Use Your Online Banking Bill Pay

Pay a tax bill using your financial institutions bill pay service.

To allow for processing, we recommend scheduling your payment to be made at least 5 business days prior to the actual due date on the tax bill. Be certain to verify the property tax account number submitted with your payment as it can change between billings.

If making an advance payment, please have your bank indicate Prepayment on the remittance.

Delayed posting may occur if the incorrect tax account number is provided.

Remit to:

Charlotte NC 28258-0084

How Can I Pay Nc State Tax Can I Pay It Online Through Turbotax Website

The question is for “Paying” NC taxes due….

The answer is NO…you cannot pay your NC taxes due just by filing an NC tax return thru TurboTax. It is not possible to arrange the payment thru TTX.

You must either mail in check with the form D-400V voucher

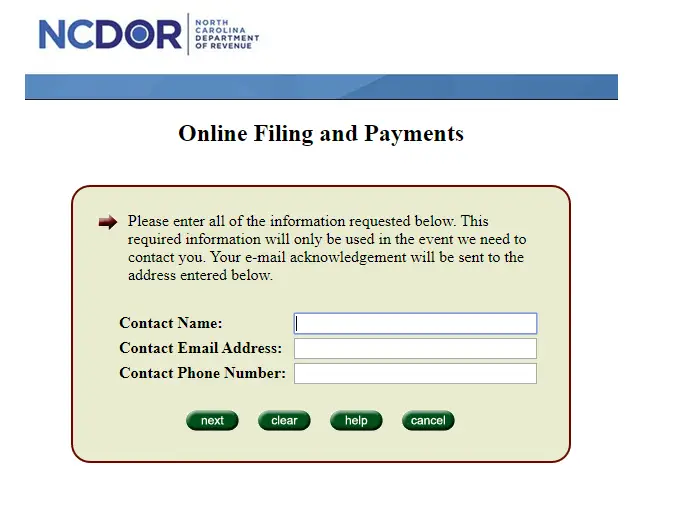

…..OR…..arrange payment for taxes due separately on the NCDOR website. Read the whole page, and then hit the appropriate button at the bottom of the page…..Here’s the page that is done at:

North Carolina Department Of Revenue

Pay Your Bills Securely with doxo

- State-of-the-art security

- Free mobile app available on Google Play & Apple App Store

- Never miss a due date with reminders and scheduled payments

- Real-time tracking and bill history

- Pay thousands of billers directly from your phone

doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. doxo is not an affiliate of North Carolina Department of Revenue. Logos and other trademarks within this site are the property of their respective owners. No endorsement has been given nor is implied. Payments are free with a linked bank account. Other payments may have a fee, which will be clearly displayed before checkout. Learn about doxo and how we protect users’ payments.

Read Also: 1040paytax.com Safe

Renew Registration And Pay Property Tax Online

1. Visit myNCDMV and or download the app for iOS or Android and click Continue to myNCDMV Services.

2. Create an account using your email address, Apple, Facebook or Google credentials, or Continue as a Guest .

8. Enter your contact information. Then, click Submit.

9. Review your Vehicle Renewal Summary and click Add item to cart if everything looks good.

10. Click Go to cart if you don’t need to add another item. Click I’ll add something else if you need to renew another vehicle or need to make another purchase online through myNCDMV.

11. Enter your email address into the “Send Receipt To” box if you’re logged in a guest. If you have an account, your receipt is sent to the email address that you use to log in to myNCDMV.

12. After clicking Go to cart, click Choose a Payment Method and enter a or link to a bank account.

Note: If you already have a card or bank account linked, it will automatically appear here. Click on the payment method to change or add a new payment method.

13. Click Pay $–.– to finalize and submit your order.

Note: You will receive a payment receipt in your email and if signed in, you can also see it in the “Receipts” tab of your myNCDMVProfile .

Making Federal And Nc Tax Payments Online

When making tax payments to the IRS or to the NC Department of Revenue , paying online is an available option. Payments for Tax Due with Returns, for Estimated Taxes and for Extensions can be made using this method.

To Make A Federal Tax Payment:

Go to the IRS website for making a tax payment.

- Select Make a Payment

- Under Pay Your Taxes Now select if you are paying by direct pay or debit/credit card. There is no charge to pay by bank draft. Fees for credit/debit cards are noted on the website.

- Select Make a Payment

Don’t Miss: Irs Taxes Due

How To Pay Your Taxes

Listed below are the ways to pay your Haywood County taxes:

1. Pay Online – You may pay online with a Credit Card, Debit Card, or Check

2. Pay by Phone – You may pay by phone by dialing 1-877-729-8290. You must have your bill # and account # when calling.

3. Pay by Mail – You may mail a check or money order to the address on your tax bill.

4. Payment Dropbox – You may pay with check or money order by placing it into the payment dropbox in front of the Historic Courthouse located at 215 North Main Street in Waynesville. NO CASH SHOULD BE LEFT IN DROPBOX.

5. Pay with Cash – You may make cash payments in the Tax Collections office. Masks and temperature screenings are required.

Pay With Visa Or Mastercard

Fees for paying with Visa or MasterCard:

- Visa or MasterCard Consumer Debit card are assessed a flat fee of $3.95 per transaction regardless of the amount of tax paid.

- All other MasterCard and Visa cards incur a service charge of 2.3% of the tax amount charged. A minimum service charge of $1.00 applies.

Pay Online: The system is available 24 hours a day seven days a week and will advise you of the total charge prior to your authorization.

In Office:Credit cards may be used when paying in person at our main office located in downtown Raleigh at 301 S. McDowell Street, Suite 3800, Raleigh NC 27601.Please note, credit cards may not be used when making a prepayment on taxes.

Don’t Miss: How To Calculate Sales Tax Backwards From Total

Personal Online Banking Bill Pay

- Pay a tax bill using your financial institutions bill pay service.

- Allow additional time for processing, we recommend scheduling your payment to be sent to us by your financial institution at least 5 business days prior to the actual due date on the tax bill.

- Be certain to verify the property tax bill number is submitted with your payment to ensure proper credit. Delayed posting may occur if the incorrect tax number is provided. The bill number is printed in color on your bill.

- If making an advance payment, please have your bank indicate Prepayment on the remittance.

- Make payable and remit to: Orange County Tax Office P.O. Box 8181, Hillsborough, NC 27278.

PAY TAXES BY MONTHLY BANK DRAFT

Orange County Tax Office offers a Bank Draft Program that will allow you to pay 2022 real and personal property taxes over a 10-month period. This will relieve you of mailing monthly payments, and it will be a convenient way to pay taxes.

- You may choose to have payments drafted on either the 5th or the 20th of the month. Drafts on the 5th will begin in February and finish in November drafts on the 20th will begin in January and finish in October.

- Applications will be accepted by mail, in person or by email. Please submit a new application for each year that you choose to participate.

- Tax bills for registered motor vehicles are not eligible for this program.

Please be advised that payments are non-refundable.

What to do:

Pay By Checking Account Online

Payment by checking account draft provides customers with the ability to authorize Wake County to draft a one-time tax payment from their checking account.

No service fees are charged for the use of this payment option.

Your checking account will be drafted within two business days of your authorization date.

You May Like: Is Freetaxusa A Legitimate Site

Pay By Automated Telephone: 1

When you pay Electronically

Whether paying online, by phone or in our office, a convenience fee is assessed for your credit card, debit card, or electronic check payment. This fee is paid to Forte Payment Systems, not to Henderson County. The amount of the fee and the total amount to be charged will be disclosed to you prior to you providing your credit card information. You will have the option to cancel the transaction prior to any charge being processed. If you elect to continue, your credit card statement will show two charges, one charge for the tax, the other for the convenience fee. Payments made online and through our automated phone system may take up to 3 business days to reflect online. You will always be credited for payment on the date you make payment.

Convenience Fee Schedule

The following fee schedule applies to payments made online, through our automated telephone system, and also those made in our office.

| Service Type |

|---|

| 2.4% of payment total,$1.50 minimum fee |

* Remember: Cash, Check, and Money Orders are always accepted on timely payments in our office with no additional fees.

How does the system work?

Begin by searching for only one of the following:

- Name – Best results using primary owner name

- Bill number – Drop the leading zeros on the bill number located in the upper left-hand corner of your tax bill

- Parcel number – All Real Property has an assigned six to eight digit parcel number located on your bill

Safe and Secure

Welcome To Chowan County Nc

You can pay your real or property taxes using the following methods:

Cash, Check, or Money Order

- Accepted at our office

- Please make checks payable to: Chowan County Tax Department

- Mail checks to: Po Box 1030 Edenton, NC 27932ORyou may drop off your payment in our overnight drop box located in front of our office at 305 W. Freemason St. Edenton, NC 27932

- A fee of $25 will be charged to accounts for any returned checks

Automatic Draft

- We now offer Automatic Draft for Tax Payments

- Automatic Drafts split your total Tax Obligation up into 4 equal monthly payments to be drafted on the last business day of each month beginning in September and ending with your final payoff amount deducted in December

- If you would like to participate in this program, please stop in our office with a voided check to fill out an Automatic Draft form or submit the Payment Plan Option page that came with your annual tax bill completely filled out with a signature and a voided check before September 8th, 2021.

- There is NO additional charge for this service!

Personal Online Banking

You May Like: How Does Doordash Do Taxes

Supported Operating Systems And Browsers

The following operating systems and browsers are supported for your notice electronically:

Operating Systems:

- or higher with at least 128-bit encryption

- Firefox 3.0 or higher with at least 128-bit encryption.

The web browser must be configured to enable per session cookies. In Internet Explorer, this can be set under the Internet Options menu option. For additional information on enabling the per session cookies please check the browsers documents/help.

If you receive a message that 128-bit encryption is needed, you will need to download the 128-bit encryption for your browser. The 128-bit encryption is standard in the United States so the problem would normally apply to someone trying to access the application from outside the United States.