For The Village Of Hoffman Estates

Sales tax rates for Cook County, effective January, 2016:

| General Merchandise | Food Prepared for Immediated Consumption | Food Consumed off Premises and Medical | Vehicles |

|---|

Sales tax rates for Kane County, effective June, 2012:

| General Merchandise | |

|---|---|

| 8.00% | 7.00% |

*Disclaimer: The Village of Hoffman Estates believes these sales tax rates to be current. However, retailers should confirm state sales tax rates with the Illinois Department of Revenue at 217-782-3336.

Alsip Sales Tax Region Zip Codes

The Alsip sales tax region partially or fully covers 1 zip codes in Illinois. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in Illinois here

About The Illinois Sales Tax

The state of Illinois has a relatively complex sales tax system, and utilizes a flat state tax rate which is broken down into four categories – the Retailers’ Occupation Tax, Use Tax, Service Occupation Tax and the Service Use Tax. All of these taxes are administered by the state’s Department of Revenue, and apply to the sale of goods and services respectively. The state’s 6.25% sales tax is divided among state and local governments, with 5% going to the state, 1% to the city and 0.25% to the county in which the tax was collected.In addition to the state tax rate, in many areas of Illinois there are county taxes and city local-option taxes, which will vary significantly depending on which jurisdiction you are in. Chicago for example, has a 9.25% sales tax including local-option taxes, which is one of the highest sales taxes of any city in the United States.

Also Check: Is Freetaxusa A Legitimate Company

Cook County Sales Tax Calculator

All merchants operating in Cook County must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax. If you purchase goods online or through the mail and do not pay any sales tax, you are expected to pay use tax to the Illinois Department of Revenue . For more details, see the Illinois sales tax.

How To Register For An Illinois Seller’s Permit

You can register for an Illinois sellers permit online through the DOR. To apply, youll need to provide the DOR with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

Don’t Miss: Buying Tax Liens In California

Sourcing Sales Tax In Illinois: Which Rate To Collect

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale . In others, sales tax is based on the location of the buyer and the destination of the sale .

Illinois generally uses destination-based sourcing. This means youre responsible for applying the sales tax rate determined by the ship-to address on all taxable sales.

For additional information, see the Illinois Department of Revenue.

Illinois Sales Tax Tates

Illinois has a base state sales tax rate of 5%. In addition to this rate, there are also several location specific sales taxes. These are administered by both home rule units and non-home rule units. A home rule unit in Illinois is defined as a county with a chief executive officer or a municipality with a population of at least 25,000. It is possible for smaller municipalities to vote to become home rule units as well. These home rule sales tax rates are defined on The State of Illinoiss Department of Revenue website, and are between 0.25% and 2.50% depending on location.

Additional local sales taxes at the county level include County Public Safety, Public Facilities, and Transportation Sales Taxes. These are charged at the county level and range between 0.25% and 1.25%. An additional 1.00% sales tax is also charged in certain counties with the County School Facility Tax Rate. All of these taxes are rolled together into either State, Local, or County level taxes and all are collected by the State of Illinois, though some local governments may impose taxes beyond these.

The above rates apply to general merchandise, which includes most tangible property, with the exception of qualifying food, drugs, and medical appliances, and any items that require a title or registration.

You May Like: Www.1040paytax.com Review

Alsip Illinois Sales Tax Exemptions

In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate.Many municipalities exempt or charge special sales tax rates to certain types of transactions. Groceries and prepared food are subject to special sales tax rates under Illinois law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Illinois state excise taxes in addition to the sales tax.

Note that in some areas, items like alcohol and prepared food are charged at a higher sales tax rate than general purchases. Illinois’s sales tax rates for commonly exempted categories are listed below. Some rates might be different in Alsip.

Groceries:

All merchants operating in Alsip must automatically calculate the sales tax due on each purchase made and include it in separately in the receipt. Goods bought for resale or other business use may be exempted from the sales tax. If you purchase goods online or through the mail and do not pay any sales tax, you are expected to pay use tax to the Illinois Department of Revenue . For more details, see the Illinois sales tax.

Illinois Sales Tax Calculator

You can use our Illinois Sales Tax Calculator to look up sales tax rates in Illinois by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Illinois has a 6.25% statewide sales tax rate,but also has 495 local tax jurisdictions that collect an average local sales tax of 1.904% on top of the state tax. This means that, depending on your location within Illinois, the total tax you pay can be significantly higher than the 6.25% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Illinois:

Recommended Reading: Does Doordash Withhold Taxes

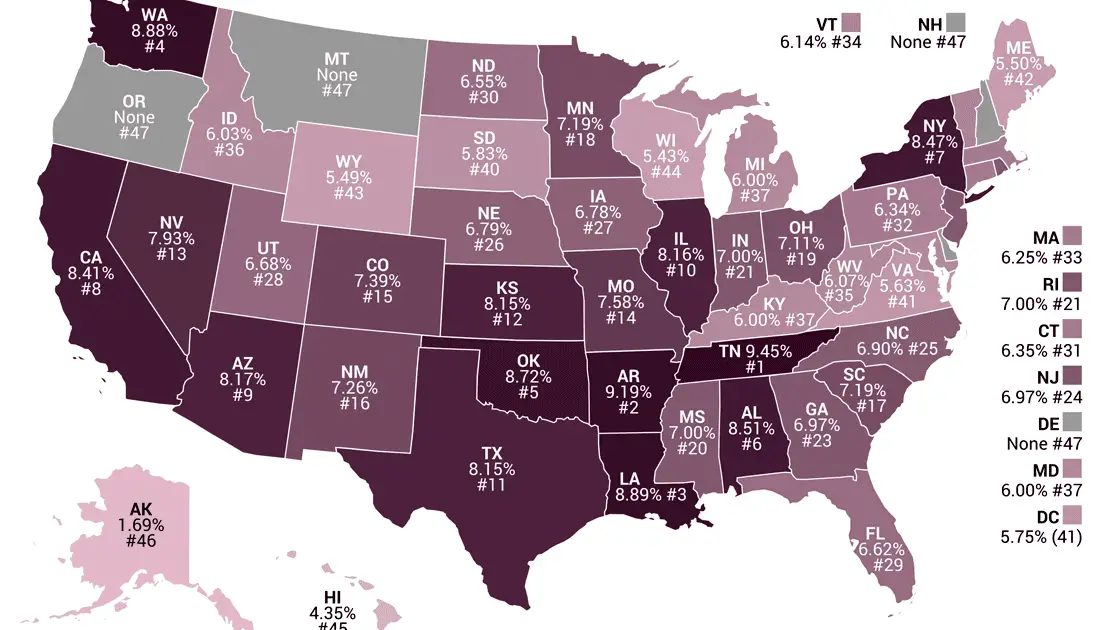

Illinoisans Pay Highest Sales Taxes In Midwest 8th Highest In Nation

Illinois combined state and average local retail sales tax rate topped 8.8% in 2022. Thats the 8th-highest in the nation and the highest in the Midwest.

Illinois state and local governments charge some of the highest retail sales taxes in the nation, with a combined state and average local retail sales tax rate at 8.81% in January 2022. It was the Midwests highest and eighth-highest in the U.S.

Those are the results of a recent analysis by the non-partisan Tax Foundation. It showed while Illinois sales tax rates are among the highest in the nation, neighboring Wisconsin has some of the lowest at 5.43%. The significant difference likely means Illinois businesses, along with state and local governments, lose out on revenue from consumers crossing state lines to save.

Evidence suggests this has been happening for years in Chicago. Its 10.25% retail sales tax rate is second-highest in the nation among major cities.

Many Illinoisans are unable to escape the states cumbersome sales taxes. Illinois is one of only 13 states to apply sales taxes to groceries. While the tax on groceries is 1%, not the full state sales tax rate of 6.25%, surcharges on groceries when consumers in the vast majority of states avoid them are tough to swallow.

Without lasting, structural reform, temporary pauses wont give Illinoisans relief from the nations leading state and local tax burden. They just give Pritzker a campaign ad.

State Of Illinois Sales Tax

To get a basic understanding of how Illinois imposes a state sales and use tax on most products and some services purchased in the state you can make a quick calculation of the amount of state of Illinois sales tax you will pay based on the product price and sales tax rate charged within the county you are purchasing from.

So, if you are paying Jackson County sales tax, the rate would be 7.25%. A $200 sports product purchase would cost you $14.50 in sales tax and the price you pay would be $214.50, not the $200 it was labeled as in the store.

Illinois sales tax rates actually refer to several tax acts. Sales tax is a combination of occupation taxes that are imposed on sellers receipts and use taxes that are imposed on amounts paid by purchasers. Sellers owe the occupation tax to the department they reimburse themselves for this liability by collecting use tax from their customers. Sales tax is the combination of all state, local, mass transit, home rule occupation and use, non-home rule occupation and use, park district, county public safety and facilities, county school facility tax, and business district taxes in Illinois.

Don’t Miss: Efstatus Taxactcom

Springfield Illinois Sales Tax Rate

springfield Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Springfield, Illinois?

The minimum combined 2022 sales tax rate for Springfield, Illinois is . This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently %. The County sales tax rate is %. The Springfield sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Illinois?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Illinois, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Springfield?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Springfield. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

When You Need To Collect Illinois Sales Tax

In Illinois, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto tax collector.

To help you determine whether you need to collect sales tax in Illinois, start by answering these three questions:

If the answer to all three questions is yes, then youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

Don’t Miss: Pastyeartax Com Review

Illinois Sales Tax Software

Illinoiss variable sales tax rates can be frustrating for out of state sellers who dont have a means of tracking the different rates based on location. It is important that you record and pay the sales tax due on time for the states in which you have sales tax nexus. This is where a tool like TaxTools can be of use. With detailed data review tools, sorting tools to ensure you are paying the right sales tax rates based on buyer destination, and integration with existing eCommerce platforms in a single interface, its much easier to manage than doing it manually. To learn more, contact us today or and get started.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

What Is Eligible For Sales Tax In Illinois

Like most states, Illinois has a list of items that are not subject to sales tax. This list of exemptions includes the following physical goods:

- Services The majority of services in Illinois are not subject to sales tax. There are, however, exceptions to this rule including activities that involve creating or manufacturing a finished good for sale.

- Certain Food, Drugs and Medical Appliances While not always immune from sales tax, these items are taxed differently in Illinois. This includes food that is not prepared for immediate consumption, prescription medications, and prescription medical appliances that are used to replace a malfunctioning part of the human body .

- Vehicles requiring registration or titling Motor vehicles, watercraft, aircraft, and trailers, and other vehicles that must be registered have different tax requirements, which you can read in STS-76, Illinoiss Vehicle Tax Information Guide.

Because of the complexity of the sales and use tax restrictions in Illinois, there are several things to keep in mind. Its recommended to reference Regulation 130.310 on the Illinois Revenue website, which goes into greater details on the general merchandise to which sales tax must apply.

Also Check: Will A Roth Ira Reduce My Taxes

Illinois Sales Tax Rates By City

The state sales tax rate in Illinois is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 11.000%.

Illinois has recent rate changes .

Select the Illinois city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Illinois was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Illinois Sales Tax Rates

The base rate of sales tax in Illinois is 6.25%, but the range of Illinois sales tax, including the county sales tax rate, occupation tax, local tax, mass transit tax, etc. is 6.25%-11%. For your convenience, we have included a table below that lists the Illinois sales tax rates for each county within the state. The table combines the base Illinois sales tax rate of 6.25% and the local county rates to give you a total tax rate for each county.

Illinois has many different counties, 102 in total, which means that Illinois has the 7th most counties out of all 50 states! Illinois sales tax rates for most counties is 1-2%, which means that most counties, when combined with Illinois sales tax rate, charge a total of 7.25-8.25% sales tax.

What you will find in the U.S., which is different from some other countries, is that when you see the price of a product such as a t-shirt in a retail store, or food on a menu in a restaurant, it is usually plus state and county sales tax.

So, when you checkout your items in a store or request the check at a restaurant, you will likely pay the price you saw on the label or on the menu + state and county sales tax. This often takes foreigners and those not used to this system by surprise because, in many other countries, the price you see is the price you pay, and the price quoted includes any sales tax or value-added tax .

Read Also: Does Doordash Take Taxes

Filing When There Are No Sales

Once you have an Illinois seller’s permit, youre required to file returns at the completion of each assigned collection period regardless of whether any sales tax was collected. When no sales tax was collected, you must file a “zero return.

Failure to submit a zero return can result in penalties and interest charges.

What Is The Car Tax In Illinois

7.25%Illinois collects a 7.25% state sales tax rate on the purchase of all vehicles. There is also between a 0.25% and 0.75% when it comes to county tax. In addition to state and county tax, the City of Chicago has a 1.25% sales tax. There also may be a documentary fee of 166 dollars at some dealerships.

Recommended Reading: Do I Have To Report Plasma Donations On Taxes

Failure To Collect Illinois Sales Tax

If you meet the criteria for collecting sales tax and choose not to collect sales tax, youll be held responsible for the tax due, plus applicable penalties and interest .

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

Misplacing A Sales Tax Exemption/resale Certificate

Illinois sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the DOR may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

You May Like: Tax Id Reverse Lookup

Cook County Sales Tax Region Zip Codes

The Cook County sales tax region partially or fully covers 2 zip codes in Illinois. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in Illinois here

60141| 60464 |