Do You Get Paid For Having Solar Panels

It is possible to make money from owning solar panels. By installing solar panels in the US, the customer is entitled to earn money for every kWh that is injected back into the grid. Despite the Net Metering scheme, which is the most popular mechanism, this will only allow you to save money, not earn it.

What Solar Energy Rebates Are Available In California

Over time, solar adoption has primarily happened in higher-income households. However, the benefits of solar energy cannot be classified according to economic status because it is a necessity for everyone. The support from solar panel incentives has been able to increase the adoption of solar orange county. The two most important California solar rebates are aimed at increasing affordable housing. Lets check them out

Other California Solar Incentives

Net energy metering , or net metering, allows customers to feed any excess energy generated by their solar panels back to the local power grid. In exchange, customers receive credits from their utility companies that can be applied to future bills. As most solar systems generate more energy than a home uses, selling that surplus power back to a utility company provides homeowners additional savings on their electricity bills and lowers the demand for grid-supplied electricity in the region.

California currently offers a statewide net metering incentive for residents generating electricity with solar panels. Exact credit values will vary based on your utility company.

Some local utility companies and municipalities also have their own solar rebates and incentives, such as Sacramentos $300 rebate. Most top solar companies will help you identify local solar programs youre eligible for, but its always worth taking a look at your local government and utility company websites to see if there are any additional incentives to take advantage of.

Also Check: How To Buy Tax Lien Certificates In California

What Other Information Does The California Solar Incentives Calculator Provide

The calculator has a database of the electric rates charged by each utility company in California. This means that from just the amount you spent on electricity last month, the calculator can show you how much electricity you used and how many solar panels you will need to power your home.

It also uses artificial intelligence to scan your roof and lay out the solar panels in the best places for maximum electricity generation.

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Also Check: 1040paytax Review

California Solar Incentives Now Cover Battery Storage

California is not only a national leader in solar, it is also a leader in solar battery storage, thanks in part to the Self Generation Incentive Program . If you install a battery storage system on your property that is serviced by PG& E, SCE, Southern California Gas, or SDG& E, you can take advantage of the SGIP incentive.

Battery storage systems that are smaller than 10 kW and are installed on a residential property are eligible for an incentive of $0.25 per watt hour of storage installed. We outline how much you can save on battery storage when you use the SGIP incentive program in our breakdown of the SGIP rebate.

SGIP also has what is known as the equity budget. This budget has money set aside for solar batteries that are installed in low-income and disadvantaged areas. The goal of the residential equity incentive is to catalyze more battery storage deployment in low-income areas. Residential equity systems will receive a rebate of $0.85 per watt hour installed.

Low income homes that are located in either a Tier 3 or Tier 4 fire district, or that are in areas that have experienced two or more planned safety power shutoff events can qualify for an even higher incentive when they install battery storage on their home – this is known as the equity resilience incentive.

On This Page You Can:

Learn what solar incentives are available to California homeowners

See what California solar incentives you qualify for based on your utility company and city

Find out how much these incentives and/or California solar tax credits will reduce your cost to go solar and add batteries

Read Also: Do You Have To Report Plasma Donations On Taxes

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

California Solar Tax Credits And Solar Rebates

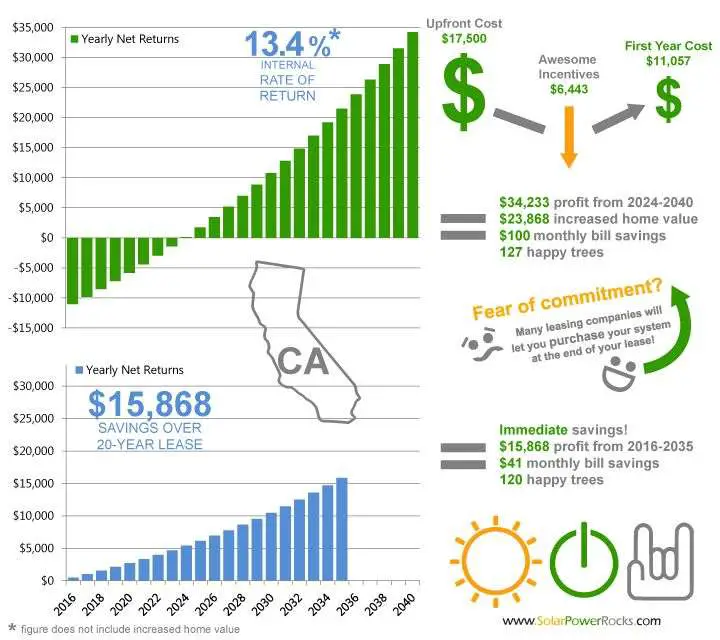

Solar panels have long proved a reliable and savvy financial investment for Californians, and many buyers are able to secure a speedy return on investment . However, there is currently no statewide California solar tax credit to help residents with the upfront cost of solar panels.

That said, all Californians are eligible for the federal solar tax credit, and the state offers several incentive programs and solar rebates aimed at further increasing access to reliable, affordable solar panels.

| California Solar Incentive | |

|---|---|

| The SGIP offers rebates for installing energy storage systems at both residential and non-residential facilities. | |

| Active Solar Energy System Property Tax Exclusion | This incentive ensures the addition of a solar panel installation doesnt raise homeowners property taxes. |

| Single-Family Affordable Solar Homes Program | The California Solar Initiative launched SASH to provide fixed, up-front incentives on qualifying affordable single-family housing. |

Also Check: Taxes For Door Dash

California Solar Rebates How To Make The Most Of Them

California is the ideal state for solar power and for a commercial facility to install a solar photovoltaic system on site. Sunny days mean plenty of solar power, but more importantly, the state offers some of the best financial incentives in the nation. If youre looking for a list of California solar rebates and tax incentives for commercial properties this is the article for you.

Does California Have A Solar Tax Credit 2020

Federal Tax Credit For Solar

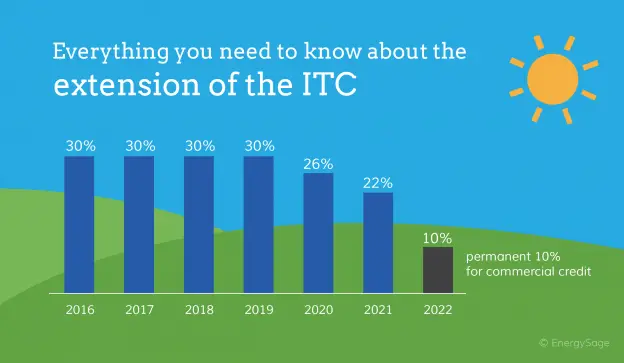

Getting a solar energy system installed in 2020 grants the maximum 26% California solar tax credit before stepping down to 22% in 2021. The federal government will be offering: The tax credit amount is 26% for solar PV systems put into service between 01/01/2020 and 12/31/2020.

Recommended Reading: Ct Tsc Ind

Does California Have A Net Metering Incentive

Under Californias net energy metering incentive, investor-owned utilities are required to buy homeowners excess solar electricity at close-to retail rates.

The NEM 2.0 program, passed by the Public Utilities Commission in 2018, guarantees that homeowners going solar will be able to sell the excess solar electricity – typically produced during midday – for a period of 20 years.

This is an extremely valuable incentive selling your electricity to the utility at a good value is the easiest way to pay off your solar panel purchase quickly.

Learn more: California Net Metering 2.0 in 2021: Everything you need to know

There Are A Few More Solar Incentives In California To Keep In Mind Aside From The Top Options:

DAC-SASH

The plan Disadvantaged Communities-Solar Homes Single Family offers cash rebates for income-eligible, single-family homeowners installing solar panels. In order to take advantage of the opportunity, homeowners must be customers of Pacific Gas and Electric , Southern California Edison or San Diego Gas and Electric .

Dont forget about the Federal ITC

Focusing on state-specific solar-going incentives, its easy to forget the federal solar incentive that makes solar so appealing to homeowners across the country: the investment tax credit, also known as the ITC. Now that the ITC has been extended by 2021, every homeowner buying a solar panel system will benefit from a 30% discount in addition to all additional state rebates and incentives.

Don’t Miss: Is Donating Plasma Taxable Income

Solar Incentives And Rebates In California

There are many incentives in place to help reduce the cost of your solar panels. Options available to California homeowners include:

- The 26% federal solar tax credit available to all homeowners who install solar systems on their primary or secondary homes in 2021.

- Californias net metering program, which allows customers to credit their net excess energy generation back to their next bill at the current retail rate.

- Local government and utility programs that may be available in your area.

Faqs: California Solar Incentives

Is there a California state tax credit for solar?

Though California does not offer a statewide solar tax credit, all residents are eligible for the current federal solar tax credit. The solar tax credit is worth 26% of the value of the system installed and can be claimed on federal tax returns.

What is the California solar tax credit for 2021?

All American households are eligible for the federal solar tax credit, which is valued at 26% of your solar system cost. California does not have any other state-specific solar tax credit, but it does offer property tax exemptions for new solar installations.

Does California have a free solar program?

The reality is, no state has a free solar program. Fortunately, California does offer several incentives and rebates for installing solar panels, making it a very cost-effective place to do so.

How much is the solar tax credit for 2021?

All U.S. households are eligible for the federal solar tax credit. In 2021, this tax credit is valued at 26% of the purchase of solar panels and qualifying energy storage devices.

Karsten Neumeister is a writer and renewable energy specialist with a background in writing and the humanities. Before joining EcoWatch, Karsten worked in the energy sector of New Orleans, focusing on renewable energy policy and technology. A lover of music and the outdoors, Karsten might be found rock climbing, canoeing or writing songs when away from the workplace.

Also Check: Does Door Dash Tax

What Is The Federal Solar Tax Credit

Installing solar panels earns you a federal tax credit. That means youll get a credit for your income taxes that actually lowers your tax bill.

The federal government enacted the solar Investment Tax Credit in 2006. In the years since, the U.S. solar industry has grown by more than 10,000% with an average annual growth of 50% over the last 10 years. The industry has created hundreds of thousands of jobs and invested billions of dollars in the U.S. economy

You can qualify for the ITC for the tax year that you installed your solar panels as long as the system generates electricity for a home in the United States.

In 2021, the ITC will provide a 26% tax credit for systems installed between 2020 and 2022, and 22% for systems installed in 2023. So, when youre deciding on whether or not to install solar panels, factor in a 22% to 26% discount.

What Net Metering Laws Apply In California

Most utility companies in California offer net metering. However, in 2018, the Public Utilities Commission changed the net metering law that applies to the investor-owned utilities. These utilities customers now get a little less than the full retail rate of electricity for the power they export to the grid during the middle of the day. This is known as the NEM 2 program.

How will the introductions of time-of-use billing affect the investment return from installing residential solar?

Under time-of-use electric billing, there are expensive peak periods in the late afternoon and early evening and cheaper off-peak periods late at night and in the morning.

Don’t Miss: How Much Tax Do You Pay For Doordash

The Investment Tax Credit

ITC is not a California solar tax incentive. However, every homeowner in the US who owns a solar panel system can claim a 26% deduction from their federal taxes. So, for example, if you install a solar system at $20,000, and you owe $6,000 in taxes, you can reduce your tax liability from $6,000 to $1,200 by applying your $5,200 solar installation tax credit.

If the value of your tax credit exceeds your tax liability, you can apply the unused credit to the following years taxes. In addition, if your tax liability was $3,000 instead of $6,000, you can rollover the unused $2,200 to next years taxes.

You are only eligible to rollover any unused credit once, and the ITC is in addition to all local and state rebates and solar incentives you receive. Also, the value of the ITC dropped to 22% in 2021 and will further drop to zero for residential installations in 2022 unless Congress renews it.

Do Utility Companies In California Offer Any Upfront Solar Rebates

Upfront rebates from utilities used to be common, but now only a few utility companies offer them.

LADWP offers a $1,000 solar rebate, as well as some other smaller utilities in the Bay Area. Unfortunately, there is no upfront solar rebate for customers of the big three investor-owned utilities. If you are a customer of another smaller utility company, you can use the calculator below to check to see what rebates you are eligible for.

Find out which solar rebates and incentives you qualify for

Also Check: Prontotaxclass

Natural Resources Defense Council

At least one major environmental group is pleased with the decision. That would be the Natural Resources Defense Council, or NRDC, which largely agrees with the utility industry that net metering is a massive giveaway from the poor to the rich.

NRDC senior scientist Mohit Chhabra told me hes especially pleased with the $600-million equity fund, which he expects will help pay for solar panels for low-income homes. He sees that as a better model than the Sierra Clubs proposal, because it would make it easier for low-income families to buy solar systems rather than lease them, and thus reap more of the long-term savings.

Chhabra says the primary goal of net metering shouldnt be to add as much rooftop solar as possible it should be to meet Californias overall climate goals, which will require a lot of rooftop solar but also many other forms of clean energy. That includes large solar and wind farms that generate renewable power at a lower cost than rooftop systems due to economies of scale.

Cheap, clean, pollution-free electricity for everybody is the first step. And then do your best to make sure solar is distributed equally, Chhabra said. Dont flip those two things.

How Does The Federal Tax Credit Work

If you have a huge tax bill, all credit can be taken at the same time or you can use the credit for several years. For example, if your solar panel system costs $ 18,000, the 26 percent tax credit would be $ 4,680. If you have $ 4,000 in taxes by 2020, your tax bill will be reduced to zero, with another tax credit of $ 680 for your 2020 returns and in the future. This IRS solar tax credit is completely convenient when the tax season is approaching!

Now to put this in perspective, if an owner stayed until 2021 to install his solar panel system, the tax credit received would be reduced. Take the same example on an $ 18,000 solar panel system, but now you will only get 22 percent of the back tax credit, equivalent to $ 3,960. Due to $ 4,000 in taxes, your tax bill would no longer be canceled. $ 720 is lost due to a 16 percent tax credit for the year 2020.

Also Check: How Much Tax For Doordash

Add Credit To Schedule 3/form 1040

The value on line 15 is the amount that will be credited on your taxes this year. Enter that value into Schedule 3 , line 5, or Form 1040NR, line 50.

The steps above outline all you need to do to have 26% of the cost of your solar panel system credited back to you! If you did energy efficiency improvements to your home in the same year, you may also need to complete page 2 of Form 5695. Either way, be sure to include Form 5695 when you submit your taxes to the IRS.

The Sgip Equity Budget For Home Battery Storage

SGIP also has what is known as the equity budget. This budget has money set aside for solar batteries that are installed in low-income and disadvantaged areas.

The goal of the residential equity incentive is to catalyze more battery storage deployment in low-income areas.

Residential equity systems will receive a rebate of $0.85 per watt hour installed.

Low income homes that are located in either a Tier 3 or Tier 4 fire district, or that are in areas that have experienced two or more planned safety power shutoff events can qualify for an even higher incentive when they install battery storage on their home – this is known as the equity resilience incentive.

Projects that qualify for the equity resiliency incentive program will receive a rebate of $1.00 per watt hour of storage installed.

This covers almost the entire cost of a solar battery system. Check our blog on SGIP’s equity resiliency program for more information.

Read Also: Tax Write Offs Doordash