How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2022 tax year, due April 15, 2023

- Single filers: $12,950

- $12,950

- Heads of households: $19,400

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

Do I Have To Claim The Credits

No, you never have to take advantage of tax breaks, but why wouldnt you? Yes, filing taxes can be an intimidating hassle. But it can be well worth it. And taking advantage of any available tax breaks while minimizing your tax bill is a smart way to give yourself a financial boost.

Acorns does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax or legal questions and concerns.

Stacy Rapacon is a freelance writer, specialized in personal-finance topics including investing, retirement, and smart spending. Her work can also be found on Kiplinger.com, U.S. News and World Report, CNBC, and other publications.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Read Also: How To Get Tax Returns From Irs

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income.

Here’s an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

TurboTax Tip: If you have had federal taxes withheld from your paycheck, you might want to file a return even when you are not required to, so you can receive your tax refund.

Recommended Reading: What Refinance Costs Are Tax Deductible

Why You Might Want To File Even If You Dont Have To

You should bear in mind that even if its not necessary for you to file a tax return, you might still want to do so. Look into it, because its possible to be able to deduct a limited amount of higher education expenses, or at least claim some education-specific tax credits such as the American Opportunity Credit. This depends on each situation, but its important to look into it first and see if you qualify.

Tax On State Benefits

Your tax code can take account of taxable state benefits, so if you owe tax on them its usually taken automatically from your other income.

If the State Pension is your only income, HM Revenue and Customs will write to you if you owe Income Tax. You may need to fill in a Self Assessment tax return.

Recommended Reading: Where Is My State Tax Refund

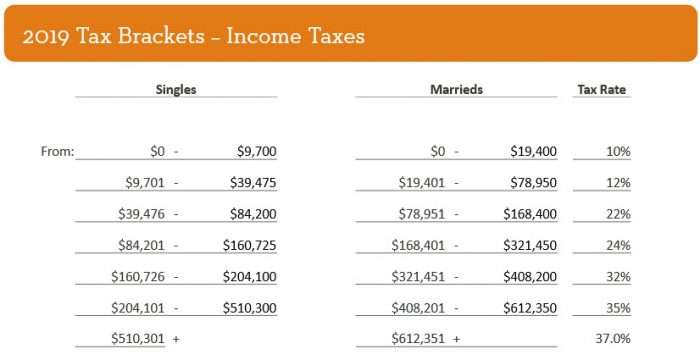

What Are The 2021 Federal Income Tax Brackets

Which tax bracket you fall into in the United States also depends on your filing status. Here are the 2021 tax brackets according to the IRS. These brackets apply to your 2022 tax filing.

Itâs broken into the four most common filing statuses: individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately:

| Tax rate |

|---|

| $523,601+ |

Is There A Minimum Monthly Payment For An Installment Plan

Your minimum monthly payment depends on what you owe and the type of payment plan you request. The IRS has two categories of payment plans:

- Simple payment plans

- Ability-to-pay payment plans .

Simple payment plans have minimum payment amounts. Ability-to-pay payment plans are based on an analysis of your ability to pay your tax bill with your assets, income, and allowable expenses.

Also Check: How To Find Out If You Owe State Taxes

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Tax Rates: How Much Do You Have To Pay

The federal and Ontario government each levy and collect income tax. However, the taxes are combined so that the tax payer only files one tax return, and pays the combined tax total which the governments then divide. The amount of tax you are required to pay will depend on the amount of income you earned during the year and the deductions and credits you claimed. In most cases, you are also required to pay tax on investment income earned in the year even if it is not received until the next calendar year.

Don’t Miss: When Should I File Taxes

Key Takeaways On Owing State Taxes

As long as you hit that threshold at which the state levies taxes, theres little you can do except pay whats due. Concealing income or willfully defaulting on these liabilities is a recipe for disaster. The tax authorities have a lot of data at their disposal to figure out if they are being taken for a ride.

Its understandable why a lot of people are confused about owing state tax. They feel that their tax liabilities are all taken care of once they have paid federal income taxes and business taxes. Taxation is a complex field that can be difficult to understand because of all the different factors in play.

As responsible citizens, it remains our responsibility to ensure that we comply with all of our tax liabilities, whether federal or state. As long as you keep doing that, youll have little reason to be concerned about the tax authorities making your life difficult.

Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

Read Also: How Do I File My City Taxes

Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions. If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

Also Check: Www.1040paytax

How To Calculate Your Total Income For The Year

Calculating your total gross income for the year isnt difficult. Simply add together all sources of income that you received for the current tax year.

Here are a few helpful tips to simplify the process:

- Include All Income: All income for the year is required to be reported to the IRS. This includes wages from your job, self-employment income, commissions, tips, and interest income.

- Gather Documentation: For accurate calculations, gather everything documenting your income. This includes W-2s for wages and 1099-MISCs for contracted work, as well as, bank statements and accounting records.

- Track Income Accurately: If youre married and filing a joint return, ensure that your income and your spouses income are tracked and reported accurately.

- Calculate Your Taxable Income: If your total yearly income is high, dont panic. On your tax return, youll be able to lower your taxable income with deductions and credits, which in turn lowers your tax liability. Well explore this more in further detail a little later.

You May Like: How To Report Airbnb Income On Tax Return

Specific Rules For Self

There is a growing number of taxpayers earning money through self-employment as more and more types of work become available online. Millions of people now earn at least a portion of their income from the comfort of their own home. If you perform some kind of work in a self-employment setting, you will need to conform to the tax rules that govern such work.

If you do work as a self-employed individual, you may need to file a tax return even if you earn nowhere near the $12,400 threshold mentioned earlier. This is because of the so-called self-employment tax. When you work for yourself, you are responsible for taxes that would otherwise be paid by an employer. These are taxes which go toward Social Security and Medicare. As long as you had net earnings of $400 or more, you will need to report those earnings and pay the associated self-employment tax.

In addition, it’s important to understand self-employed tax brackets if you are working for yourself. The freedom that comes with being self-employed is a wonderful thing, but you’ll also have more responsibilities with regard to the operation of your venture. Any self-employed individual in need of assistance should contact a tax professional.

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $10,275 he makes then 12% on anything earned from $10,276 to $41,775 then 22% on the rest, up to $80,000 for a total tax bill of $13,214.

Effectively, this filer is paying a tax rate of 16.52% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 12.96% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Recommended Reading: Do You Pay Taxes On Unemployment

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Read Also: How Does Business Tax Work

Do Students Have To Pay Taxes

Up to the age of 19 years old, your parents can claim you as a dependent, at least unless you continue your education. If you continue your education, they can claim you as a dependent through age 24. Students who are claimed as dependent should check the requirements of dependents to see if they fit there, and if they do, then they can file a tax return.

Are You A Dependent

Parents can claim their children as dependents until age 19. If they are continuing their education, parents can claim them until age 24.If you are a single dependent under the age of 65 and not blind, your tax filing will depend on unearned income, earned income, and gross income:

- Unearned Income: $2,200

- Earned Income: $12,400

- Gross Income: Was more than the larger of either $1,100 or your earned income up to $11,650 plus $350

Even if you could be claimed as a dependent and dont need to file a return, you may still want to in order to claim a tax refund.

Also Check: Can I File Taxes If I Receive Ssi

Why Is My State Tax Higher Than Federal

Since state tax and federal tax are completely separate calculations, it’s normal for state tax to be more than the federal tax. One has nothing to do with the other, and the amount of taxes owed can vary. Many different factors affect the amount of liability you could face.

“Sam is a wonderful, results-oriented and extremely knowledgeable and talented attorney, who really has ‘heart’ in working on behalf of his clients, and explains options in a straightforward, respectful manner. He has assisted us with great outcomes which have added to our quality of life. I would not hesitate to recommend Sam for his services as he is an ethical, personable and expert attorney in his field. You will likely not be disappointed with Sam’s work ethic, approach and his efforts.”

-Aileen Dwight, Licensed Clinical Social Worker & Psychotherapist