Where Can I Find Out How Much Property Tax I Paid

Here are some ways to figure it out:

- Check box 10 on Form 1098 from your mortgage company

- Review your bank or credit card records if you paid the property/real estate tax yourself

- Go to your city or county tax assessor’s website and look for a link to Property search or Property Tax records

Keep in mind

- If you pay your property tax with your mortgage, you can only deduct it after your lender has paid the tax on your behalf. You can contact your lender to find out when they typically make these payments. .

- Claim the deduction in the year you made the payment. If you paid your 2022 property tax on December 14, 2021, claim it on your 2021 return.

We’ve got more info on how to enter the property tax you paid.

Related Information:

How Do Property Taxes Work

Let’s define a couple of key terms before we get into the details of how property taxes work. First, you must become familiar with the “assessment ratio.” The assessment ratio is the ratio of the home value as determined by an official appraisal and the value as determined by the market. So if the assessed value of your home is $200,000, but the market value is $250,000, then the assessment ratio is 80% . The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes.

Wondering how the county assessor appraises your property? Again, this will depend on your countys practices, but its common for appraisals to occur once a year, once every five years or somewhere in between. The process can sometimes get complicated. In a few states, your assessed value is equal to the current market rate of your home. The assessor determines this by comparing recent sales of homes similar to yours. In other states, your assessed value is thousands less than the market value. Almost every county government explains how property taxes work within its boundaries, and you can find more information either in person or via your local governments website.

To put it all together, take your assessed value and subtract any applicable exemptions for which you’re eligible and you get the taxable value of your property.

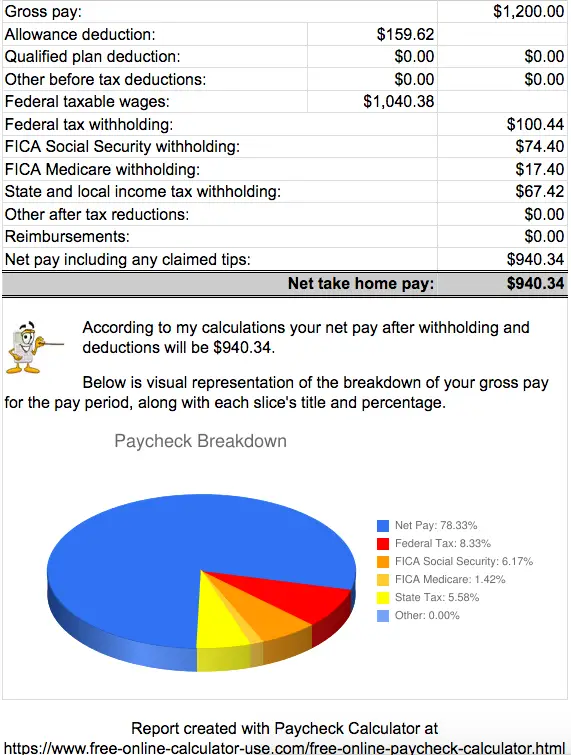

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Recommended Reading: Find Employers Ein

How Do You Calculate New Price After Increase

Divide the larger number by the original number.

Dont Miss: Ein Look Up Number

How To Calculate Your Tax Bill

Property taxes in Tennessee are calculated utilizing the following four components:

|

APPRAISED VALUE |

The Appraised Value for each taxable property in a county is determined by the county property assessor. |

|

|

ASSESSMENT RATIO |

The Assessment Ratio for the different classes of property is established by state law . |

|

|

The Assessed Value is calculated by multiplying the appraised value by the assessment ratio. |

||

|

TAX RATE |

The Tax Rate for each county is set by the county commission based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the county’s tax base. |

You May Like: Do I Have To Pay Taxes On Plasma Donation

Do I Really Need To Register For Vat

Well, that depends on your particular circumstances. If your turnover in a 12-month period reaches the current £85,000 threshold, then registration is compulsory â and if you donât do it, youâll receive a fine as a penalty. If you donât hit this figure, then registration isnât obligatory read more..

How To Figure Your Property Tax Bill

Property taxes in Tennessee are calculated utilizing the following four components:

The APPRAISED VALUE for each taxable property in a county is determined by the county property assessor.

The ASSESSMENT RATIO for the different classes of property is established by state law .

The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

The TAX RATE for Davidson County is set by the Metro Council based on the amount of monies budgeted to fund the provided services. These tax rates vary depending on the level of services provided and the total value of the countys tax base. The tax rates are not final until certified by the State Board of Equalization.

To calculate the tax on your property, assume you have a house with an APPRAISED VALUE of $100,000. The ASSESSED VALUE is $25,000 , and the TAX RATE has been set by the Metro Council at $3.288 or $2.953 per hundred of assessed value. To figure the tax simply multiply the assessed value by the tax rate of $3.288 or $2.953 per hundred dollars assessed.

Read Also: Is Donating Plasma Considered Income

How To Calculate Sales Tax Backward From Total

Most of the state and local governments would collect a sales tax on the products sold in stores. For some people, they need to know how much they had paid for, especially when they need to fill out accurate tax returns or receive monetary credits for any sales tax which theyve overpaid. Knowing this information is very beneficial, especially if you have to make a list of any purchases youve made outside of your state and find out how much taxes youve paid on them.

You dont pay for a reverse sales tax instead, you calculate it. The simplest way to do so is to use this reverse tax calculator. For instance, youve made some purchases on a business trip. As you go through the receipts, you may want to find out how much is the sales tax and how much is your actual income. Rather than calculating the sales tax from the purchase amount, its easier to calculate the sales tax in reverse then separate this amount from the total amount.

The computations remain the same whether youre performing a reverse sales tax calculation using a receipt that you have, or youre trying to figure out the price of an item before the taxes. Lets take a look at some steps for you to calculate the sales tax backward from the total. Before you start, you should know the total amount youve paid for as well as the amount of tax paid. Then follow these steps:

- Subtract the tax paid from the total amount

$26.75 $1.75 = $25

- Divide the tax paid by the price of the item before tax

$1.75 ÷ $25 = .07

Performing A Sales Evaluation

The assessor values the property using comparable sales in the area. Criteria include location, the state of the property, any improvements, and the overall market conditions. The assessor then makes adjustments in the figures to show specific changes to the property, such as new additions and renovations.

Also Check: Irs Taxes Due

Is 7 Cents A Dollar Tax

Base retail sales tax is set at a certain number of cents per every dollar spent in a retail transaction, and the rates vary widely. Some states have no base retail sales tax at all. These states are Alaska, Delaware, Montana, Hew Hampshire and Oregon. Only California as a base sales tax above 8 cents per dollar.

How Are Mill Rates Set

Local governments set mill rates by dividing the budgeted revenue by the total assessed value of properties within the jurisdiction. So, for simplicity’s sake, say your town has a budget of $2,000, and the properties have a collective assessed value of $500,000. The tax rate, then, would be $2,000 ÷ $500,000, or 0.40% .

Also Check: Do Taxes Get Taken Out Of Doordash

Relationship Between Property Values & Taxes

- Prior to the economic downturn, property values were increasing annually, reaching a high of $58 billion in assessed value in fiscal year 2009.

- In addition, new construction was added to the rolls each year, also increasing the assessed value to be taxed.

- Both these helped keep the tax rate down.

How Property Tax Rates Are Determined In Bc

Municipal property tax rates are determined based on the budget needs of the municipality. Municipalities consider their expected spending and other revenue and use property taxes to make up for the rest. The specific property tax rate for a certain year depends on the budget of the municipality and its total assessment base . If more tax revenue is necessary, tax rates will need to go up, and vice-versa.

The School Tax is less transparent. Every year, BCs Minister of Finance determines the total amount needed from the School Tax. The Lieutenant Governor in Council then has until May 4th to determine the specific tax rates for each school district. School tax rates can differ between school districts as well as in the districts themselves.

Additional School Taxes on High-value Properties in BC

If you own a residential property assessed at more than $3 million, you will have to pay an additional school tax. You will also still have to pay the base school tax rate on the whole value.

As of 2020, you would have to pay:

- 0.2% on the value of your property between $3 million and $4 million

- 0.4% on the value of your property above $4 million.

A $5 million detached home would have to pay an additional school tax of $6,000 in 2020.

0.2% x $1M = $2,000 0.4% x $1M = $4,000 Total: $6000

Read Also: When Does Doordash Send 1099

Local Differences In Property Tax Assessment

Ryshakov notes that some jurisdictions update their assessments every five years, giving you a predictable tax bill until the following assessment. Howeve, in some places, such as Texas, homes are reassessed every year. If real estate prices escalate quickly , your tax bill can blow up. “Some of the people who move to Texas are in for a big surprise,” she says. “What they are paying today is not necessarily what they will be paying tomorrow.”

In California, Proposition 13 created a different property assessment system from other states. When you buy, your home is assessed at your purchase price. After that, the assessed value can only increase by a maximum of 2% annually, though local governments can add on parcel taxes. Your property’s assessment won’t revert to market value until you sell in California, though you may get reassessed if you renovate your property.

When it comes to figuring out your tax rate, Ryshakov says, “It’s very state-, county-, and even municipality-specific. Know your market. Know what’s going on. A lot of people get in trouble because they don’t know.”

Sales Tax Calculator And De

This calculator requires the use of Javascript enabled and capable browsers. There are two scripts in this calculator. The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the total sales price, including tax. You may change the default values if you desire. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Enter the sales tax percentage. For instance, in Palm Springs, California, the total sales tax percentage, including state, county and local taxes, is 7 and 3/4 percent. That entry would be .0775 for the percentage. The second script is the reverse of the first. If you know the total sales price, and the sales tax percentage, it will calculate the base price before taxes and the amount of sales tax that was in the total price. This is particularly useful if you sell merchandise on a tax included basis, and then must determine how much tax was involved in order to pay your sales tax, this is the ideal tool. Several state tax agencies actually suggest our calculator to merchants that could use it in that manner.If you need to calculate the sales tax percentage and you know the sales amount and the tax amount, use our Sales Tax Percentage Calculator. CALCULATE SALES TAX

Also Check: Amended Tax Return Online Free

Where To Find Property Taxes Plus How To Estimate Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

How Do I Calculate The Property Taxes On My Property

This is how you can calculate the property taxes on your property:

- Looking at your notice of value, find the “appraised value” of your property. Multiply the appraised value by the “assessment percentage” for your property _ times _% = assessed value

- Multiply the assessed value by your “mill levy” and then divide by 1,000 to estimate the property tax you owe. _ times _ divided by 1,000 = tax bill

Contact your county clerk to find out what your mill levy is.

Related Tags

You May Like: Doordash 1099 Nec

How Much Is Property Tax

The Council of the District of Columbia establishes property tax rates, which can change from year to year. Heres how to calculate yours:

- You must pay tax on each $100 of your propertys assessed value.

- To determine the amount of property tax due, divide your propertys assessed value by $100, then multiply that amount by the property tax rate.

For example, assume your tax rate is 1.2% and your house is assessed at $250,000. To determine the property tax, divide $250,000 by 100, which equals $2,500. Now multiply $2,500 by 1.2 your annual property tax bill is $3,000. Keep in mind this amount excludes homestead or senior citizen deductions, trash services and any other credits.

Where Can I Find How Much I Paid In Property Taxes

If you own property, youre taxed on the value of that property. In most cases, its an amount you pay as part of your mortgage, but if you own your home or land outright, youll pay those taxes to the city rather than to a financial institution. Whether your taxes go through a mortgage company or directly to the government, though, youll probably occasionally be interested in finding out just how much tax youre paying. You can get information on property taxes you paid through your mortgage company or the county assessors office.

Also Check: How Do Taxes Work On Doordash

What Is The Mill Rate Of The Property

When learning how to calculate property tax, itâs important to understand what the mill rate is for your property.

A mill rate is a tax rate that is calculated by determining how much money each jurisdiction will need in the upcoming year for public services, such as public schools, parks and recreational facilities, emergency services, the local police force, public transportation and libraries. Mill rates can change every year or every few years, depending on where you live.

Once a jurisdiction figures out how much money theyâll need to fund public services, that number is divided by the total number of homes in the area. The resulting figure is the mill rate.

A mill rate is typically expressed as a number, such as 50 mills. One mill is one-thousandth of a dollar, the equivalent of $1 per $1,000 of property value. So a mill rate of 50 means youâd pay $50 per every $1,000 in property taxes. To convert the mill rate into a percentage, youâd divide 50 by 1,000 and get 0.05, or 5%.

Hereâs an example of this in action: Letâs say your home is assessed at $250,000 in an area with a mill levy of 50 mills or 5%. Youâd multiply 0.05 by $250,000, and youâd get $12,500. That number reflects your estimated annual property taxes.

How Do You Calculate Net Income In Canada

Every deduction you can make is subtracted from your total income each year to arrive at your net income. determines your provincial and local non refundable credits as well as other social credits you receive, such as the GST/HST equivalable credits, or any social benefits you receive like the GST/HST credit or the Canada child benefit.

Don’t Miss: How Do I Pay Taxes For Doordash