Whats New For January 1 2022

This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2022. We recommend that you use the Payroll Deductions Online Calculator , the publication T4032 Payroll Deductions Tables, or the publication T4008 Payroll Deductions Supplementary Tables, and the formulas in this guide for withholding, starting with your first payroll in 2022.

Effective January 1, 2022, PDOC will accept direct entry of Total Claim Amount and Total Claim Amount Provincial or Territorial .

How Much Child Support To Deduct

Our notice includes a schedule of deductions that tells you how much child support to deduct. You must not change the deduction amount listed in the schedule.

You cant change the deduction even if your employee or contractor, their lawyer or anyone else, asks you to. You can only change it if we tell you in writing, or if the Protected Earnings Amount applies.

Once you make a deduction from your employee or contractors pay, you have legal obligations to send us any deductions you make. If you dont meet your legal obligations, we can impose penalties.

You can pay these deductions using a range of payment options.

Your employee or contractor can on the Child Support information line if they have any questions. Well give them advice based on their situation.

Dont Forget Payroll Taxes

Payroll taxes are tied directly to payroll deductions, for your employees and for your business. Remember that in addition to the taxes you must withhold from your employees paychecks, you have your own business payroll tax responsibilities as well.

Youll need to pay federal unemployment taxes and FICA taxes on top of those from your employees, and youll need to report payroll taxes on a quarterly basis. FICA and income taxes are reported to the IRS using Form 941 and FUTA taxes are reported using Form 940.

One of the most common payroll mistakes that small businesses make is missing payroll tax deadlines, as theyre due quarterly, instead of annually. Ensure that part of your payroll process involves managing your businesss payroll tax responsibility, as well as the payroll deductions you must withhold from your employees.

Once again, using a payroll software program with tax functionality is a great way to help you streamline and stay on top of this process.

Read Also: Doordash Taxes Calculator

Formula To Calculate Provincial And Territorial Tax Payable

We have not repeated the entire explanation for the provincial and territorial variables. Effective January 1, 2022, the variables for Option 2 are the same as for Option 1, except for factor K2P, which is as follows:

K2P = * If the result is negative, enter $0.

Replace the lowest provincial or territorial tax rate with the appropriate rate for the province or territory that applies to the employee or pensioner.

Only for Quebec:

Only for outside Canada or in Canada beyond the limits of any province or territory:

T2 = $0

Tax Rates And Income Thresholds

For 2022, the Ontario tax rates and income thresholds are:

Chart 2 2022 Ontario tax rates and income thresholds

| Annual taxable income |

|---|

For 2022, the Ontario health premium is:

- when taxable income is less than or equal to $20,000, the premium is $0

- when taxable income is greater than $20,000 and less than or equal to $36,000, the premium is equal to the lesser of $300 and 6% of taxable income greater than $20,000

- when taxable income is greater than $36,000 and less than or equal to $48,000, the premium is equal to the lesser of $450 and $300 plus 6% of taxable income greater than $36,000

- when taxable income is greater than $48,000 and less than or equal to $72,000, the premium is equal to the lesser of $600, and $450 plus 25% of taxable income greater than $48,000

- when taxable income is greater than $72,000 and less than or equal to $200,000, the premium is equal to the lesser of $750 and $600 plus 25% of taxable income greater than $72,000 and

- when taxable income is greater than $200,000, the premium is equal to the lesser of $900 and $750 plus 25% of taxable income greater than $200,000

Read Also: Plasma Donation Taxable

How To Calculate Voluntary Paycheck Deductions

While FICA, federal income tax, and state and local income taxes all require mandatory payroll deductions, there are some other voluntary sources that could lead to additional paycheck withholdings. Potential voluntary paycheck deductions include:

- Health insurance Based on the plans offered and which of those plans your employees choose

- Retirement Based on how much each employee opts to have withheld from each paycheck

- Life insurance Based on whether employee opts to have deductions to go toward a life insurance premium

- Job expenses Varying deductions based on any business expenses made by an employee that are either not or only partly covered by the employer

What Is The Difference Between Basic Salary And Gross Salary

| Basic Salary | Gross Salary |

|---|---|

| Basic salary is the amount paid to an employee before any extrasare added or taken off. It does not include any allowances, overtime or any extra compensation | Gross Salary is the amount of salaryafter adding all benefits and allowances but before deducting any tax |

| For Example: An employee has a gross salary of Rs. 50, 000 and basic salary of Rs. 20, 000, then he/she will get a Rs. 20,000 as a fixed salary. |

You May Like: Irs Employee Lookup

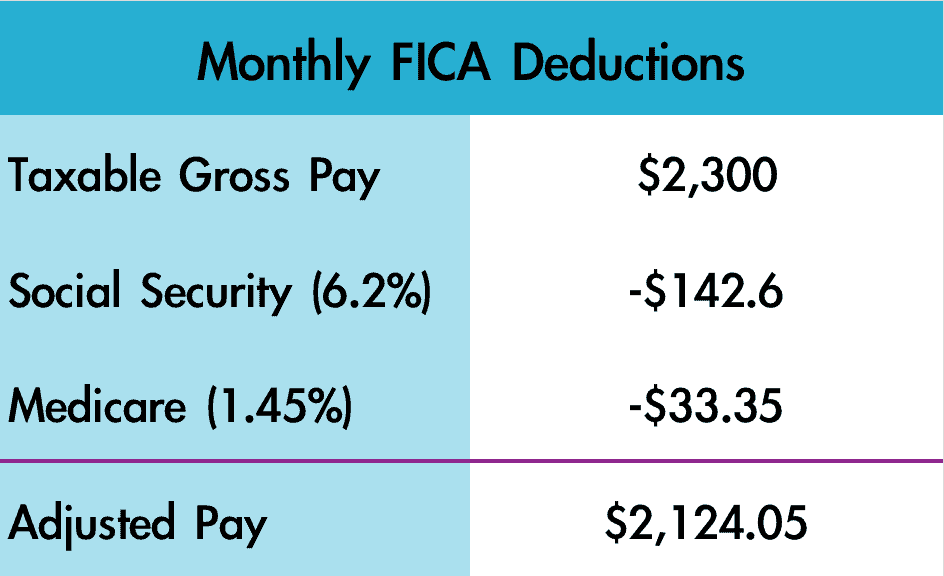

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How To Calculate Your Net Paycheck

What is FICA, and why am I paying so much? If youve ever asked yourself this question while examining your paystub, heres your answer: FICA is an acronym that stands for Federal Insurance Contributions Act, the law that created Social Security. Your share of FICA includes employee contributions for Social Security and Medicare. Employers also pay a share of the FICA tax for each employee.

FICA is just one of many potential paycheck reducers that represent the difference between your salary, or gross pay, and the actual amount you take home, your net pay.

Don’t Miss: Appeal Taxes Cook County

Formula To Determine Cpp Contributions For Employees Who Were Transferred By Their Employer From Quebec To A Location Outside Quebec During The Year Paid By Commission

C = The lesser of: $3,499.80 0.0570 × If the result is negative, C = $0.

* No rounding required for this factor.

Note

For these formulas, round the resulting amount to the nearest $0.01. The maximum amount for the year will vary according to the rules in the section called Special CPP Situations.

Each employer needs to deduct CPP contributions based on the employees pensionable income, without regard to any other earnings the employee may have had with another employer in the same year. Accordingly, you must use the maximum above even if the employee works for you less than 12 months. Similarly, you are not entitled to a refund of the employers share of CPP if the employee works for you less than 12 months.

For payments where the employee receives remuneration such as a bonus, retroactive pay increase, vacation pay when vacation is not taken, or accumulated overtime pay, and the payment is not included with the regular remuneration for the current pay period, you should introduce a code or use the factor B with the record. Also do this if a non-periodic payment is made and no regular remuneration is paid in the pay period. You do this to avoid allowing the basic exemption for the pay period in the formula described above.

The basic exemption amount used to determine the employees contributions for the pay period has to stay the same throughout the year, regardless of whether an employee has worked in each week of the pay period.

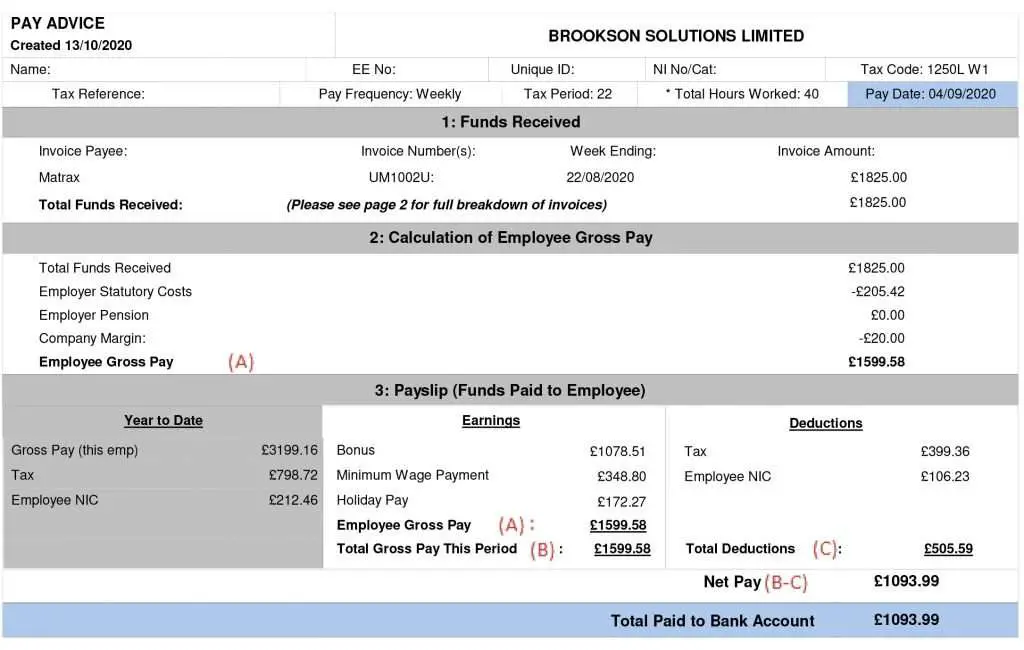

What Should You Do With Your Paycheck Stub

Pay stubs are used to verify payment accuracy and may be necessary when settling wage/hour disputes. For this reason, employees may want to save their pay stubs, but arent required to do so. Employers, however, must keep payroll records for the specific lengths of time mandated by federal and state governments.

Read Also: Amended Tax Return Online Free

In Summary You Should Determine The Calculation Basis As Follows:

- add together all cash benefits

- calculate the value of payments in kind

- calculate the value of expense allowances

- add together the benefits and make any deductions from the calculation basis

Once you have determined the calculation basis, check that the amounts aren’t below the minimum thresholds for withholding tax. Then you make the deduction in accordance with the employee’s tax deduction card.

Publications And Subscriptions Deduction

The cost of specialized magazines, journals, and books directly related to your business is tax deductible as supplies and materials.

A daily newspaper, for example, would not be specific enough to be considered a business expense. A subscription to Nations Restaurant News would be tax deductible if you are a restaurant owner, and Nathan Myhrvolds several-hundred-dollar Modernist Cuisine boxed set would be a legitimate book purchase for a self-employed, high-end personal chef.

Recommended Reading: Do You Pay Taxes On Donating Plasma

There Are Some Payments In Kind That You Must Determine The Value Of As An Employer Some Examples:

- goods and services that you provide or sell at a discount to your employees, even when the goods and services are purchased from business associates or other third parties

- employment-related options

- private use of bonus points earned on travels paid by the employer

Generally, payments in kind must be valued at market value unless specific or special rules apply.

For a more detailed description of the valuation rules, see the guide Salary ABC or contact your local tax collector/treasurer.

Is A Pay Stub The Same As A Paycheck

Although paychecks and pay stubs are generally provided together, they are not one in the same. A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document.

Also Check: Efstatus Taxactcom

Canada Pension Plan And Employment Insurance

These programs are run by the federal government and participation is mandatory. You may benefit in the future by receiving payments from these programs. For example, EI protects workers who become unemployed by paying out benefits to those who apply and qualify. If you retire after age 60, the CPP pays benefits to seniors who qualify.

In addition to the amounts that are deducted and withheld from your pay, your employer also makes contributions to EI and CPP on your behalf. The amount depends on how much you contribute.

Calculate The Medicare Withholding

Multiply the current Medicare tax rate by the amount of gross wages subject to Medicare. Check to see if the employee has reached the additional Medicare tax level and increase deductions from the employee’s pay. The 0.9% additional Medicare tax must be deducted when the employee’s wages reach $200,000 each year, and the additional amount is calculated on only the amount over $200,000.

Calculate Social Security and Medicare withholding separately, because they are included on the employee’s paycheck and in the employee’s W-2 in different places.

Recommended Reading: Plasma Donation Tax

Calculate The Gross Pay

A paycheck starts with the gross earnings of an employee. As stated earlier, this is the total amount before any withholding or deductions. To get the gross income in a paycheck for purposes of calculating income tax and other taxesSocial Security and Medicareyou need to include all wages, tips, and salaries earned in a pay period.

-

How to determine gross income: Gross pay is calculated for employees on hourly wage by multiplying the number of hours worked, including overtime, by the rate per hour. To get the gross pay for salaried employees, you divide the annual income amount with the number of pay periods. Heres an example of how to calculate gross income for salaried and hourly employees:If your annual salary is USD$42,000, youll divide that by the number of pay periods in the year to determine the gross income for one pay period. The total pay periods will be 24, if the employer pays you twice a month. That will be a gross income of USD$1,750, being USD$42,000 divided by 24. The gross pay of an hourly rate employee whos worked for 40 hours at a rate of USD$15 is USD$600. You also need to add overtime amounts to the regular pay to get the gross earnings in a pay period. Youll see how to calculate overtime in the next step.

Adjusted Gross Pay For Social Security Wages

When you determine the gross wages, you need now to calculate adjusted gross income from pay stub. You may need to pay closer attention to these calculations. Before calculating the income tax and FICA withholding, there are some payments to employees you must remove. Notably, the type of payments excluded in Social Security wages may differ from those removed from the federal income tax.

You can check IRS Publication 15 pages 3842 to see the complete list of payments to employees. Youll also be able to tell which ones are included in the Social Security wages and which ones are subject to income tax withholding by the federal government.

You May Like: Property Tax Protest Harris County

How To Calculate Payroll Deductions

Calculating payroll deductions is the process of converting gross pay to net pay. To do this:

Chapter 2 Personal Tax Credits Returns

To determine federal total claim , use the total claim amount on Form TD1. Employers are to update TC at the beginning of each year by using either indexing or claim codes.

To determine provincial or territorial total claim , use the total claim amount on the appropriate provincial or territorial Form TD1. Employers are to update TCP at the beginning of each year using either indexing or claim codes.

Since claim codes use a mid-point in a range, indexing is considered more accurate.

A separate worksheet, TD1-WS, is available for employees or pensioners who want to calculate partial claims for some of the federal personal tax credit amounts.

Don’t Miss: 1040paytax.com Official Site

What Are Payroll Deductions For Insurance

Many Americans who have health insurance purchase it through their employers via payroll deductions. This offers considerable cost savings because the premiums can be withheld from their wages on a pre-tax basis under a Section 125 plan. In actuality, however, employees are not paying for their health coverage directly, but are reimbursing their employer, who submits payment to the health insurance provider.

Deductible Expenses From The Gross Income

Deductible Expenses

Under the National Internal Revenue Code of the Philippines, valid business expenses may be deductible from the gross income in order to legally reduce a taxpayers taxable income. Understanding the concept of deductible expenses is of paramount importance especially to those who are engaged in a business. After all, business expenses are necessarily incurred in order to earn a profit. In this regard, these allowable deductions become tools by which taxpayers can equitably measure the net income that the taxpayers earn from their respective business undertakings.

As a rule, an expense may be deducted from the income if the following requisites concur: the expenses must be ordinary and necessary, it must have been paid or incurred during the taxable year, it must have been paid or incurred in the trade or business of the taxpayer, and it must be substantiated by receipts, records and other pertinent papers. In addition, if the expense is subject to withholding tax, the same must be paid and remitted to the Bureau of Internal Revenue .

The deductible business expenses must likewise be legitimate and legal. This requirement is necessary in order to avoid the manipulation of business expenses to lower down income taxes or to encourage illegal activities in the operation of ones business. As such, facilitation fees such as bribes and kickbacks to corrupt public officials are not allowed as deductible business expenses.

Recommended Reading: Square Dashboard 1099