Pay Your Tolls Using Ez Pass

If you already have an EZ Pass NY, you can pay your toll using exactly the same procedure that youve been following till now. If you dont have an EZ Pass, however, you can signup here to get started. What makes EZ Pass a user-friendly payment process is because it is acceptable in 16 states of the Federation. So if you are a constant traveler, owning an EZPass is a sure way of setting yourself up for a stress-free journey.

Paying Without An Ez Pass

If you do not have an EZ Pass, you can stillpay your New York toll charges in one of the following two ways:

- Mail Tolls

This is a traditional form that uses mail order. Your toll bills will be mailed to the registered address of the vehicle owner. Once youve received the bill, you can pay it in person, over the phone, or through your bank. Know more about Mail Tolls.

- Short-termAccount

You can alsoset up a short-term account with your credit card and license plate number.This plan is ideal for those who use rented cars.

Do I Need To Report My Gambling Winnings To The Irs

A good strategy to follow: If in doubt, fill it out.

Youre better off reporting everything, even if you didnt necessarily need to, than risking underreporting. Although the chances of the IRS auditing you might be low, its always a possibility.

Underreporting can lead to fines and interest, which could wipe out any savings you might have accrued by not reporting your gambling winnings. There are some minimum thresholds for gambling with the IRS:

- $1,200 from playing bingo or slots, not reduced by the wager.

- $1,500 from a keno game, reduced by the wager.

- $5,000 from playing poker, reduced by the wager or buy-in.

- $600 or more or at least 300 times the amount of your wager for any other gambling types , reduced by the wager.

- Your winnings are subject to federal income tax withholding for any other reason .

Keep in mind that these levels are cumulative throughout the year. So, for example, if you win $1,000 playing poker five times during a tax year, you would hit that threshold.

How do you know how much to report to the IRS for a tax year? A special form, Form W-2G, provides the answer to that question.

Also Check: Tax Write Off Doordash

Ez Pass Working Process

When driving slowly through a toll lane, the electronic system reads your EZ Pass transponder using a transmitting antenna. After reading your transponder in a matter of seconds, the system will deduct the toll fee from your EZ Pass prepaid account.

Some toll facilities open up their gates to deduct toll fee after reading your transponder. Subsequently, there is a video enforcement system in place to identify motorists who are violators. At the end of the toll lane, a traffic signal is displayed, indicating that you have paid the toll. If you havent for some reason, the signal will notify you to Contact EZ Pass immediately for more information.

Business Installment Payment Agreements

Businesses can obtain IPAs. However, the requirements can vary on a case-by-case basis. This is largely determined by the amount and type of taxes due. In many cases, the DTF requires a 20% down payment. However, there have been many cases where an IPA was still granted without the down payment. An IPA could be a for business with a trust fund liability. For example, sales taxes and withholding taxes are great examples of trust fund taxes. Consequently, Form DTF-5 may be required by all responsible officers of the business. They will need to fill it out personally.

Sole-proprietors, single-member LLCs, or members of multi-member LLCs, generally accumulate income at the personal level . Therefore, the individual options above would most likely apply.

Also Check: 1099 Form Doordash

Pay An Open Audit Case

If you received a Statement of Audit Changes or a Consent to Field Audit Adjustment letter and have a balance due, you can pay online with our Pay an Open Audit Case online service.

If you prefer not to create an account, you can pay online with Quick Pay . You can also pay by mail, with a check or money order, to the address referenced in your letter.

State Business Taxes And Fees

When it comes to income taxes, most LLCs are so-called pass-through tax entities. In other words, the responsibility for paying federal income taxes passes through the LLC itself and falls on the individual LLC members. In most states, LLCs themselves do not pay income taxes, only their members do.

New York, however, imposes an annual filing fee on both typical single-member LLCs and typical multi-member LLCs . The amount of the filing fee varies depending on your LLC’s gross income sourced from New York in the immediately preceding tax year. Some LLCs, such as those without any income, gain, loss, or deduction from New York do not need to pay the fee. The fee can range from $25 to $4,500. The fee is paid to the Department of Taxation and Finance using Form IT-204-LL. The form must be filed within 60 days after the last day of your LLC’s tax year. For more details, check the DTF website.

Also Check: Doordash Self Employment Tax

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

PART-YEAR RESIDENT STATUS RULES

NONRESIDENT STATUS RULES

What Can I Deduct From My Taxes Related To Gambling

Both the IRS and New York allow you to deduct your gambling losses for the year. The important thing to remember on both returns, however, is that you can only do so if you itemize your deductions.

If you take the standard deduction, you forfeit this privilege. Whether it makes sense to itemize depends on how many deductions you have and what the standard amount is for your tax bracket.

There are two important things to remember here:

- You cant deduct more than you won, even if you did actually lose more than you won during the course of the year.

- You can only deduct what you actually lost while gambling. The cost of your food, lodging, etc., while gambling is not deductible.

Once youve totaled all your gambling losses for the year, put that total on Line 28 of Schedule A, Form 1040. Attach that schedule to your 1040. As noted, New York is one of a few states that also allows you to deduct your gambling losses. For that, youll need Form IT-196. Put your losses on Line 29 and attach the form to your IT-201.

A common mistake that people make when they deduct their losses is trying to simply subtract their losses from their winnings and then reporting the difference as their winnings for the year. Keep the two amounts separate. Reporting this way can result in underreporting, which can lead to fines and interest.

Additionally, its crucial that if you do deduct your losses, keep detailed records of your gambling for at least five years.

Read Also: Ct Tsc Ind

How Can Tax Group Center Help

Getting a tax issue taken care of in New York is something that must be handled somewhat gingerly. One of the reasons for this is that the NYS Back Tax Drivers License Suspension Law is a fairly aggressive law that can mean the suspension of your license if you owe unpaid taxes in New York. Make sure youre approaching unpaid taxes in New York effectively by bringing in a tax professional to help you apply for a payment plan. We may also be able to help you explore hardship options if youre unable to make monthly payments. The team at Tax Group Center has familiarity with tax laws and payment plans in New York. We help people find solutions for state tax debt relief every day. GiveTax Group Center a call today to book a consultation.

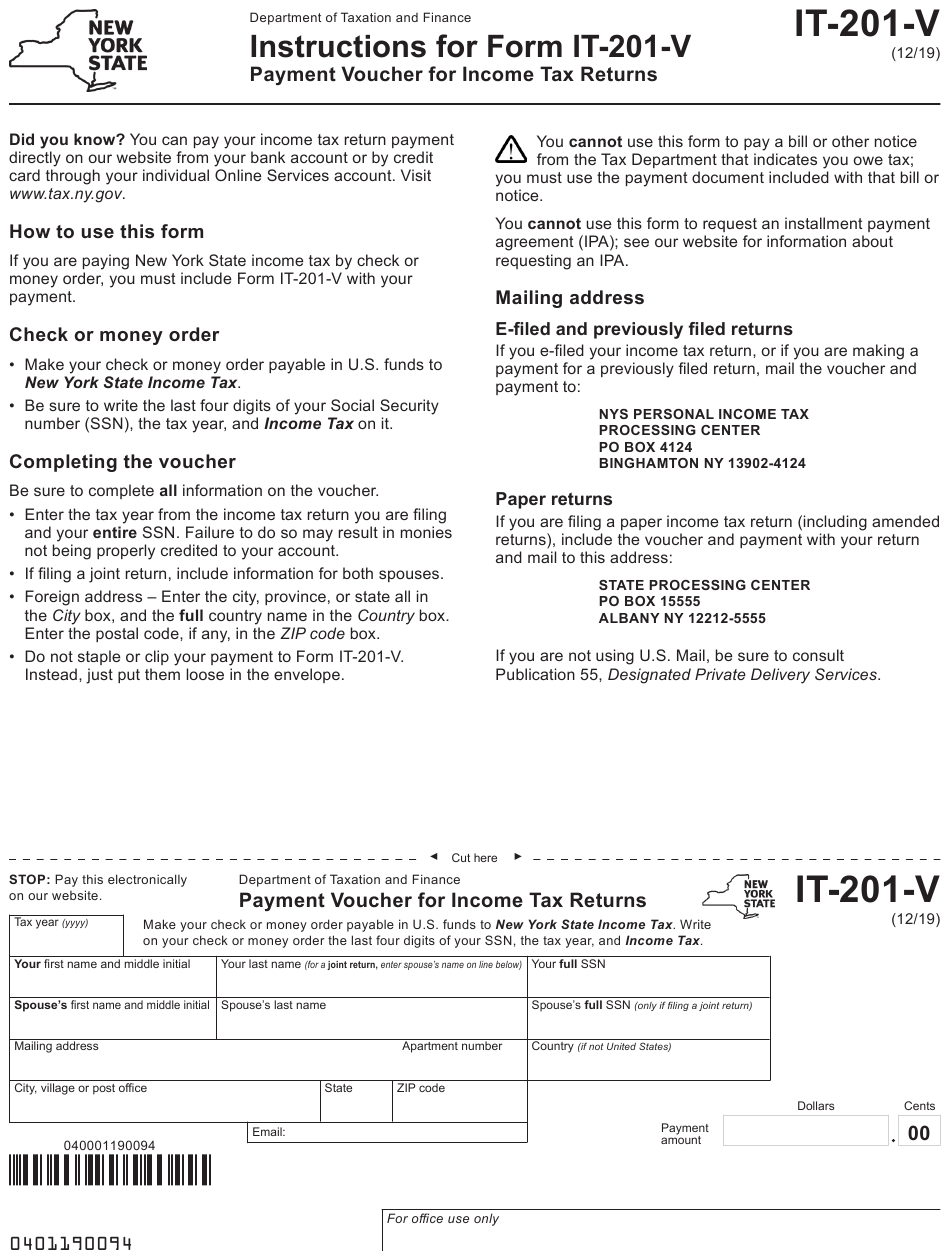

I Would Like To Pay My Nys Income Tax How Do I Do This

If you prepared your New York State tax returnin TurboTax the program should have prompted, you to print out a copyof your State return. Included in that print out should be filinginstructions along with a payment voucher. If you did not set up a direct payment plan while completing your New York State tax return in TurboTax,you can pay your taxes owed by mail or electronically.

To pay your taxes electronically youcan do so at the New York StateDepartment of Taxation. This secure onlineapplication allows you to pay by either debit card, ACH, credit card orcheck/money order.

Read Also: Www..1040paytax.com

To 6 Year Nys Tax Payment Plan

If a taxpayer requires more than 3 years to pay off a tax balance, NYS may request financial information. Therefore, in cases requiring financial verification, a DT-5 form or financial information will need to be provided.

In certain cases, NYS may file a tax warrant with the County Clerk and the Secretary of State. As a result, the tax warrant creates a tax lien. Therefore, it is generally a good idea to ask if DTF can refrain from issuing a tax warrant as long as you stay compliant with your IPA.

How To Apply For An Ipa

There are a few ways to apply for a payment plan with NYSs DTF.

- You can hire a licensed tax professional with NYS tax resolution experience. You can request a . There is no obligation.

- If you have your bill, you can call the NYS Department at 518-457-5434. You will need to enter your taxpayer identification number and the four-digit pin on your bill.

- You can apply online once you set up an account. Once logged in, select Payments, then bills and notices and then Request an Installment Payment Agreement.

As part of the IPA application process, taxpayers can request a term and/or specific monthly payment amount. During the time DTF is reviewing an IPA request, DTF may ask taxpayers to make good faith payments. Usually, these payments match closely the monthly payment amount the taxpayer asked for with the IPA.

DTF will look at the taxpayers compliance history and financial state when deciding to grant the IPA request. If DTF grants an IPA, the taxpayer must stay compliant with all tax filings and pay all new tax balances in full. Any failure to stay in compliance will automatically default the IPA. If a taxpayer cannot make the minimum monthly payments with an Installment Payment Agreement, they may want to consider other options, including an Offer in Compromise.

Don’t Miss: How Much Are Taxes For Doordash

How To Cancel And Reschedule A Payment Due With A Return Or Extension Or An Estimated Tax Payment

If you already scheduled your return, extension, or estimated tax payment due on April 15, 2020, your direct debit payment will not be automatically rescheduled to occur on July 15, 2020. You must cancel and schedule a new direct debit payment.

To cancel a payment scheduled to be withdrawn from your bank account on a future date, you must submit your request to cancel the scheduled payment at least two business days before the scheduled settlement date. Use View and cancel scheduled payments in your Online Services account to cancel the payment.

To schedule a new payment for a later date, see How to submit a payment using your Online Services account.

If you dont have an Online Services account, see Create account. If you need assistance creating an account or would prefer to cancel your scheduled direct debit payment by phone, please call 518-485-7884 to speak with a representative.

Please see Tax Department response to novel coronavirus for the latest updates and announcements.

Were committed to working with youand listening to your concernsthroughout this time of uncertainty and rapidly changing circumstances. Feel free to share your concerns on our Feedback page.

When Will Nys Dtf Terminate An Ipa

DTF may terminate an IPA at any time if it believes the taxes owed pursuant to the IPA are in jeopardy of being collected. Generally, if DTF wants to cancel or modify an IPA, it must provide the taxpayer 30 days notice. It can terminate or modify the IPA if:

- The taxpayer provided inaccurate or incomplete information before entering into the IPA

- The taxpayers financial state has changed drastically

- You fail to make a payment or pay any other tax balance when due

- You fail to provide the updated financial info requested by the DTF

If you are looking to connect with a tax professional with experience resolving NY tax problems, visit the aforementioned link or start your search below. Not all professionals have experience with the New York Department of Taxation so be aware of that when selecting a company or professional to help. Using our site, you can have confidence that the professionals listed with New York Experience are top-rated professionals that can ensure you get the best outcome for your situation.

Disclaimer: This article is not legal or tax advice. This article should not be used as a substitute for the advice of a competent attorney or tax professional admitted or authorized to practice in your jurisdiction.

You May Like: How Do You Do Taxes For Doordash

Was Your Refund Less Than You Expected

Owing money to any New York state agency can result in your income tax refund being seized. If youre behind on child support or have unpaid restitution or court fees, your state refund taxes can be used to pay those debts.

Your tax refund may be less than you expected because you made an error on your tax return. The Department of Taxation will notify you of the changes made to your return. Review the information provided to ensure you agree with the changes made.

More Help With Nys Income Tax

Understanding your tax obligations can be time consuming. Whats even more time-intensive is how to NYS income tax from your federal taxes as an itemized deduction.

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Make sure you maintain your eligibility for the Earned Income Credit with five commonly confusing requirements and scenarios. Learn more with H& R Block.

Don’t Miss: Does Doordash Send You A 1099

What Are The Conditions Of The New York Tax Payment Plan

A state of New York tax payment plan is available to any taxpayer owing $20,000 or less. A plan can include up to 36 monthly payments. Once accepted, your account will still accrue all penalties and interest on your unpaid balance for the full life of your IPA. However, you are generally safe from collections efforts as long as you are locked into a payment agreement with the DIF. The New York DIF reserves the right to take collection action against you if you fail to satisfy your full tax balance. Action can also be taken against you if you fail to comply with any of the terms you agreed to when entering your IPA. The New York DIF requires you to file all future returns by their due dates in order to keep your payment plan active. The DIF also reserves the right to request an update of your financial condition.