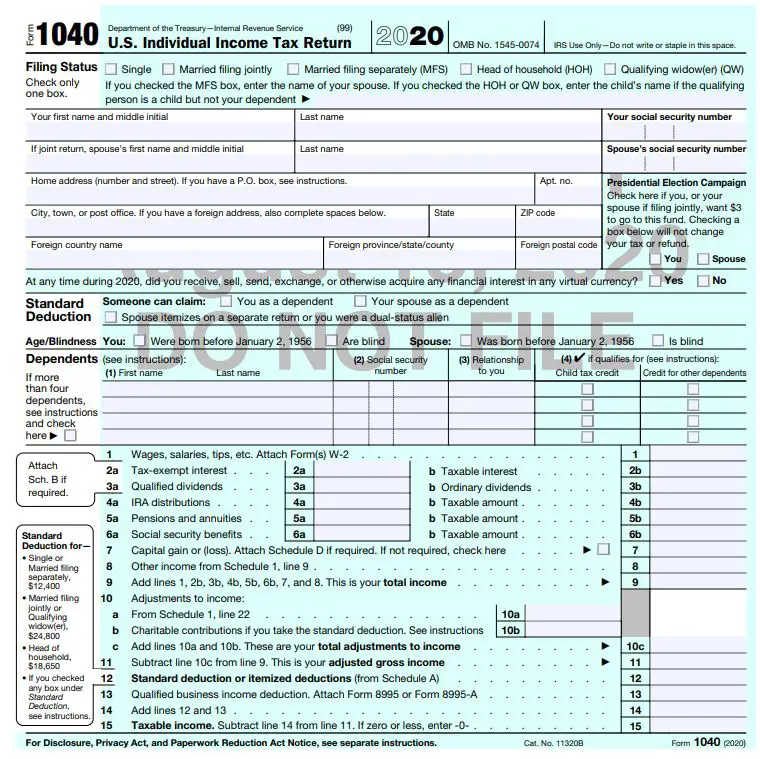

Get Your Paperwork Together

Before filing, a good rule of thumb is to look over last year’s return to make sure you’re not missing any documents that should be included.

“This way you can file on time knowing that you are not leaving any other pieces, and that the state, and federal government, both have all the information that you need to file your tax return,” said Sheneya Wilson, CPA and founder of Fola Financial in New York.

This year, there are a few extra things some taxpayers need.

If you got unemployment insurance benefits in 2020, the American Rescue Plan made changes to what is considered taxable income. Now, the first $10,200 of those benefits or $20,400 for a couple filing jointly, when both partners got unemployment is not taxable for those who had an adjusted gross income of less than $150,000 in 2020.

Those who had unemployment income should make sure they have a 1099-G from their state before they file federal returns, and that they’ve correctly deducted the income that isn’t taxable.

Most who filed before the updated rule don’t need to take any further action to get back the taxes they paid on unemployment income that should have been exempt the IRS said it will automatically process refunds for those individuals and that those should begin to be sent in May.

In addition, if you should have received one of the previous stimulus payments but didn’t get it, you need to file for a recovery rebate credit to claim the money on this year’s return.

How Will Taxpayers Receive Penalty Relief Refunds

Most taxpayers will receive their penalty refund via a paper check sent through the mail. The IRS says it will mail the check to the taxpayers last known address.

If your mailing address has changed since you last filed, you must update your mailing address with the IRS.

To track the status of your penalty refund payment, you need to create a free online account with the IRS. With an online account, you can bypass long telephone hold times at the agency and obtain information about your refund quickly.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Also Check: Can Energy Efficient Windows Be Claimed On Taxes

When Can I File Taxes In 2021

Immediately. The Internal Revenue Service began accepting and processing tax returns for the 2020 tax year on Feb 12. That was a lot later than last yearnearly two and a half weeks later, in factas the IRS needed time to program and test its systems after the tax law changes passed in December as part of the second round of stimulus checks. Without that testing, there could have been a delay in the turnaround time on refunds.

The start of tax season is one of two peak times for the IRS, as people with relatively simple tax filings and those expecting big refunds often file as soon as possible. All totaled, over 150 million individual tax returns are expected to be filed this year.

Filing A Simple Return

To claim any recovery rebate or child tax credits that you are eligible for, you can file a simple return online by going to GetCTC.org. This online resource is both mobile friendly and available in Spanish.

You May Like: How Do Small Business Owners File Taxes

If You Have A Balance Due

If you haven’t paid all of the tax you owe by the filing deadline:

- You’ll likely end up owing a late payment penalty of 0.5% per month, or fraction thereof, until the tax is paid.

- The maximum late payment penalty is 25% of the amount due.

- You’ll also likely owe interest on whatever amount you didn’t pay by the filing deadline.

If you didn’t get an extension

- You are also looking at a late filing penalty of 5% of the unpaid tax per month, plus interest.

- The maximum late filing penalty is 25% of the amount due.

If You Need Help With Your Return

If you are unable to get help filling out your North Carolina return, you can contact a service center for assistance or call toll-free at 1-877-252-3052. Your federal return must be completed before we can assist you in filling out your North Carolina return.

If you are disabled, have a low income, or are a senior citizen, income tax returns can be prepared free of charge through the Volunteer Income Tax Assistance or the Tax Counseling for the Elderly programs. For location and dates of assistance call the Internal Revenue Service toll-free at 1-800-829-1040.

Also Check: What Is The Income Tax Rate In Texas

Why You Should Consider Filing A Tax Return Even If Youre Not Required To File

Filing a tax return is probably not something most people enjoy doing. So why would anyone want to file a tax return if they don’t have to? Well, actually, there are some important reasons you might get a tax refund and you may be eligible for an additional stimulus payment. If youre eligible for future payments or credits, it helps if IRS has your 2020 tax return and direct deposit information on file.

While people with income under a certain amount aren’t required to file a tax return because they won’t owe any tax, if you qualify for certain tax credits or already paid some federal income tax, the IRS might owe you a refund that you can only get by filing a return. Some tax credits are “refundable” meaning that even if you dont owe income tax, the IRS will issue you a refund if youre eligible. Many people miss out on a tax refund simply because they dont file an IRS tax return.

There is usually no penalty for failure to file if you are due a refund, but why miss out on money thats rightfully yours? If, however, you wait too long to file your return and claim a refund, you risk losing it altogether. Thats because an original return claiming a refund must generally be filed within three years of its due date. If you havent filed a tax return for tax year 2017 and had any money withheld from your paychecks or are eligible for tax credits, you need to file by May 17, 2021. If you dont, the money is forfeited, by law, and becomes property of the U.S. Treasury.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Also Check: How To File Past Taxes

Will My Tax Refund Be Less In 2022

That’s because half of the expanded CTC was paid out in advance through monthly checks from July 2021 through December 2021 and parents will claim the other half of the tax credit on their tax returns before the filing deadline of April 18, 2022. … The result could be a smaller tax refund in 2022, tax experts say.

Monitor Your Tax Status

Register for an account with the Georgia Tax Center and you can sign up to receive notifications when any activity takes place on your account. These notifications help you monitor your tax status and help combat fraudulent activity.

After filing, use Where’s My Refund? to track the status of your refund.

Recommended Reading: Do Businesses Pay Income Tax

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What If I Owe The Irs But Can’t Pay

If you find yourself in this situation, you have a few options available, such as:

- installment agreements

- “offers in compromise”

You can also simply file your return and wait for the IRS to bill you, but don’t be surprised if the bill includes interest and penalties. Typically, the failure-to-pay penalty is less than the failure-to-file penalty so you likely should file even if you can’t pay the tax.

Also Check: When Does Irs Open For 2021 Tax Season

After You File Your Tax Return

Get your notice of assessment, find out the status of your refund, or make a change to your tax return

To provide feedback on your filing experience or any other CRA service, go to Submit service feedback – Canada.ca

To formally dispute your notice of assessment or reassessment, credit or benefit decision, you may want to file a notice of objection. To find out if this option is right for you, go to File an objection

Its Not Too Late To File Your Tax Return

Although the regular tax season is over, you can still file a late tax return until October 15, 2022. If you do not file you may miss out on a refund or any tax credits for which you may be eligible.While theres no penalty for filing late if you do not owe taxes, you could face fees and penalties if you do owe for 2021. The information below can help you navigate this process and complete your return before the final deadline.

Read Also: Do I Pay Taxes When I Sell My Car

Check If You Need To File An Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass.

Find out if you need to file an Income Tax Return:

Non-resident individuals

What If I Filed Jointly With My Spouse But Now File Separately

If you filed jointly with your spouse in either 2019 or 2020, but not in 2021, the IRS will send a refund check in the names of both taxpayers. The payment will be sent to the primary individual named on the tax return.

For example, lets say John and Kelsey filed a late return jointly in 2019 and qualify for penalty relief. If John was listed as the primary taxpayer, the penalty refund check will be mailed to his current address.

Don’t Miss: What Tax Forms Do C Corporations File

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- That’s no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesn’t stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Don’t think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Don’t Miss: What If I Never Filed Taxes

How Can I File My 2020 Tax Return

Did you prepare it last year but just not file it? Or do you need to prepare it also?

If you prepared it last year but did not file it, you will have to access it using the same account and user ID you used to prepare it, pay your TurboTax fees, then print, sign and mail it. It cannot be e-filed.

If you have not prepared a 2020 returnL

Online preparation and e-filing for 2018 and 2019 and 2020 is permanently closed.

To file a return for a prior tax year

If you need to prepare a return for 2018, 2019 or 2020 you can purchase and download desktop software to do it, then print, sign, and mail the return

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sams, etc.

Remember to prepare your state return as wellif you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Do I Pay Taxes On Roth Ira Gains

Can I Pay My Tax By Credit Card

Yes, you can pay your tax bill with credit in a variety of ways. Credit card and bank loans are both payment options. You can apply for a bank loan, home equity loan or take a cash advance on a credit card to pay your tax bill.

Third party providers like Official Payments Corporation are also available to facilitate using a credit card to pay your tax bill.

- These companies charge a convenience fee for their service.

- That fee is in addition to any interest and finance charges your credit card company may charge you.

Irs Annual Maintenance And E

The IRS normally shuts down their e-file servers in November and December to prepare for the upcoming tax year. The Intuit Electronic Filing Center will stop accepting e-file transmissions before the IRS shutdown to ensure that all e-file submissions are received by the IRS before the shutdown.

After the shutdown, you’ll no longer be able to e-file tax year 2018 returns nor receive e-file acknowledgements for tax year 2018 or prior returns. Tax year 2019 and 2020 returns can still be e-filed when the IRS re-opens for the tax year 2021 filing season.

You May Like: How Much Does It Cost To File Taxes With Taxslayer