How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity. Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider. Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Review Your Refund Status Details

If you e-file, your status should be available in about 24 hours. Paper returns take up to four weeks before showing up in the system. Electronically filed taxes take three weeks to get your refund in most cases. Paper returns take six weeks.

Most people get to this page and see a three-step process. First is return received. Second is refund approved. Third is refund sent. If it has been less than 21 days since filing an electronic return, you will probably see this graph and where your refund is in the process.

In my case for 2018, the bars vanished after a few weeks and my status was replaced with this message:

I waited until the 21 days had passed and called up the IRS to see what was going on.

Netfiling Your Tax Return

- To avoid losing your tax return in the mail, consider Netfiling your tax return instead.

- When you NETFILE your tax return, you receive a confirmation number instantly from the CRA as proof that your tax return was received.

- Processing your tax return is a lot faster if you NETFILE you also receive your tax refund a lot sooner.

You can also use the CRAs My Account to double check that your return was transmitted OK.

Read Also: Why Am I Owing Taxes This Year

Is The Irs Behind On Refunds 2022

Although the IRS says most refunds will be sent within 21 days, experts warn that delays are likely, noting that the agency is still working through 2020 tax returns. … Donald Williamson, an accounting and taxation professor at American University in Washington, said he expects “weeks and weeks” of IRS delays in 2022.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Recommended Reading: What Is The Sales Tax Rate In Illinois

Understanding Your Irs Notice Or Letter

Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

If you agree with the information, there is no need to contact us.

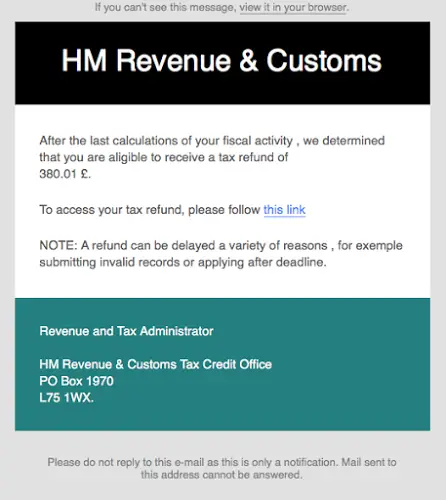

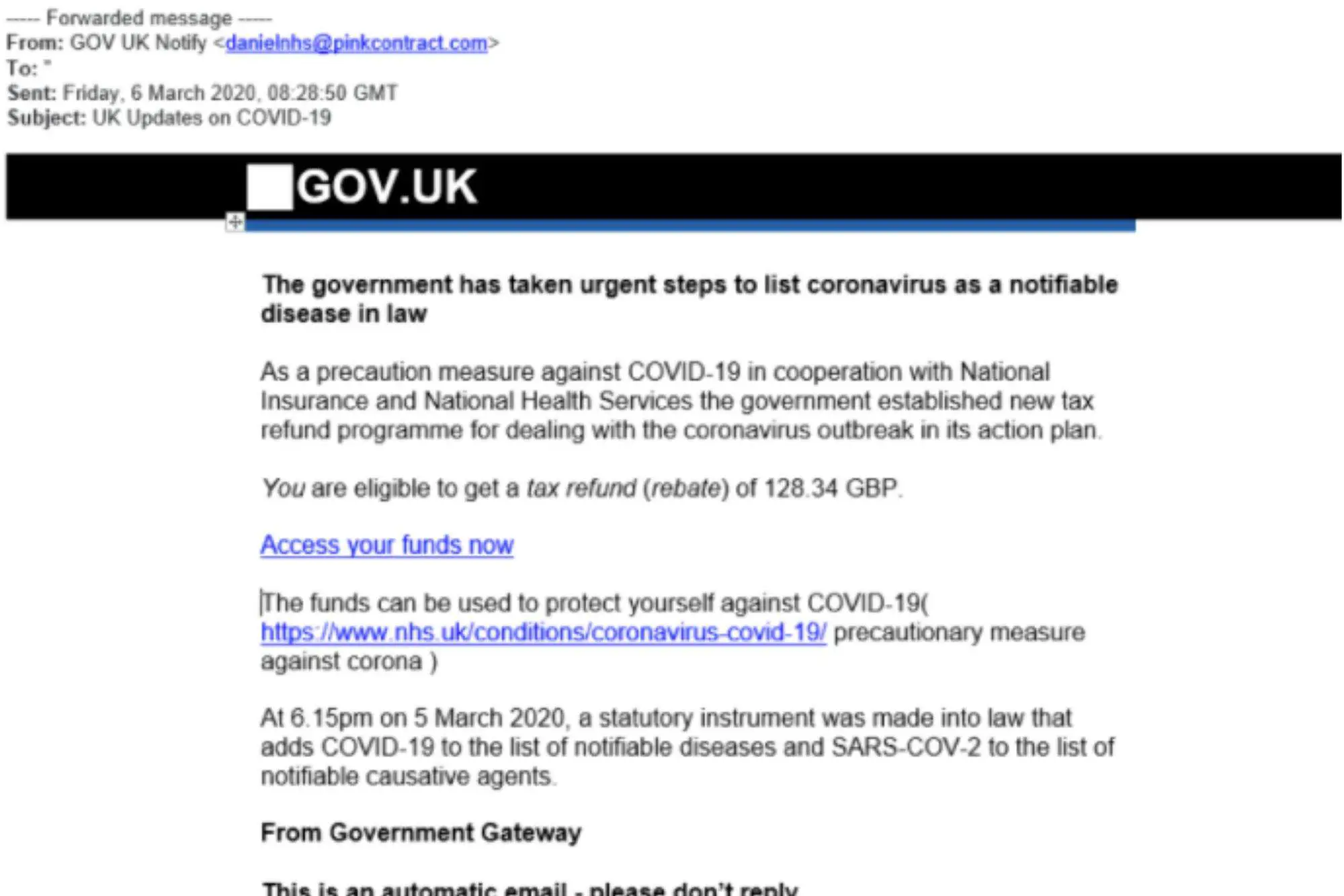

If, when you search for your notice or letter using the Search on this page, it doesn’t return a result, or you believe the notice or letter looks suspicious, contact us at . If you determine the notice or letter is fraudulent, please follow the IRS assistor’s guidance or visit our Report Phishing page for next steps.

To get a copy of your IRS notice or letter in Braille or large print, visit the Information About the Alternative Media Center page for more details.

Check Your Refund Status Online

Next, you’ll want to point your web browser to the IRS refund status tool. Click the link to “Check My Refund Status” at this page on the IRS website to access the tool.

You can also find your refund status using the free IRS2Go app, but the web page worked just fine for me and I didn’t have to download anything to make it work.

You’ll need to enter your Social Security number, select your filing status, and enter your refund amount from step 1 to get your result.

Also Check: How To View Tax Return Online

Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

The Irs Lost My Tax Return: What You Should Do To Get Your Refund Money Back

Yes, its no joke that the IRS can lose your tax return.

If you have completed your tax return and sent it to the IRS, but they then say they never received it dont panic. Were here to help you, and remember, youre not the only one caught up in this frustrating and worrying situation.

We all know its not your fault, but this is Uncle Sam were dealing with, so keep reading to learn how to fix this problem and claim your refund back.

Also Check: Can You File Previous Years Taxes Online

How Do You Speak To A Live Person At The Irs

Did this post save you a ton of time and heartache? Consider buying me a cup of coffee. Thanks so much!

Irs Phone Numbers: How To Speak To A Human At The Irs

Weve all been thereyou need to speak with someone at the IRS about a tax issue, and youre having a hard time getting an actual human being on the phone. Its frustrating. We want to help you avoid this annoyance and get your tax solutions quickly. Whether youre calling the stimulus check phone number or the general IRS phone number, you need a live person.

This guide helps you navigate the different communication channels within the IRS. Soon, you will be speaking to the correct IRS representative for your situation.

Recommended Reading: How Much Do You Have To Make To Owe Taxes

Whats Next: When Will I Get My Tax Refund

Once youve resolved all the problems related to your returns, you enter the next worrying stage: When will I get my tax refund? No wonder why everyone hates dealing with taxes.

Honestly, theres nothing much you can do apart from waiting to hear from the IRS. According to the IRS, most tax refunds are issued within 21 days, while some may take longer if the return requires further review, which may be prompted by the following issues::

- Your return includes errors

- Your return is incomplete.

- Your return is affected by identity theft or fraud.

The IRS will contact you by mail if extra information is needed to process your tax return.

To track and stay updated about the process of your refund, consider one of the following methods:

- Visit Wheres My Refund?: enter your Social Security number or individual taxpayer identification number , filing status, and the exact amount of your refund to check your refund status.

- Download the IRSs mobile app IRS2go: prepare the same above-mentioned personal information details to track your refund.

Other Irs Phone Numbers

While you can always call the main IRS number, lesser-known IRS phone numbers could help you get assistance faster. Heres a list of other IRS phone numbers, categorized by your status or concern, to help you reach the right people who can assist you with your specific situation.

Employment Status

- Victims of identity and refund theft : 800-908-4490

- Report scams and phishing, confirm the legitimacy of IRS agent: 800-366-4484

Residency or Special Tax Status

- Taxpayers who live overseas: 267-941-1000

- Adoption Taxpayer Identification Number application status: 737-800-5511

Refunds, Payments, and Balances

- Questions about balances: 800-829-0922 800-829-7650 800-829-3903

- Check status of a tax refund: 800-829-1954

- Check status of a tax refund on hold: 866-897-3315

- Make a payment using Electronic Federal Tax Payment System: 800-555-4477 800-244-4829

- Verify, pay off, or resolve a tax lien: 800-913-6050

- Confirm which debts will offset your tax refund: 800-304-3107

Types of Taxes

- Estate and gift tax concerns: 866-699-4083

- Questions about excise tax: 866-699-4096

Tax Return Issues

- International Taxpayer Advocate, English: 787-522-8601

- International Taxpayer Advocate, Spanish: 787-522-8600

Documents and Transcripts

- Order a tax transcript: 800-908-9946

Accessibility and Local Services

- For the hearing impaired : 800-829-4059

- Schedule an appointment with a local IRS office: 844-545-5640

- Request paper tax forms: 800-829-3676

- Find a free tax clinic close to you: 800-906-9887 888-227-7669

Read Also: Are Property Taxes Paid In Advance

Visit Your Local Irs Office

The IRS operates local Taxpayer Assistance Center offices, or TACs, in every state. To see their local addresses and phone numbers, click on your state on the list of Taxpayer Assistance locations. Generally, you cant just show up at a local IRS office any time. You have to make an appointment. That IRS number is 844-545-5640.

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Read Also: When Do We Start Filing Taxes 2021

How Long Does It Take To Receive An Amended Refund

You should receive your amended refund within six months from the date filed. If it has been more than five months since you filed your amended return, please call 1-877-252-3052 for assistance. Select the option for l Individual Income Tax then listen for the Refund option to speak with an agent. Please do not call 1-877-252-4052 as instructed in the main greeting. Interest will be paid on amended refunds at the applicable rate.

Individual Tax Enquiries Line

Call 1-800-959-8281 to get tax information for individuals.

Our automated service is available at all times and provides information on the topics listed below. If you need more information after listening to your selections or if the topic you’re calling about isn’t listed, please speak to an agent.

Telephone agents will be available:

- Monday to Friday: 8 am to 8 pm

- Saturday: 9 am to 5 pm

- Sunday : Closed

Closed on public holidays

Recommended Reading: How To Do Tax Deductions

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

How To Pay Bills While You Wait For Your Tax Refund

Because tax refunds can be delayed for a number of reasons, the IRS cautions taxpayers not to rely on receiving their tax refund within three weeks in order to cover expenses or make an important purchase.

Here are some ideas for getting by while you wait for your refund check.

You May Like: How To Complete K1 Tax Form

Best Time To Call Irs Customer Support

IRS customer support, which can be reached at 1-800-829-0922, is available Monday through Friday from 7AM to 7PM.

According to the IRS website, wait times average fifteen minutes in the months preceding the filing deadline , and average twenty-seven minutes in the months following the filing deadline . Based on our experience the best times in general are afternoons and Thursdays & Fridays.

Also Check: How Do You Add Sales Tax

How To Speak Directly To An Irs Agent

The IRS indicates that our phone and walk-in representatives can only research the status of your refund 21 days after you filed electronically 6 weeks after you mailed your paper return or if Wheres My Refund? directs you to contact us. Heres how to get through to an agent.

- Select your language, pressing 1 for English or 2 for Spanish.

- Press 2 for questions about your personal income taxes.

- Press 1 for questions about a form already filed or a payment.

- Press 3 for all other questions.

- Press 2 for all other questions.

- Make no entry when queried for the SSN.

- Press 2 for personal or individual tax questions.

- Press 4 for all other questions.

You May Like: How Do You Pay Owed Taxes

Read Also: Where Do I Mail My Federal Tax Return

Where’s My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You

If you filed your tax return on time and still haven’t gotten your refund, at least it’s earning interest.

Katie Teague

Writer

Katie is a Writer at CNET, covering all things how-to. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Peter Butler

How To writer and editor

If you filed your tax returnelectronically and were due a refund, you probably already received it. The IRS reported that it’s processed 97% of the more than 145 million returns it received this year and issued a few more than 96 million refunds.

If you filed a paper return, however, you could still be waiting. In June, the National Taxpayer Advocate, an independent watchdog within the IRS, reported the agency was facing an “unprecedented backlog of unprocessed paper tax returns and returns with suspected errors or suspected identity theft.”

As a result, delays in completing paper returns have been running from six months up to one year.

Read more: 8 Reasons Your Tax Refund Might Be Delayed

Why Is It So Hard To Talk To Someone Live At The Irs

The answer is simply they have too much on and not enough people to do the work. The IRS Data book report shows that they experienced a 40% rise in live telephone calls over the last few years.

Even if the rise is more moderate than in the past the trend of long wait times to talk to a real IRS agent will likely persist.

After all there are nearly 70 million tax payers trying to get telephone assistance. The WMR site still however remains the most common channel for folks to get updates on their tax return and refunds.

You May Like: Are Estate Planning Fees Tax Deductible

You Have Not Updated The Status Of My Refund In A While When Will I Receive It

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you through U.S. Postal Service mail.

How Can I Check The Status Of My Refund

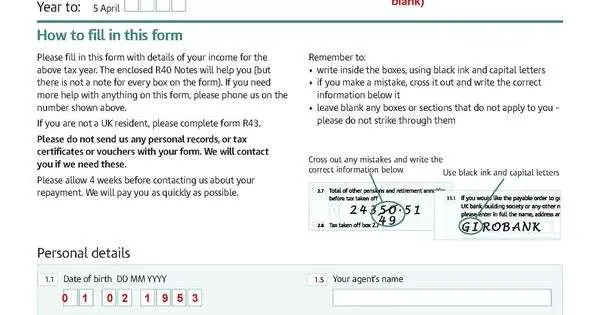

You can check the status of your refund online by using our Wheres My Refund? web service. In order to view status information, you will be prompted to enter the social security number listed on your tax return along with the exact amount of your refund shown on line 34 of Form D-400, Individual Income Tax Return.

Recommended Reading: How To Owe Less On Taxes