Other Circumstances For Extended Statutes Of Limitations

In some circumstances, the statute of limitations is longer than three years. For example, if you dont report income that youre required to report, and it exceeds 25% of the income shown on that years tax return, the IRS has six years to audit your return.

In addition, not filing or filing a fraudulent tax return allows the IRS to audit you indefinitely. So keep any tax records for those years permanently.

Go Online And Use The Wheres My Refund Irs Tool It Works

Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

Keeping Tabs On Your Old Tax Returns May Not Be Your Top Concern In Life Until A Situation Comes Up When You Need Them

For example, if you apply for a mortgage or student loan, you typically have to disclose your income but lenders wont always just take your word for how much you earn. Thats where your official tax records come in. They can serve as proof of your income when applying not only for loans but for things like rental housing, government benefits or other kinds of financial aid.

If you dont have a copy of your tax return on hand when you need it, no problem! You can use a few different methods to get your past tax information.

The first big question: Do you need a full copy of your tax return, or can you get by with a transcript?

Also Check: Protest Property Taxes In Harris County

What Are The Most Common Reasons For Delay

An incomplete return, an inaccurate return, an amended return, tax fraud, claiming tax credits, owing certain debts for which the government can take part or all of your refund, and sending your refund to the wrong bank due to an incorrect routing number are all reasons that a tax refund can be delayed.

Important Tax Filing Dates For Businesses

Just like individual citizens, businesses also have to pay taxes. Business owners should note the following tax deadlines for 2022:

- If you had a business with employees in 2021, this is the day you must submit your W-2 forms to the IRS. You must furnish copies to your employees by this deadline as well. January 31 is also the due date to submit 1099 forms issued to independent contractors.

- Tax filing deadline for S-corporations and partnerships to file their 2021 business returns.

- Corporations must file their 2021 business tax returns by this date.

- Final day for S-corporations and partnerships to file their 2021 business tax returns with an extension.

- Last day for corporations to file their 2021 business tax returns if they received an extension.

Getting clear on your tax obligations can help you avoid IRS penalties and keep your financial house in order. It goes hand in hand with maintaining strong credit. Experian understands this, and allows you to check your credit score and for free with just a few clicks.

Don’t Miss: How To Get 1099 From Doordash

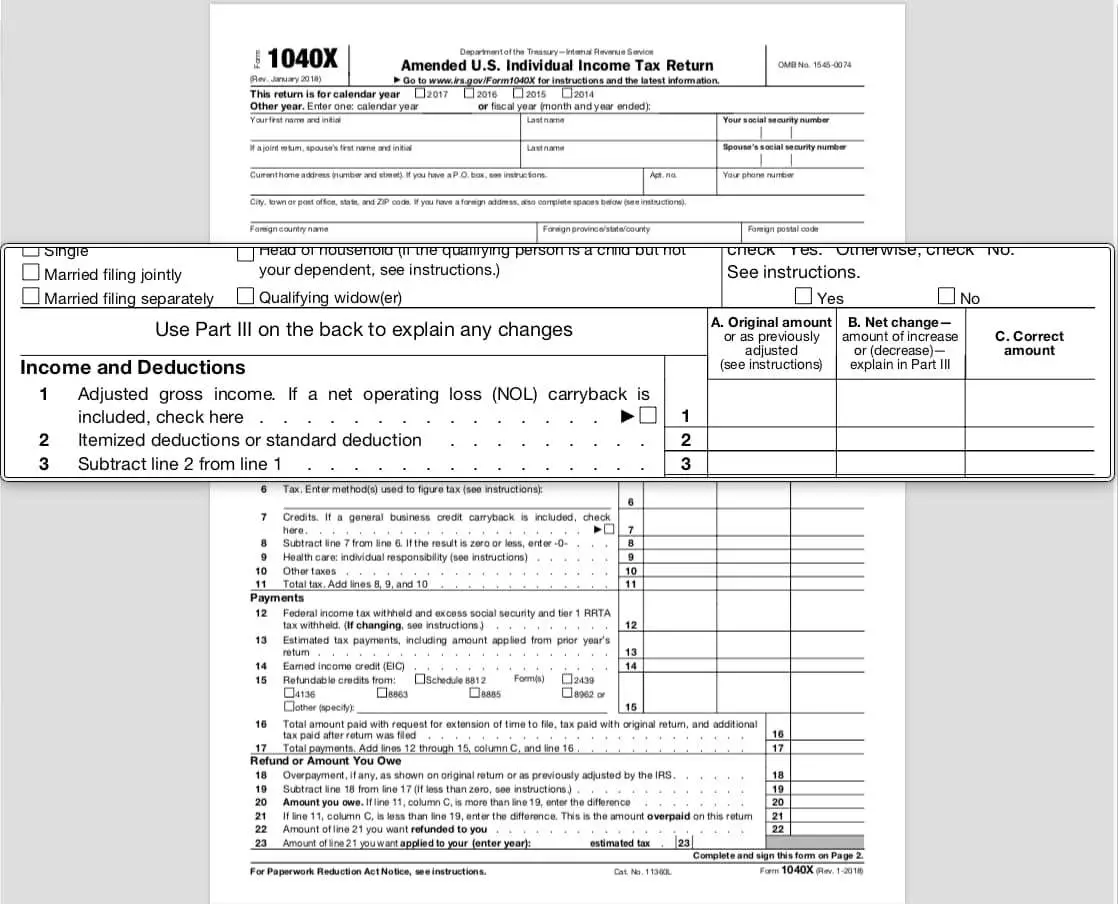

What Do I Use For My Original Agi If My Filing Status Has Changed From Last Year

If your filing status changed from the previous year to “Married Filing Joint”, then each taxpayer will use their individual original AGI from their respective prior year tax returns.

If the change is from “Married Filing Joint”, then both taxpayers will use the same original AGI from the prior year’s joint tax return.

Youre A Victim Of Tax Fraud

One type of tax fraud involves someone using your personal information to file a fraudulent tax return and claim a refund in your name. For the 2020 tax-filing season, the IRS identified more than 450,000 fraudulent refund claims, with more than 44,000 of them tied to identity theft. If you think youre a victim of tax-related identity theft, you can contact the IRS and the Federal Trade Commission to report it.

Don’t Miss: Do You Pay Taxes Working For Doordash

How To Get A Copy Of Your Tax Transcript

There are three ways to get a copy of your tax transcript.

The easiest way is to use the IRSs online transcript portal, Get Transcript. To use this service to access your transcripts online, youll need to provide your Social Security number, filing status from your most recent return, date of birth and the mailing address from your most recent tax return. Youll also need a few other things: an email account, a mobile phone with your name on the account, and an account number from an eligible account to verify your identity.

You can also fill out and mail in a copy of Form 4506-T or use the Get Transcript by Mail option through the Get Transcript portal. But if you make your request that way, you should be prepared to wait 30 days to receive your copy. Finally, if youre a phone person, you can also get a copy of your transcript by calling the IRS at 1-800-908-9946. Phone orders typically take five to 10 business days.

One thing to note: The IRS is now issuing transcripts that block out portions of your Social Security number, telephone number, last name and address. Thats why youll have to provide an account number to verify your identity so they can use it to match up with your file. By limiting the amount of personal information on the transcript, the IRS hopes to help reduce the risk of identity theft.

How To Find Out Which Years Taxes Were Not Filed

You’re supposed to pay your taxes by April 15 every year. There can be substantial penalties if you fail to do so. Fortunately, the Internal Revenue Service still will take your money if you pay late and even send out refunds up to three years after the original deadline. You’ll need to start by figuring out which years you did not file your income taxes. You can check online, call the IRS and speak to an agent or visit an IRS office in person to find out this information.

Recommended Reading: Doordash Tax 1099

Irs Begins Accepting 2021 Tax Returns

There’s no rule saying you have to wait until April to file your taxes. Those who have all the necessary paperwork could submit their 2021 tax return as early as January 24. If you file electronically and are enrolled in direct deposit, you’ll typically receive your tax refund within three weeks if you qualify for onethough refunds may be slower to arrive this year, according to the IRS. Here are some of the documents you’ll need to file your tax return:

- W-2s from your employers, or 1099s from your clients if you’re self-employed.

- Documents pertaining to contributions made to tax-advantaged accounts. This includes 401s, traditional IRAs, and health savings accounts .

- Documents showing interest paid on student loans. For 2021 taxable income, you can deduct up to $2,500.

- Receipts for child care expenses in 2021. This can include day care, babysitters, and before- or after-school care. Parents and guardians may be eligible for a tax credit.

- If you’re self-employed, receipts for any business expenses in 2021. These may help reduce your taxable income.

Use A Tax Return To Validate Identity

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Read Also: Www.efstatus.taxact.com

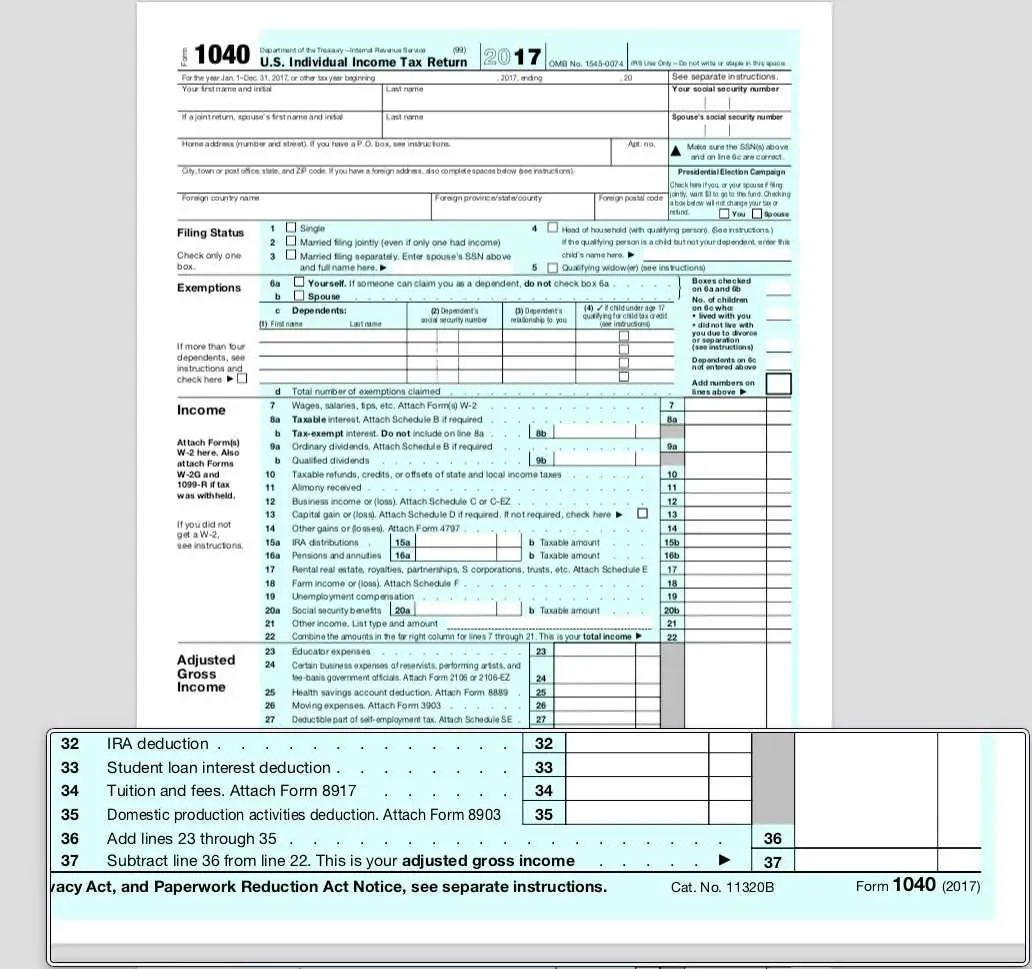

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Responses To How To Check A Prior Year Tax Refund Status

ALQURUMRESORT.COM” alt=”How can i get my agi over the phone > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How can i get my agi over the phone > ALQURUMRESORT.COM”> Hi Jeremiah,

I appreciate you reaching out via our blog! If you prepared your tax return with PriorTax, you can contact our customer service team to help you out. You can reach out via phone, livechat or email and one of our representatives will be able to assist you. Our phone number is 877-289-7580 .

Hi my problem is that. I never re ieved my tax return for the past year, due to someone filed use ok ng my name and i was sent, a letter from the irs and it explained what happene. I know that i since then have recieved many email and gmails refureing to my refund, when i could so badly use that money right now, i yet to recieve it at all. Ive also have recieved confermation from the irs that i soo. Would be receiving. My refund check and never have yet. Why i wish i knew, could you please check into or if you know soneone th a t can help me please that would be amazeing. Thank you have a blessed night.

Stasha Carpenter

I E-filed my 2016 state & federal taxes 1st week in February Received refund from state in 21/2 weeks and federal about 31/2 weeks. And have never filed my 2015 return until a little over a week ago.so in short they never held onto my 2016 refund until I filed my 2015 taxes.so hopefully beings my 2016 was already approved, maybe it will speed things up a little on my 2015 refund.who knows. Just as well to forget about because thats when it arrives Lol Lol

Read Also: Doordash Dasher Taxes

Obtain Your Irs Transcript

Create an online IRS account by searching for Get Transcript Online at IRS.gov and following the prompts. Youll need to provide this information to register your account:

- Your Social Security number, mailing address from your most recent tax return, filing status and date of birth

- Your email address

- A mobile phone that has your name on the account

- Verification of a personal account from a , mortgage or certain types of consumer loans

After you have created your online IRS account, youll be able to view a transcript of your tax return immediately. You can also print or download the information. If you request a copy of your transcript by mail or by fax, expect a five to 10-day wait.

Weeks And Weeks Of Irs Delays

Although the IRS says most refunds will be sent within 21 days, experts warn that delays are likely, noting that the agency is still working through 2020 tax returns.

During the 2020 budget year, the IRS processed more than 240 million tax returns and issued roughly $736 billion in refunds, including $268 billion in federal stimulus payments, according to the latest IRS data. Over that period roughly 60 million people called or visited an IRS office.

Donald Williamson, an accounting and taxation professor at American University in Washington, said he expects “weeks and weeks” of IRS delays in 2022. “My advice in 2022 is file early, get started tomorrow and try to put your taxes together with a qualified professional.”

Compounding the challenge, tax preparers told CBS MoneyWatch that it remains hard to reach IRS personnel on the phone. The IRS answered only about 1 in 9 taxpayer calls during fiscal year 2021, Collins reported. “Many taxpayers are not getting answers to their questions and are frustrated,” she noted.

“Back in the old days, you’d wait 5-10 minutes and get an IRS agent on the phone,” said Christian Cyr, a CPA and president and chief investment officer at Cyr Financial. But now, he said, his CPAs wait hours to speak with an IRS employee, with no guarantee of ever reaching one.

1. File electronically

“Paper is the IRS’s Kryptonite, and the agency is still buried in it,” National Taxpayer Advocate Collins said on Wednesday.

2. Get a refund via direct deposit

Also Check: Doordash Deductions

Your Refund Was Sent To The Wrong Bank

Filing your return electronically is the fastest way to get your refund, especially if youre using direct deposit. That assumes, however, that you plugged in the right numbers for your bank account. If you transposed a digit in the routing or account number, your money could be sent to someone elses account.

If your refund ends up in someone elses bank account, youll have to work with the bank directly to get it back. The IRS says it cantand wontcompel the bank to return your money to you.

When’s The Earliest I Can File My 2021 Taxes

The IRS began accepting and processing 2021 tax returns on Jan. 24, 2022. That’s far earlier than last year’s Feb. 12 start date.

IRS Free File, a partnership between the IRS and leading tax-software companies, launched on Jan. 14: The program allows taxpayers who made $72,000 or less in 2021 to file electronically for free, using software provided by participating providers.

You May Like: How To Get Doordash 1099

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Child Tax Credit Payments: Do I Need Irs Letter 6419 To File Taxes

Some families may want to hold off a bit when it comes to filing a return until they spot the IRS letter 6419, which can help them file an accurate return and avoid delays. Others who don’t want to wait may need to review their own records and check their specific information at the “Child Tax Credit Update Portal Site” at IRS.gov/ctcportal.

DON’T THROW THIS IRS DOCUMENT AWAY:Why IRS Letter 6419 is critical to filing your 2021 taxes and the child tax credit.

You May Like: Do You Get Taxed On Doordash

Tax Bills Available At Mytax Portal

If you have WinZip®, Adobe Acrobat Reader or other similar programs, you can view or print the tax bills for the current Year of Assessment and the last 3 years from myTax Portal as follows:

Find out more about the FAQ to view your tax bills.

Irs Child Tax Credit: Here’s How To Get The Rest Of Your Money

Parents still have a lot of 2021 child tax credit money left on the table.

Advance payments have ended, but half of the expanded child tax credit remains to be claimed.

Tax season is now in full swing — that means you can now submit your tax return to the IRS. Jan. 24 also marks the first chance that parents have to claim the rest of their expanded child tax credit money. Monthly payments ended in December, but there’s still more money to come from the enhanced credit. When you file your 2021 tax return, you’ll be able to claim any child tax credit money you haven’t yet received — at least half, or more if you opted out of advance payments or had a new baby later in 2021.

To make sure you get the rest of your money, keep track of Letter 6419 from the IRS. It contains details about your child tax credit status that you’ll need for your taxes. If you haven’t received that form yet, watch for it in the mail. That IRS letter will tell you how much money you received in 2021 and the number of qualifying dependents used to calculate payments.

You may be wondering if the child tax credit has been extended for 2022 or if Congress will ever reauthorize the expanded child tax credit or the advance payments. We’ll explain the latest on the child tax credit and what to expect when you’re ready to file your taxes this year.

Don’t Miss: Have My Taxes Been Accepted