New Jersey And New York Propose Taxes On Financial Transactions

New York has proposed Assembly Bill 5215 and Senate Bill 3980, which would impose a new tax on the purchase of securities having a New York connection. Security would be broadly defined to include shares of stock, partnership interests, bonds, notes and derivative financial instruments, such as options, futures contracts, etc. Varying tax rates would apply to covered transactions, and a hierarchy would apply to determine who pays the tax . Similarly, New Jersey Assembly Bill 4402 and Senate Bill 2902 would impose a tax on persons or entities that process 10,000 or more financial transactions through electronic infrastructure located in New Jersey during the year. The tax rate would be $0.0025 per financial transaction processed through electronic infrastructure in New Jersey. For specific details, each states respective proposals should be reviewed.

Reality Check: Few Will Really Pay More Than 50%

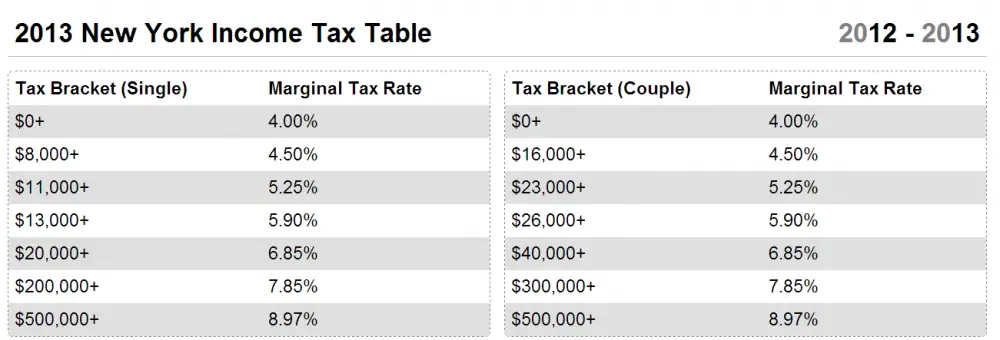

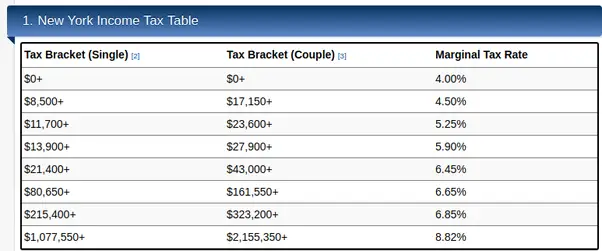

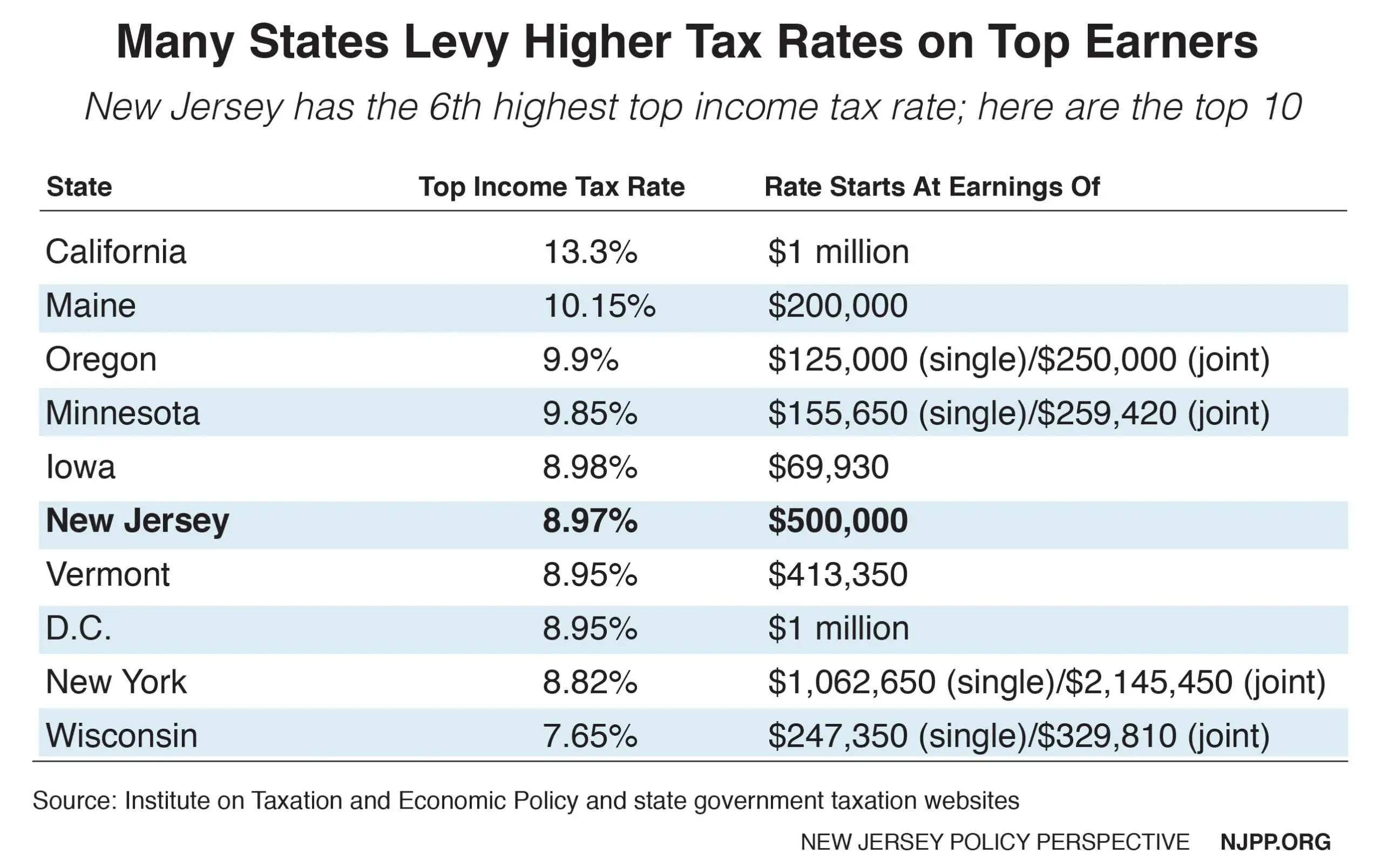

New York’s income tax rate for annual earnings above $1 million will rise to 9.65%, from its current 8.82%, under the latest deal. It will also create new tax brackets for income above $5 million and $25 million a year, with even higher rates of 10.3% and 10.9%, respectively.

The increases combined with New York City’s own 3.9% tax on personal income, as well as federal income tax rates that range from 10% to 37%, will raise the top marginal personal tax rate for city residents to nearly 52%. That would push New York past California, which currently has the highest marginal personal tax rate of just over 50% on income over $1 million.

Few of Gotham’s wealthiest, however, will end up paying rates that high. Nearly 3 million New York City residents file taxes, according to state data from 2018, but just 30,000 reported making more than $1 million a year. And only about 4,000 of those people made more than $5 million. That’s about the population of Armonk, the wealthy New York City suburb that is home to IBM headquarters.

And remember: That 52% surcharge is a marginal rate paid on the income above $25 million. High-wage earners will still pay a lesser, combined all-in rate of 44% on income below $1 million.

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Don’t Miss: How Much Time To File Taxes

New York Provides Updates For Housing Development Fund Projects Covid

Effective April 16, 2021, New York exempts certain housing development fund projects from sales and use tax, and provides for a COVID-19 debt relief credit against corporate income tax. For specific details, please see L. 2021, A3006 . Further, New York has extended certain Brownfield credit periods for two years for specified taxpayers that failed to meet credit requirements due to COVID-19 pandemic restrictions. For information pertaining to the Brownfield credit extension, please see L. 2021, S2508 .

New York Assessed Values

The property tax system in New York starts with an assessment of your property to determine the market value. That is done by a local official, your city or town assessor. Assessments should happen regularly, but many cities and towns have not made reassessments in many years.

Since many assessments are not current, each tax area is assigned a Residential Assessment Ratio that represents the ratio between assessed values and current market values. So, for example, if the market value of your home is $100,000, and your citys RAR is 54%, your assessed value should be $54,000.

Your RAR doesnt affect the taxes you actually pay, but it is important to know to ensure that your home is not over-assessed. For example, if your home is worth $150,000, your local RAR is 50%, and your assessed value is $125,000, your home is over-assessed. Your assessed value implies a market value of $250,000, much higher than the true market value of $150,000. In that case, you may want to contest your assessment. Otherwise, you will wind up paying more than your fair share of taxes.

Don’t Miss: Can Home Improvement Be Tax Deductible

Save With Wise When Invoicing Clients Abroad

If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees. Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

Read Also: How Can I Make Payments For My Taxes

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

New York City Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined NYC rate.

You May Like: Taxes For Doordash

Entertainment And Information Services Provided By Telecommunications Service

An additional 5% sales tax is imposed on entertainment and information services provided by telecommunications service that are received by the customer in an exclusively aural manner . See N-93-20, Increase in Tax Rate Applicable to Entertainment and Information Services Provided by Means of Telephony and Telegraphy.

New York City Income Tax

New York City has a separate city income tax that residents must pay in addition to the state income tax. The city income tax rates vary from year to year. The tax rate you’ll pay depends on your income level and filing status, and it’s based on your New York State taxable income. There are no city-specific deductions, but some tax credits specifically offset the New York City income tax.

If you work for the city but don’t live there, you must still pay an amount equal to the tax you would have owed if you had lived there. This rule applies to anyone who began employment after Jan. 4, 1973.

Also Check: How Much Is Payroll Tax In Louisiana

How To Calculate New York Sales Tax On A Car

You can calculate the state sales tax on a vehicle purchase by first taking the vehicle’s purchase price and then deducting any trade-ins, rebates, and incentives. This will be a portion of your out-the-door costs. From there, you can multiply this cost by 4.5%.

As an example:

- Lets say you purchase a new vehicle for $50,000.

- Your trade-in vehicle is worth $7,500 and you get a $2,500 rebate.

- That puts your out-of-pocket cost at $40,000.

- Now multiple $40,000 by 4%.

- This gives you a state sales tax of $1,600.

New York City Sales Tax

On top of the state sales tax, New York City has a sales tax of 4.5%. The city also collects a tax of 0.375% because it is within the MCTD. The total sales tax in New York City is 8.875%. This is the highest rate in the state. With such a high sales tax, its no wonder the cost of living in New York City is so high.

Read Also: How To Correct State Tax Return

How To Calculate Nyc Sales Tax

To calculate the amount of sales tax to charge in New York City, use this simple formula:

Sales tax = total amount of sale x sales tax rate .

Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

State Of New York Tax Rate Summary

New York continues to have some of the highest tax rates in the country. Its standard deductions are less than those at the federal level. New York taxes include:

- Income tax rates: 4% to 10.90%

- Standard deductions: $3,100 to $16,050

- Estate tax rates: 3.06% to 16%

- Sales tax: 4% plus up to 8.8% added on by municipalities

Don’t Miss: Efstatus.taxact 2014

New York Proposes Capital Gains Business Tax Surcharges

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include a one percent surcharge on the capital gains of certain individuals for tax years beginning on or after January 1, 2021. The capital gain surcharge would be imposed in addition to individual income tax. Further, both proposals call for a surcharge to be imposed on corporations for tax years beginning on or after January 1, 20201. While both surcharges are structured differently, in either case the tax would apply to corporations with income or receipts above a designated threshold. The Assembly proposal calls for an 18 percent surcharge, while the Senate proposal would permanently raise the corporate franchise tax rate from 6.5% to 9.5%. Lastly, the Assembly version of the Bill would reinstate the 0.15 percent capital base tax that had previously been repealed for tax years beginning in 2021.

Additional Ny Payroll Tax Resources:

Our calculator can help you do most of the heavy lifting, but here are some additional resources and contact information you may need to start running payroll in New York:

New York Department of Taxation & Finance : 485-6654 | Register for Withholding Taxes

New York Department of Labor : 457-9000 | Register for NY Unemployment Taxes

You can also learn more about city taxes and determine the appropriate withholding rates for your employees here:

Don’t Miss: Where’s My Refund Ga State Taxes

Other New York City Taxes

New York City charges a sales tax in addition to the state sales tax and the Metropolitan Commuter Transportation District surcharge. But food, prescription drugs, and non-prescription drugs are exempt, as well as inexpensive clothing and footwear.

There’s also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. This tax rate includes New York City and New York State sales taxes, as well as a hotel occupancy tax. Rooms renting for less expensive prices are subject to the same tax rates, but at lesser nightly dollar amount fees.

Medallion owners or their agents pay a tax for any cab ride that ends in New York City or starts in the city and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, or Westchester counties. This tax, known as the taxicab ride tax, is generally passed on to consumers. Medallion owners are those who are duly licensed with a medallion by the Taxi Limousine Commission of New York City.

New York Update On Extension Of Filing Deadline

The New York Department of Taxation and Finance has issued a notice alerting taxpayers that the 2020 individual tax returns and related payments are now due on May 17, 2021. The Department emphasizes that the extension is for individual personal income tax returns only. However, estimated tax payments for 2021 have not been extended and are still due on April 15, 2021.

Also Check: Does Contributing To Roth Ira Reduce Taxes

Sales Taxes Imposed By Certain School Districts

Certain school districts in New York State impose sales tax on utilities and utility services. A school districts utility tax is in addition to the tax imposed by the state and by the county and/or city in which the school district is located. You can look up the combined tax rate on utility services sold in a school district by entering the delivery address of the utility or utility service in our online Jurisdiction/Rate Lookup by Address.When you enter the address, youll find a description of the applicable utility or utility service. These services fall into three categories:

- residential energy sources and services,

- nonresidential energy sources and services, and

- telecommunications services.

The school districts that impose these taxes, and the applicable tax rates, are listed on Schedule B, Taxes on Utilities and Heating Fuels and Schedule T, Taxes on Telephone Services. See also Tax Bulletin Residential Energy Sources and Services .

The Nyc Earned Income Credit

The New York City Earned Income Tax Credit is equal to 30% of your allowable federal Earned Income Tax Credit reduced by your NYC Household Credit if you qualify for and claim that.

Full-year residents and part-year residents of NYC who qualify for and claim the federal Earned Income Credit can claim the New York City Earned Income Credit.

New York State offers an Earned Income Credit as well. You can still qualify for an NYC Earned Income Credit even if you don’t qualify for the state credit, and you can claim both if you do qualify for the state credit. This tax credit is also refundable.

Don’t Miss: Efstatus.taxact

County City Taxes Mean New York State Sales Tax Rates Will Vary

Throughout the rest of the state, sales and use tax rates will vary depending on the county and city youre in. And New York counties typically add an additional 4 percent or more to your taxes every time you make a qualifying purchase. The highest rates are in the five counties that make up New York City, but Oneida and Erie county each have a 4.75 percent rate in addition to New Yorks 4 percent. The counties with the lowest additional sales tax rate are Saratoga County, Warren County and Washington County, only adding another 3 percent to every purchase.

Everything You Need to Know: New York State Taxes

Heres a look at each county in New York and its prevailing sales tax rate:

| 8% |

Sales And Other Taxes

The state’s sales tax has been set at 4% since June 1, 2005, but local municipalities can add up to 8.88%. Food, prescription drugs, and non-prescription drugs are exempt, as are clothing and footwear costing less than $110 per item.

The state imposes a motor fuel tax that includes a:

- Motor fuel excise tax

- Petroleum business tax

- Petroleum testing fee

The state gasoline tax was 32.98 cents a gallon as of February 2021 state and federal taxes together are 51.38 cents per gallon. The cigarette tax is $4.35 per pack of 20.

Read Also: Plasma Donation Taxes

When Sales Tax Is Exempt In New York

There are several exemptions available that will allow you to avoid paying state sales tax:

- If the vehicle is a gift from a family member

- If you paid out-of-state sales tax

- If you were not a resident of New York when the vehicle was purchased

- If you are a member of the U.S. Armed Forces and you are not a resident of the state of New York

- If you leased the vehicle

Write Your Employees Paychecks

Youre good enough, youre smart enough, and gosh darn it, youve figured out all your payroll! Once youve calculated your employees net pay by working out all their deductions and withholdings, youre ready to cut their checks.

In addition to making sure your employees get paid on time, dont forget to set aside the employer taxes your company is responsible for. Those FICA and UI payments can add up if you dont remit them on a regular basis.

Federal tax filings are due quarterly by filing Form 941 and annually by filing Form 940, but for most New York employers, taxes must be paid on an ongoing basis via the EFTPS payment system. Find detailed information from the IRS here.

Recommended Reading: How Do I Protest My Property Taxes In Harris County

Imposed Sales Tax On Vapor Products

Effective December 1, 2019, a new 20% supplemental sales tax will apply to retail sales of vapor products in New York, which should be collected by a vapor products dealer. Any business that intends to sell vapor products must be registered as a vapor products dealer before making sales of vapor products. The Tax Department is developing an online registration process. In addition, if a taxpayer has debit blocks on their bank account, even if the taxpayer has already authorized sales tax payments to the Tax Department, the taxpayer must communicate with their bank to authorize their vapor products registration payment.