairs. Finally, a little less than 10% of federal tax revenue goes to covering interest payments on the soaring national debt, which is the fastest-growing federal expense.

How Long Will It Take To Get Your Refund

General refund processing times during filing season:

- Electronically filed returns: Up to 4 weeks

- Paper filed returns: Up to 8 weeks

- Returns sent by certified mail: Allow an additional 3 weeks

The Wheres my Refund application shows where in the process your refund is. When we’ve finished processing your return, the application will show you the date your refund was sent. All returns are different, and processing times will vary.

See how our return process works:

Read Also: Www.1040paytax.com.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Can I Cash A Check At Cvs

CVS does not offer check-cashing services to its customers in any of its stores. CVS does, however, accept personal and business checks as a form of payment. Alternative places to visit to get checks cashed include Walmart, Kroger, Safeway, and Wegmans, as well as your nearby bank or credit union.

Recommended Reading: Pastyeartax.com Reviews

I See An Irs Treas 310 Transaction On My Bank Statement What Is It

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

Also Check: Www Aztaxes Net

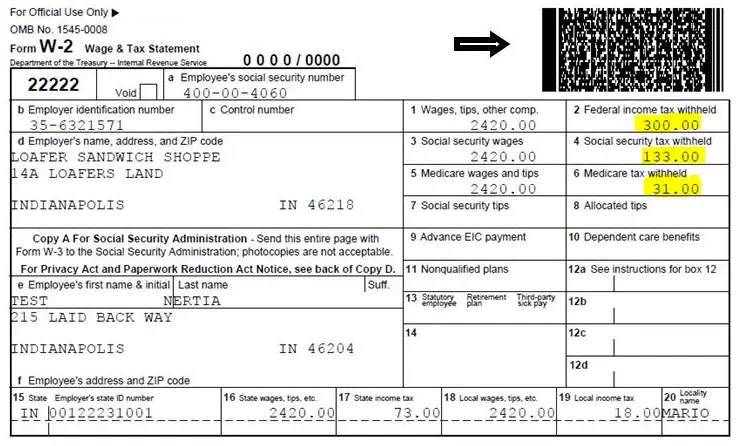

Filing Federal Income Tax Return

expand_moreWhat is income tax?Federal income taxAdvantages of filing a federal income tax returnInternal Revenue ServicesTypes of IncomeTax filing status under federal income taxSingle personHead of HouseholdA widow with a dependent childRules for filing a federal income tax returnThe procedure of filing a federal income tax returnSteps to file a federal income tax returnTax credit under federal income tax returnTax refundContext and ApplicationsPractice ProblemsRelated Concepts

Spending By Main Source Categories And Agency In 2021

*The Economic Impact Payments issued in response to the COVID-19 pandemic, the Child Tax Credit Payments , unemployment benefits, food assistance, housing assistance, and more are included in the Income Security category.

If you want to learn more about where your money is going, check out USAspending.gov.

Read Also: Plasma Donation Taxes

Rules For Filing A Federal Income Tax Return

- The tax rate and brackets are charged only on the taxable income of the taxpayer.

- The gross salary should be reduced by the standard deduction allowed by the IRS.

- The taxpayer’s gross income is up to standard deduction, and then the tax rate is zero percent.

- After deducting the standard deduction, the resulting amount is taxable on which IRS charges tax.

Why Is My Tax Refund Delayed

Some tax returns take longer to process than others. In general, if your return is error-free and complete, it will get processed within 21 days. Some reasons that can delay processing are:

- Incomplete information

- IRS suspects identity theft or fraud

- Some claims require additional reviews like the Recovery Rebate Credit, Earned Income Tax Credit, Additional Child Tax Credit, Injured Spouse Allocation, etc.

The IRS will contact you by mail if they require any additional information or corrections. Usually, if the Where’s my refund’ tool does not have an updated return status, then call center agents will not either.

Also Check: How To Protest Property Taxes Harris County

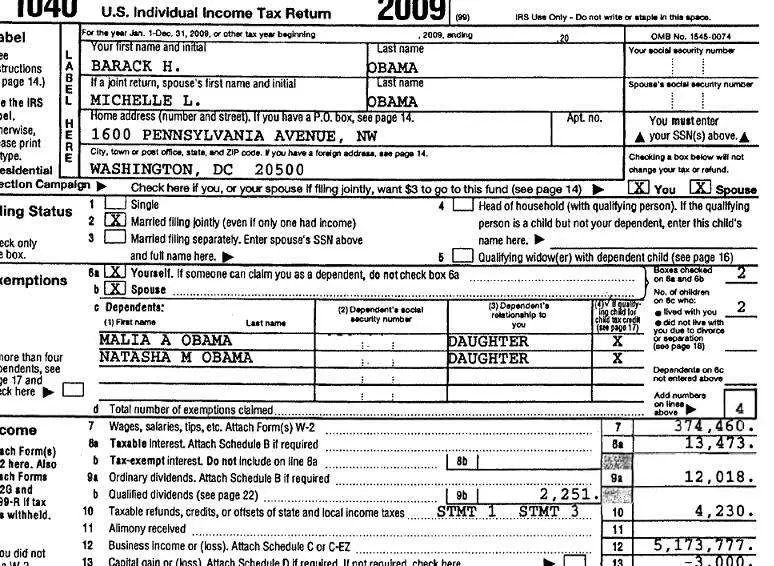

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2021. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,950 you pay 12% on the rest.

-

Example #2: If you had $50,000 of taxable income, youd pay 10% on that first $9,950 and 12% on the chunk of income between $9,951 and $40,525. And then youd pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,800 about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate.

» MORE:See state income tax brackets here

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Don’t Miss: Doordash Tax Forms

What Should I Do With My Tax Refund

The options are endless, but here are a few suggestions on making the most out of your tax return.

Overall, having a solid personal financial plan will make it easy to prioritize how best to utilize your tax refund. In general, we recommend paying off any high-interest loans, like outstanding credit card balances. If you still have money left, invest in your future by putting the money into retirement investment accounts like the Roth IRA.

- Pay off high-interest loans.

- Use it as a down payment for a new home or investment property

- Put money into savings for an emergency fund or retirement account

- Invest in your health Buy weights for your home gym or invest in non-toxic cookware

Each individual will have different needs, so be sure to think about what would work best for you before making any decisions.

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Don’t Miss: Efstatus.taxact.com Login

Why Would My Tax Refund Come In The Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first few payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment.

For more information about your money, here’s the latest on federal unemployment benefits and how the child tax credit could affect your taxes in 2022.

Covid Related Operational Delays

With Covid, IRS operations can be affected, so it’s a good idea to check if you should be expecting any delays in processing your refund by clicking here. In general, if there are delays past 21 days, your return requires special handling or extra information. Watch out for online updates or a notice in your mail.

Don’t Miss: Do I Have To Pay Taxes On Plasma Donation

Ways To Make The Tax Refund Process Easier

Find your tax refund fast by proactively checking your IRS federal tax return status. Before filing and using the IRS Wheres My Refund portal to track your 2020 government return, consider:

- Reviewing your return carefully. Mistakes can delay your returns progress on the tax refund tracker. Be sure to review your information carefully before filing with the IRS.

- Filing early. The earlier you file, the sooner you can check the status of your IRS federal tax return. Early filing also provides more time to deal with issues should something go wrong.

- E-Filing your return. Instead of spending 6-8 weeks wondering wheres my tax refund from the IRS?, do yourself a favor and file electronically. E-Filed government returns are typically processed in under half the time as paper returns.

- Opting for direct deposit. Avoid waiting for your check by having your IRS refund deposited into your account. Once the WMR reads Refund Approved, your money will be ready to spend.

- Tracking your 2020 refund right away. Staying up-to-date on your return ensures youre in the loop every step of the way.

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Don’t Miss: How To Buy Tax Liens In California

What Banks Are Affiliated With Jp Morgan Chase

We trace our roots to 1799 in New York City, and our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings,

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Recommended Reading: Taxes On Plasma Donation

How To Get A Faster Tax Refund

Here are four things that can help keep your “Where’s my refund” worries under control.

Avoid filing your tax return on paper. It’s a myth that your IRS refund status will be “pending” for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering “where’s my refund?” by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Don’t let things go too long. If you haven’t received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. “Where’s my refund” will undoubtedly be a concern, but the thing to worry about here is refund theft. It isn’t corrected quickly, so you may be in for an even longer wait.

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.

Also Check: Irs Employee Search