How To Claim Energy Tax Credits

To claim any of these home energy tax credits, youll need to complete Form 5696, Residential Energy Credits. Be sure to keep receipts from your purchases in a safe spot until youre ready to tackle the tax filing stage.

And, to make it easy, enter any cost information you have on qualifying purchases into TaxAct. The program will calculate the credit for you and automatically report the amount on Form 5696. No sweat, no hassle.

The Residential Energy Property Credit

The end of 2020 is approaching quickly and unless there is a last minute extension of the program, December marks the end of the residential energy property credit for homeowners a tax credit incentive of up to 10% of the cost of energy efficient exterior windows and/or doors.

As of April 2021, we still havent heard if this will be extended. Were assuming the IRS is too busy dealing with coronavirus tax changes to circle around to this, but well let you know as soon as we hear something!

If youve had windows or exterior doors installed by DunRite Windows & Doors this year, then you may qualify for the credit. Keep that receipt on hand when you are ready to file.

Claiming New Windows On Your Tax Return

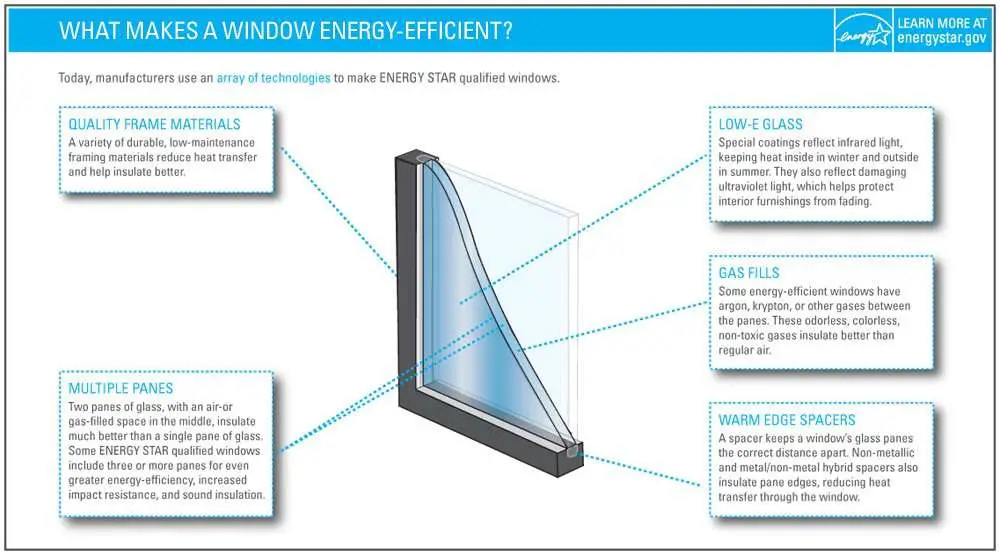

A range of different window types qualifies for a tax deduction, including casement, egress, and double-hung. The stipulation is that they must meet Energy Star standards.

Partial improvements are also eligible, so you dont need to replace every window in your home to qualify for this tax credit. It also applies if you added a window that wasnt there previously.

You may claim 10% of the total cost, up to a maximum of $200, for new windows.

You May Like: When Do I Pay Taxes As An Independent Contractor

What Insulation Improvements Were Included

Lets take a closer look at which improvements were specifically included in these tax breaks when it comes to insulation. Homeowners could claim their tax credits for any of the following items:

The insulation items had a general tax credit that could be used. Homeowners were asked to take a tax credit of ten percent of the total cost including labor for a maximum of $500. Keep in mind that there may have been certain caps and maximum tax credits placed on individual items within the insulation category though.

Windows had a tax credit worth 10% of the cost with a maximum credit amount of just $200. All of the new windows were required to meet the 6.0 Energy Star requirements to demonstrate their overall energy efficiency.

To be more specific, the credit could be used for any home that was replacing a double-hung, casement, or egress window on a preexisting residence. New homes that opted for qualifying windows could also claim the credit.

The best part of the program was that the windows didnt have to be installed throughout the entire house. A partial installation was still eligible for the tax credit, allowing homeowners to choose which areas of their home could benefit from upgrades the most.

Home Accessibility Tax Credit

Renovations or expenses incurred which make homes safer or more accessible for Canadians 65-years of age or older, or for the disabled people of any age may qualify for the HATC provided they are being claimed by the eligible individual or by someone who looks after the individual and meets all of the CRAs requirements. Up to $10,000 in expenses can be claimed under the HATC. Since this is a non-refundable tax credit, you are eligible to receive 15% of the renovation costs as a reduction on your taxes.

Don’t Miss: Is H& r Block Tax Identity Shield Worth It

Irs Solar Tax Credits:

Solar panels collect light energy from the sun and convert it into electricity for your home and solar hot water heaters use the sun to provide hot water to your home. Heres what you need to know to find out if you qualify for home energy improvement tax credits for installing solar panels or solar hot water heaters. Find out more about how solar energy works on our blog.

Renewable Energy Tax Credits

Under the Tax Cuts and Jobs Act of 2017, individuals were only able to claim an energy efficiency tax credit for solar systems. The other energy tax breaks expired in 2017. That changed when the Bipartisan Budget Act of 2018 passed, which extended the same sunsetting credit value for solar energy systems to fuel cells, small wind turbines, and geothermal heat pumps.

You may be able to claim a credit of 30% of the cost of qualified energy efficient property:

- Solar electric property

Read Also: How To Track Your Taxes

New $1500 Window Tax Credit Has A Catch

Window companies and installers are stuffing mailboxes with fliers touting a new $1,500 federal tax credit for putting new energy-efficient windows in your home. The credit, part of the $787 billion stimulus passed in February, is equal to 30% of the first $5,000 you spend on windows. That’s a credit, not a deduction, meaning you get $1,500 off your taxes. The credit can be claimed for either 2009 or 2010.

But here’s what the eager salesman might not tell you: Depending on where you live, you may want to wait until next year to buy those new windows.

Why? In some regions, such as the far north, the most energy-efficient windows for your home won’t qualify for the credit. They might not qualify in 2010 either. But window makers have launched a lobbying campaign to change the law and it may be worth holding out to see if they succeed.

“It’s great to have a $1,500 credit, but making sure you’re buying the right window isn’t easy,” says Charles Goulding, a CPA and energy tax lawyer in Syosset, N.Y.

If you’ve already had energy-efficient windows installed this year, don’t panic. It could be that the windows you put in this past April qualified for a $1,500 credit, whereas if you were to install the same windows in September they wouldn’t snag a credit.

Conversely, such a low U factor isn’t cost effective in Miami where there is little need for heating. Worse, it’s hard to get that low a U factor in an aluminum frame window, which is safer in a hurricane.

I Am Eligible For The 2022 Oeptc Payments But I Forgot To Apply For Them When I Filed My 2021 Income Tax And Benefit Return Can I Still Apply For Them

Yes. You have to request an adjustment to your 2021 return. Do not file another 2021 income tax and benefit return. Instead, you can make your request by using our My Account online service. My Account is a secure, convenient, and time-saving way to access and manage your tax and benefit information online, seven days a week. For information on how to register, see My Account.

If you havent signed up for My Account, you can send the following information to your tax centre: a completed Form T1-ADJ, T1 Adjustment Request, or a signed letter indicating that you want to apply for the 2022 OEPTC amounts on your 2021 return.

Please attach a completed Form ON-BENto your letter or Form T1-ADJ or provide information for whichever of the following apply to you:

- a statement that indicates whether you lived in a designated Ontario university, college, or private school residence in 2021

- the rent paid by or for you for your principal residence in Ontario for 2021

- the property tax paid by or for you for your principal residence in Ontario for 2021

- the home energy costs paid by or for you for your principal residence on a reserve in Ontario for 2021 or

- the accommodation costs paid by or for you for living in a public or non-profit long-term care home in Ontario for 2021

Recommended Reading: When Do You Pay Taxes On Stocks

Use The Home Sale Exemption

If you decide its time to sell your home and the profit is less than $250,000 for a single filer or $500,000 for married joint filers, you dont have to pay capital gains on the appreciation of your primary home.

This exemption will help you lower the sale funds that are considered a profit and potentially help you escape capital gains entirely.

Keep in mind that if you use online tax filing, youll be able to claim all of the home repair tax deductions that youre eligible for without having to know all the complex tax laws.

How Do I Claim An Energy Efficient Window Tax Credit

To claim an energy-efficient window replacement tax credit, you must fill out Form 5695. The form must be included with your tax return you submit to the IRS. For certain upgrades, you can file the Residential Renewable Energy tax credit. You can still save by using these credits, although they have been dropping in value. But a tax credit is more valuable than a standard deduction, and helps offset the high costs of home upgrades such as installing energy-efficient windows.

Don’t Miss: How To Do Doordash Taxes

Ac Heating And Ventilation

Certain products used for AC, ventilation, and heating will also qualify for a tax credit. For ACs, the tax credit is worth $300, heat pumps are worth $300, and boilers using gas, propane, or oil are worth $150. In addition, any furnaces using natural gas, oil, or propane can yield a $150 tax credit.

You should check for details on the Energy Star website as the limits are stringent.

The Homeowners Guide To Energy Tax Credits And Rebates

When you file this year, its especially important to reap the benefits of your households energy-efficiency. There were a number of changes to the tax code for homeowners that took effect in 2019 and remain available for the 2021 tax year. Congress has yet to extend them into 2022, so we put together a list of some common home improvement and renewable energy tax credits that may help you save money on your 2021 tax return before these opportunities expire. Weve also included information on rebates available for energy-efficient appliance purchases to help you save money if you need or want to use your tax savings on energy-efficient appliances.

Read Also: How To Find Out Last Year’s Tax Return

Tax Credits For New Home Construction

Building a home is an exciting adventure, and being able to design a house from the ground up to fit a familys needs and expectations is incredibly satisfying. That said, its an expensive endeavor. HomeAdvisor estimates the average cost of building a home to be just over $300,000 in 2020, although this average also includes the segment of luxury homes that have entered the homeowners market.

The government used to offer a tax credit for first-time homebuyers that also applied to first-time homebuilders. This came into being after the real estate market crash of 2008 to encourage Americans to continue buying homes. New home construction tax credits were very beneficial to many families at that time in economic history.

SmartAsset explained that this credit changed from year to year but offered up to $8,000 that could be subtracted from a filers taxes. Unfortunately, these tax breaks for building or buying a new house ended in 2010. If you didn’t purchase or close on your home before September 30, 2010, you will no longer be able to claim the credit.

Energy Tax Credits Reduce Your Cost Basis

You must reduce the cost basis of your home by the dollar amount you claim for residential energy tax credits. You must reduce your basis by points the seller paid to you.

Its basis is the total amount it cost to complete construction if you had a hand in building a portion or the entirety of your home yourself.

As an example, let’s say you bought your home for $250,000 and sold it for $300,000. Your cost basis would be $250,000, assuming you didn’t make any other improvements that didn’t result in claiming a residential energy tax credit. You would have a capital gain of $50,000the difference between $300,000 and $250,000and capital gains are taxable.

Now let’s say that you claimed a $4,000 tax credit for your fuel cell at one point. Your gain increases to $54,000, or $300,000 less $246,000, because you must subtract this from your cost basis.

Also Check: Do You Have To File Taxes On Ssdi

How To Qualify For Tax Credit On Energy Efficient Windows

The federal income tax credit for energy efficient window replacements has been raised recently. Purchases on windows could be reimbursed for 30% of their total expense up to $1,500 for every household, if you qualify. This latter figure represents a 50% increase over the same tax credit of two years ago.

This tax credit is applicable to income taxes filed for 2009 and 2010 according to the economic stimulus bill signed on February 17th by President Barack Obama. So exactly what steps are needed to get back 30% of the expenses youve put towards your energy saving project?

Here are the basics on how to qualify for tax credit on energy efficient windows, laid out for you.

British Columbia Efficient Appliance Rebates

If you live in BC and you purchase an Energy Star clothes washer, dryer, or refrigerator, you may apply for the BC Hydro Rebate. Rules and requirements change, but as of 2016, BC Hydro requires you to purchase the appliance between May 1 and June 30 of the year of your application.

The rebate amount varies from appliance to appliance, and in some cases, your rebate may double or even triple depending on where you live. For example, residents of Richmond may receive triple rebates on some items. FortisBC also offers rebates to BC appliance buyers.

You May Like: What Is The Tax Rate For Federal Income Tax

How Much Can I Claim For A Biomass Stove On My Tax Return

You can receive a $300 energy-efficient home improvement tax credit for purchasing a biomass stove.

Other common questions about biomass stove tax credits:

- What should a retailer provide me when I buy a biomass stove to get the tax credit? Retailers should give you the Manufacturers Certification Statement for the model you purchase. This is a signed statement from the manufacturer certifying that the stove qualifies for the tax credit. Manufacturers often have these on their websites if you did not get one when you bought the stove. Be sure the statement matches the model number of your biomass stove.

- What does the IRS consider to be biomass fuel? The IRS defines biomass fuel as any plant-derived fuel available on a renewable or recurring basis.

Discover more home improvement tax credits and energy-efficient appliance rebates:

Air Conditioning | Water Heaters | Geothermal Heating | Wind Turbines | Tax Rebates

Do I Have To Calculate The Oeptc

No, you do not have to calculate your entitlement. After you apply, the 2022 OEPTC will be calculated for you and, if you are entitled, your payments will be issued as explained in question 6. If you are not entitled, in most cases, you will receive a notice explaining why.

For the prior-year calculation sheets, go to Ontario energy and property tax credit calculation sheets.

Read Also: How To File An Extension On Tax Return

My Spouse Owns Our Home But She Is Living In A Nursing Home Are We Entitled To The 2022 Oeptc

In a situation where spouses or common-law partners live apart and maintain separate principal residences in Ontario on December 31, 2021, for medical reasons, if they choose, each may apply for the 2022 OEPTC for their separate eligible residences. For the purposes of these claims, the CRA considers you to be involuntarily separated, so your claims will be calculated as if you were single.

On Form ON-BEN, Application for the 2022 Ontario Trillium Benefit and Ontario Senior Homeowners’ Property Tax Grant, in addition to completing the application area for the OEPTC, tick box 61080 in Part A on the back of the form and provide your spouse’s or common-law partner’s address in Part C Involuntary separation. This will let the CRA know that there is an involuntary separation.

Tax Credits For Energy Efficiency

Conserving energy costs is a growing trend across the nation and around the world. Whenever possible, people are seeking out alternative sources of energy such as solar power.

You may even be well acquainted with the large black solar panels that are quickly springing up on the rooftops of houses everywhere. Since the trend became so popular and is important for preserving the world we live in, the federal government began to issue tax credits for energy efficient upgrades made to existing structures.

The Internal Revenue Service is responsible for managing these claims, and there are some pretty strict guidelines about what qualifies. Under the umbrella of the 2009 International Energy Conservation Code, there were certain requirements listed that outlined improvements that constituted energy efficiency.

The tax credits were available for homeowners to take advantage of for their primary residence only. They could be used to improve the insulation of your building or to upgrade to a more efficient heating, cooling, or water-heating system.

The maximum credit that homeowners could apply for between 2011 and 2016 was $500. Once you claimed the maximum amount in any of those years, you could not use it again for the following five years.

You May Like: How To Learn About Taxes

Am I Eligible For An Insulation Tax Credit

This tax credit has been extended through December 31, 2021, and you may take advantage of it even if you replaced your insulation before 2021. If you were eligible and did not claim it on your return as far back as 2017, you can refile your return for the appropriate year to take advantage of the savings. Consult your tax professional to find out if refiling is right for you.

- This must be your primary residence .

- This must not be a new home or a rental.

- Bulk insulation products such as batts, spray foam insulation and rolls are typically covered.

- The credit can apply to replacing or improving insulation, but its primary purpose must be to insulate.

- You must have a copy of the Manufacturers Certification Statement to qualify.

- More eligibility requirements can be found here.