Individuals Living Abroad Or Traveling Outside The United States

If youre living or traveling outside the U.S. or Puerto Rico on May 1, you have until to file your return. You must still pay any tax you expect to owe by the May 1 due date.

Enclose a statement explaining that you were out of the country, and write Overseas Rule on the top of your return and on the envelope.

Awaiting Processing Of Previous Tax Returns People Can Still File 2021 Returns

Rettig noted that IRS employees continue to work hard on critical areas affected by the pandemic, including processing of tax returns from last year and record levels of phone calls coming in.

“In many areas, we are unable to deliver the amount of service and enforcement that our taxpayers and tax system deserves and needs. This is frustrating for taxpayers, for IRS employees and for me,” Rettig said. “IRS employees want to do more, and we will continue in 2022 to do everything possible with the resources available to us. And we will continue to look for ways to improve. We want to deliver as much as possible while also protecting the health and safety of our employees and taxpayers. Additional resources are essential to helping our employees do more in 2022 and beyond.”

The IRS continues to reduce the inventory of prior-year individual tax returns that have not been fully processed. As of December 3, 2021, the IRS has processed nearly 169 million tax returns. All paper and electronic individual 2020 refund returns received prior to April 2021 have been processed if the return had no errors or did not require further review.

Taxpayers generally will not need to wait for their 2020 return to be fully processed to file their 2021 tax returns and can file when they are ready.

Expat Tax Filing Dates

Generally, expats receive an automatic 2-month extension to file and pay. When you are abroad on the regular April tax deadline, you must file your US tax return. by .

If you still need more time, maybe to qualify for the FEIE, you can request an extension to .

Nonetheless, any tax owed should be paid by July 15, 2020 to avoid interest and late penalties.

In certain circumstances, a further extension until December 15 may be available at the discretion of the IRS.

Also be aware of due dated for estimated taxes if you are self-employed or otherwise dont have automatic withholdings.

Recommended Reading: Do You Pay Income Tax On Unemployment

Estimated Tax Filing Deadlines For 2022

While the regular filing deadline is what will be needed for most employees, if you have self-employment income, then youll also want to be sure that youre taking care of paying your estimated taxes for the year. There are 4 deadlines throughout the year to pay your estimated tax for each quarter, and generally speaking, they always fall in the middle of April, June, September, and January. For 2022, the estimated tax payment dates are:

Auto Registration For Personal Income Tax

If you are deemed as required to file a tax return, this year SARS will automatically register you for personal income tax based on reliable data from third party sources.

Taxpayers who meet the below criteria will be considered for auto registration:

- South African citizens and permanent residents

- Tax deducted by your employer and/or IT3 data sources indicate that you are liable to submit a tax return

Once the IRP5 and IT3 certificates have been evaluated and you are deemed as required to file a tax return, SARS will automatically register you for Personal Income Tax and issue an ITA150.

Read Also: How To Compute Sales Tax

Allocate Estimated Tax Payments

A trust or decedents estate may choose to distribute estimated tax payments to beneficiaries.

To distribute the estimated tax payments to beneficiaries, the trust or decedents estate must file Form 541-T by the 65th day after the close of the current taxable year.

If a trust files by calendar year, it must file Form 541-T by .

You May Like: Do You Charge Sales Tax On Services

Tax Deadlines: January To March

- : Deadline for employees who earned more than $20 in tip income in December to report this income to their employers on Form 4070.

- :Deadline to pay the fourth-quarter estimated tax payment for tax year 2021.

- : Your employer has until Jan. 31 to send you your W-2 form reporting your 2021 earnings. Most 1099 forms must be sent to independent contractors by this date as well.

- :Deadline for employees who earned more than $20 in tip income in January to report this income to their employers. You can use Form 1070 to do so.

- : Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions and Form 1099-MISC, unless the sender is reporting payments in boxes 8 or 10.

- : Deadline for businesses to mail Forms 1099 and 1096 to the IRS.

- : Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by Jan. 18, 2022.

- : Deadline for employees who earned more than $20 in tip income in February to report this income to their employers.

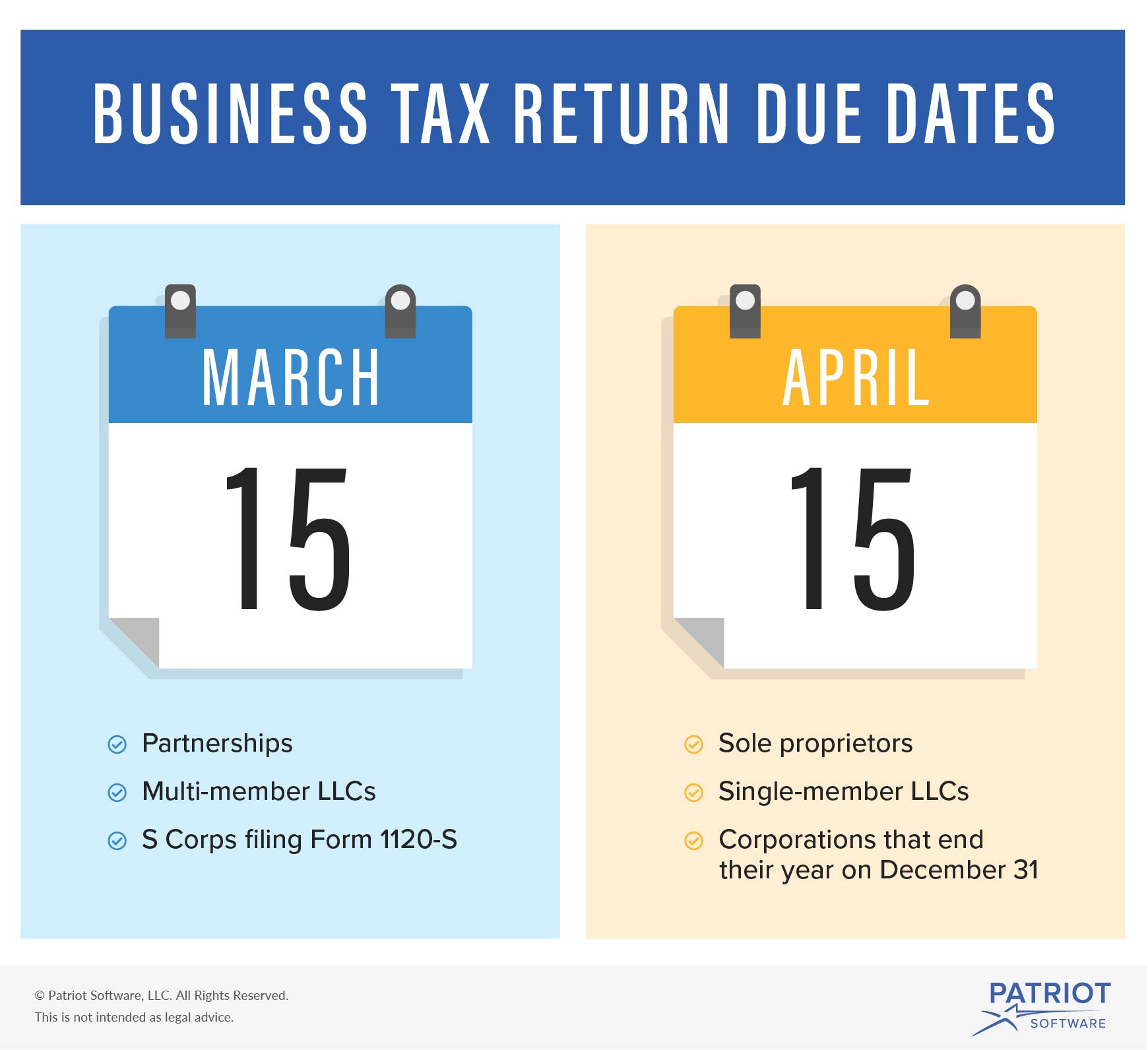

- :Deadline for corporate tax returns for tax year 2021, or to request an automatic six-month extension of time to file for corporations that use the calendar year as their tax year, and for filing partnership tax returns or to request an automatic six-month extension of time to file .

- : Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

Also Check: Does The Irs Forgive Back Taxes

Whats The Deadline To Pay Your Taxes

Even if you successfully apply for an extension, the payment deadlines donât change. The penalty for late payment is 0.5% of the taxes owed each month compared to 5% for late filing. Regardless of whether you can pay your small business taxes, it always pays off to file on time.

If youâre sending your return via snail mail, the IRS considers your return âon timeâ if itâs addressed correctly, has enough postage, and is in the mail before the end of business on your filing deadline. Otherwise, you can e-file your return before midnight on your tax filing deadline day.

If youâre self-employed, your business probably pays taxes in four sums throughout the year, rather than on one day. These are called estimated tax payments and you can think of them as a prepayment of your income and self-employment taxes . The due dates for these 2022 payments are April 18, June 15, September 15, and January 16 .

If youâd rather have someone else handle your bookkeeping and federal income tax filing, check out Bench.

Weâll set you up with a dedicated team of bookkeepers and a tax team to provide year round tax advice and file your taxes for you. With these teams, youâll have a tax planning session to ensure you are more prepared for next year. Weâll take both headachesâbookkeeping and taxesâoff your hands, for good.

Read Also: What Is The Mailing Address For Irs Tax Returns

Can You Pay Nj Property Taxes Online

Once a return has been accepted and processed, aTrademarkia-enabled electronic payment system can be used by online filers. Its a good idea to double-check with a tax return preparer or a third-party software provider if youre filing your return with them to make sure a payment hasnt already been set up.

Property taxes paid in Tax Years 2017 and earlier are now deductible up to $15,000, and property taxes paid in Tax Years 2018 and later are deductible up to $10,000. It was made to lower and middle-class taxpayers tax bills in order to make this change. During the year, landlords can also deduct 18% of rent paid as property taxes from rent paid by tenants. Property taxes are reduced in this manner, allowing residents who earn rental income to keep their taxes low.

Also Check: Do I Have To File Taxes If I M Self Employed

What Is The Department Doing To Help Prevent Fraud

Because fraudsters work hard to devise new ways to steal identities and money, the Department continues to experience attempted tax refund fraud. The Vermont Department of Taxes works with the IRS, other state revenue departments, and companies and trade associations in the tax and financial services industries to develop and implement new procedures to help protect taxpayer money.

Submitting false W-2 information is a favorite tactic of fraudsters. Because of this, the Department continues efforts to validate wage withholding information with filings and payments by employers. The Department has emphasized the February 1 due date for employers to file W-2 information. Filing this information electronically with the Department by the due date prevents a frequent source of refund delay. Learn more about identity theft and fraud.

Forms Filed Quarterly With Due Dates Of April 30 July 31 October 31 And January 31

- File Form 941, Employers QUARTERLY Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter. If you timely deposited all taxes when due, then you have 10 additional calendar days to file the return. See Publication 15, Employer’s Tax Guide, for more information.

Don’t Miss: How To Get Tax Credit For Solar

Tax Deadline For Quarterly Estimated Payments

If you’re self-employed, an independent contractor or have investment earnings, you might be curious about another set of deadlines: quarterly estimated payments. The IRS requires these quarterly estimated tax payments from many people whose income isnt subject to payroll withholding tax.

For estimated taxes, the answer to “When are taxes due?” varies. The year is divided into four payment periods, and each period has its own payment due date. Check below to see the dates for 2022.

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

Individual Tax Returns Due

For 2021, the individual tax return date has been moved from April 15 to May 17. This is the deadline to file Individual tax returns . If your income is below $66,000 for the tax year, you can e-file for free using IRS Free File. If your income was above that, you can use the IRSâ free, fillable forms.

If youâre a sole proprietor filing Schedule C on your personal tax returns, the May 17, 2021 deadline applies to you too.

May 17 is also the deadline to file for an extension to file your individual tax return.

You May Like: Where Is My Tax Refund Ga

Read Also: Where To Pay Irs Taxes

What If I Elect To Be Taxed As An S Corp Instead

If you were previously a C corp or an LLC electing to be taxed as a C corp, and you end up changing your mind and decide to file as an S corp or a partnership instead, most of the above deadlines will apply to you except for one: the C corporation tax return deadline on April 18th.

March 15th is the deadline to file your S corporation tax return or partnership return .

Note that S corporations and partnerships do not pay taxes on their income. That tax is paid on the individual incomes of the shareholders or partners, respectively.

March 15 is also the deadline to file for an extension for S corp and partnership tax returns.

Forms:

If youre filing your return yourself, you need to:

- file your return by 7 July

- pay your residual income tax bill by 7 February the next year

- pay your AIM provisional tax when your software tells you, if you are using AIM

- pay your provisional tax instalments on the dates confirmed by Inland Revenue, if youre using one of the other three options

- contact Inland Revenue early if you think you may have trouble meeting any of these due dates.

Note: Residual income tax is another term for tax to pay.

If you use a tax agent, you need to:

When Are Taxes Due If I File An Extension

If you file Form 4868 and receive the automatic six-month extension, you will have until Oct. 17, 2022, to submit your 2021 tax return.

If you already know that youll need an extension, plan on filing Form 4868 sooner rather than later. That way, if anything goes wrong with your application, youll have plenty of time to fix any errors and resubmit it ahead of the April 18 tax deadline. This also ensures you have time to get your documents together for your extended deadline in October. The IRS website has all the forms, deadlines and information youll need.

Don’t Miss: Can I Still File My Taxes 2020

Where Can I Go To File My Taxes For Free

Last year, about 200,000 Vermont taxpayers qualified to file their federal and state income taxes through Free File, but over 12,000, or six percent, of those eligible, used this free online filing service. Taxpayers with low to moderate incomes and elderly taxpayers may also take advantage of free tax assistance through the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, the AARP Foundation Tax-Aide Program, and the MyFreeTaxes Partnership. To find out more about these free programs and to see if you’re eligible, see Free File and Free Tax Preparation Assistance.

What If I Made A Mistake And Need To Re

It happens. You file your tax return, then realize you forgot to report some income or claim a certain tax credit. You don’t need to redo your whole return. Along with filing an amendment using Form 1040-X, youll also need to include copies of any forms and/or schedules that youre changing or didnt include with your original return.

IRS Form 1040-X is a two-page form used to amend a previously filed tax return. TurboTax can walk you through the amendment process to correct your tax return.

To avoid delays, make sure you only file Form 1040-X after youve already filed your original Form 1040. If youre filing a Form 1040-X to collect a tax credit or refund from a previous year, youll need to file within three years after the date you timely filed your original return, or within two years after the date you paid the tax, whichever is later.

Read Also: What Happens When You Forget To File Taxes

We Have Made It Easier For You

We continue to make it easier for you to comply. Starting July 2022, we will be assessing a significant number of taxpayers automatically.

We auto-assess based on the data we receive from employers, financial institutions, medical schemes, retirement annuity fund administrators and other 3rd party data providers. If you have not yet received your IRP5/IT3s and other tax certificates like medical certificate, retirement annuity fund certificate and other 3rd party data that are relevant in determining your tax obligations, you should immediately approach your employer or medical scheme or retirement annuity fund or other 3rd party data providers to make sure that they have complied with their submission requirements.

When Are Taxes Due In Canada 2022

When are taxes due in Canada 2022? Our new tax year is coming right up and after a long 2021 with covid changes in our tax system we are finally here to submit your taxes on time. If you are looking for important deadlines for the tax year 2021 to be filed in 2022 you came to the right place. In this article we will touch base on personal tax deadlines, self-employment tax deadlines, corporate tax deadlines and everything else you need to know within. Installment payments as well as Interest and Penalties will be touched upon during our article.

Don’t Miss: When Does Income Tax Have To Be Filed

State Tax Deadlines For Filing 2021 Individual Returns

Most states require individual taxpayers to file their state income taxes by Tax Day. Thats easy to remember because it is the same deadline as the federal tax deadline. However, there are several states that impose different deadlines and nine states that have no income tax. You can see the deadline for each state and the District of Columbia in the table below.

| 2022 State Income Tax Deadlines |

| State |

New Jersey Income Tax Returns

If you live in New Jersey and want to file your state income tax return, there are several methods to do so. To file online, you can call the Customer Service Center at 609-292-6400 during regular business hours. If you want to check your payments and credits, you can do so by visiting NJ.gov/taxes and clicking the Taxes tab. The due date for the state of New Jersey Income Tax returns is the same as the due date for federal income taxes: the deadline is when the federal return is due. For calendar year taxpayers, the deadline for filing their 2021 New Jersey returns is April 18, 2022. A fiscal year filing deadline is the 15th day of the fourth month following the fiscal years end. Check or money order payable to State of New Jersey TGI. If youre filling out a New Jersey Income Tax return, you should enter the same Social Security number as you enter in your New Jersey Social Security number.

No Comments

Also Check: When Will I Get My Child Tax Credit

When Are Taxes Due Each Year

Though dates can differ due to holidays and other things, federal tax deadlines are typically predictable. Continue reading to learn what the deadlines are for personal and business taxes and why those dates might change.

Personal Taxes Most years, the deadline to file personal taxes in the United States is April 15. However, this deadline may change due to holidays. For instance, in 2016, Emancipation Day fell on April 16, a Saturday. Washington D.C. celebrates Emancipation Day, but in order to be properly observed, it cannot fall on a weekend day. Thus, the federal celebration of Emancipation Day was moved to Friday, April 15. Tax Daythe day that taxes are duecannot fall on a weekend day either, so this year it was moved to April 18, the Monday following the day it would have been celebrated if not for Emancipation Day. In 2021, Tax Day will fall on Thursday, April 15th.

In short, personal taxes are usually due on April 15 unless Emancipation Day causes the deadline to be moved. IRS.gov is a great place to check whether the personal tax deadline is any day other than April 15th.

S-corporations and C-corporations that use the calendar year as their fiscal calendar must pay taxes a whole month earlier than most people. This year, that day fell on March 15. The general rule is that whatever fiscal year your corporation is using, taxes are due on the 15th day of the third month of the fiscal year.

For more on when the IRS begins accepting and processing tax returns .