Itemized Tax Deductions And Credits:

The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. You’ll need the following documentation to make sure you get all the deductions and credits you deserve.

- Child care costsprovider’s name, address, tax id, and amount paid

- Education costsforms 1098-T, education expenses

- Adoption costsSSN of child, legal, medical, and transportation costs

- Home mortgage interest and points you paidForms 1098

- Charitable donationscash amounts and value of donated property, miles driven, and out-of-pocket expenses

- Casualty and theft lossesamount of damage, insurance reimbursements

- Other miscellaneous tax deductionsunion dues, unreimbursed employee expenses

Properly documenting the taxes you’ve already paid can keep you from overpaying.

- State and local income taxes paid

- Personal property taxesvehicle license fee based on value

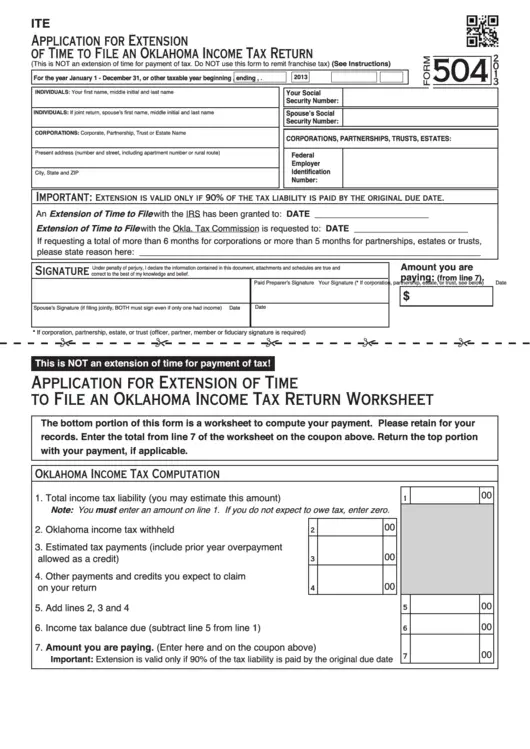

Is The 1040 Es Form For You

If you’re self-employed, have freelance income or any sort of income where taxes weren’t withheld, then YES you need to file the 1040 ES every quarter!

Since your employer is no longer withholding your income taxes, you are now required to handle this on your own by making estimated tax payments each quarter.Instead of paying an annual tax return, you now must file your taxes more frequently, each quarter, or roughly every 3 months. This can be completely new and confusing. There are now many deadlines to keep track of and new information to learn in order to avoid any penalties. Unlike the Form 1040, the 1040-ES is filed more than once and year, and is part of the process of paying quarterly taxes. Read along to learn how estimated taxes work, determine if you do need to file 1040-ES and ensure you understand the ES-1040 form.

How Long Does It Take To File Taxes

It takes about 13 hours for the average taxpayer to do their return, according to IRS. That time includes time for recording keeping, tax planning, for submission and other activities and is, of course, dependent on how youre filing and what tax forms you are using. That time may also vary if you own a business or not. Non-business filers may only take up to 8 hours to complete their taxes while business owners spending about 24 hours filing their taxes.

Certain forms also take longer to file. For example, depending on the complexity of your taxes, the total preparation time can vary from and average of five hours for a 1040-EZ to an average of 16 hours for a standard 1040 form.

RELATED ARTICLES

Read Also: H& r Block Early Access W2

Online Filing Sales Tax Returns

Like income returns, there are various options for individuals and businesses to file their sale tax returns online. GST/HST NETFILE and GST/HST TELEFILE allow individuals to file their sales tax returns directly online, and are the quickest and easiest options to use. As previously stated above, the My Business Account is also available for filing sales taxes, alongside other business-related taxes.

Individuals can also pay their net tax owed electronically through their Canadian financial institution using the Electronic Data Interchange option . However, those in Quebec will be unable to use this electronic service. Other internet-based filing services include the GST/HST Internet File Transfer, offering business owners the ability to pay their sales taxes to the CRA directly through their third-party accounting software.

What Tax Documents Do I Need To Keep

It may be wise to keep your annual tax returns from at least the last three years. You’ll likely want to reference your prior year’s tax return when you file the current year’s return. You’ll also want to keep any receipts from charitable contributions, proof for tax deductions or tax credits you hope to claim, and any forms the IRS sends you year-round.

Also Check: Payable Com Doordash

Four Factors That Impact Income Thresholds

Four factors determine whether you must file, and each circumstance has its own gross income threshold. The four factors are:

- Whether someone else claims you as a dependent

- Whether you’re married or single

- Your age

Some of these factors can overlap, which can change the income thresholds for required filing.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Don’t Miss: Efstatus.taxact

Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2020 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,400.

- Your gross income was more than $1,100, or $350 plus your earned income up to $12,050, whichever is greater.

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more: They must file if their gross income was at least $5, and their spouse files a separate return and itemizes deductions.

Why Is It Important To Understand Tax Forms

Nowadays, most people file their taxes using websites or other products that do the work of figuring out which forms you need to file and filling them out. But its not always cheap. Many of those services and software like TuroTax or H& R Block charge users depending on which forms they need to use.

For 2020 tax filings , anyone who made less than $72,000 a year is able to file for free as part of the IRS Free File program. Companies including Intuit, which makes TurboTax, H& R Block and others spent millions lobbying to bar the IRS from making its own free filing option while promising to create their own free products. But then, as ProPublica reported, they systematically undermined the truly free options by hiding search results and even though for many, theyre anything but.

If you havent filed yet, we recommend checking out our guide to filing your state and federal taxes completely for free, looking to see if you qualify for the Earned Income Tax Credit or learning how to track your refund. Though the IRS offers the option of paper filing, with the current COVID-19 state of affairs and a massive backlog of paper returns and documents the agency is encouraging taxpayers to file electronically to ensure prompt payment of refunds and avoid filing errors. Most paid and free tax prep services will tell you which forms you need to file, but if youre still confused, see below for a list of the most commonly used tax forms.

Also Check: Employer Tax Id Lookup

What Is A W

Use Form W-4, also called Employees Withholding Certificate, to tell your employer how much in taxes to withhold from your paycheck. Any time you start a new job, your employer will ask you to fill this out. The W-4 will help you determine the correct amount to have your employer withhold if you ask your employer to withhold less, you will still owe the remaining tax, plus, in some instances, a penalty. The IRS online Tax Withholding Estimator can help you fill out this form correctly.

Best for:People with new jobs, a change in income or other significant financial or family changes.

Learn Which Credits And Deductions You Can Take

Getting a sense of which can help you pull together the proper documentation. Here are a few to consider:

- Savers credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2021 tax year, if your filing status is single, you may be eligible if your adjusted gross income is $33,000 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $66,000 or less. However, these numbers are subject to change in future tax years.

- Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

- Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

- Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

If you think you may qualify for additional credits or deductions, check the IRS website.

Read Also: Reverse Ein Search

Using Professional Accounting Services

Those who might not have the best grasp on financial matters might choose to hire a professional accountant or bookkeeper to file their taxes for them. If you opt for accounting service, they will handle all of your returns and will file them online through the CRA portal, Represent a Client.

However you opt to file your returns, the CRA dictates you must hold onto all your tax documents for at least six years. Hence, keeping organized tax files is a significant part of any business or persons tax management.

Understanding the tax return process can help small businesses organize all of the required information to file their returns successfully. Be prepared for this tax season with QuickBooks accounting software. Try it free today!

Income And Investment Information

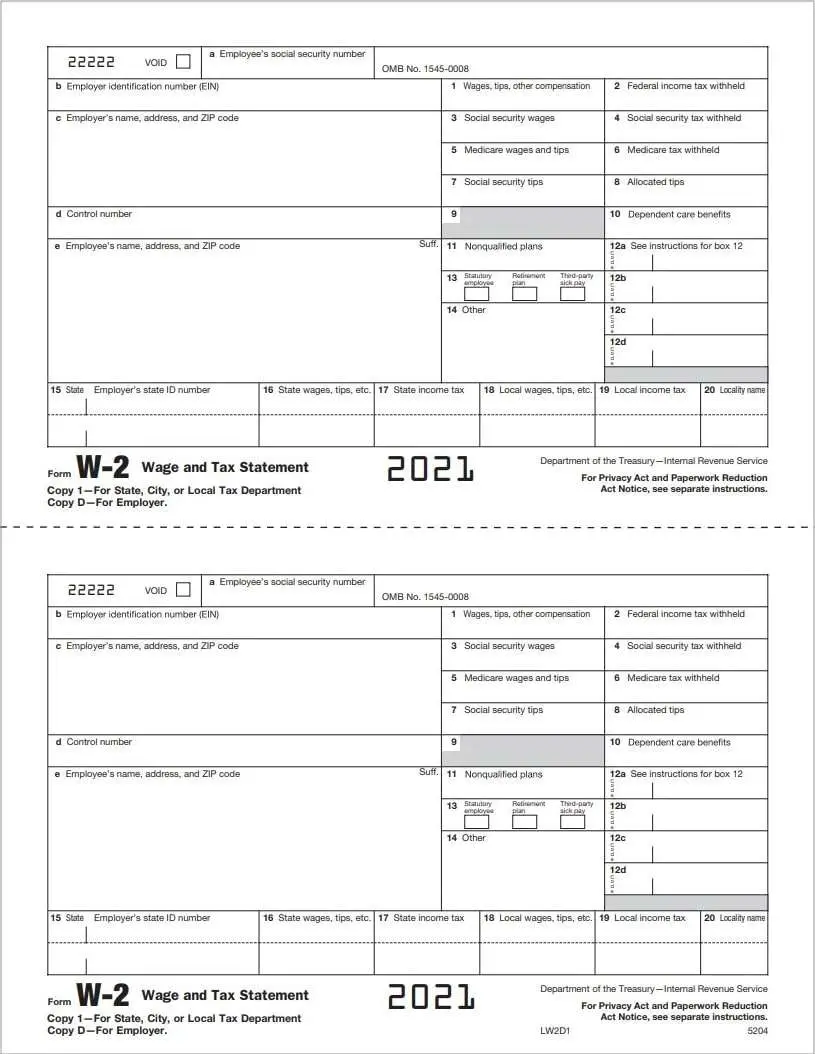

- Form W-2 Wage and Tax Statement -Your W-2 shows how much you earned and how much was withheld for taxes. Your employer has until February to send you your form. If you havent received yours, go ahead and request it.

- Bank or financial institution statements Did you make contributions to an IRA? Youll need a Form 5498. Are you paying down student loan debt? Be sure to grab your Form 1098-E. Did you take out a home mortgage? Be sure to have your Form 1098 Mortgage Interest Statement.

- Last years state refund amount If you itemize your deductions, then your state refund is considered income for tax purposes.

- Other miscellaneous income records This could include award money, gambling winnings, lottery pay-outs, etc.

- Any Form 1099s There are several different types of 1099. Some of the common ones include:

- 1099-NEC if you are self-employed and received $600+ from a client

- 1099-DIV if you received dividends

- 1099-G if you received money or benefits from the government

- 1099-K if you made third-party transactions

- 1099-R for distributions from a retirement plan, IRA, pension, annuity, etc.

- 1099-MISC if you have paid at least $600 in rent, prizes and awards, medical and healthcare payments, or other income payments.

You May Like: Doordash How Much Should I Set Aside For Taxes

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.

Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Read Also: How Do I Get My Pin For My Taxes

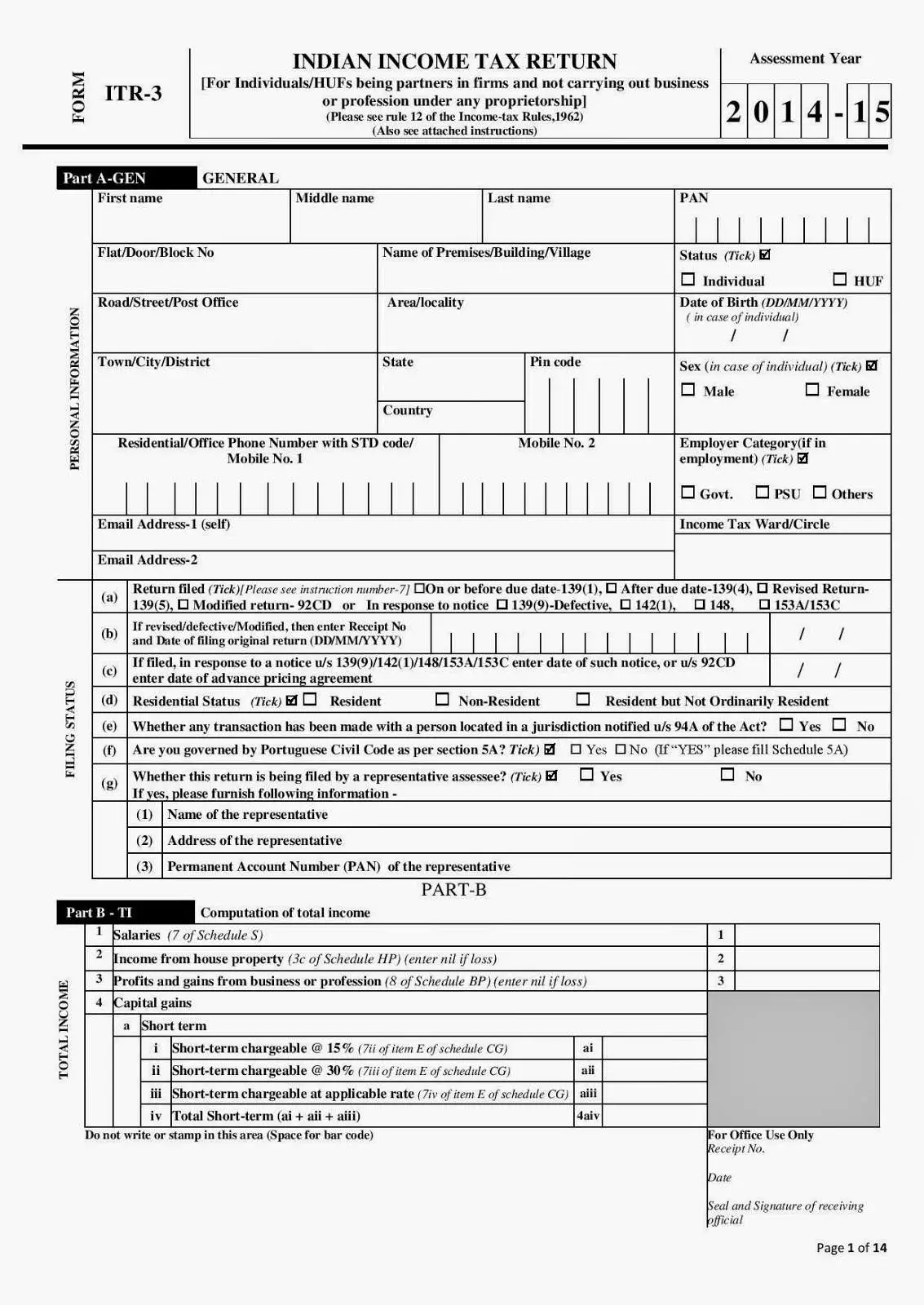

Individual Income Tax Filing

Filing electronically, and requesting direct deposit if youre expecting a refund, is the fastest, safest, and easiest way to file your return.

Free Fillable Forms: The software provider that previously supported our free fillable forms no longer offers them for individual income tax filing. Please consider one of our other filing options for your 2021 Virginia income tax return.

Information You May Need

- Your age, your spouse’s age, and filing status.

- Federal income tax withheld.

The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they’re inquiring. If married, the spouse must also have been a U.S. citizen or resident alien for the entire tax year. For information about nonresidents or dual-status aliens, please see International Taxpayers.

Disclaimer

Estimated Completion Time: 17 minutes

Please Note: After 15 minutes of inactivity, you’ll be forced to start over.

Caution: Using the “Back” button within the ITA tool could cause an application error.

Don’t Miss: How To Calculate Taxes For Doordash

Can I File My Small Business Taxes With My Personal Taxes

The ability to file your business taxes alongside your personal taxes will depend upon the structure of your business. A business owner who operates a corporation must file their corporate taxes separately from their personal taxes. Conversely, small businesses run as sole proprietorships and partnerships are required to report their business taxes on their personal income tax returns.

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Read Also: Is Doordash Taxable Income

What Is A 9465 Form

If you cannot pay your taxes in full when you file, you can use Form 9465 to request a monthly payment plan. If you can pay within 120 days and you owe less than $50,000, you can request a payment plan online, too. Such payment plans will incur a user fee, accrued penalties and interest, but low-income taxpayers may have the user fee reduced, waived or reimbursed. User fees are usually lower when you set up a payment plan online. While a payment plan is in effect, late-payment penalty accruals are cut in half. If you can pay your taxes in full within 120 days, you can apply online for the IRSs payment plan or call the IRS at 800-829-1040 to avoid the fee associated with setting up an installment agreement.

Best for:People who need more than 120 days to pay their taxes in full and owe more than $50,000. If you want to set up a monthly payment plan, the IRS encourages you to request one online.

Forms That Have Always Been Around

Forms you may need to submit with your return include the following:

- W-2s: These are forms your employer provides detailing wages and taxable benefits earned and taxes withheld during the year. Employers must send a W-2 by January 31 if you earned more than $600 in wages during the year.

- W-2G: This details gambling winnings and federal tax withheld from winnings.

- 1099-MISC: If you have income from freelance or gig work, the company that paid you should send you a 1099 detailing the payment.

These forms typically show earned income. Of course, there are other forms you may need to include, but these are some of the most common.

If you submit a return via mail, you can attach copies of these forms. If you e-file using an online tax program, youll need to upload your forms to the program.

Don’t Miss: Irs Taxes Due

Documents For Claiming Tax Credits

Tax credits are more advantageous than deductions because they subtract directly from what you owe the IRS, whereas claiming tax deductions only reduces your taxable income.

Claiming some tax credits will require that you receive a Form 1098 for the paid expenses, most notably those that are available for education. Prior to tax season, youll want to keep detailed records of what you spend so you can support claiming other credits. Some tax credits are supported by your income documentation and your tax return.

A few of the more well-known individual tax credits that are available for the 2021 tax year include:

- Adoption credit: For a portion of expenses you paid to adopt a qualifying child

- American opportunity and lifetime learning credit: For qualifying educational expenses for you, your spouse, or your dependents, reported to you and to the IRS on Form 1098-T

- Child and dependent care credit: For expenses you paid for care by another individual for your child or disabled dependents so you could go to work, look for a job, or attend schoolyoull need the care providers tax identification number or Social Security number

- Earned income tax credit: For taxpayers with lower income

- Recovery rebate credit: For economic stimulus payments you were entitled to receive in 2021 but did not

- Savers credit: For contributions made to qualifying retirement plans