Income Tax Expense Vs Income Tax Payable

Income tax expense and income tax payable are two different concepts.

Income tax expense can be used for recording income tax costs since the rule states that expenses are to be shown in the period during which they were incurred, instead of in the period when they are paid. A company that pays its taxes monthly or quarterly must make adjustments during the periods that produced an income statement.

Basically, income tax expense is the companys calculation of how much it actually pays in taxes during a given accounting period. It usually appears on the next to last line of the income statement, right before the net income calculation.

Income tax payable, on the other hand, is what appears on the balance sheet as the amount in taxes that a company owes to the government but that has not yet been paid. Until it is paid, it remains as a liability.

Calculating Taxable Income Using Exemptions And Deductions

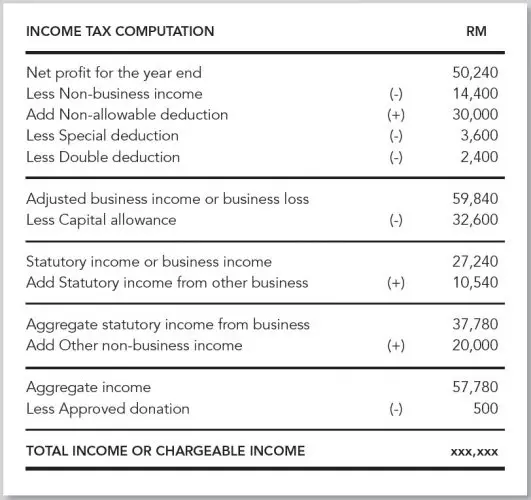

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

The Inflation Tax Is Regressive

A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

Recommended Reading: What Percentage Is Payroll Tax

Components For Calculating Income Tax

A few key components should be remembered when calculating income taxes. Here’s a list of these key components:

- Financial Year -The year in which money is earned is referred to as the financial year. It is the time period from April 1st of this year to March 31st of the next year. You must prepare all of your investment proofs and gather all of your documentation throughout this time.

- For example – FY 2022-23 is period between 1st April 2022 to 31st March 2023

Difference Between Take Home Salary And Ctc

Your job may entitle you to some benefits in the form of food coupons or a cab service apart from your salary. The total cost to the company is the sum of all the benefits offered plus your salary.

Below is an example of components of your CTC that is on your offer letter.

Broadly your CTC will include:

a. Salary received each month.

b. Retirement benefits such as PF and gratuity.

c. Non-monetary benefits such as an office cab service, medical insurance paid for by the company, or free meals at the office, a phone provided to you and bills reimbursed by your company.

Your take-home salary will include:

a. Gross salary received each month.

b. Minus allowable exemptions such as HRA, LTA, etc.

c. Minus income taxes payable .

Read Also: When Is Tax Refund 2021

Deductions Allowed To Individual Opting For New Tax Regime

- Transport allowance for a divyang employee

- Conveyance allowance, to meet the conveyance expenditure incurred in performance of duties of an office

- Any allowance to meet the cost of travel on tour or on transfer.

- Daily allowance, to meet the ordinary daily charges incurred by an employee, on account of absence from his normal place of duty.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Calculate Tax Expense

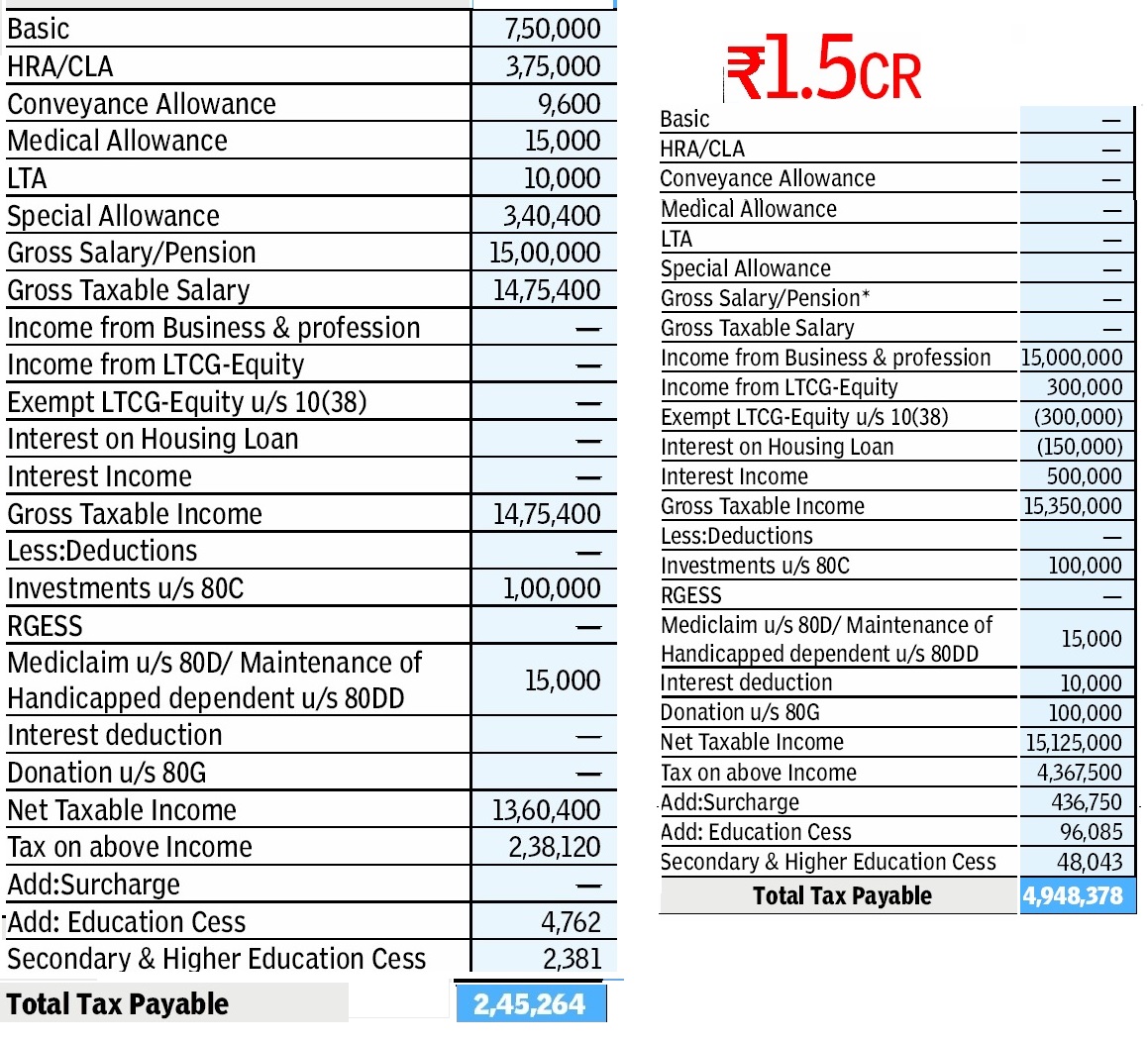

How To Use The Income Tax Calculator For Fy 2022

Following are the steps to use the tax calculator:

1. Choose the financial year for which you want your taxes to be calculated.

2. Select your age accordingly. Tax liability in India differs based on the age groups.

3. Click on ‘Go to Next Step’

4. Enter your taxable salary i.e. salary after deducting various exemptions such as HRA, LTA, standard deduction, and so on.

Or else, just enter your salary i.e salary without availing exemptions such as HRA, LTA, standard deduction, professional tax and so on.

5. Along with taxable salary, you must enter other details such as interest income, rental income, interest paid on home loan for rented, and interest paid on loan for self occupied property.

6. For Income from Digital Assets, enter the net income , such income is taxed at 30% Plus applicable surcharge and cess.

7. Click on ‘Go to Next Step’ again.

8. In case, you want to calculate your taxes under the old tax slabs,you will have to enter your tax saving investments under section 80C, 80D, 80G, 80E and 80TTA.

9. Click on ‘Calculate’ to get your tax liability. You will also be able to see a comparison of your pre-budget and post-budget tax liability .

Note: Whichever field is not applicable, you can enter “0”.

You can even get your tax computation on your mail.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Read Also: How To Correct State Tax Return

How To Understand Income Tax Slabs

The Indian Income-tax works on the basis of a slab system and the tax is levied accordingly on individual taxpayers. Slab implies the different tax rates charged for different income ranges. In other words, the more your income, the more tax you have to pay. These income tax slabs are revised every year during the budget announcement. Again, These slab rates are segregated for different categories of taxpayers. As per the Income-tax of India, there are three categories of individual taxpayers such as:

- Individuals below 60 years of age including residents and non-residents

- Resident Senior citizens 60 to 80 years of age

- Resident Super senior citizens more than 80 years of age

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 – $18,200 | $0 |

| 19c for every dollar between $18,201 – | 0 |

| 32.5c for every dollar between – | 0 |

| 37c for every dollar between – $180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance. See income thresholds and rates for the Medicare levy surcharge on the ATO website.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

Also Check: How Are S Corporations Taxed

Income Tax Calculation In The Us

The tax deduction rates in the United States vary with the income of the individual. Another criterion for deciding the tax deduction for individuals is whether you are filing your returns as a married person , as a single, head of household or a married person filing separately. Here are the different IRS tax brackets prevalent in the U.S.A.

Deductions Not Allowed Under The New Income Tax Regime

- Individuals who opt for the new tax regime under Section 115BAC need to forgo a total of 70 deductions and tax exemptions. These include:

- Leave travel concession under Section 10, Clause

- House rent allowance under Section 10, Clause

All about HRA exemption

- Allowances under Section 10, Clause

- Allowances to MPs/MLAs under Section 10, Clause

- Allowance for the income of minor under Section 10, Clause

- Exemption for SEZ unit under Section 10AA

SEZ full form

- Deduction for entertainment allowance, standard deduction and employment/professional tax under Section 16.

- Interest under Section 24 with respect of self-occupied or vacant property referred to in Sub-section of Section 23.

- Also, loss under the head income from house property for the rented house is not allowed to be set off under any other head and would be allowed to be carried forward unlike the old regime.

- Additional deprecation under Section 32, Sub-section , Clause

- Deductions under Section 32AD, 33AB, 33ABA

- Deductions for donation for or expenditure on scientific research contained in sub-clause or sub-clause or sub-clause of sub-section or sub-section of Section 35.

- Deduction under Section 35AD or Section 35CCC

- Deduction from family pension under Section 57

- Any deduction under Chapter VIA

- Deduction under Sub-section of Section 80CCD and Section 80JJAA can be claimed.

All about tax on rental income

Recommended Reading: How Much Is Sales Tax In New Mexico

How To Use The Online Income Tax Calculator

Follow the below-given steps to use the tax calculator:

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Recommended Reading: What Is The Corporate Tax Rate In Switzerland

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

First What Is Income Tax And What Is Taxable Income

Income tax is the tax levied by the government on an individuals income. This term individual here applies to a person, Hindu Undivided Family, company, co-operative societies and trusts. And, the tax slabs are decided based on ones income and age.

Now, taxable income is income of an individual minus the tax exemptions, deductions and rebate. These processes are laced with complicated calculations and adjustments, so we take you through them to make the math simple.

Step 1: Calculate your gross income

First, write down your annual gross salary you get. This will include all the components of your salary including House Rent Allowance , Leave Travel Allowance and special allowances, like food coupons and mobile reimbursements etc..

Next, take out the exemptions provided on the salary components. The major exemptions you get are HRA i.e. House Rent Allowance and LTA i.e. Leave Travel Allowance.

For HRA, remember you can claim HRA ONLY if you live in a rented house and can submit valid rent receipts as proof. You can easily fill out and from the ETMONEY website and submit it after affixing revenue stamp and getting it signed by your landlord or landlady to claim HRA benefit. If you have your own accommodation or live with parents, then HRA is fully taxable. Also, your tax exemption under HRA is taken as the lowest of the following amounts:

The amount you arrive at is your gross total income.

Step 2 Arrive at your net taxable income by removing deductions

The Bottom line:

You May Like: How To Calculate Annual Income After Taxes

Exemption Of Leave Encashment

Check with your employer about their leave encashment policy. Some employers allow you to carry forward some amount of leave days and allow you to encash them while others prefer that you finish using them in the same year itself. The amount received as compensation for leave days accumulated is referred to as leave encashment and it is taxable as salary.

Exemption of leave encashment from tax:

It is fully exempt for Central and State government employees. For non-government employees, the least of the following three is exempt.

a. 10 months average salary preceding retirement or resignation

b. Leave encashment actually received.

c. Amount equal to salary for the leave earned

The amount chargeable to tax shall be the total leave encashment received minus exemption calculated as above. This is added to your income from salary.