What Is A Tax Transcript

A tax transcript is basically a printout summary of the major data on your tax return, including a particularly important one: adjusted gross income, or AGI.

The IRS doesnt charge for tax transcripts, and you can get one online immediately . Youll need to register online with the IRS before you can access the Get Transcript online tool.

In most cases, when you need tax return info you can use a tax transcript. Ask whoever needs your tax information whether a tax transcript will be OK or if a copy of the return is required.

How Do I Get My Actual Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

What Is A Sa302 Calculation

This is a much more detailed breakdown of your tax return. Itspecifies the tax rate youre on, the total income on which youve been chargedtax, the amount of income tax you owe, along with any Class2 and Class4 National Insurance contributions. It will also tell you about deductions,balancing payments, and any other income you may have received from othersources.

Self-employed workers can use SA302 documents to provideevidence of their income. So if youre applying for a mortgage, for example,and the bank or building society asks you to prove your income for a givenperiod, you can follow the steps above to access your SA302 documents.

If you didnt submit your tax return online, or if yourestruggling to locate certain older paper documents, then you can try contactingHMRC. Youll need your Unique Taxpayer Reference number to hand, aswell as your National Insurance Number. You should also ensure that all of yourpersonal details are up to date in your personal tax account, sothat HMRC can properly identify you with their screening questions.

Don’t Miss: Does Roth Ira Get Taxed

How Far Back Can You Go To File Taxes In Canada

According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Whether you are late by one year, five years, or even ten years, it is crucial that you file immediately. You may think that since you dont have the money to pay your taxes, its best to not file, but this isnt the right move.

The CRA does not forget about you over time. Every day that goes can cost you more money in late-filing penalties, interest, and other potential fees when you delay filing your taxes.

How Long Should You Keep Tax Records

The government recommends that you keep tax records for atleast 22 months following your return. But if youre self-employed, thegovernment requires you to keep your records for at least five years followingthe 31 January deadline of each tax return.

You can read our full guide to keepinggood tax records. Our guide lists occasions when you might want to keepyour tax records for longer, along with some advice on what to do if yourrecords are lost, stolen or damaged.

Read Also: How To Apply For Sales Tax Exemption In Georgia

How To Access Old Tax Returns

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She advises clients nationwide through her tax firm, Cassandra Lenfert, CPA, LLC. With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. She received her BA in Accounting from the University of Southern Indiana in 2006. This article has been viewed 48,000 times.

Accessing old tax returns may be necessary if you need to look up specific information about your income or your expenses. You can also use old tax returns as proof of your financial history for a mortgage or loan application. As a taxpayer, you are able to access a transcript or an official copy of old tax returns in just a few easy steps. A transcript is free to access, but each official copy of your old tax returns will cost you $50 USD as of March 2019.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

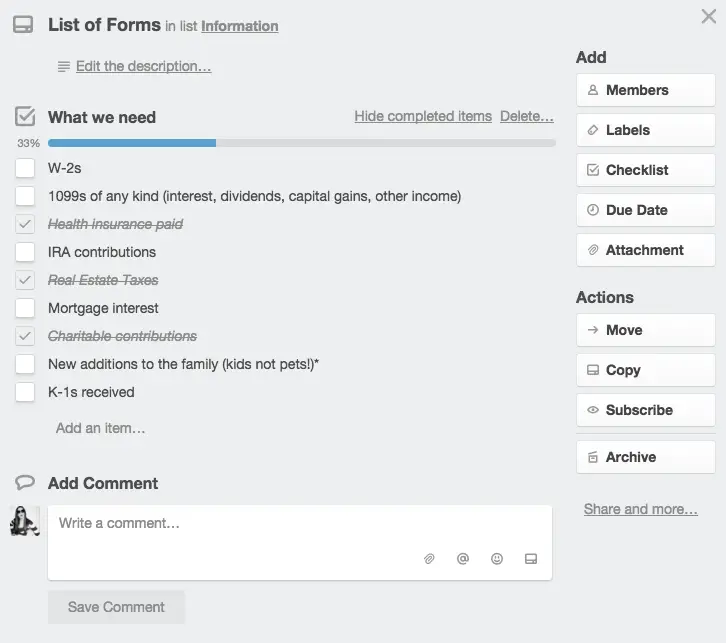

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Read Also: Where Can I Cash My State Tax Refund Check

Q4 Can I Use Get Transcript If Im A Victim Of Identity Theft

Yes, you can still access Get Transcript Online or by Mail. If were unable to process your request due to identity theft, youll receive an online message, or a letter if using the Mail option, that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

Dont Miss: How Do I Find The Amount Of Property Taxes Paid

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To Find Tax Amount

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

You May Like: When Are Quarterly Taxes Due

What’s On A Tax Transcript

A transcript displays your tax information specific to the type of tax transcript you request.

The IRS is responsible for protecting and securing taxpayer information. Because of data thefts outside the tax system, cybercriminals often attempt to impersonate taxpayers and tax professionals. Thieves attempt to gain access to transcript data which can help them file fraudulent tax returns or steal additional data of other individuals and businesses listed on transcripts.

The IRS better protects your information from identity theft by partially masking the personally identifiable information of everyone listed on transcripts. All financial entries remain fully visible to assist with tax preparation, tax representation and income verification. Anyone with a need to know will be able to identify the taxpayer associated with the transcript based on the data that still displays.

How To Get A Copy Of Your Tax Return

If you do need a copy of your tax return, you have a few options.

- You can ask your tax preparer to send it to you.

- If you used an online tax preparation and filing service to e-file your return, you may also be able to access a copy of your tax return directly through the program for the years you filed through the software. But be aware the service may limit the number of years you can access or charge a fee to allow you to access and download past years returns.

- Finally, you can always request a copy directly from the IRS. You cant request a past years return over the phone or online, so youll need to fill out Form 4506 and mail it in. Itll also cost you $50 per copy, per tax year for which youre requesting a return copy, and it could take 75 days for the IRS to process your request.

Read Also: How To Retrieve 1040 Tax Return

Transcript Of Your Tax Return

We offer various transcript types free of charge. You can go to the Get Transcript page to request your transcript now. You can also order tax return and account transcripts by calling and following the prompts in the recorded message, or by completing Form 4506-T, Request for Transcript of Tax Return or Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript and mailing it to the address listed in the instructions. Form 4506-T-EZ was created only for Form 1040 series tax return transcripts. Allow at least 10 business days from when the IRS receives your request to receive your transcript.

How To Get A Copy Of Your Prior Year Tax Information

If you filed the prior year return with our program, the information should be pulled forward for you assuming the same username was used. If you are filing under a different username than last year, you can log into the prior year account for a copy of the prior year return.

- If the return was filed and accepted, log into the account and click on the tax year you wish to view under the Prior Year Returns heading. Click on Access Return > Continue. Select View/Print return to print, view or save a copy of the accepted return.

- If the return was not e-filed or was rejected, log into the account and click on the tax year you wish to view under the Prior Year Returns heading. Select Fix Return > Continue. Continue to the Summary/Print screen to print a copy of the current information in the account.

If you do not remember the username or password for the prior year account, no problem! Go to our websiteand click on . Select ‘Forgot Username’ or ‘Forgot Password’ from the bottom of the screen. Enter the information required to gain access to the prior year account.

If you filed the prior year return using another service, you can get a transcript of the return from the IRS website. This takes about 15 minutes to complete online and the IRS will email you the transcript showing the Adjusted Gross Income amount.

See also:

Don’t Miss: How Do You Figure Out Your Tax Liability

Filing Past Due Tax Returns

File all tax returns that are due, regardless of whether or not you can pay in full. File your past due return the same way and to the same location where you would file an on-time return.

If you have received a notice, make sure to send your past due return to the location indicated on the notice you received.

Q5 How Do I Request A Transcript For An Older Tax Year When Its Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a show all + expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. To get older tax account transcripts, submit Form 4506-T.

Recommended Reading: Is It Hard To Do My Own Taxes

Obtaining Copies Of Previously Filed Tax Returns

Individuals

To get a copy or transcript of your tax return, complete Form DCC-1 and send it to:

New Jersey Division of TaxationDocument Control CenterPO Box 269 Trenton, NJ 08695-0269

You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. We will only release the tax return to the person who signed the return or to an authorized representative. An authorized representative must provide a Form M-5008-R that covers the return being requested. To pick up a copy/transcript of your return you must provide a photo ID . If you are not the person who signed the return , we wont be able to provide you with a copy. However, we can process your request and will send copies to the individual who signed the return at the address on file with the Division of Taxation.

Businesses

Any return filed through the On-line Services Filing and Payment Services can be obtained by logging on with your Business Identification Number and assigned PIN number.

Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

New Jersey Division of TaxationDocument Control Center

Tax Transcript Vs Exact Copy Of Tax Return

You can obtain an exact copy of your previously filed tax return by filing Form 4506, Request for Copy of Tax Return with the IRS. You can request many types of tax returns on the Form 4506, including:

In some cases, a tax return transcript may satisfy the person or entity requesting your tax information. Most mortgage lenders are satisfied with the information provided on a tax return transcript.

A tax return transcript is a shorter printout of the information on your previously filed tax return. It lists most line items including your adjusted gross income from your original tax return as filed. It does not show any changes made in an amendment to your return. A tax return transcript is only available for the current year and previous three years.

There are several advantages to the tax return transcript. It is free, while there is a small fee for an exact copy of your tax return. The fee for an exact copy of your tax return is $43 as of 2021.

Please note, if you file a tax return jointly with your spouse, only the primary spouse listed on the tax return can request a tax return transcript via the telephone. Either spouse can request a tax return transcript via the website or complete and mail the Form 4506-T. Similarly, either spouse can complete and mail the Form 4506 to request an exact copy of the tax return.

You May Like: How To Calculate Income Tax

Copies Of Tax Returns

A copy of your tax return is exactly that a duplicate of the return you mailed or e-filed with the IRS. For a fee, the IRS can provide up to six years back, plus the current years tax return, if youve already filed yours. Youll need to fill out and mail Form 4506 to the IRS to request a copy of a tax return.

You might need a copy of your old tax return, rather than a tax transcript, if more-detailed information from prior tax returns is required or if older tax information is needed.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRSWheres My Refund page. Youll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

Also Check: How To File Llc Taxes As S Corp

Recommended Reading: Do I Need To File Taxes For Stimulus Check

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

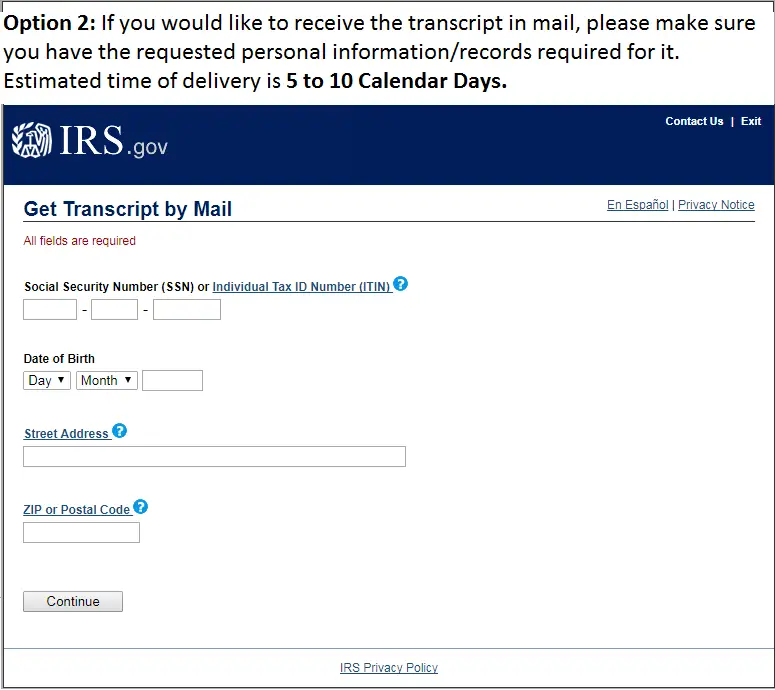

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form: