How Much Income Is Tax Exempt

For example, for the 2020 tax year , if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. Ditto if youre married and filing jointly, with both spouses under 65, and income less than $24,800.

Best Nonprofit Startups And 501c3 Tax Exempt Filing Services In Fort Worth

There are tons of factors to consider when filing for 501c3 tax exempt status for your nonprofit organization. One wrong thing can have your application denied or your tax exempt status revoked. Nonprofit Elite offers the best in 501c3 compliance and consulting, nonprofit startup, and 501c3 filing services. With a 100% IRS approval rate, you are guaranteed a successful 501c3 filing in Fort Worth, Texas.

How Does A Ppf Account Work

The objective of the PPF account is to provide savings in small amounts for people and help them cultivate the habit of investment. It is the most basic ad popular type of instrument, and the amount can be a minimum of INR 500 to a maximum of INR 150,000. The investment amount can vary substantially and as per your choice. The interest rate of the PPF scheme is set by the Indian government. The current interest rate on the PPF account is 7.1%. Due to the PPF exemption, the interest earned in the PPF scheme is also tax-free under Section 80C of the Income Tax Act.

You can also provide standing instructions to your desired bank to have a certain amount deducted every month or year to make it easy. You can check and maintain your PPF account online too.

Recommended Reading: Is Ein Same As Sales Tax Number

Advantages & Disadvantages Of Tax Exempt

Availing tax immunity or exemption may have pros and cons for any individual or entity. So let us look at them:

You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

It helps diminish the tax pressure on an individual or firm.

Socio-economic Benefits

Providing tax benefitsTax BenefitsTax benefits refer to the credit that a business receives on its tax liability for complying with a norm proposed by the government. The advantage is either credited back to the company after paying its regular taxation amount or deducted when paying the tax liability in the first place.read more to the public welfare programs refines their business structureBusiness StructureBusiness structure is the legal framework adopted by a company to execute business activities in compliance with the corporate rules and regulations. An organization can be a sole proprietorship, partnership, limited liability company or corporation.read more and offers numerous socio-economic advantages.

No Downplaying Of Income

2. Drawbacks

Increased Cost Of Compliance

Filling the tax-exempt forms mandates the amenability to many formalities. Subsequently, this keeps adding to the cost of the organization.

Time-Consuming

The entire legal procedure may be quite time-consuming, with tons and tons of paperwork. So, the entity must be well-prepared for the same and be patient throughout the process.

Why Is It Important To Understand How Tax Exemptions Work

If youve received a type of income thats exempt from federal or state income tax , its important to know it so that you dont overpay. The same goes if you didnt have any income tax liability at all last year if you can avoid having taxes withheld from your paycheck, you can have more money in your pocket and working for you throughout the year.

While tax-exempt status for organizations may not be as important to individual taxpayers, it may be a good idea to check for it if youre planning to donate to one. If you donate money to an organization that doesnt qualify for tax-exempt status, it means they dont meet the requirements set by the IRS and your contributions may not be tax-deductible.

Don’t Miss: Do You Have To File Taxes By April 15th

Which Organizations Qualify

Organizations that meet the requirements for the subsection of the Internal Revenue Code that they have applied to qualify for tax-exempt status. Private businesses and corporations, or any business that is for-profit, will not qualify for tax-exempt status. Private individuals and families also do not qualify even if they make large donations the exception to this rule is if the individual or family creates a private foundation to further nonprofit causes. Additionally, any nonprofit that earns tax-exempt status and then is found to be using the money for private purposes or are operating against the requirements set forth for the status will automatically lose their status and will be required to pay taxes on any and all donations.

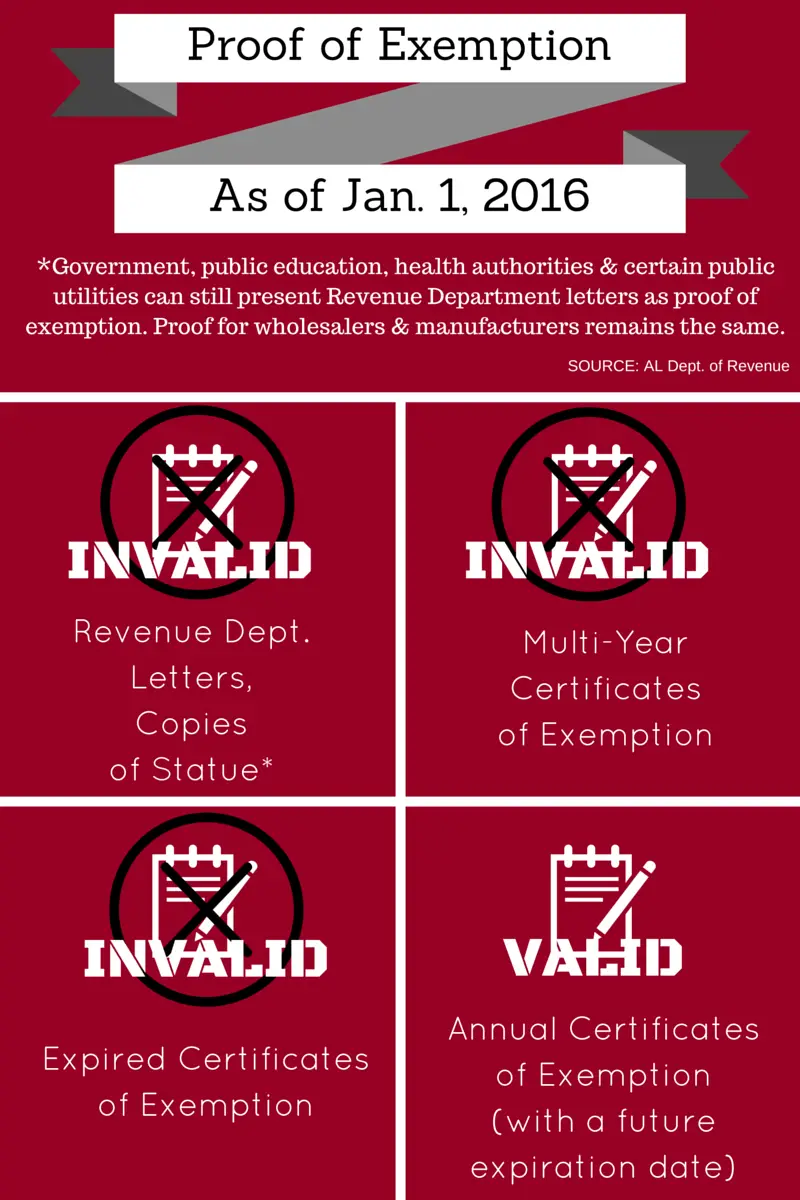

Tax Exempt And Sales Tax

One huge perk of being a nonprofit is that you can make purchases without paying sales tax. Although it can vary from state to state, generally speaking, youll merely need to document proof of your 501 status. The purchase will need to relate to your organizations charitable mission.

You provide a certificate of sales tax exemption to each seller, which that seller will then keep on record in case the taxability of the sale is ever questioned. If you regularly buy from a particular seller, you may be able to set up a blanket exemption certificate that will cover every purchase.

If youre selling products or services with the proceeds going toward your mission, you also may be exempt from collecting and remitting sales tax on those items. However, if youre selling online or outside your typical business area, youll want to research local sales tax laws to make sure youre compliant. In Washington State, for instance, nonprofits must collect and remit sales tax on any goods or services they sell.

Read Also: How To Deduct Mileage On Taxes

What Does Exempt Mean

Generally, the IRS will issue a tax refund when you pay more tax than what is actually owed in that specific tax year. When you file exempt with your employer, however, this means that you will not make any tax payments whatsoever throughout the tax year. Therefore, you will not qualify for a tax refund unless you are issued a refundable tax credit. Come tax season, your employer will provide you with Form W-2, which identified the total amount of taxes that was withheld throughout the year. If your tax liability is less than the amount withheld, the IRS will issue you a tax refund for the difference.

Is Filing As Exempt Illegal

Filing as exempt is not illegal. If you meet the criteria for filing as exempt you should file exempt on your W-4. Even if you qualify for a federal tax exemption, your employer will still withhold Social Security and Medicare taxes.

The reason you are cautioned against filing as exempt is not that it is illegal, but because you can get into trouble with the IRS if you do it when you do not qualify. If you should be paying tax, your employer should be withholding this from your paycheck for you. If you withhold too little, you are not making your tax payments to the IRS. You may then owe tax and face a penalty when you file your return.

Don’t Miss: Do I Have To File Taxes If I M Self Employed

What Does Being Tax

Understanding what it means to be tax-exempt can help you or your organization optimize your taxes. If you know what types of investment income are tax-exempt, for example, you may consider how those types of earnings can fit into your portfolio to try to minimize your tax burden.

Keep in mind that tax-exempt rules can vary significantly from jurisdiction to jurisdiction, so its important to confirm whether something thats exempt at the federal level also applies in your state and any other local tax jurisdictions.

Individuals may also want to understand what it qualifies as tax-exempt when they make decisions about their charitable giving.

How To Claim Exempt Status

On your W-4, enter your identifying information, such as your name, address, and Social Security number. Do not complete lines 5 and 6 and write Exempt in the box on line 7. Sign and date the form and return it to your employer.

Your employer will stop withholding federal tax after receiving your completed Form W-4. If your situation changes after submitting the form to your employer so that you will owe tax, you must complete a new W-4 within 10 days showing your allowances and additional withholding, if any, and leaving line 7 blank.

Read Also: Can I File Past Years Taxes Online

What Does Tax Exemption Mean A Guide For Employers

If an employee is tax exempt, this may have different implications for your business and payroll. Typically, youll deduct taxes from an employees pay, but what does tax exempt mean for how you calculate pay? Read on to learn what it means for an employee to be tax exempt, whos eligible for tax exemptions and the forms and regulations to be aware of.

Frequently Asked Questions About Exemptions

State law allows various types of organizations to be exempted from paying sales tax, hotel occupancy tax and franchise tax. Certain nonprofit organizations may also be eligible for property tax exemptions.

To apply for exemption, complete the appropriate application and include the required documentation.

If your organization is applying for exemption:

- on the basis of a federal exemption, or under an exemption category other than religious, educational, charitable, or homeowners association, complete and submit Form AP-204, Texas Application for Exemption Federal and All Others

- as a homeowners’ association, complete and submit Form AP-206, Texas Application for Exemption Homeowners’ Associations

If your entity is registered in Texas, you can order copies of your formation documents through the Secretary of State’s SOS DIRECT system, or you can call .

Out-of-state entities must include a file-stamped copy of your organizations formation documents and a current Certificate of Existence from the Secretary of State or equivalent officer in your home state.

Certain 501 organizations can apply for exemption based on their federal exempt status:

Read more about 501 exemptions.

No. Merely having a federal tax identification number or federal employer identification number does not mean that an organization is exempt from state or federal taxes.

Contact the Internal Revenue Service. Read their Publication 557, Tax-Exempt Status for Your Organization, or call .

Recommended Reading: How To Include Unemployment On Taxes

How Could This Affect My Taxes

Qualifying for a tax break can reduce your taxable income or potentially exempt you from tax withholding from your regular paycheck.

The suspension of the personal exemption may also affect your taxes. In 2017, you could typically deduct $4,050 for each exemption you were eligible to take. Depending on how big your family is, the loss of personal exemptions could potentially increase your taxable income.

Unfortunately, though, its not easy to determine the direct impact of the suspension, because Congress also substantially increased the standard deduction amount for all filing statuses and doubled the child tax credit, which could potentially offset some or all of the loss from personal exemptions.

Tax Exemptions Versus Deductions

Tax exemptions can often be confused with tax deductions. Both help to reduce your taxable income, but they serve very different purposes. If money coming in is tax exempt, it means that no taxes are due on that amount, making it pure earnings. It reduces the need for employers to withhold taxes from paychecks or submit reports to tax authorities showing how much was earned.

A tax deduction, on the other hand, must be filed at tax time. The taxpayer needs to keep records of the expenses and input the information on the appropriate forms at tax time. There is a limit as to what can be deducted and unless the taxpayer is offsetting business income, the deductions must be enough to exceed the standard deduction, which can be difficult to do if its merely charitable contributions and property taxes.

For those who are self employed or run their own businesses, however, deductions can dramatically reduce the amount of annual earnings subject to self-employment tax, which is designed to help take care of these taxpayers retirement.

References

Recommended Reading: How To Claim Unemployment Tax Break

Is Your Business Tax

Could your business qualify for tax-exempt status? Learn what it means to be tax-exempt and how to apply.

By: Jamie Johnson, Contributor

The only two certainties in life are death and taxes…but maybe not all taxes. Some businesses qualify for tax-exempt status at the federal level.

Taxes are a fact of life for most business owners, but if you run a certain type of organization, you could be exempt from paying federal income taxes. Learn more about what it means to be tax-exempt and how you can apply.

What Is The Reason For Tax Exemption

Through tax-exemptions, governments support the work of nonprofits and receive a direct benefit. Nonprofits benefit society. Nonprofits encourage civic involvement, provide information on public policy issues, encourage economic development, and do a host of other things that enrich society and make it more vibrant.

You May Like: Can Medical Expenses Be Deducted From Taxes

When Will I Find Out If My Application Is Approved

The IRS should contact you within 180 days of submitting your application. However, if it seems to be taking a long time, you can check its status. The IRS will thoroughly review your application, so if you make any mistakes, this can slow down the process considerably.

The IRS approves most tax-exempt applications, but there is always the possibility your application could be denied. If this happens, it’s a good idea to consult with your CPA and find out why the application was turned down. It could be something as simple as applying to be classified as a different type of nonprofit organization.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

for more expert tips & business owners stories.

To stay on top of all the news impacting your small business, go here for all of our latest small business news and updates.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

What If There Is An Error Change Or Dispute With Form W

If an employees personal or financial situation changes, they may be required to complete a new Form W-4. These changes include tax deduction eligibility, variations in salary or wage, and adding or removing dependents.

Unauthorized changes to Form W-4, such as defacement or adding form entries that were not requested, will make it invalid. The form is likewise invalid if the employee informs you that theyve included any false information.

In these cases, employers should withhold taxes as if the employee were a single individual with no deductions or exemptions. If the employee had a previous W-4 form, you can use it to determine the amount to withhold until the employee provides you with a valid Form W-4.

Should the IRS have a dispute with the requested withholding amount, it may send both the employee and employer a lock-in letter, which will determine a new withholding agreement. The IRS allows the employee a period of time to dispute the new withholding amount before it takes effect.

Also Check: What Are The Proposed Changes To Capital Gains Tax

What Is Ppf Tax Exemption

Public Provident Fund account is a long-term investment option. PPF scheme is available for all Indian citizens. The PPF account can be opened in the authorized banks or post offices. PPF has been one of the most popular and affordable investment options for approximately many decades. Many investors prefer to invest in PPF accounts.

There are various benefits of a PPF account, but one of the essential ones is PPF exemption. The income generated through PPF is tax-free under Section 80C of the Income Tax Act, 1961. The interest rate earned on the PPF account will be credited by the start of the financial year. The Indian government sets the interest rate of the PPF account. Additionally, the maturity proceeds of the PPF account are also exempt from taxation.

The lock-in period of the PPF account is 15 years. So, at the end of 15 years, you will receive the maturity benefits. However, you can extend the maturity period of your PPF account for five years.

Tax Exempt: What It Is And What It Means

What does it mean to be tax exempt? The government does not require tax on certain transactions and income types if they are tax exempt.

As an individual or business, you may report tax-exempt items on your tax return but only as a record, since you dont have to pay taxes on them. In contrast to tax deductions, which reduce gross taxable income, tax-exempt items are left out of all tax calculations.

Theres another use of the term: An entire organization may also be tax-exempt, which means that a specified amount of the gifts and income they receive cannot be taxed.

Also Check: How To Calculate Sales Tax From Total

How To Apply For Tax

The process of applying for tax-exempt status is not easy and can take a long time to complete. If you’re ready to get started, here are the four steps you’ll take:

- Set up a legal business entity: Before you can apply for tax-exempt status, you need to set up a legal business entity. If you’ve been operating as a sole proprietor, you’re not eligible, so you’ll need to set up either an LLC or a corporation.

- Apply with your Secretary of State: Once you’ve chosen a business entity, you can apply through your states Secretary of State. When you apply, you’ll name your business and provide a business mailing address. Once you’ve established your business entity, you’ll receive the articles of incorporation. From there, you can request your Employer Identification Number from the IRS.

- Figure out your tax-exempt status: Once you have all the necessary company paperwork, you need to determine what type of tax-exempt status you’re applying for. For instance, if you run a religious organization or charity, then you’ll likely qualify for Section 501 status. Knowing what status you’re applying for will help you find the correct forms to fill out.

- Submit your application: Now, you’re ready to complete the application process. Make sure to fill out the forms correctly because minor errors can delay the application process. If the purpose of your organization changes during the application process, you’re required to let the IRS know in writing.